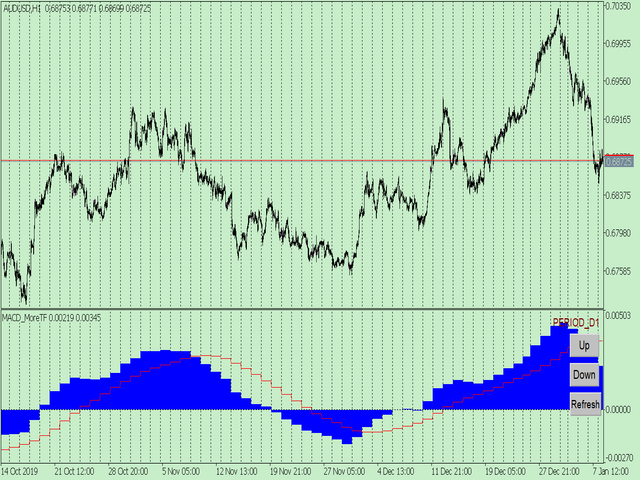

MACD MoreTimeFrame

I found that most traders need to use multiple time frame indicators. They usually switch time frame to see indicators.

However, once the timeframe is switched, you cannot see the corresponding relationship between the price in the smaller timeframe and the indicator in the larger timeframe.

For example: if your price chart is in H1 timeframe, you can see H4, D1 and W1 indicators in H1 timeframe Chart. This is more helpful for you to find the structural change of price, so as to better help you make decisions.

2. What is this

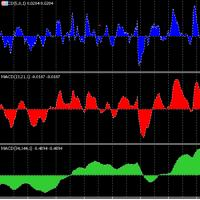

MT5 has many system built-in indicators, such as trend, ocillators, volumes, and Bill Williams. They are all commonly used. And they can meet the needs of most traders.

For all these built-in indicators, I have all developed the multi timeframe version. Any indicator you can switch the time frame through the GUI. So you can choose what you need.

3. How to use

Add the indicator to Chart and you will see the GUI.

- Up button means switching to a higher time frame;

- Down button means switching to a lower time frame;

- Refresh button means refreshing, because sometimes your MT5 needs to load and download symbol price data, Refresh button can show indicators faster.

4. Parameter Description

General parameters:

- Input_ForexName=""; // Input your symbol. Default is Chart Symbol.

- Input_TimeFrame=PERIOD_CURRENT; // Choose TimeFrame. Default is Chart TimeFrame.

- TimeModeAll=true; // Whether to use all TimeFrame: m1/m2/m3/m4/.../H1/H2/H3/H4/......

- GUICorner = CORNER_RIGHT_UPPER; // the corner of GUI. Usually you don't need to change it.

- Parameters equivalent to system built-in indicators, very simple and easy to understand.

5. Other instructions

You can choose the indicators you like. Due to word limit on web pages, below are the links to the category of current indicator.

The indicators are divided into DEMO version and unlimited version. The DEMO version is free and can only be used for EURUSD / AUDUSD / GBPUSD / NZDUSD / USDCHF / USDJPY / USDCAD / XAUUSD.

Thanks!

用户没有留下任何评级信息