All that glitters isn't gold—at least for the investors who are eschewing the precious metal in favor of the companies that mine it.

After years spent in the shadow of gold, miners are back in favor, driven by stronger earnings and cuts to mining costs.

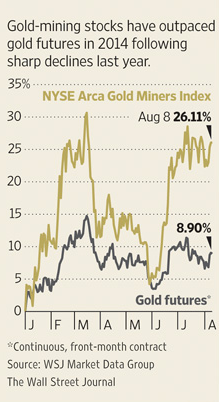

The NYSE Arca Gold Miners Index, which tracks 39 gold-mining companies, has soared 26% so far this year, compared with a 8.9% rise in gold and a 4.5% increase in the S&P 500.

The gold-miner rally is a boon for high-profile hedge-fund managers such as

George Soros

and John Paulson—as well as traditionally gold-focused traders

like

Peter Palmedo

and

Eric Sprott.

Their gold bets were pummeled last year, when a rise in bond

yields and muted inflation dulled gold's allure, sparking a stampede

that drove the precious metal's price down 28% and the gold-mining index

down 54%.

Gold stocks tend to outpace gold's losses when gold falls, and overshoot its gains when prices rally. Now, the prospects for gold are promising, some investors say, but those for gold miners are even better. Flare-ups in Ukraine and the Middle East have prompted fund managers to pile back into relatively safe investments like gold, pushing up prices on those haven assets.

Investors buy these stocks as a way to double down on gold bets. Not only do these companies garner more revenue and profit from a higher gold price, but many also have shown the ability to boost earnings by expanding output and cutting costs. Although valuations are above their lows, shares are still cheap by historical standards, some investors say.

"Gold companies just don't look as expensive as they did in previous years… and you have a sentiment that is warming toward gold," said Catherine Raw, a portfolio manager for BlackRock Inc.'s $451 million Commodity Strategies Fund. She raised her fund's exposure to gold miners at the start of the year.