당사 팬 페이지에 가입하십시오

- 조회수:

- 9584

- 평가:

- 게시됨:

- 업데이트됨:

-

이 코드를 기반으로 한 로봇이나 지표가 필요하신가요? 프리랜스로 주문하세요 프리랜스로 이동

Theory :

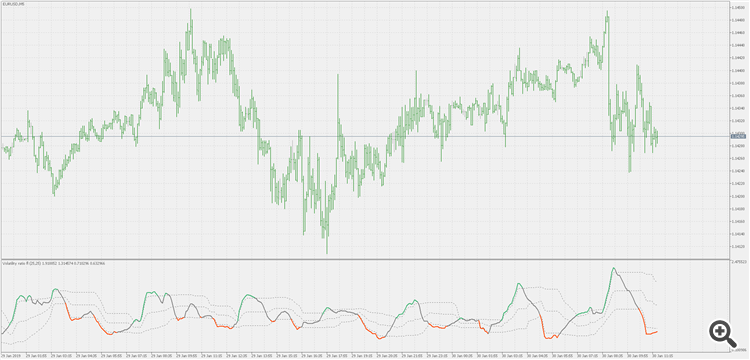

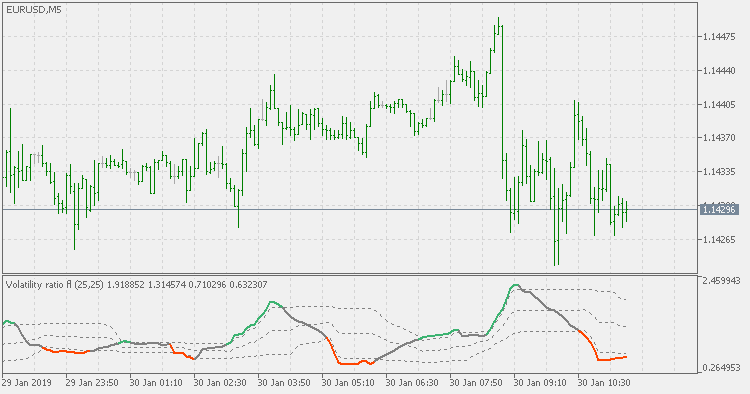

There is always a need to measure if the market is "quiet" or it is

volatile. One of the possible way is to use standard deviations, but the

issue is simple : we do not have some levels that could help us find

out if the market is in a state of lower or higher volatility. This

indicator is attempting to do that but not by using fixed levels but adding floating (adaptive) levels. That way you have possible more states (including the "neutral" state) that can be checked and used in trading decisions

Usage :

This is not a directional indicator. It should be used for volatility detection, not trend assessment - for that you have to use some other indicator and then check this one if the market volatility conditions are those that you expect

Volatility ratio

Volatility ratio

Volatility ratio - standard deviations based

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

Chande's DMI - std adaptive with floating levels

RSX volatility ratio adaptive

RSX volatility ratio adaptive

RSX volatility ratio adaptive

Volatility ratio adaptive double smoothed Wilders EMA

Volatility ratio adaptive double smoothed Wilders EMA

Short description.