Young Ho Seo / プロファイル

- 情報

|

12+ 年

経験

|

62

製品

|

1207

デモバージョン

|

|

4

ジョブ

|

0

シグナル

|

0

購読者

|

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

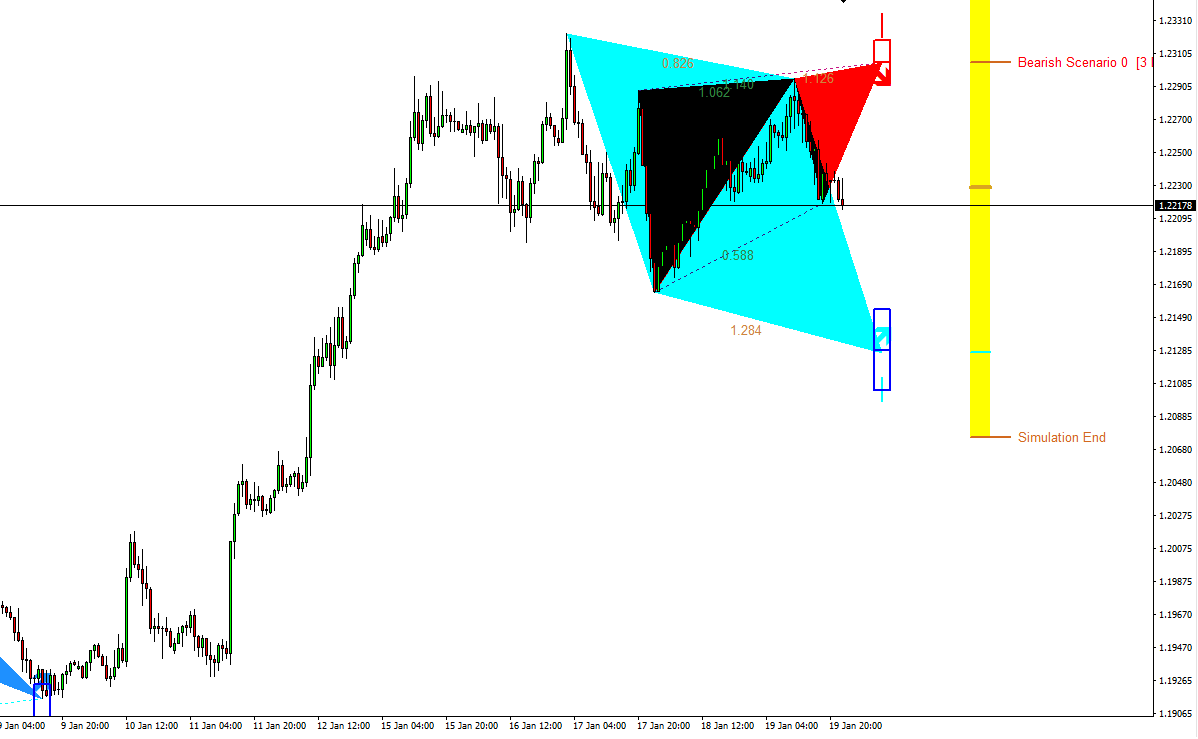

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too. Harmonic Pattern Scenario Planner is also compatible with our Harmonic Pattern Order EA.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game.

http://www.imdb.com/title/tt0435705/

We are the only one selling the future predictive harmonic pattern scanner.

http://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/users/financeengineer/seller#products

