Trading recommendations

Sell in the market. Stop-Loss 0.7760. Take-Profit 0.7630, 0.7600, 0.7540, 0.7500, 0.7445

Buy Stop 0.7770. Stop-Loss 0.7730. Take-Profit 0.7800, 0.7820, 0.7900, 0.7960

Traders are taking profits and align positions on the eve of the US presidential election. Recent public opinion polls in the US indicate a steady but slight advantage over Hillary Clinton, Donald Trump, is 3-6 percentage points. However, in recent weeks, Trump closing the gap, and in the last hours before the vote, both candidates continue to campaign actively. The vote may be a surprise to the markets.

Meanwhile, the Chinese have new data on the state of the foreign trade balance of the country. Although the surplus of the foreign trade of China in October rose (up to $ 49.06 billion dollars against 41.99 billion US dollars in September and the forecast 51.7 billion US dollars), the data were weaker than forecast values. Exports decreased by 7.3% compared with October last year, after falling 10.0% in September. Imports decreased by 1.4% after falling 1.9% in September.

Australia's economy is export-oriented, and commodities such as liquefied natural gas, coal, iron ore are Australia's major export commodities. One of the main buyers of the commodities from Australia it is China, which is the world's largest net importer of commodities. The decline in imports of raw materials in China is indirect evidence of slowing the world's second largest economy, and it is painful impact on commodity prices and quotations for commodity currencies, which include the Australian dollar.

Published earlier (03:30 GMT + 3) the results of the survey of the National Bank of Australia showed a more pessimistic companies and worsening business environment. Confidence in the business environment fell to 4 in October from 6 in September, conditions index fell to 6 from 8 in September. The sub-index reflecting the employment situation, orders and inventory levels also fell during the period.

Today the attention of market participants will be focused on the results of the US presidential election, and the first results will be published on Wednesday 9 November.

If Clinton wins is expected to increase risk appetite and dollar quotations and the US stock market.

Technical Analysis

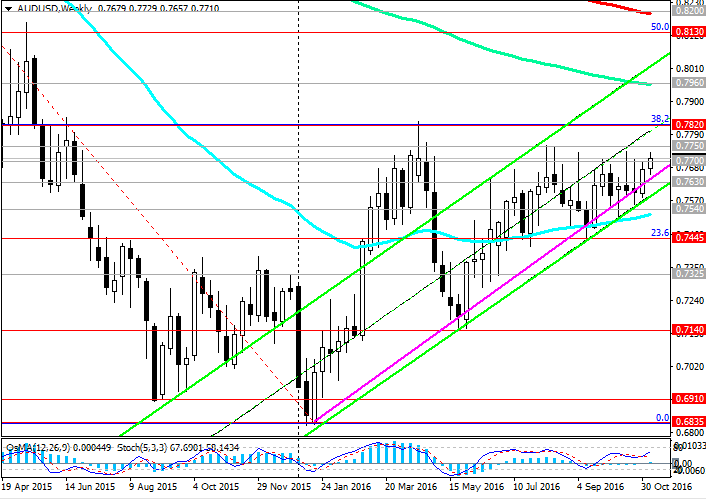

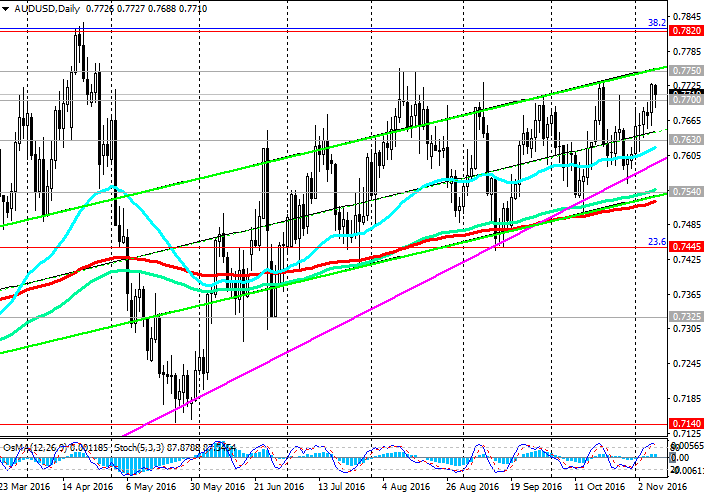

The AUD / USD remains in ascending channel on the daily and weekly charts.

On the weekly chart the pair is growing in the uplink to the upper boundary, passing near the level of 0.7960 (EMA144 on the weekly chart). When the pair is trading above the support level 0.7630 (EMA50 on the daily and EMA200 on the 4-hour chart), 0.7540 (EMA200, EMA144 and the lower line of the rising channel on the daily chart) and is at an important level of 0.7700.

In case of breaking 0.7700 level next goal will be the level 0.7750 (the upper boundary of the rising channel on the daily chart).

Indicators OsMA and Stochastic on the daily, weekly, monthly charts were developed on long positions.

The Australian dollar is one of the most popular currency among investors seeking a steady income. The interest in it is also supported by purchases by investors that put its growth strategy based on trade «carry-trade» (interest rate in Australia 1.5% is among the highest in the world among countries with developed economies).

In case of breakdown and consolidation above the 0.7750 is high probability of further growth of the pair to 0.7820 levels (Fibonacci level of 38.2% and April's highs), 0.7960 (EMA144 on the weekly chart), 0.8130 (50.0% Fibonacci level), 0.8200 (EMA200 weekly chart).

In an alternative scenario, the breakdown of the support level 0.7630 could signal a further decrease in pair AUD / USD to the 0.7540 level. A breakdown of the support level 0.7445 (23.6% Fibonacci level of the correction to the wave of decrease in pair from July 2014) can deploy uptrend pair AUD / USD and send it to the support levels 0.7325, 0.7140 (May lows).

Support levels: 0.7700, 0.7630, 0.7540, 0.7445, 0.7325, 0.7290, 0.7200, 0.7140

Resistance levels: 0.7750, 0.7820, 0.7900, 0.7960

Author signals - https://www.mql5.com/en/signals/author/edayprofit

*)presented material expresses the personal views of the author and is not a direct guide to conduct trading operations.