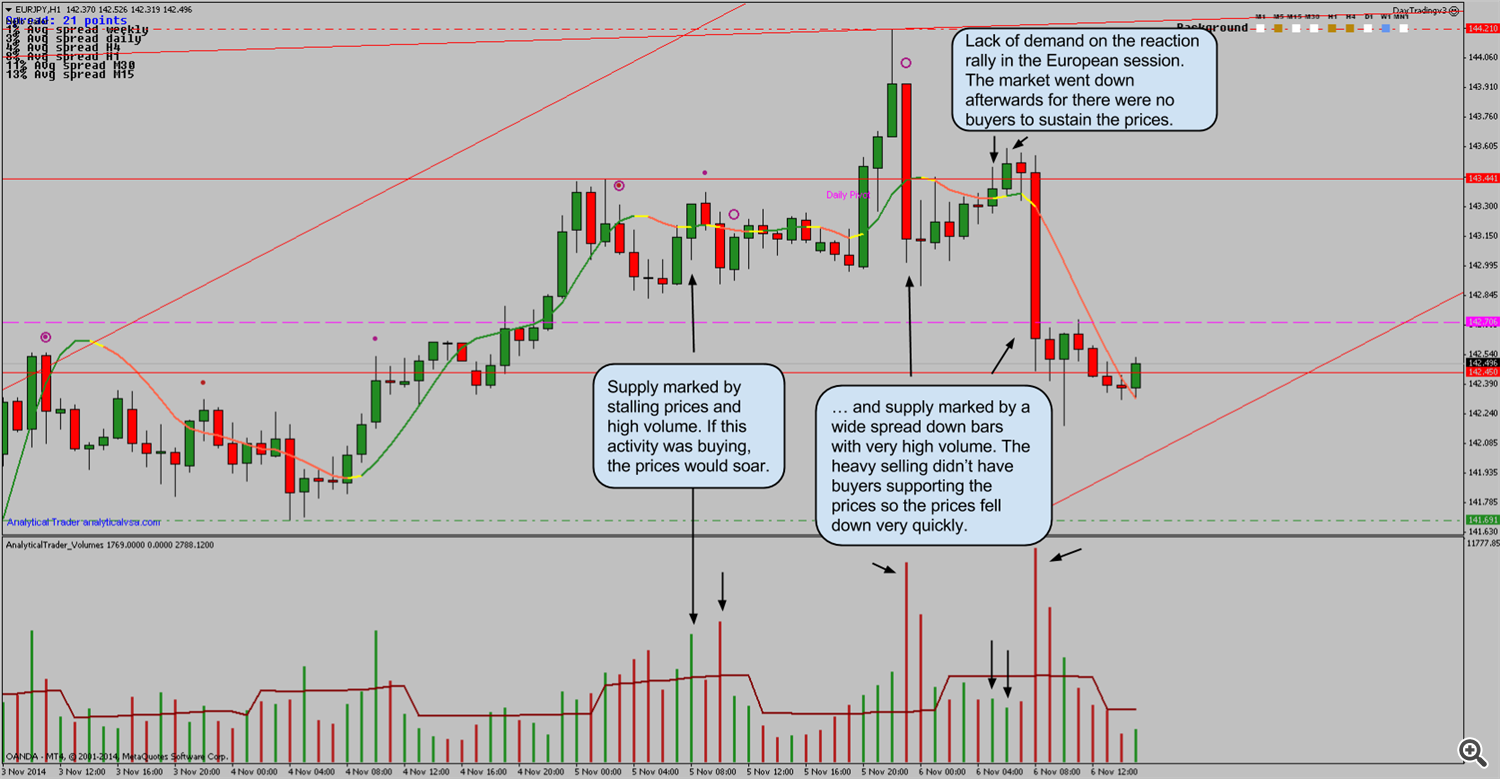

EURJPY has seen a lot of selling at 142.8 – 143.931 level by institutional traders. This was first marked by a high volume up bar with the next candles down. If this was true buying, the market would have gone up instead of stalling. This means that the activity (volume) seen on that bar was mostly hidden selling: the traders with a considerable amount of funds dumped their long trades on the market, capping it and preventing it from going upper.

On the next high volume candles there weren’t buyers to absorb the selling, so the market went down on wide spreads. Before the last major move down, at 143.1, there was a low volume reaction, which confirmed there were no buyers to sustain the market, so it went down afterwards.

Overall the market is still in an uptrend, marked by the red trendline below the prices. I’m looking for a better short entry spot, either when the trendline breaks or the prices go upper on low volume, or on more supply. If for any reason, quality buying appears on the market (i.e. signals like these ones, but on reverse), I’d be more careful.