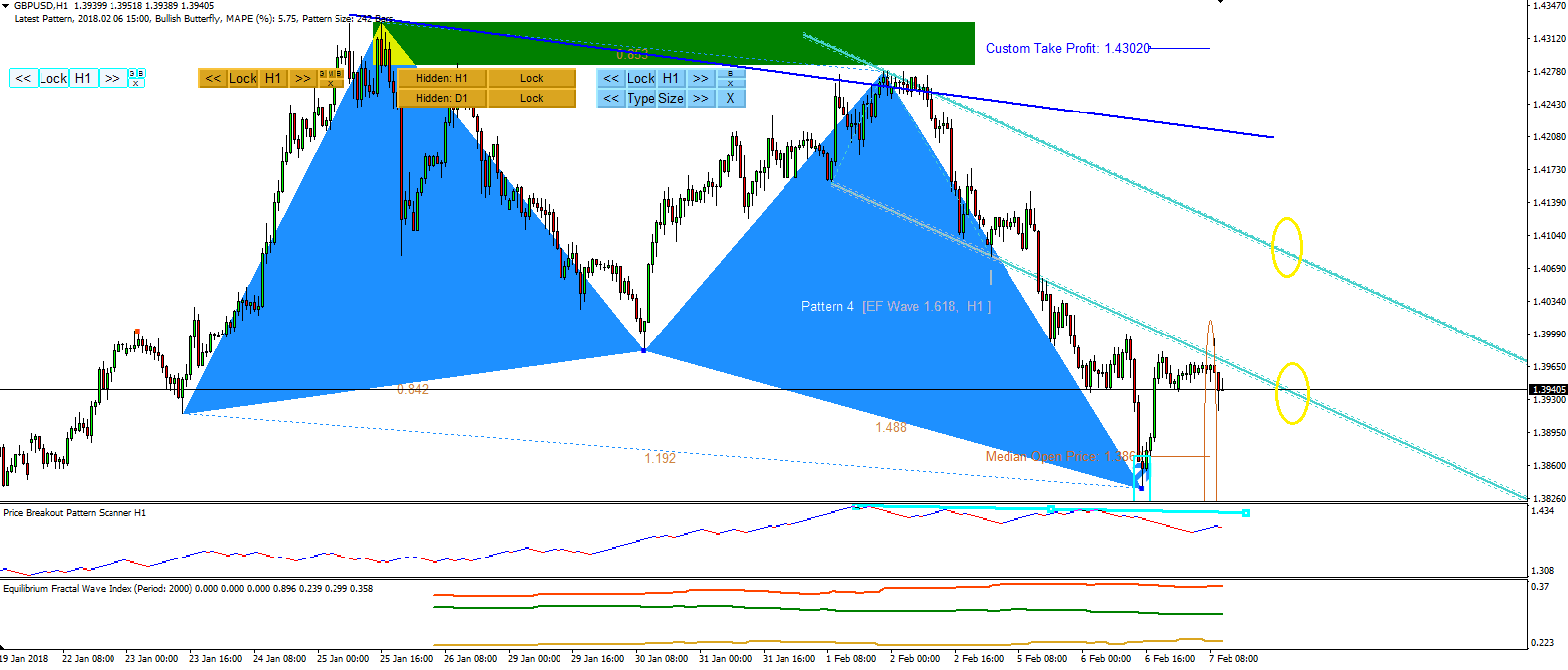

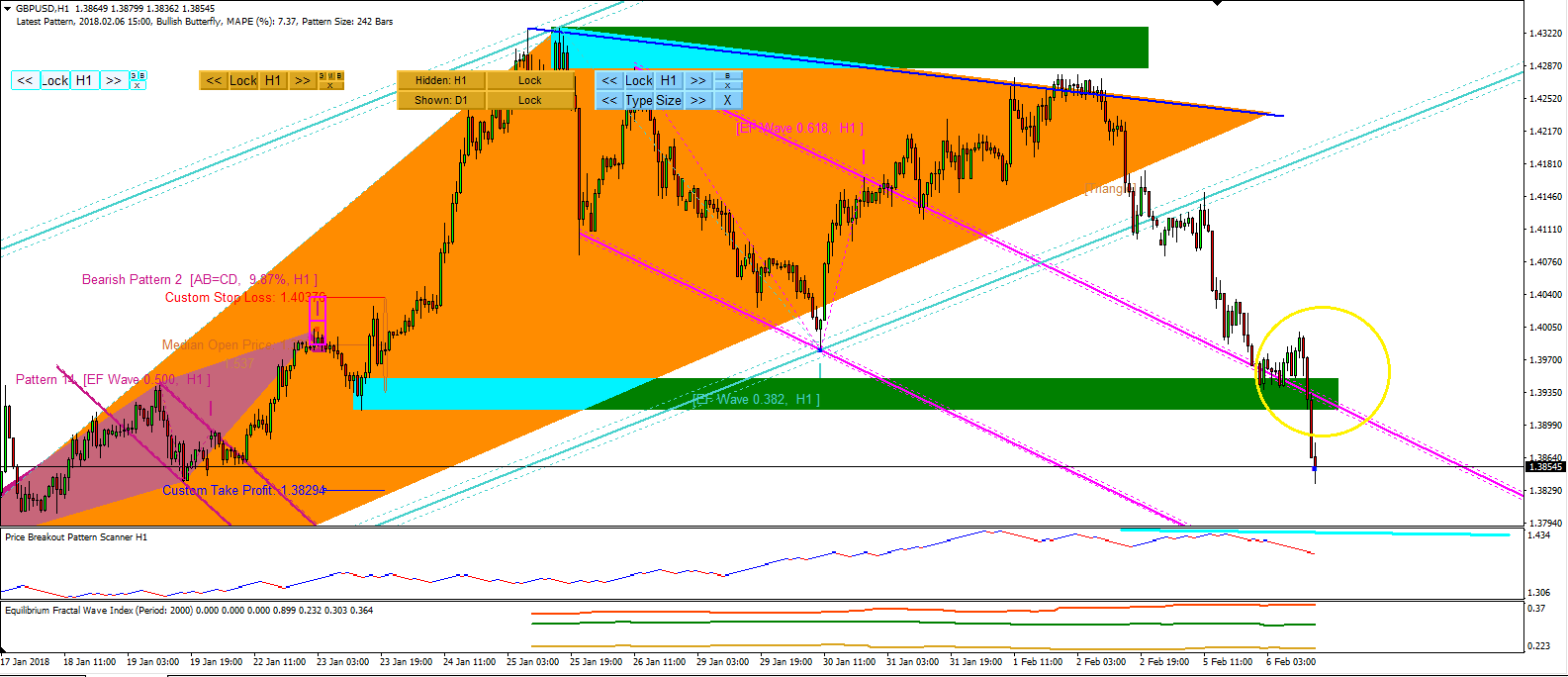

In our last analysis, we have given you the medium term analysis for EURUSD. We also provide the medium term analysis for GBPUSD. Last week, GBPUSD made a sharp fall following the EFW channel in H1 timeframe. In fact, the price dropped until it hit the wedge pattern detected in H4 Price Breakout pattern scanner. It is possible that GBPUSD can go out of this wedge pattern if there is further bearish momentum next week. For your trading, we have marked some improtant region to watch out. Especially we recommend to watch out the diamond region where both long term and short term EFW channel crosses (EFW Analytics). Along with these diamond region, watch out the bottom fo the wedge pattern (H4, Price Breakout Pattern Scanner).

If you are looking for powerful trading system, simply visit our site:

