Abiroid Scanner NRTR

- 지표

- Abir Pathak

- 버전: 1.2

- 업데이트됨: 31 5월 2025

- 활성화: 20

Detailed blog post with screenshots here:

https://www.mql5.com/en/blogs/post/762513

Features:

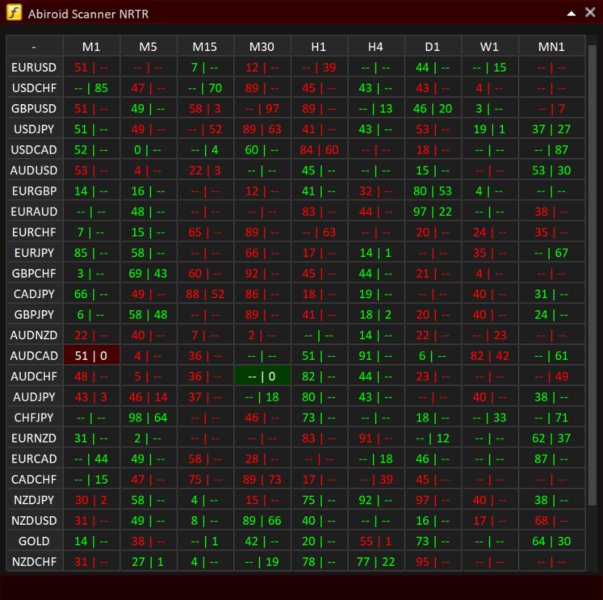

This scanner will show:

