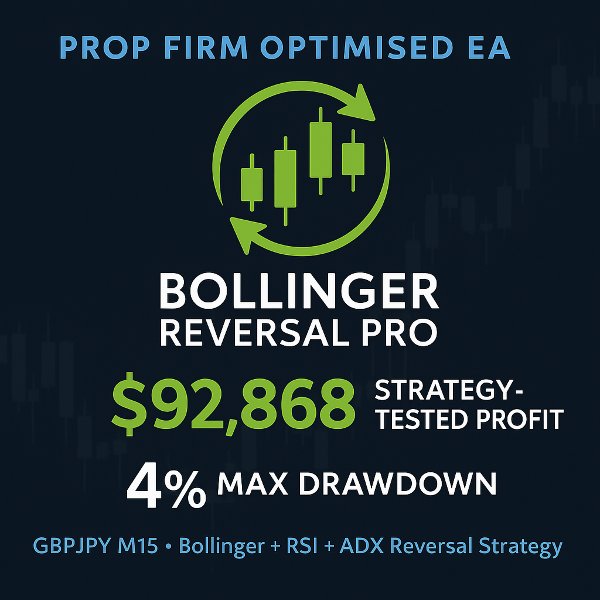

Bollinger Reversal Pro Prop Firm Optimized GBPJPY

- Experts

- Adam Benjamin Kildare

- 버전: 1.1

- 업데이트됨: 5 8월 2025

- 활성화: 5

Bollinger Reversal Pro – Built for Prop Firm Success

Bollinger Reversal Pro is a low drawdown, non-hedging, high reward Expert Advisor combining Bollinger Bands, RSI, and ADX to identify high‑probability reversal trades with strong trend confirmation.

Optimized for GBPJPY M15 and tested under $100K, 1:100 leverage FTMO‑style conditions, this EA delivers high‑impact trades with exceptional reward‑to‑risk ratios — ideal for both prop firm challenges and live funded accounts.

Bollinger Reversal Pro trades only during the Australian/Asian session and is completely closed before the London session starts, keeping sessions independent and avoiding cross-session volatility.

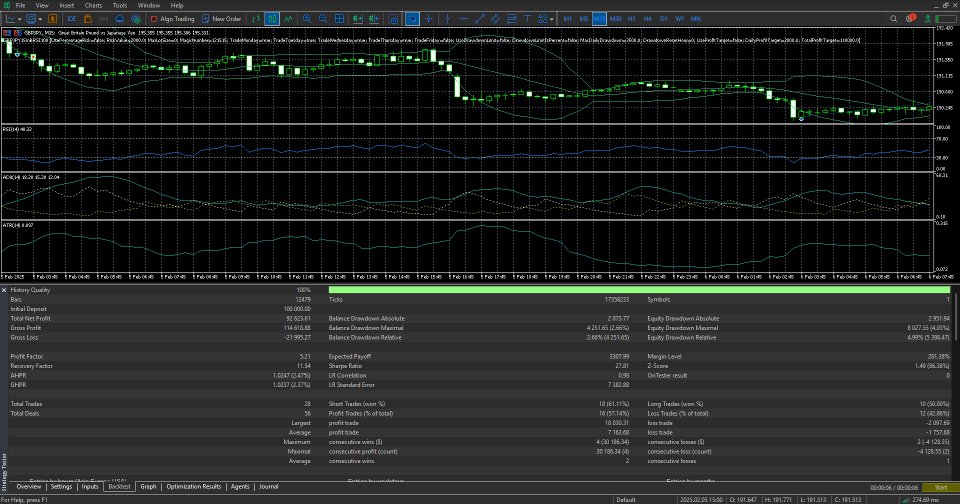

Strategy Tested 6‑Month Performance

- Total Profit: $92,868

- Max Equity Drawdown: 4%

- Win Rate: 57.14%

- Average Consecutive Losses: 1

- Trades Taken: 28

- Average Loss: –$1,757

- Average Win: $7,163 (≈ 4× larger than average loss)

- Default Risk Per Trade: $2,000 for $100K at 1:100 leverage (already set in EA)

Statistics Current 2/8/2025

Why It’s Ideal for Prop Firm Challenges & Live Accounts

- Low Drawdown – Stays within common 5% daily / 10% total rules

- Large Average Win Size – 4× bigger than average loss

- User‑Defined Risk – Adjust for account size and number of EAs

- Independent Session Trading – Runs only during Australian/Asian session to avoid volatile cross‑session moves