http://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

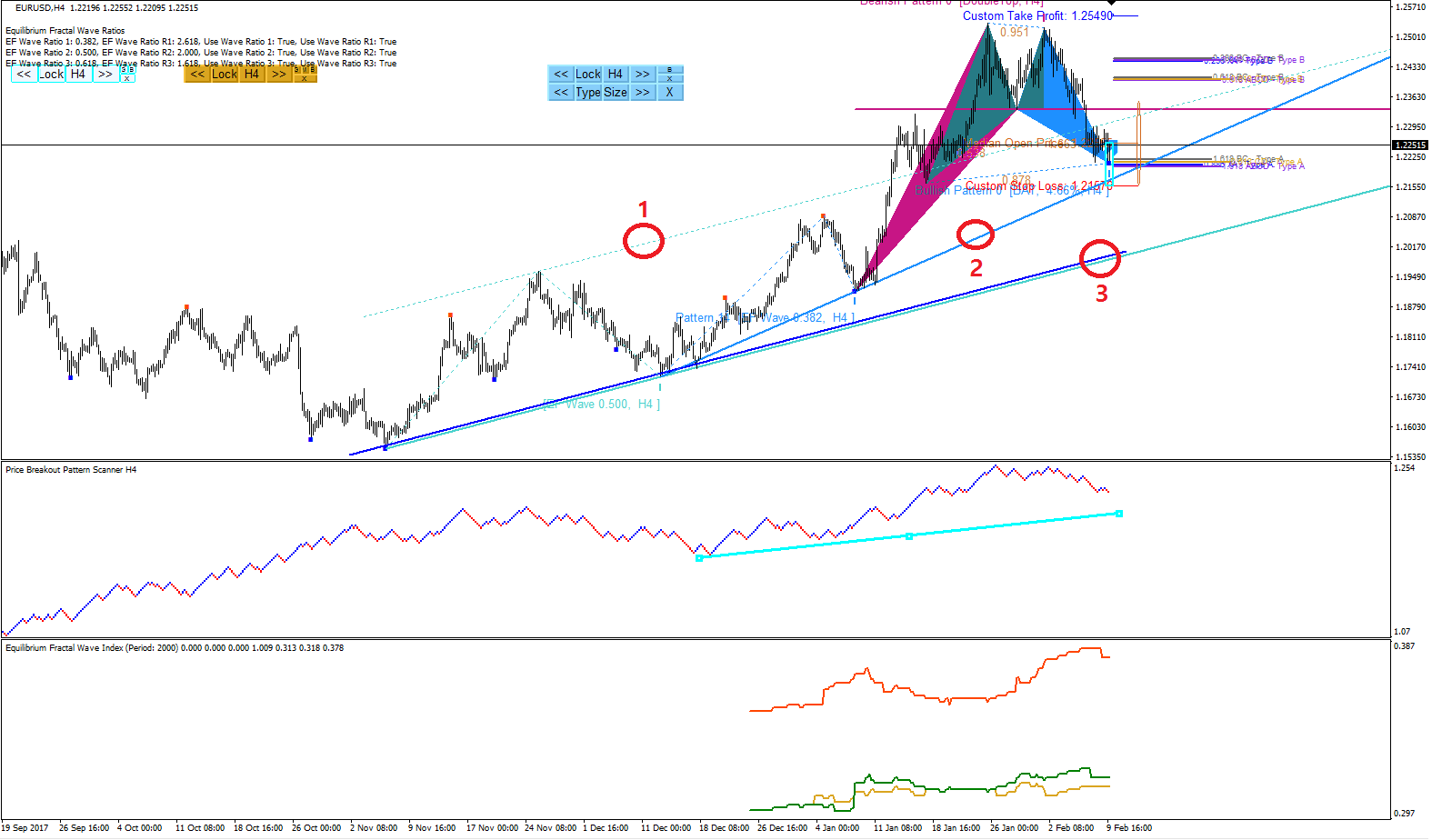

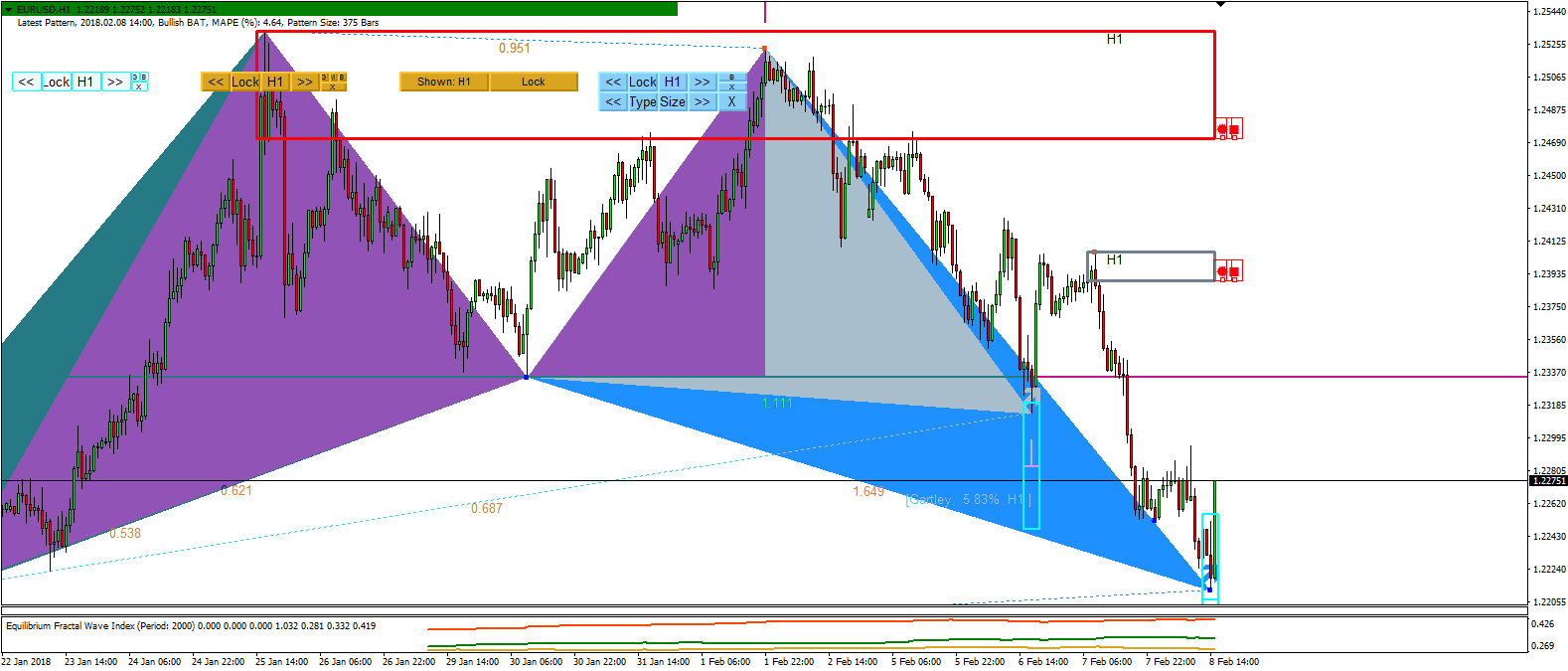

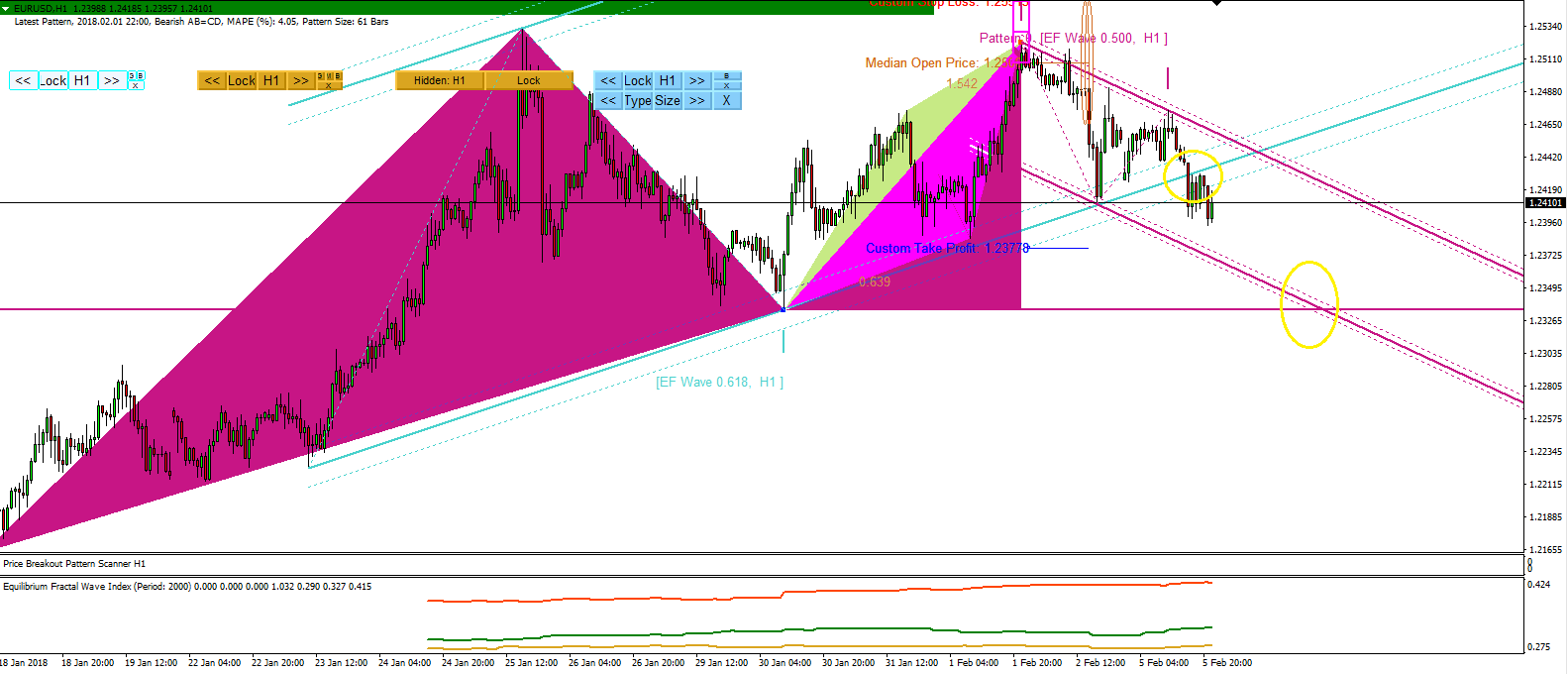

Here is some analysis on EURUSD. I think this screenshot will explain the current situation of EURUSD best. I have marked long term EFW channel double confirmed with Smart Renko (in Price Breakout Pattern Scanner). EURUSD entered a bullish region since 12 January 2018 (outside EFW channel). Then EURUSD gone pretty high breaking the last three years highest. Then the formation of double top really made EURUSD to fall. EURUSD entered inside EFW channel (Line 1) and it changed its pace from fast to moderate. Now important bit here. We have harmonic BAT Pattern. Luckily we had a first candle bar bullish. However, small concern of mine is that the EFW wave projection shows the BAT pattern can be slightly premature. Although the Pattern Completion Interval touched the EF Wave projection (line 2), I can measure around 30 pips distance. Finally, if EURUSD will collapse in the future, then the EF wave projection (or channel) line 3 will be important support. Line 3 must be monitored periodically for our trading. Hope this analysis is useful for your trading and investment.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Here are the short summary of market outlook last week.

GBP

Service PMI look less than forecasting and it also looks decreasing gradually. But it is still over 50.

Manufacturing production stayed in the middle.

AUD

Retails sales have come out less than the forecasting. Could this negative month be just one of those month by chance? Ironically AUDUSD increased next day.

NZD

