- All trades are based on specific rules according to the FxTaTrader Hybrid Grid strategy.

- All open positions can be viewed by clicking here.

- All closed positions can be viewed by .

This articles will provide:

- The weekly currency chart for the interesting pairs.

- The daily(timing) chart for the interesting pairs.

- Possible positions for the coming week and positions taken.

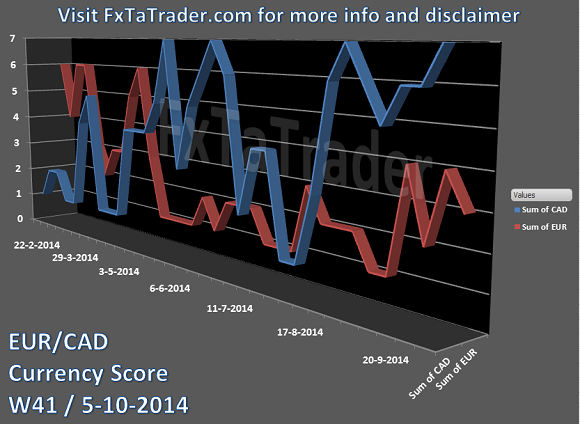

- According to the "Currency score" and "Ranking & Rating list" the EUR/CAD is the best pair to trade and the EUR/GBP the second best according to the strategy rules for the FxTaTrader Hybrid Grid strategy.

- Last week (pending) orders were placed for the EUR/GBP and profit was made on 2 positions.

___________________________________________

Open/pending positions of last week.

Total outlook: Down

This pair will be discussed briefly in this article because the interesting pair for coming week is the EUR/CAD. The situation compared to last weeks has not changed very much for going short and this pair remains interesting for the Hybrid Grid strategy. The GBP however lost some strength last week. For more detailed information please read my previous article by clicking here.

___________________________________________

Possible positions for coming week.

Ranking and rating list Week 41

Weekly Currency score: Down

Based on the currency score the pair looks interesting in the last 3 months. The CAD showed in that period recently one dip going below the EUR and it recovered fast. Based only on this information the pair looks interesting for going short.

On the monthly(context) chart the indicators are looking weak for going long.

The Ichimoku is showing a neutral view with price being in the middle of the cloud. The Tenkan-Sen is above the Kijun-Sen but both in the cloud. The Chikou-Span is below the cloud. The indicator is looking mixed with no clear direction.

The MACD is in positive territory. According to the histogram the inner-strength is weakening. The pair seems to be in a consolidation phase.

The Parabolic SAR is short but showing the preferred pattern of higher stop loss on opening of new long and short positions.

Since the monthly chart is used to get the context where that pair is in for the long term the indicators are looking fine because they are showing weakness in the current uptrend.

Weekly chart: Down

The Ichimoku is meeting almost all the conditions except for Chikou-Span being still above the cloud.

The MACD is in negative territory and showing continuation of this downtrend.

The Parabolic SAR is going short and showing the preferred pattern of lower stop loss on opening of new long and short positions.

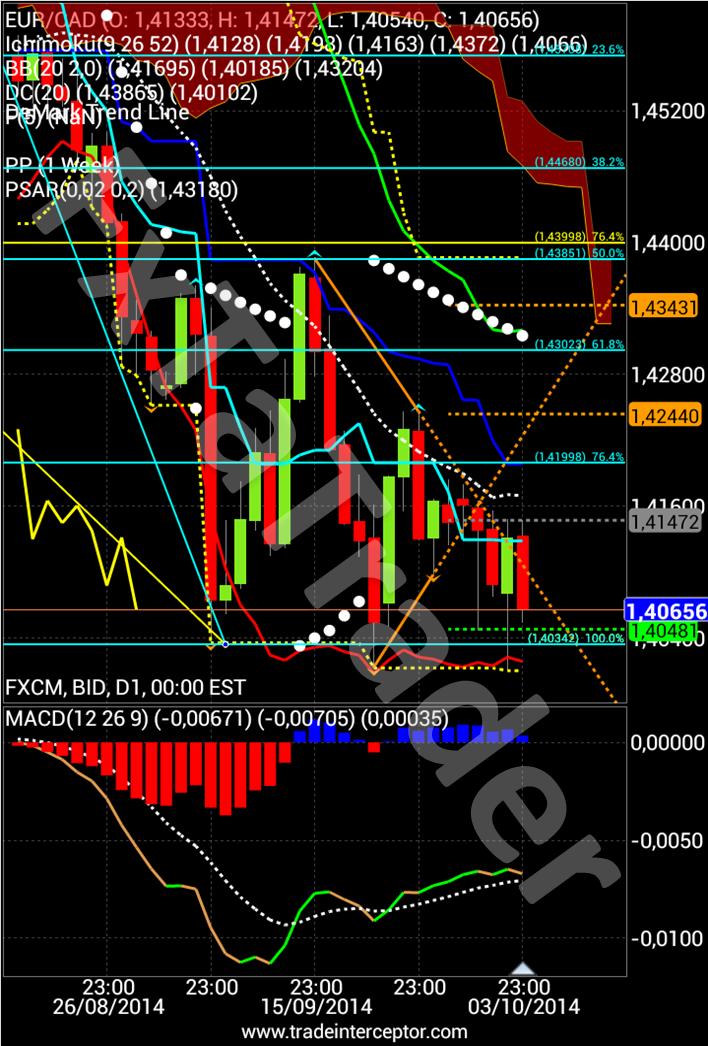

Daily chart: Down

On the daily(timing) chart the indicators are looking strong for going short.

The Ichimoku is meeting all the conditions.

The MACD is in negative territory. According to the histogram the inner-strength is getting better.

The Parabolic SAR is going short but not showing the preferred pattern of lower stop loss on opening of new long and short positions. However there is no preferred pattern yet for going long either.

Total outlook: Down

EUR/CAD Daily chart

___________________________________________

Open/pending positions evaluation account of last month.

- The timing chart is the weekly instead of the daily and the decision chart is the monthly instead of the weekly. There is no context chart.

- There is also more emphasis on taking carry trades because positions will be held longer.

- The profit target is 1/4 ATR of the monthly chart instead of the weekly.

I will go briefly into details on all the interesting pairs for the evaluation account. For more information you can check the Evaluation account on FxTaTrader.com.

___________________________________________

The EUR/NZD remains a very interesting pair for the longer term and for the FxTaTrader Hybrid Grid strategy. I will monitor this pair for new possibilities.

Ranking and rating list (Click to open the list)

Rank: 21

Rating: = +

___________________________________________

Also this pair remains a very interesting pair for the longer term and for the FxTaTrader Hybrid Grid strategy.

Ranking and rating list (Click to open the list)

Rank: 11

Rating: --

___________________________________________

Also this pair remains a very interesting pair for the longer term and for the FxTaTrader Hybrid Grid strategy.

Ranking and rating list (Click to open the list)

Rank: 17

Rating: +

___________________________________________

Also this pair remains a very interesting pair for the longer term and for the FxTaTrader Hybrid Grid strategy.

Ranking and rating list (Click to open the list)

Rank: 13

Rating: -

___________________________________________