A Forex trader should wait for the price to turn in the opposite direction after touching one of the bands before considering that a reversal is happening.

Even better one should see the price cross over the moving average.

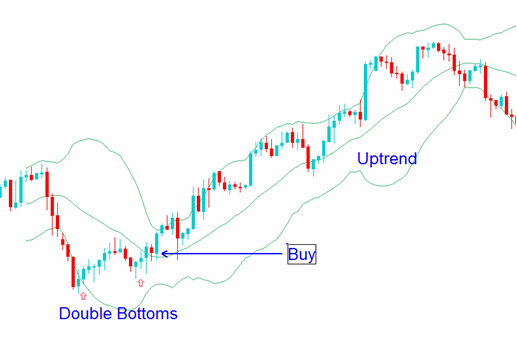

Double Bottoms Trend Reversals

A double bottom is a buy setup/signal. It occurs when price action penetrates the lower bollinger band then rebounds forming the first low. then after a while another low is formed, and this time it is above the lower band.

The second low must not be lower than the first one and it important is that the second low does not touch or penetrate the lower band. This bullish Forex trading setup is confirmed when the price action moves and closes above the middle band (simple moving average).

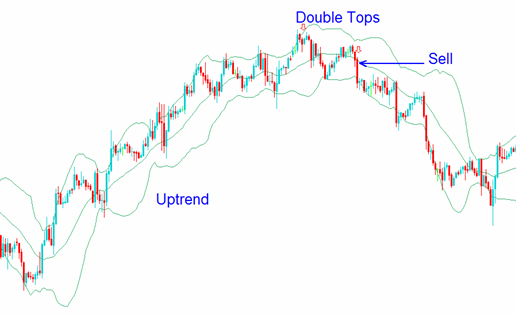

Double Tops Trend Reversals

A double top is a sell setup/signal. It occurs when

price action penetrates the upper bollinger band then rebounds down

forming the first high. then after a while another high is formed, and

this time it is below the upper band.

The second high must not be higher than the first

one and it important is that the second high does not touch or penetrate

the upper band.