Employment change was improved over the forecasting. Comparing to the mega employment change last month, this month might be small.

USD

WTI crude oil price dropped marginally. Currently it is hanging below 60 dollar. Not sure if the stock market shake up pressurizing the oil price down. Economically possible assumption though since contracting economy will need less oils (less demand on oil). But the dollar was strong against all major currency pairs.

CAD

Horrible employment change. Almost 98k difference to the forecasting.

If you need a powerful trading system based on the latest trading and investment science, then visit our website:

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

We have many free tools you can use for your trading and investment.

Why don't you take advantage of them when they are free.

You can download them here.

http://algotrading-investment.com/product-category/free/

Also you can access to free trials from our website

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

We have just released the brand new article for your trading "Best Fibonacci Ratio and Shape Ratio for Winning Technical Analysis with 100 Years of Belief". It is only 10 page short article but it will be really useful for your trading. If you were using Fibonacci ratio blindly, just give a quick look at the article. You will find some interesting knowledge through the article.

The article "Best Fibonacci Ratio and Shape Ratio for Winning Technical Analysis with 100 Years of Belief" can be found from:

https://algotradinginvestment.wordpress.com/2018/02/09/best-fibonacci-ratio-and-shape-ratio-for-winning-technical-analysis-with-100-years-of-belief/

http://algotrading-investment.com/2018/02/09/best-fibonacci-ratio-shape-ratio-winning-technical-analysis-100-years-belief/