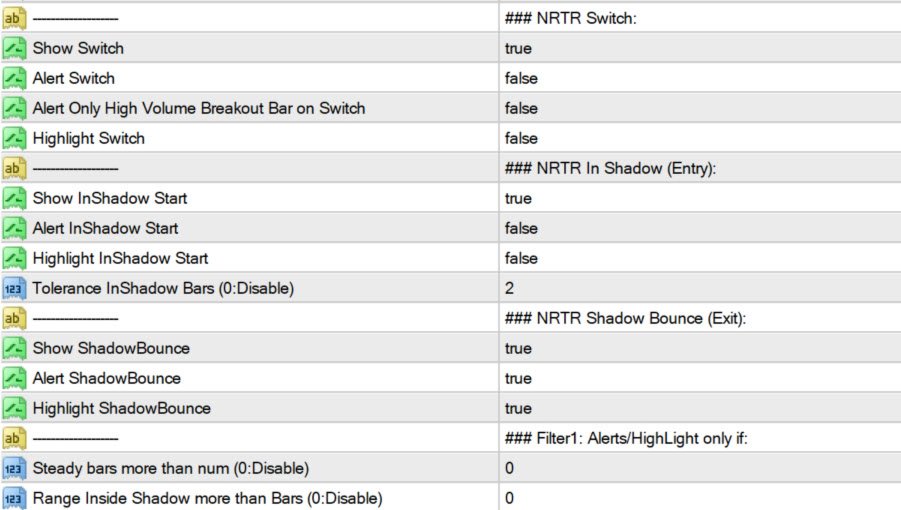

- NRTR Basket Trading

- Trend direction

- Last NRTR Switch (breakout) - number of bars and if it was a high volume bar

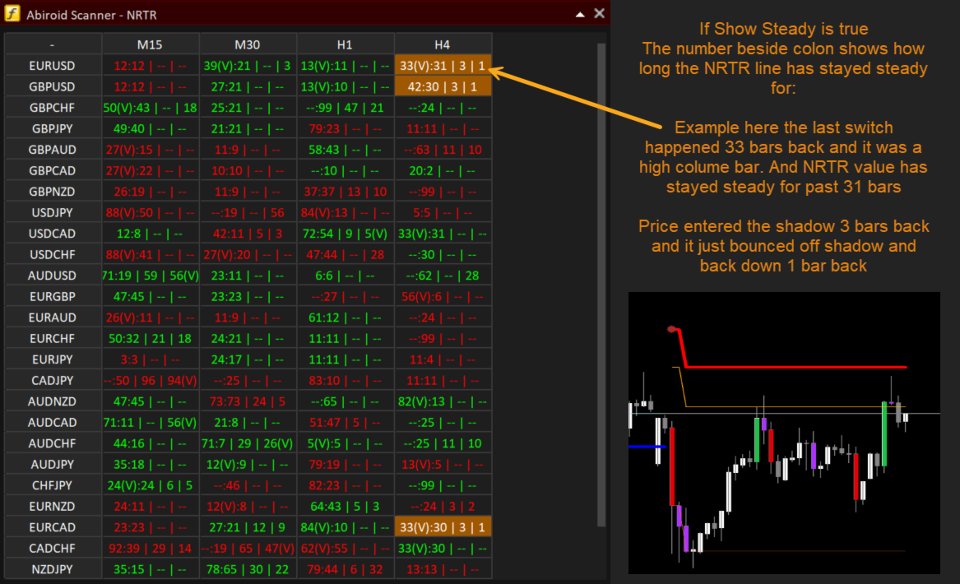

- How many bars has the SR stayed steady for

- When price last entered an NRTR shadow

- When price bounced off the NRTR shadow back inside

NRTR Explained:

https://www.mql5.com/en/blogs/post/762509Basket Trading

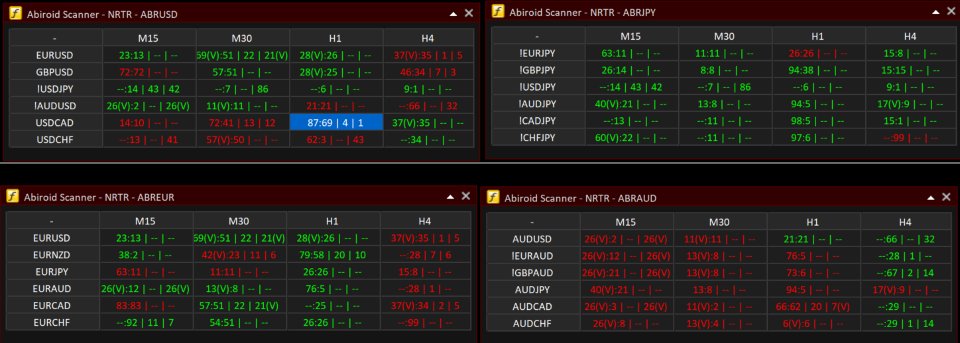

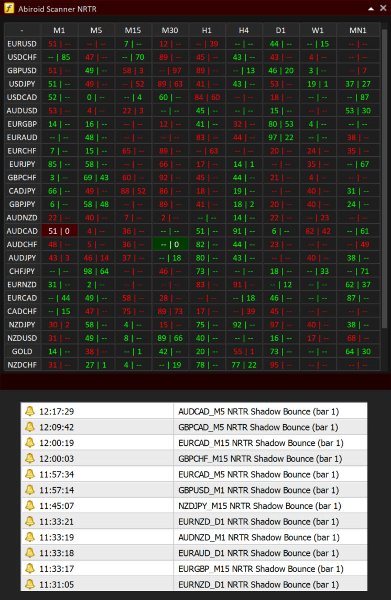

If you like to basket trade, then you can set multiple scanners in separate baskets and see how the overall currency is doing.

You can also set which pairs need to be reversed. To allow basket settings to work. E.g. If it's a USD basket, then you will need EURUSD signals to be reversed. So it aligns with USD basket signals. All reversed pairs will have an exclaimation like: "!EURUSD". Non-reversed pairs will just be like "EURUSD".

