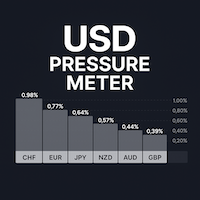

USD Pressure Meter MT4

- 지표

- Sathit Sukhirun

- 버전: 1.12

- 활성화: 20

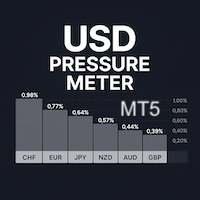

USD Pressure Meter: Key Benefits for Forex Market Analysis and Macro View

The "USD Pressure Meter" offers several crucial benefits for analyzing the Forex market and understanding the broader macro-economic landscape:

1. Analyzing USD Pressure

This indicator measures the "pressure" the US Dollar (USD) faces from other currencies over a 1-day period (1 Day Relative Performance).

- If other currencies strengthen against the USD → it means the USD is weakening.

- If other currencies weaken → it means the USD is strengthening.

2. Identifying Capital Flow Signals

Investors can observe:

- Money flowing out of USD to other currencies like CHF, EUR → signals potential USD weakness.

- Money flowing back into USD → indicates potential USD strength.

This is ideal for Risk-On / Risk-Off strategies and trading based on global economic trends.

3. Gauging Short-Term Direction

The 1-day change is suitable for Intraday or Swing Traders who want to:

- Identify the "strongest" currency.

- Pair the strongest currency with the weakest for trades, e.g.:

- Long CHF / Short USD

- Long EUR / Short USD

4. Supporting Portfolio Allocation Decisions

This information can be used to adjust the proportion of different currencies in an investment portfolio, for example:

- Reducing USD weighting when other currencies are simultaneously strengthening.

- Increasing weighting in safe-haven currencies like CHF, JPY.

Key Benefits Summary

| Benefit | Description |

| Currency Analysis | Shows USD direction against major currency pairs. |

| Pressure Analysis | Indicates which currencies are strengthening or weakening globally. |

| Strategic Use | Applicable for trading strategies, portfolio allocation, and hedging. |

| Easy Visualization | Data is clearly presented in a Histogram format for easy interpretation. |