US Retail Sales to Guide USD trading

On Thursday, USD trading remained technical in nature and confined to relatively tight ranges. Nevertheless, the dollar performed reasonably well given the lacklustre global sentiment. Disappointing US jobless claims had no lasting negative impact on the dollar. The dollar even (re)gained slightly ground later in the session as Fed governors kept the dollar open for a rate hike in the near future. EUR/USD closed the session near the intraday low at 1.1377 . USD/JPY held close to the 109 handle even as sentiment on the US equity markets deteriorated and finished the day at 109.02.

Overnight, most Asian equities trade again in negative territory, due to disappointing earnings across the region. Once again, the negative impact of declining equities on the dollar remains limited. USD/JPY trades only slightly below yesterday’s close, holding in the 108.80 area. EUR/USD is also little changed in the 1.1375 area. Moderately hawkish comments from the Fed helps to protect the downside of the dollar. The Aussie dollar maintains its downtrend as the momentum in the commodity complex eases and as investors contemplate to possibility of further RBA rate cuts. AUD/USD is testing the recent low in the 0.73 area.

Today, the euro area, Q1 GDP is expected to be confirmed at a strong 0.6% Q/Q. US retail sales are forecast to have picked up in April. The consensus is looking for a 0.8% M/M increase in the headline reading, boosted by stronger car sales. We believe that the risks remain for a downward surprise. Consumer confidence has weakened recently, wage growth slowed, while higher oil prices are weighing on consumers’ spending power. The US PPI inflation is expected to have picked up in April, becoming positive for the first time since December 2014. Core PPI however is expected to have slowed from 1.0% Y/Y to 0.9% Y/Y. We side with the consensus. Finally, Michigan consumer confidence is expected to have improved slightly early May, but we see downside risks. Recently, the link between the dollar and the developments on other markets was often diffuse. Both EUR/USD and USD/JPY stabilized or followed their own technical dynamics. Yesterday, the dollar performed rather well given a fragile equity sentiment. However, if US retail sales and consumer confidence disappoint (coming on the heels of a poor payrolls report), markets will question of the chance of a June or July rate hike, which will weigh on the dollar.

Technically, EUR/USD broke last week above the 1.1495 MT range top on broad-based USD weakness. This break was a technical warning for potential further dollar losses and opened the way for a retest of the key 1.1714 (2015 high). However, the USD decline petered out despite mixed US eco data and a poor US payrolls report. We maintain the view that the US economy is strong enough to allow the Fed to implement two rate hikes later this year. This is not discounted in the interest rate and FX markets. However, there is currently no trigger to kick-start a USD rally. The soft Fed approach, pockets of risk aversion and the Treasury report on currencies pushed USD/JPY to a new lows last week. Verbal Japanese interventions to stop the rise of the yen are likely to continue. We doubt they put the basis for a sustained USD/JPY rebound. We sell USD/JPY in case of a rebound to the recent highs (110/111 area) as we expect some fatigue in the global equity rally (return of risk-off?).

Sterling unmoved by BoE inflation report

On Thursday the focus for sterling trading was on the BoE policy decision and even more on the quarterly inflation report and press conference of governor Carney. The BoE as expected left its policy unchanged. There were no dissenters (9-0). They also maintained the assessment that the next rate move will probably be a rate hike. The BoE acknowledged the recent slowdown in growth, but the downward revision of the growth projection remained limited. Carney elaborated in extenso on the potential effects of Brexit on the economy, but didn’t draw any conclusions for current monetary policy. The BoE’s assessment was slightly less soft than we (and apparently also part of the market) expected. Sterling traded technically early in the session, but gained some ground after the BoE decision. EUR/GBP closed the session at 0.7873 (from 0.7908). The earlier gains of cable were reversed later in the session as the dollar rebounded. Cable finished the session little changed in the mid 1.44 area.

Today, only the UK construction output will be published. Another poor figure (-3.2% M/M and -2.7% Y/Y) is expected. We don’t have a good reason to take a different view from the consensus. If anything, the report might be slightly negative for sterling. However, both EUR/GBP and cable are currently confined to tight ranges.

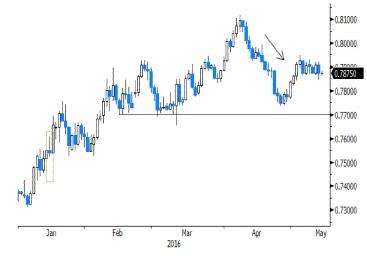

The technical picture of EUR/GBP improved as the pair broke above the mid 0.79 area. A counter move occurred last month and threatened to deteriorate the picture. However the sterling rebound petered out. Weakening UK eco data and uncertainty on the referendum are negatives for sterling and this will stay so until the referendum on June 23. We think sterling will stay in the defensive. EUR/GBP might drift higher in the 0.7735/0.8117 range.

![]()