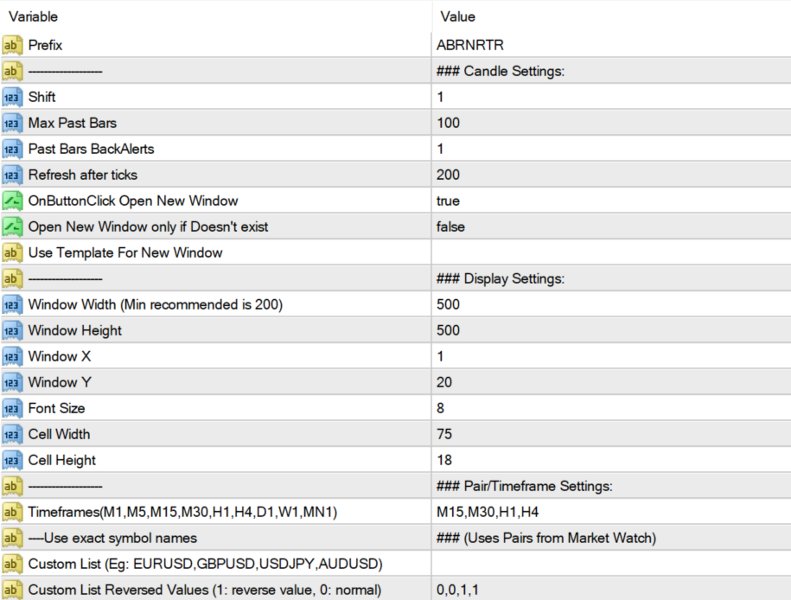

You can specify your own custom pairs list. Make sure that pair name is exactly like in market watch. And pair is available in Market watch. If Custom pair list is blank, it will use all pairs available in Market watch.

So, suppose if you see that AUD is in an overall downtrend, then it won't be a good idea to trade any BUY signals at this point.

E.g:

If Custom List is: EURUSD,GBPUSD,USDJPY,AUDUSD,USDCAD,USDCHF

And Reverse Pair List is: 1,1,0,1,0,0

0 is normal values. And 1 means reverse values.

So it will reverse: EURUSD and GBPUSD and AUDUSD:

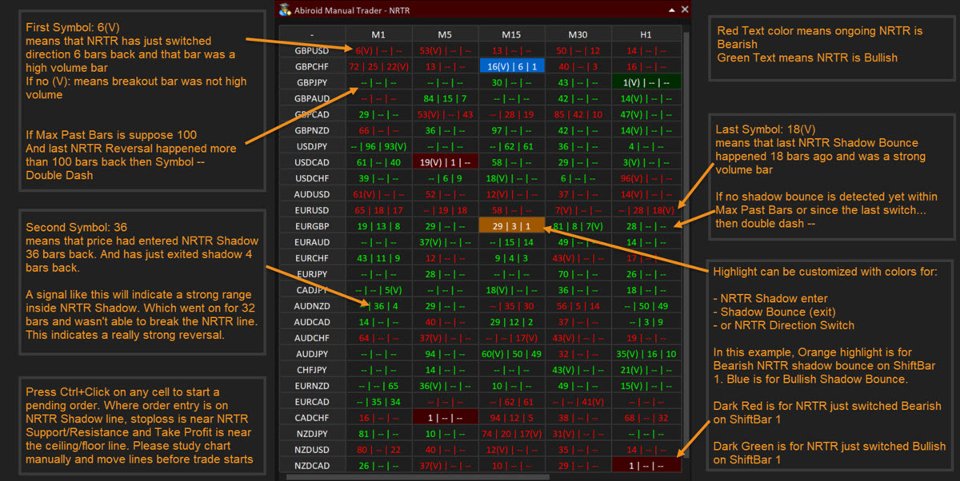

Trade Style:

Place Pending Orders manually.

There are 2 ways to trade signals:

Trends or Reversals

Trends:

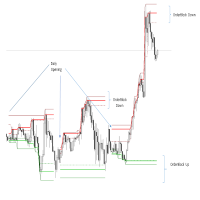

Suppose you want to just do quick scalping along the direction of overall trend, then just wait for price to breakout NRTR SR areas with a strong volume bar:

Example AUDUSD M15:

Overall AUD currency is bearish. And had been slow and ranging. But price picks up and has a high volume breakout downwards.

Since breakout bar was too strong, price will usually self correct by retracing a bit. So, it's always a good idea to place a pending SELL order a bit inside that breakout bar. And look at the past bars to find a good take profit.

If you are scalping, keep an eye on the price and see when it starts slowing and ranging. Always place a very close stop loss when scalping.

Reversals:

When price enters the NRTR Shadow, but doesn't breakout.. instead it forms a range, then that's a good place to wait. Especially if NRTR has stayed steady.

If you are trading conservatively, then look for a high volume bar reversing out of the shadow:

Keep a pending SELL limit order with entry at the shadow line. And stop loss a bit above the NRTR red line. And take profit should be at least 2-3 times that. Somewhere above the red floor line.

Look at the past bars, to see how the pair has been doing. If it usually reaches the floor or ceiling lines or not. And place take profit accordingly.

Also use something for volatility like BBSqueeze, and trade only when good volatility. Very slow ranging market will not give good reversals.