https://www.mql5.com/en/users/financeengineer/seller#products

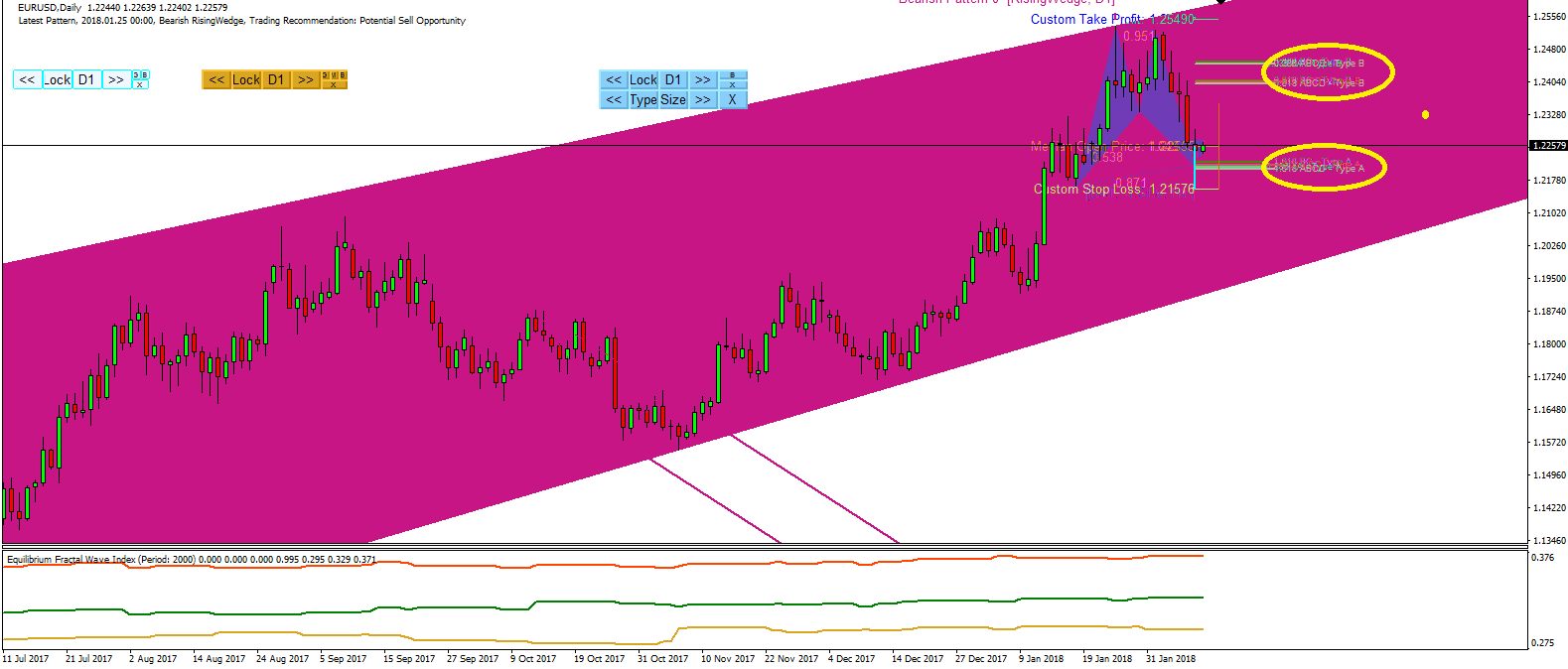

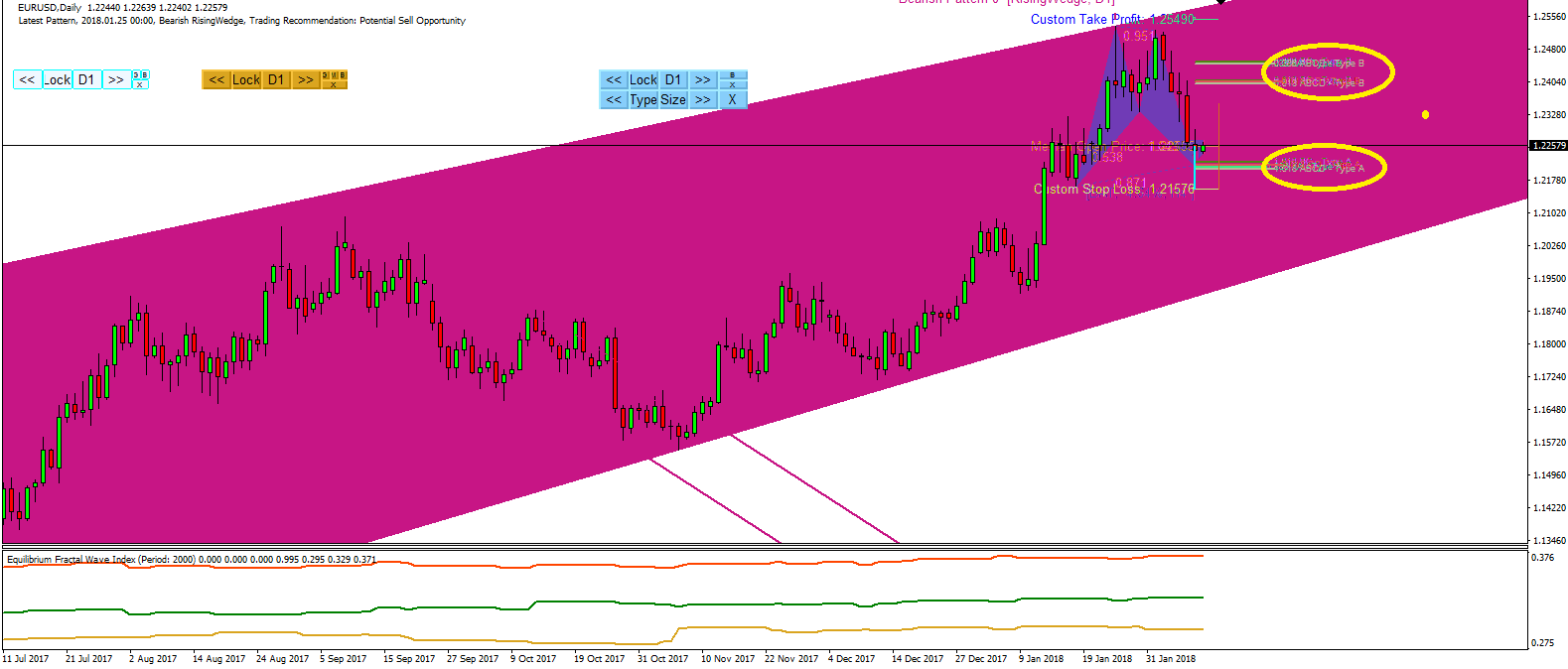

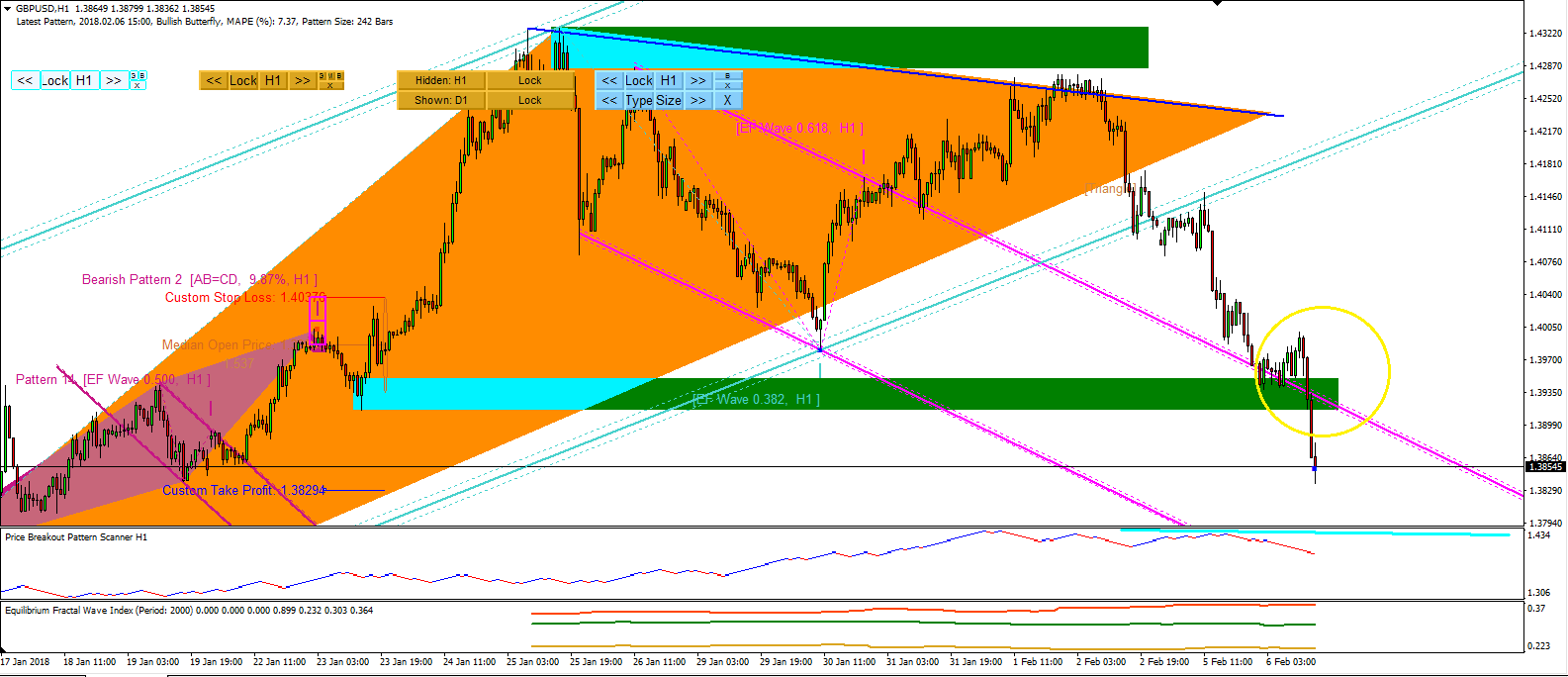

Before we made a short term analysis on EURUSD. Today we have decided to provide you medium term analysis on EURUSD. We brought BAT pattern from H4 timeframe into D1 timeframe. You know how to do this. Just lock the pattern in H4 and change the timeframe. Anyway, in D1, we can see that EURUSD is inside large rising wedge (Price Breakout Pattern Scanner). We have BAT pattern really in the middle of wedge pattern. We have marked both PRZ Type A and Type B as potentially important level to watch out. The thing is after the BAT pattern formation , EURUSD have not entered into the bullish region yet. So please watch on thsese level in your medium term analysis.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

