APAC Currency Corner – RBA's Turn

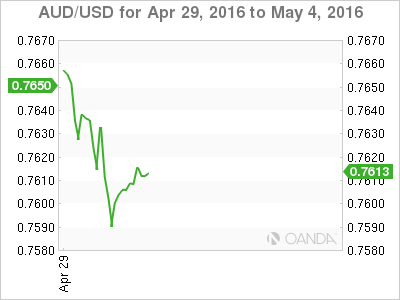

AUD We have a huge week ahead in Australia, highlighted by Tuesday’s RBA policy review and Federal Budget IN

the wake of last week’s tepid inflation report, Traders have been

increasingly pricing in the probability of an RBA rate cut, which now

stands at 58 percent as per short-term money market futures. With local

lenders now jumping on the band waggon for good measure. The issue

at hand is not so much the current economic conditions but rather the

across the board weakness in last week CPI reading which came in lower

than the RBA 2-3 % target band. Many are viewing the miss on CPI as an

ominous sign that even if the RBA does not cut this meeting, low

inflation levels may well stay below the RBA target through 2016, and

will ultimately lead the RBA to reconsider the current monetary policy.

At minimum, the low level of inflation affords the RBA to adopt a more

dovish tone in their Statement on Monetary Policy However, even

with a rate cut, it is debatable if this will lead to any major position

recalibrations on the Aussie dollar or will it only translate into a

kneejerk lower as the market is expecting broader USD dollar weakness in

the weeks to come. While much uncertainty swirls around the

announcement, what we can say for sure is we are likely set for another

volatile week on the Aussie dollar front following last week’s CPI and

BOJ surprises. Keep in mind; external drivers will likely be key

to the Aussie dollar long term fortunes regardless of a short-term

capitulation if a rate cut announcement holds true. While commodity

prices are looking very constructive and expected to remain firm, the

two-way risk going into the announcement is very higher as the RBA could

follow through on market expectations. While RBA rate decision is

the major domestic release, April’s US Employment will attract its

usual intense focus. With recent US economic data deteriorating versus

consensus forecasts, Friday’s employment report could be a key driver

for currency markets by either reaffirming the string of high employment

releases in the US or predicting more storm clouds on the horizon for

the USD. With that in mind, the Jobs data on Friday is should remain

robust with Nonfarm Payrolls expected to print 200k. Also, the expected

0.3% in a month on month earnings should bring the YoY number to 2.4%. Over

the weekend, China official PMIs for April disappointed market

expectations with the manufacturing index down 0.1pt to 50.1 and the

non-manufacturing index down 0.3pts to 53.5. In both instances, the new

orders index was a little weaker also. However, with high-risk events

due later in the week, the AUD has shown little reaction to the data. AS

for the budget, traders will be monitoring the Credit Rating Agencies

Reactions but the early thought is that the Budget will need to show

ongoing fiscal restraint to get an all clear from the agencies.

Therefore, we should not expect a sugar coated pre-election style budget

laden with tax sweetener designed to appease voters.

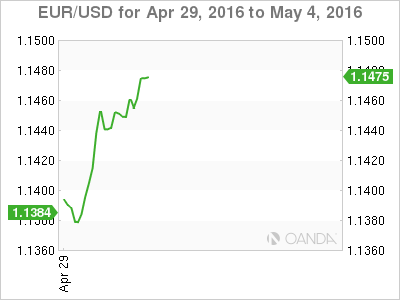

Strom Clouds for USD US

consumers speak through their pocketbooks as evidenced by Friday’s US

data. Personal income rose in March but personal spending fell. The Q1

GDP report already suggested this but income was one-tenth stronger than

forecasted and spending, one-tenth less. While the US presidential

election run-up is weighing on the consumer sentiment, it is more likely

consumers are disgruntled by the state of the economy and growing

increasing frustrated by the Federal Reserve Board, who appear more

confused about the economic direction than ever. Besides, there is the

ever-present conviction amongst investors that central banks cannot do

it alone. With consumer confidence running sour, the markets responded

accordingly. US equity markets went south, WTI prices retreated, gold

topped at 1297 and USDJPY touched 106.24

The USD is in need of a

lifeline with USD bulls pinning hopes on another robust Employment

report Friday. However will it be enough to tame the USD bears?.

