Why I stopped trading without TPO (Market Profile) – and how to read it properly

Most of us started out staring at standard candlesticks. The problem is: A candle only tells you where the price went, but not how long it stayed there. For institutional traders, however, that is the deciding factor: Time = Acceptance.

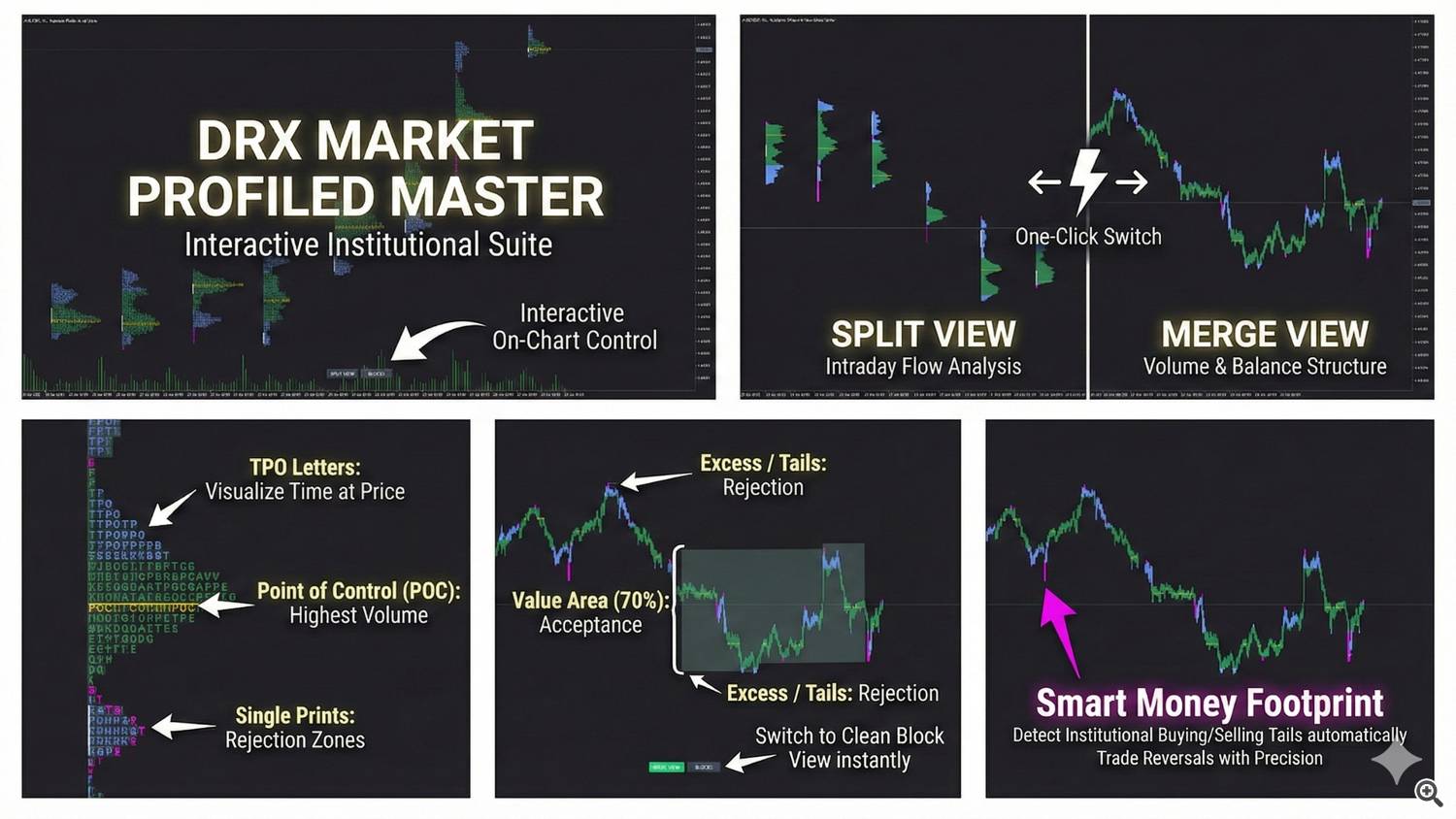

I actually developed the DRX TPO Master because the standard indicators on MT5 drove me crazy. They are usually just static blocks that clutter up the chart. I wanted something I could actually interact with to see the real structure of the market.

Here is a quick breakdown of how TPO works and how to use the tool in practice.

The Core Logic: It's an Auction Try to visualize the market as an auction process rather than just a line on a chart.

-

Value Area (The thick green zone): This is where 70% of the trading volume happened. Buyers and sellers agree here; the price is considered "fair." Trading inside this zone is often choppy and random (noise).

-

POC (Point of Control - Yellow Line): The price level where the market spent the most time. This often acts as a massive magnet for price the following day.

The "Split vs. Merge" Feature (Why it matters) This is the main feature of my tool. Usually, you just see the profile as one big block (Merge View). That’s great for seeing who won the day (buyers or sellers). But often you need to know: When did that volume happen?

By clicking "SPLIT", the profile breaks down into individual 30-minute letter blocks.

-

The Scenario: You see the POC is at the top of the profile, but the price closed at the lows.

-

The Split Analysis: By "breaking it open," you might see that buyers were aggressive in the morning (Letters A-F) but completely failed in the afternoon. That is crucial context for the next day that gets lost in a standard block profile.

What I look for when trading (Setup Examples)

I mainly use TPO for two specific things:

A) The "Single Prints" (Magenta Lines) If you see long, thin lines in the profile (marked in Magenta on my tool), these are called "Single Prints" or "Tails." It means price rushed through this level without building any volume.

-

The Meaning: The market rejected this price.

-

The Trade: If price slowly comes back to these Single Prints the next day, it is often a very strong Support/Resistance zone for a bounce.

B) Breakout from Balance When the market forms a tight Value Area for several days, energy is building up. As soon as price breaks out and closes outside of the previous day's Value Area (and finds acceptance there), a new trend often starts. TPO helps you avoid trading against this new trend.

Conclusion TPO isn't a holy grail, but it filters the noise out of the chart. You immediately see: Where is the value, and where is just hype? The DRX TPO Master is designed to make this analysis as simple as possible in MT5—interactive and without trashing your chart. Give the "Split" function a try; it often opens your eyes to the intraday flow.

If you have questions about the settings or the color coding, just hit me up or join the discussion in the group: 👉 https://t.me/drx_trading