- Non-Hedging – Safe for hedging and non-hedging account types

- Optional Daily/Overall Profit Target – Stop trading after reaching your goal

- Optional Daily Drawdown Limit – Enable to stop trading after your chosen threshold

- Spread & Time Filters – Avoids poor market conditions

Key Features

- Triple‑Filter Entry Logic – Bollinger Band extremes, RSI overbought/oversold, and ADX trend strength

- ATR‑Based SL & TP – Adaptive stop and take profit levels

- Max Spread Filter – Avoids poor fills during volatile periods

- Cooldown Between Trades – Prevents overtrading

- Timed Trade Closure – Always flat before key high‑volatility windows

- Prop Firm Friendly – Meets common challenge rules

- User‑Defined Trading Days – Avoid trading during high‑impact economic news

Recommended Settings

- Symbol: GBPJPY

- Timeframe: M15

- Account Size: $100K tested, adjust risk proportionally for other sizes

- Leverage: 1:100

- Risk Per Trade: $2,000 per $100K (adjust up for larger, down for smaller)

- Trading Style: Session‑based reversal trading

- Broker Time: GMT+3

Important Notes

- Bollinger Reversal Pro has been optimized using FTMO trading conditions:

- GBPJPY M15

- $100K account size

- 1:100 leverage

- GMT+3 broker server time

- Performance results may differ with other brokers, server times, or execution conditions. Check your strategy tester to confirm.

- The default $2,000 risk per trade is set for a $100K account at 1:100 leverage.

- For other account sizes, adjust proportionally:

- $4,000 for $200K

- $1,000 for $50K

- $500 for $25K

- Increasing risk beyond these levels will overleverage the account and may cause performance to degrade.

- If running multiple EAs on the same account, divide the risk amount by the number of EAs in use.

- You can reduce the risk for smaller accounts or increase it for larger accounts safely.

- Always forward test with your broker’s demo account before trading live.

Try Before You Buy – Free Demo Available

You can download a free demo version of Bollinger Reversal Pro directly from the MQL5 Market page.

We recommend testing it in your MetaTrader 5 Strategy Tester using your preferred account balance, leverage, and broker conditions.

This will help you see exactly how Bollinger Reversal Pro performs before going live.

How To Test This EA

After downloading the demo an extra icon named 'GBPJPY15mBRP100' will appear in the Expert Advisors section of your Navigator to show that the demo was downloaded successfully.

Next click on the View button in the top taskbar and select Strategy Tester in the drop-down menu. Select Single from the options in the overview and the inputs for the strategy tester should appear. Click on the Experts bar and select 'GBPJPY15mBRP100' from the dropdown. Change the Symbol to GBPJPY and the timeframe to 15m (if you ever forget GBPJPY15m is in the beginning of the name). If for some reason you are unable to find GBPJPY you may need to click view from the top taskbar then symbols and select it to be shown in the window that appears. Next select the testing history period. We recommend six months so that there is sufficient history to show performance but not too long to include data from market conditions that are no longer relevant. In the forward Section it’s generally easier to select 'No' to show the whole history in one page otherwise selecting 1/4 will split the test data into 6months ago - 1.5 months ago in back test and then 1.5 months ago - now in a forward section. Select delays to last ping on your server and modelling to every tick to give you the most accurate results from your back test. Enter your account balance in the deposit section and your leverage in the leverage section then ensure optimization is disabled. Next open the inputs tab, right click anywhere on the table and select defaults to ensure no previously cached inputs have affected the inputs on this EA. Now you're good to hit start and after a few seconds a back test bar should appear next to the inputs bar and will show you the data on how the EA performed on your terminal with your brokers data.

Risk Management

Bollinger Reversal Pro is pre‑configured with optimized parameters for stability and performance.

The key safety and scheduling settings that remain under your control include:

- Risk amount (adjustable for account size and number of EAs)

- Optional daily drawdown and profit targets

- Trading days (can be adjusted to avoid news events)

Get Started in 3 Steps

- Load Bollinger Reversal Pro on GBPJPY M15.

- Keep the default $2,000 risk for $100K accounts, or adjust proportionally.

- Let the EA trade its optimized session hours.

Disclaimer: Strategy Tester results are not a guarantee of future performance. Always forward test on demo before going live.