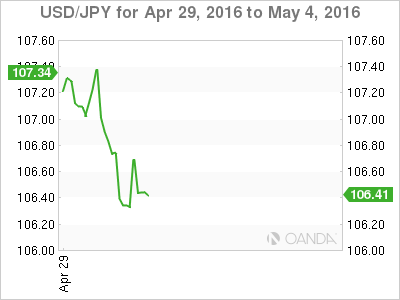

JPY Traders

always remind themselves some days you are the windshield and other

day’s you are the bug, last Thursday and Friday was no exception. While

lingering Disappointment from the Bank of Japans inaction continues to

weigh in Japanese markets Negative sentiment started filtering through

to other global markets and this ripple effect should be closely

monitored as the negative impact from waning Global Risk sentiment could

add more fuel to an already overheated YEN. While The YEN has

incredible momentum and it is likely, we will see a deeper move lower in

USDJPY, keep in mind this week could be full of traps and gaps as

liquidity will be running at a premium during golden week holidays in

Japan. Market are relatively thin this morning and while we

bounced off early morning lows of 106.20 there has been little momentum

or incentive to take the pair above 106.75 in early trade.

BoJ

With a weekend to digest and judgement less clouded its worth rehashing. One of the biggest takeaways from last week was just how huge market expectation was for an of a BoJ easing despite falling only-only three months after last policy adjustment. The fact is, in BoJ terms, that would have been unprecedented, and likely why near 50 % of economists did not expect a move last week.

However, the lack of action by the BoJ should not imply that the BOJ has exhausted their means to adjust policy and investors should not err into believing the BoJ has run out of ammunition. I suspect Japanese Rates will go lower but with BoJ concerned about the systemic impact of negative rates on Domestic Banks, the central bank opted for a wait and saw approach before embarking on further policy easing.

When the BoJ eases again, it will likely include a negative lending facility to accommodate domestic banks.

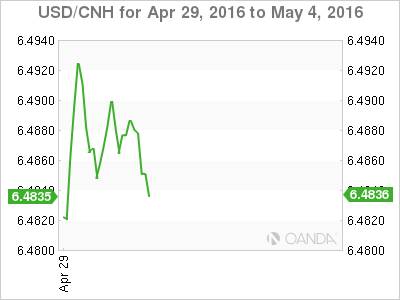

CNH

The large fall in USDJPY had a significant an impact on the CNY fix, as JPY has a 14.7% weight in the CFETS basket. The JPY also clearly influenced other USD Asia pairs. The day on day fall in the USDCNY fix was the largest one-day decline since 2005, but even with such a significant fall, CNY lost approximately 18bps on a basket basis.

However, there is still a high demand on shore for USD below 6.5000 indicating the market is trading on USDCNY sentiment rather than the basket.

China PMI

The official Purchasing Managers’ Index (PMI) rose to 50.1 in April, easing from March’s 50.2 and barely clinging above the 50-point mark that defines expansion from contraction.

The market was expecting the reading would improve to 50.4 after upbeat March data raised hopes that Mainland extended economic slowdown was easing. While the results may have disappointed a print above, 50 is suggesting that the stimulus impacts have a positive effect in China. However, the slight drop and miss on consensus are still worrisome and not overly supportive not bode well as China seeks to rebalance economy

PBOC Fix

ASEAN

In general, we seem to have entered a new period of indifference in the USDASIA basket.

MYR

There has been no clear trend in USDMYR recently and despite strong oil prices, the price action has not been supportive so far. I suspect it is due to Risk aversion trickling back into the global FX markets coupled with some lingering concerns over 1MDB

With that in mind, the MYR may be more vulnerable to weaker OIL prices this week so traders will continue eyeing OIL Patch price movements

![]()