거래 로봇을 무료로 다운로드 하는 법을 시청해보세요

당사를 Telegram에서 찾아주십시오!

당사 팬 페이지에 가입하십시오

당사 팬 페이지에 가입하십시오

스크립트가 마음에 드시나요? MetaTrader 5 터미널에서 시도해보십시오

- 조회수:

- 7958

- 평가:

- 게시됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

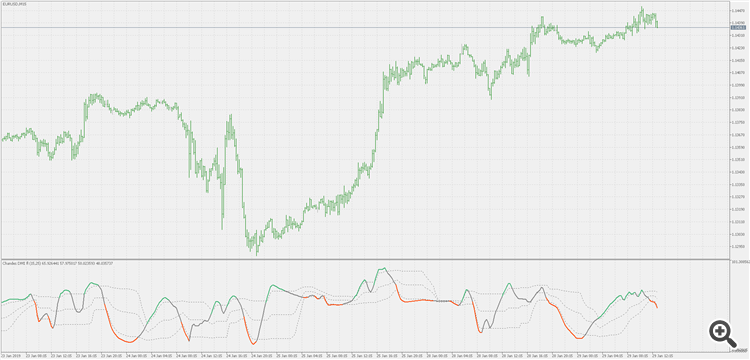

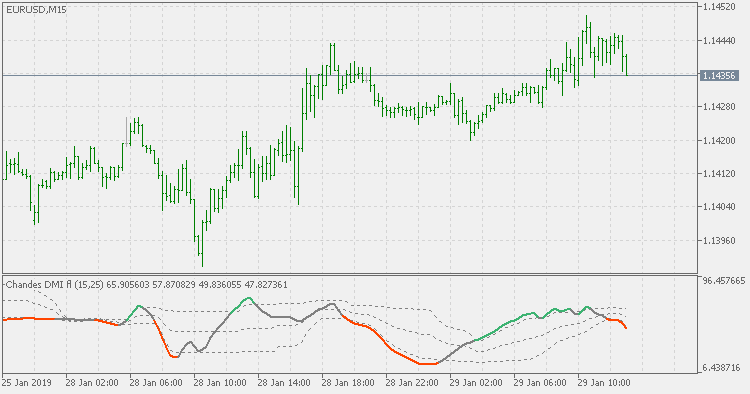

Theory :

Original definition of the Tushar Chande's and Stanley Kroll's DMI is the following :The dynamic momentum index is used in technical analysis to determine if a security is overbought or oversold. This indicator, developed by Tushar Chande and Stanley Kroll, is very similar to the relative strength index (RSI). The main difference between the two is that the RSI uses a fixed number of time periods (usually 14), while the dynamic momentum index uses different time periods as volatility changes, typically between five and 30.

This version is deviating from it in a number of ways :

- it is using RSX instead of RSI for calculation (thus producing a much smoother result)

- it is using standard deviation adapting to calculate that RSX

- it is adding floating levels instead of using fixed levels for OB/OS signal. It is similar to the version using discontinued signal lines (originally published here : Chande's DMI - with DSL) , but the floating levels are different from discontinued signal lines in many things, but the main difference is that DSL, even though it is adapting itself to the values, it basically remains oscillation around some "central" value, while for floating levels there is no such limitation at all

Usage :

You can use color changes as signals. Color change can be one of the following :

- color change on slope change

- color change on outer levels cross

- color change on middle level cross. the middle signal line is calculated as the average of upper and lower level, which makes it a good new "zero" line (or 50 line in case of DMI)

Chande's DMI - std adaptive with dsl signal lines

Chande's DMI - std adaptive with dsl signal lines

Chande's DMI - std adaptive with dsl signal lines

Sharp modified MA

Sharp modified MA

Sharp modified MA

Volatility ratio

Volatility ratio

Volatility ratio - standard deviations based

Volatility ratio - with floating levels

Volatility ratio - with floating levels

Volatility ratio - standard deviations based with floating levels