당사 팬 페이지에 가입하십시오

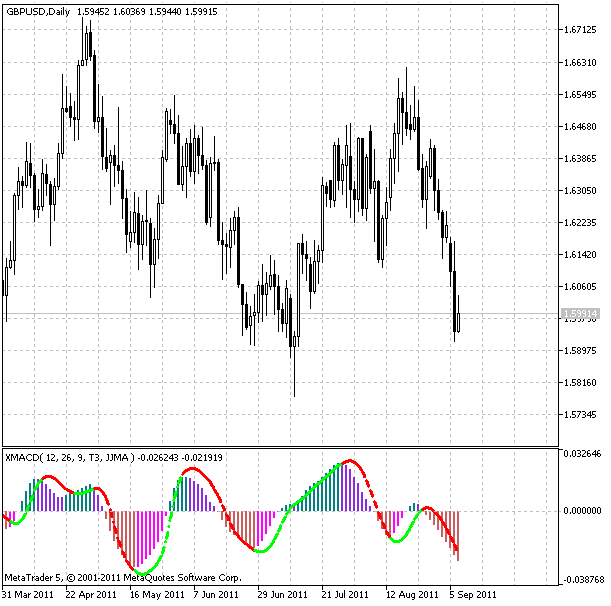

히스토그램 자체와 신호선의 평균화 알고리즘을 변경할 수 있는 고전적인 버전의 MACD 지표로, 10가지 가능한 옵션 중에서 선택할 수 있습니다:

- SMA - 단순이동평균;

- EMA - 지수 이동 평균;

- SMMA - 평활 이동 평균;

- LWMA - 선형 가중 이동 평균;

- JJMA - JMA 적응 평균;

- JurX - 초선형 평균;

- ParMA - 파라볼릭 평균;

- T3 - 틸슨 다중 지수 평활;

- VIDYA - 투샤르 찬데 알고리즘을 사용한 평균화;

- AMA - 페리 카우프만 알고리즘을 사용한 평균화.

Phase1 및 Phase2 매개변수는 평균화 알고리즘에 따라 의미가 상당히 다르다는 사실에 주의해야 합니다. JMA의 경우 -100에서 +100까지 변화하는 외부 변수 Phase입니다. T3의 경우 더 나은 인식을 위해 평균화 계수에 100을 곱한 값이고, VIDYA의 경우 CMO 오실레이터의 주기이며, AMA의 경우 느린 EMA의 주기입니다. 다른 알고리즘에서는 이러한 매개변수가 평균에 영향을 미치지 않습니다. AMA의 경우 빠른 EMA의 주기는 고정되어 있으며 기본적으로 2와 같습니다. AMA의 차수 계수도 2로 고정되어 있습니다.

히스토그램의 색상과 신호선은 현재 시장 추세에 따라 변경됩니다. ColorXMACD_Alert 인디케이터는 마지막 닫힌 막대에서 신호선의 색이 변할 때 경고하는 기능을 추가로 제공합니다.

이 인디케이터는 SmoothAlgorithms.mqh 라이브러리 클래스(터미널_데이터_터미널 디렉토리\MQL5\Include에 복사)를 사용하며, 이에 대한 자세한 설명은 "중간 계산을 위한 추가 버퍼 없이 가격 시리즈 평균화" 문서에 게시되어 있습니다.

이 지표는 MQL4에서 처음으로 구현되었으며 2009.03.03에 최소 지연을 가진 효율적인 평균화 알고리즘과 지표 및 전문가 자문에서의 사용 문서에 게시되었습니다.

MetaQuotes Ltd에서 러시아어로 번역함.

원본 코드: https://www.mql5.com/ru/code/509

BB_XMACD

BB_XMACD

BB XMACD 지표는 MACD 지표의 간단한 변형으로, 추세 방향의 변화 지점 및 현재 추세의 강도를 식별하는 데 도움이 됩니다.

Seven strategies in One expert

Seven strategies in One expert

전문가 이름은 '멀티전략EA'입니다.