Current trend

On Wednesday, the Yen strengthened against the USD amid the publications of macroeconomic data form Japan and the FOMC Minutes.

The deficit of the Balance of Trade in Japan for July amounted to 268.1 billion Yen, which was a lot worse than the previous figure (-70.5 bln) and forecasts (-56.7 bln). At the same time, July exports grew by 7.6% and exceeded forecasts.

FOMC Minutes, on the other hand, showed increased concerns of the regulator regarding the future inflation growth as they think it will remain below the 2% target for the next two years.

Support and resistance

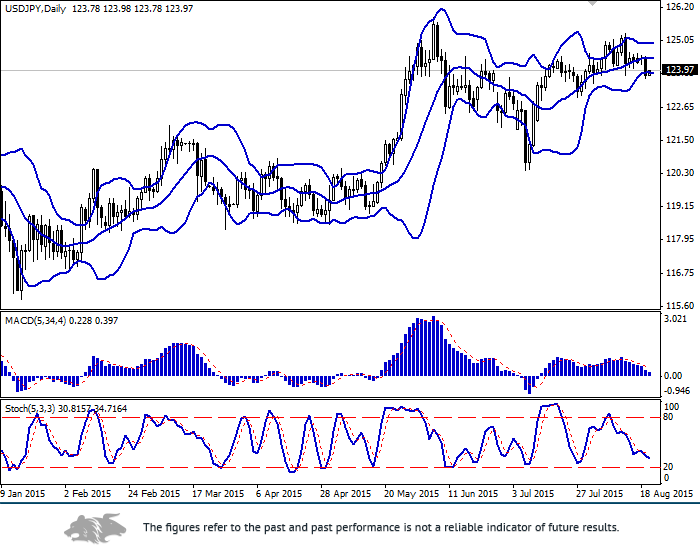

Bollinger Bands on the daily chart is directed horizontally, but is giving a buy signal as the price has left the upper border of the range. MACD is moving downwards. Stochastic is also falling and approaching the oversold zone.

The indicators are not giving a clear trading signal.

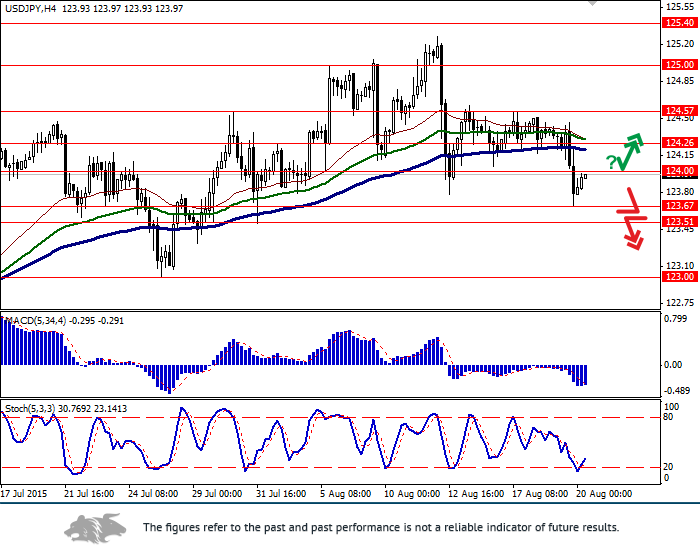

Support levels: 123.67 (19 August low), 123.51 (31 July low), 123.00 (27 July low).

Resistance levels: 124.00 (local high), 124.26, 125.57 (local high), 125.00, 125.40 (beginning of June high).

Trading tips

Open long positions after the breakdown and consolidation above the level of 124.00 (with the appropriate indicators signals) with targets at 124.57, 124.70 and stop-loss at 123.50.

Short positions can be opened after the price consolidation below the level of 123.51 with the target at 123.00 and stop-loss at 124.00.