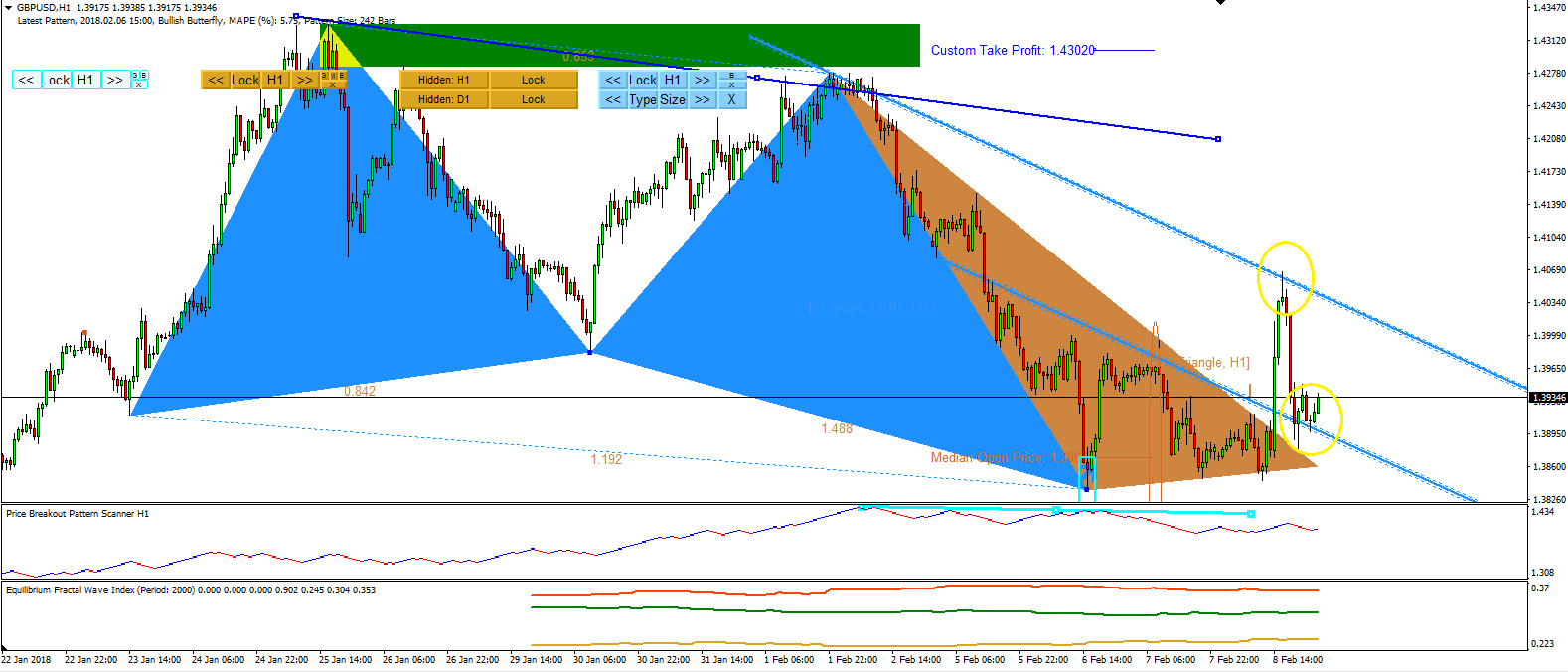

Yesterday, we had a fast market move for all major currnecy pairs. For GBPUSD, we also had many patterns build up pretty fast. Especially we had a triangle pattern formed, then we had a massive breakout. Some of you following our post, we had already mentioned that to watch out the EFW channel shown in the screenshot because it did provide good indicator for bearish and bullish move for GBPUSD. The breakout in fact penetrated through the EFW channel to the other end. GBPUSD rose by 130 pips and then it drop down to the bottom of EFW channel. It is just evidance of how strongly EFW channel act as important support and resisatnce at the moment.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

EURUSD was on the bearish region since yesterday. EURUSD nearly dropped around 200 pips since yesterday. Today EURUSD is reacting bullish on the latest BAT pattern. EURUSD made around 50 pips up on this corrective move.

For your information, we have Equilibrium Fractal Wave Analytics MT5 version released too.

https://www.mql5.com/en/market/product/27702

https://www.mql5.com/en/market/product/27703

http://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

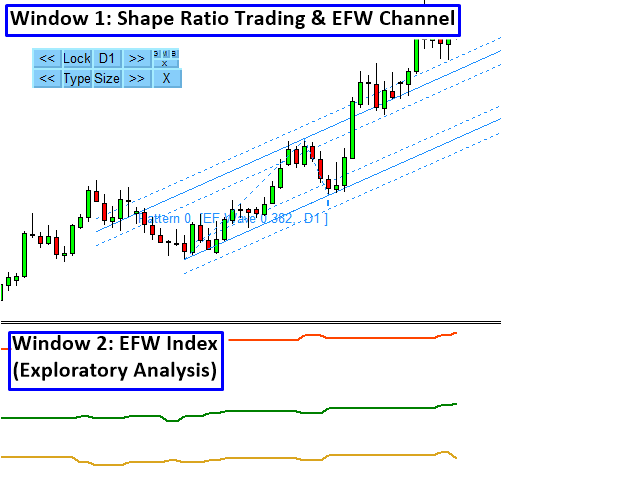

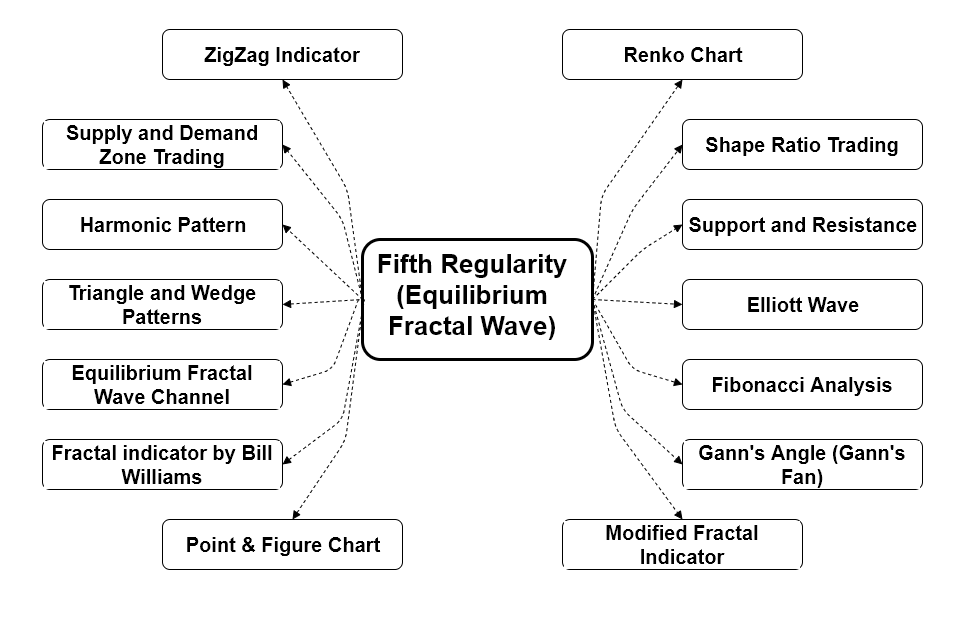

Introduction to EFW Analytics EFW Analytics was designed to accomplish the statement "We trade because there are regularities in the financial market". EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts. Firstly, Equilibrium Fractal Wave Index is an exploratory tool to support your trading logic to choose which

New Powerful trading system, Equilibrium Fractal Wave Analytics was releaed on MQL5.com for MetaTrader 4 platform. Soon, MetaTrader 5 version will be releaed too. Meet the powerful trading system incorporating many advanced trading features for advanced trader. This is fully visual trading system with the built in trading logic.

https://www.mql5.com/en/market/product/27703

http://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

A lot of new post have been updated in Financial Trading with Five Regularities Forum. This is the first forum in the world dedicated to the Scientific Price Action and Pattern Trading. Feel free to join this free education to improve the performance of your trading and investment.

http://tradeinvestsmart.com/forum/technical-analysis-1/financial-trading-with-five-regularties-of-nature/#p103

