Institutional Footprint Zones

- 지표

- Shawntel Wisdom Nyungu

- 버전: 2.2

- 활성화: 5

Institutional Footprint Zones

Advanced Multi-Timeframe Supply & Demand Analysis

Institutional Footprint Zones is a professional trading indicator designed to reveal where large market participants have previously left strong buy and sell footprints. It automatically identifies, tracks, and manages high-probability Supply and Demand Zones across multiple timeframes, allowing traders to align entries with institutional price behavior instead of random market noise.

The indicator eliminates the need for manual zone drawing and subjective analysis by using a structured, rule-based approach to zone detection, validation, and lifecycle management.

What the Indicator Does

Institutional Footprint Zones continuously analyzes price action to detect areas where price moved aggressively away from a level, indicating strong institutional participation. These areas are marked as Supply or Demand Zones and updated in real time as market conditions evolve.

Zones are dynamically adjusted, filtered, and classified based on their strength, freshness, and relevance across higher and lower timeframes.

Key Features

1. Automatic Supply & Demand Detection

-

Identifies institutional Supply and Demand zones based on impulsive price movement and structure behavior

-

Automatically draws zones on the chart with no manual input required

-

Zones adapt to changing market conditions in real time

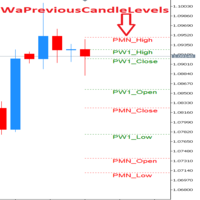

2. Multi-Timeframe (MTF) Zone Analysis

-

Displays zones from higher timeframes directly on the current chart

-

Clear visual differentiation between current timeframe zones and higher timeframe zones

-

Helps traders trade in alignment with higher-timeframe institutional bias

3. Zone Strength & Validation Logic

Each zone is evaluated and classified using internal validation rules such as:

-

Strength of the price departure from the zone

-

Number of touches and reactions

-

Fresh vs. previously used zones

-

Time spent inside the zone before expansion

This allows traders to focus on high-quality institutional levels, not every price fluctuation.

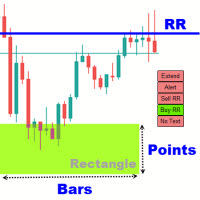

4. Smart Zone Filtering

Users can customize how many and which zones appear on the chart:

-

Minimum and maximum zone size filters (in pips)

-

Ignore weak or outdated zones

-

Option to hide broken or invalidated zones

This keeps the chart clean and focused on actionable levels.

5. Institutional Confluence Recognition

When zones from multiple timeframes overlap, the indicator highlights these areas as high-confluence institutional zones, where large participants are more likely to defend price.

This feature is particularly useful for:

-

ICT concepts

-

Smart Money trading

-

Market structure-based strategies

6. Real-Time Alerts

Configurable alerts notify the trader when:

-

Price enters a Supply or Demand zone

-

A new zone is formed

-

A zone is broken or invalidated

Alerts can be delivered as:

-

Platform alerts

-

Push notifications

-

Chart notifications

Each alert includes contextual information such as timeframe and zone type.

7. Session-Aware Market Analysis

Optional session filtering allows traders to focus on zones created during:

-

London session

-

New York session

-

London–New York overlap

This helps identify zones formed during periods of highest institutional activity.

8. Non-Repainting Logic

Once a zone is confirmed and printed on the chart, it does not repaint or move historically. Zones are only updated when market structure clearly invalidates them.

This ensures transparency and reliable backtesting.

9. Lightweight & Optimized Performance

-

Designed for smooth performance across multiple symbols and timeframes

-

Strategy-tester friendly

-

No unnecessary logging or chart overload

Fully compatible with MetaTrader 5 validation requirements.

Who This Indicator Is For

-

Traders using Supply & Demand concepts

-

ICT and Smart Money traders

-

Price action traders seeking objective institutional levels

-

Scalpers, intraday traders, and swing traders

-

Traders who want clarity without clutter

Important Notes

-

Institutional Footprint Zones is an analytical tool, not an automated trading system

-

It does not guarantee profits and does not place trades automatically

-

Designed to assist decision-making by highlighting institutional price behavior