Research: Russian oil and gas companies can cope with low oil, despite junk status and bearish sentiments

Russia's economy has had several worrisome quarters, and so far, there is not a positive sign of recovery. The falling oil price, as well as the international sanctions imposed as a result of the ongoing Ukrainian crisis are adding to the jittery sentiment.

International rating agencies have downgraded Russia’s sovereign rating

to junk status, as the ruble heavily plunged in December and the economy entered a recession. However, the country’s oil and gas companies are coping

with bearish sentiments and the market turmoil much better than some

would have you believe, says Forbes.

The credit burden of Russian companies, as measured by net leverage, should still remain “acceptable”, according to a stress test conducted by Fitch Ratings, assuming no recovery in oil prices (with 2015-17 average oil prices at $55 per barrel and $1 fetching 60 rubles).

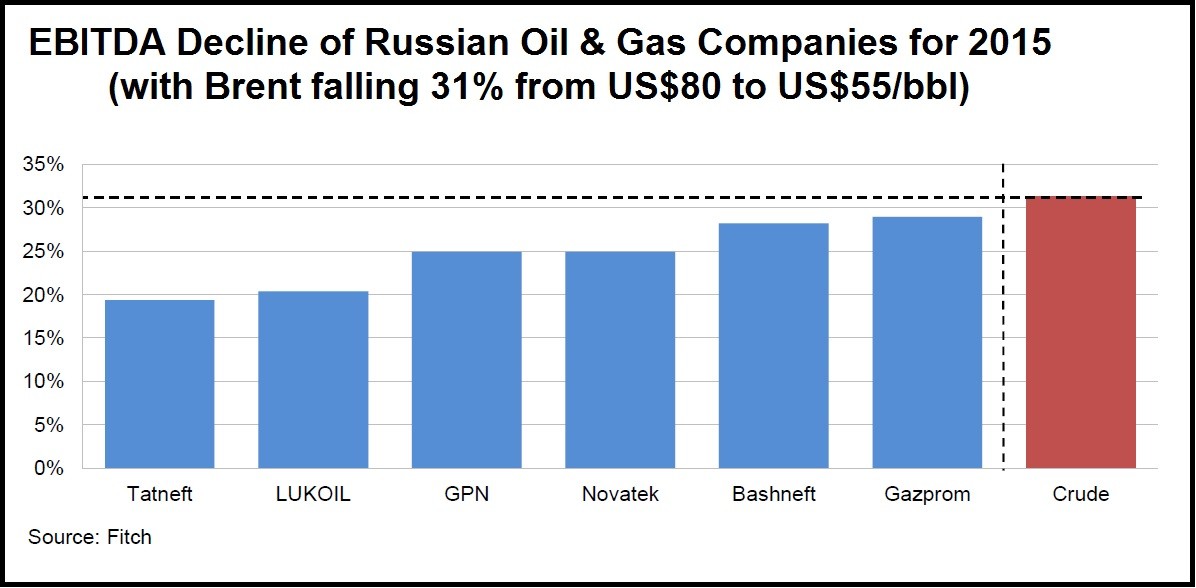

“As per our sensitivity analysis, Brent falling from US$80 to US$55, or by 31%, will result in the companies’ EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) declining by a median of only 23% in dollar terms. This also takes into account the ruble depreciation effect: we assume US$/RUB50 at US$80/bbl, and US$/RUB60 at US$55/bbl,” says analyst Dmitry Marinchenko.

Fitch outlines three major indicators which add to the scenario shown above:

1) a progressive tax regime, which means that the effective tax

rate paid by Russian oil producers decreases as oil prices fall, and

vice versa.

2) a relatively flexible exchange rate regime, which means the ruble will depreciate in response to oil price falls, cushioning the impact of lower export revenues.

3) the regulation of domestic gas prices, which are set in rubles, but which fall in dollar terms more slowly than oil prices do as long as the ruble depreciation does not exceed the fall in crude prices.

Ratings of Russian oil and gas companies remain broadly dependent on the direction of their country’s sovereign rating, and lower oil prices themselves should trigger no downgrades.

International ratings

In January Fitch downgraded Russia to ‘BBB-’/Negative. S&P has also downgraded Russia to junk status. The agency now rates the country down a notch at BB+.

Market data does suggest Russian oil and gas capital expenditure (capex) would fall as many global players also review their spending. Fitch expects capex to go down at least in dollar terms as a result of the ruble devaluation, as up to 75% of it is ruble-pegged.

“We expect Russian companies to reduce their capex budgets in response to weaker oil prices and fewer financing options through stricter capital discipline, negotiations with contractors and possibly putting some new projects on hold,” Marinchenko says.

There are some notable caveats though. The country might alter its favorable tax regime for oil and gas companies which could hurt them. A stronger currency without an oil price recovery, quite possible in theory, could also pose problems. However, most market commentators see a very low probability of either happening and on the latter point Fitch does not think such a recovery is a significant risk at $55 per barrel.

Nonetheless, Russian Arctic ambitions are likely to be put on ice. Trimmed financing options and international debt markets being off limits would also see liquefied natural gas (LNG) terminals backed by Novatek, Rosneft and Gazprom face delays. The Kremlin could step up state support, but much needed international technical cooperation is also off the table.

The inevitable thing is a gradual global correction in oil and gas production levels, and Russia won’t be immune. Moreover, it might be the first major oil producer to blink.

However, the only pressing concern Russian oil and gas companies have today is making sure their current corporate entity structure survives. Fitch’s stress test seems to suggest they would manage that comfortably over 2015-16 and as well as repay their upcoming debt maturities.