S&P Poised to Break Losing Streak Ahead of U.S. Elections

S&P Poised to Break Losing Streak Ahead of U.S. Elections

Talking Points:

-Last week saw fear drive price action across capital markets as driven by fear around U.S. Presidential elections, set to (finally) take place tomorrow.

- Already on the open of trading this week we’ve seen reversals in key markets, namely the U.S. Dollar and U.S. Stocks. But traders are likely going to want to be careful of trying to forecast U.S. election results with these early price action indications. Instead, ‘bigger picture’ setups in Gold and Oil could garner trader’s attentions around tomorrow’s elections.

-If you’re looking for trading ideas, check out our Trading Guides.

There is but one item dominating the economic calendar for this week, and that is the U.S. Presidential election set to take place tomorrow. Outside of that one inordinately large item we have but three high-impact data points for the week; so likely we’re going to be seeing politics dominate price action.

And this actually started before trading even opened for the week. Over the weekend, the FBI released a statement that indicated that no additional action will be taken against Hillary Clinton after the re-opened investigation was announced last week. And in short order, strength in both the U.S. Dollar and U.S. equities returned after last week saw losses in both. On the chart below, we’re looking at the gap-higher in the Greenback to open trading for this week, along with the continuation movement after the open.

In U.S. Stocks, the 9-day losing streak in the S&P began to make headlines as the index hadn’t seen such a run of weakness since 1980. But given today’s aggressive gap-higher, it would appear that this most recent streak has met its demise (not confirmed until market close). On the chart below, we’re looking at the jump-higher in the S&P to open the week.

Given the fact that risk aversion is reversing aggressively, this may lead traders to attempting to forecast the results of tomorrow’s elections by gauging price action – and this can be a dangerous thing.

If we dial back to the Brexit referendum, we saw a similar turn-of-events as the risk trade rallied into the vote after the assassination of MP Jo Cox(GBP, FTSE both going up); only to reverse into strong risk aversion as results of the referendum made their way into markets. But within short order, the risk trade got another jolt of life as it became obvious that Central Bankers would likely try to offset those Brexit risks with even more fast and loose monetary policy, and in the months following that is precisely what happened as the FTSE ran into another fresh all-time-high.

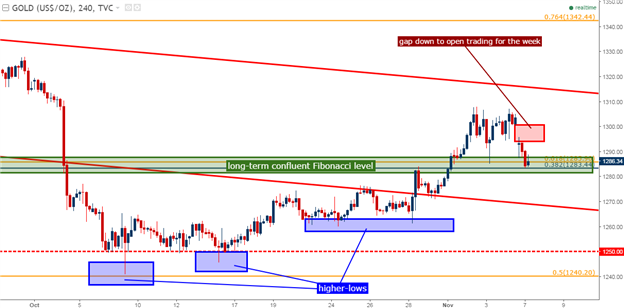

Of particular interest around tomorrow’s elections are price action setups in commodities like Gold and Oil. Given the recent turn of USD-weakness, we’ve seen some interesting developments over the past week that could continue to garner focus around the elections this week.

Gold prices put in an aggressive top-side move to find resistance a little bit above the $1,300-psycholgoical level last week. But after the re-emergence of USD strength to open the week, Gold prices have taken a hit to find support at a familiar level around the $1,285 level.

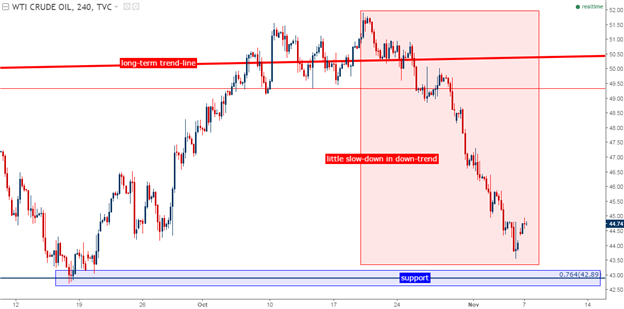

Oil prices, on the other hand, have been getting hit-lower for a little over two weeks now. We’ve been following the longer-term trend-line as a potential indication of ‘bigger picture’ resistance, and after October gave another inflection on the under-side of this trend-line, the door opened for a bearish reversal setup.

And on the chart below, we’re looking at the near-term setup in WTI. As we can see from the chart below, there has been little bid support in Oil prices over the past couple of weeks. Just below current prices, at $42.89 we have a longer-term Fibonacci level that had helped to set support in September.