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

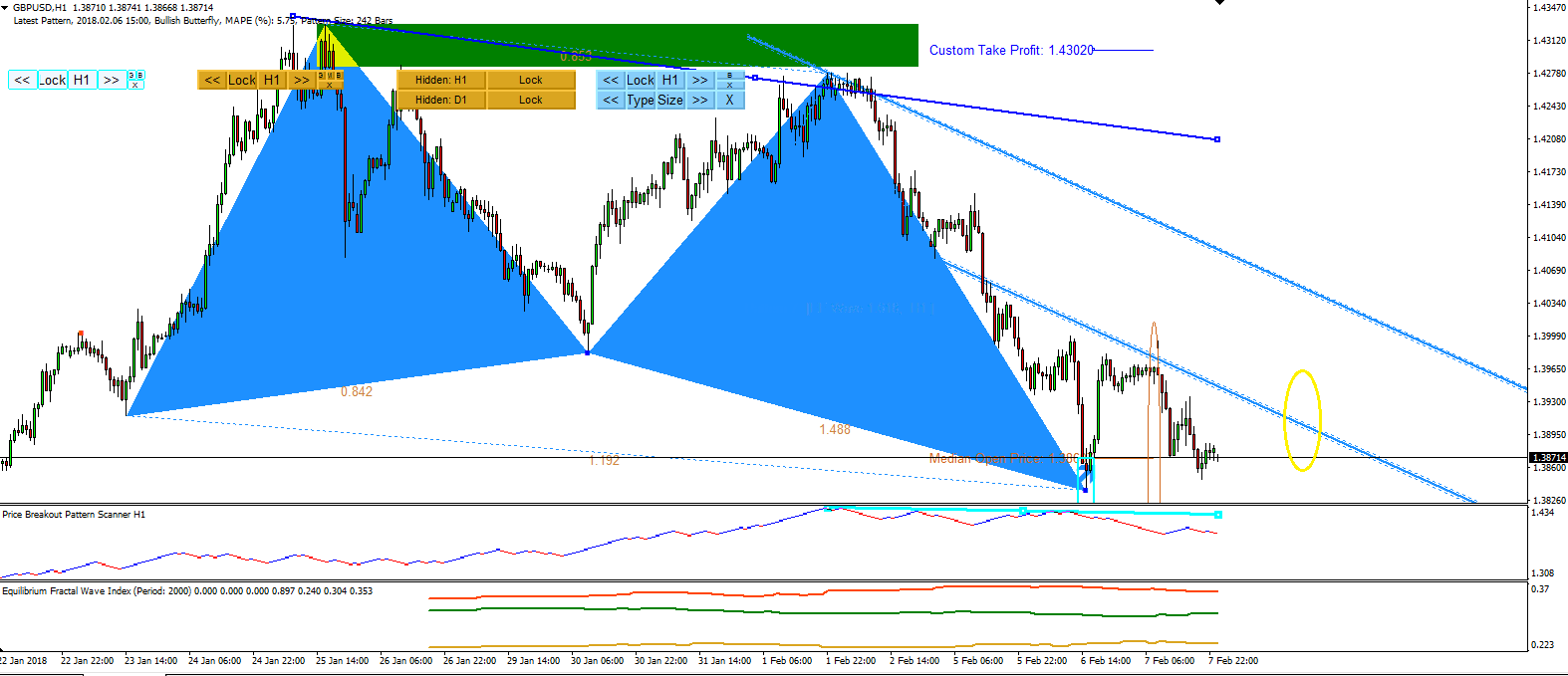

In our last analysis, we have confirmed that GBPUSD is still in more of bearish region even after the formation of Butterfly pattern (Harmonic Pattern Plus). In the US session, GBPUSD drop further down by 50 pips. Watch out how the GBPUSD will react around the equilibrium fractal wave channel marked in the screenshot for your trading.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Introduction to EFW Analytics EFW Analytics was designed to accomplish the statement "We trade because there are regularities in the financial market". EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts. Firstly, Equilibrium Fractal Wave Index is an exploratory tool to support your trading logic to choose which

After the long fall started from the Supply Zone (Mean Reversion Supply Demand), GBPUSD finally stopped at 1.38350. With the formation of Butterfly pattern, GBPUSD made a correction of a bit (Harmonic Pattern Plus). However, the EFW Channel indicates that GBPUSD is still in the bearish trading zone. Please watch out the EFW Channel further for your trading (marked in yellow circle).

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products

Mixed picture on EURUSD. EURUSD hit the neckline of the double top. Soon after EURUSD had a formation of Gartley (H1, Harmonic Pattern Plus) and EFW Channel. EURUSD ran around 80 pips after the formation of Gartley. Currently EURUSD move along with the latest EFW Channel. Top and bottom of EFW channel should be watched carefully for your trading. We have circled them as yellow.

https://www.mql5.com/en/users/financeengineer/seller#products

http://algotrading-investment.com/

We have five more posts in our Financial trading with five regularities forum. Learn and build excellent trading skills and knowledge through this free education.

http://tradeinvestsmart.com/forum/technical-analysis-1/financial-trading-with-five-regularties-of-nature/

https://www.mql5.com/en/users/financeengineer/seller#products

http://algotrading-investment.com/

GBPUSD made a notable movement in Asian session. In our previous analysis, we have already marked the potential support around the Demand zone + EFW channel. There was initial bounce on its first touch. However, in the second touch, GBPUSD went straight through the demand zone. It moved down nearly 100 pips. We have a another minor Demand Zone around 1.3780.

http://algotrading-investment.com

https://www.mql5.com/en/users/financeengineer/seller#products

Second post is available in the Financial trading with Five Regularities Forum. We hope more of you to join to learn the excellent way of trading. It is free and educational.

http://tradeinvestsmart.com/forum/technical-analysis-1/financial-trading-with-five-regularties-of-nature/

In our last analysis about EURUSD, we have shown that EURUSD was landed nicely over the padding of the EFW Channel. Indeed, EURUSD Breakout below the EFW Channel. Now, it is heading down. Our EFW Analytics detected new small EFW Channel at the sensible place (Red). The bottom of EFW Channel will acts as support for some time. Especially, I have marked the junction between the neck line of Double Top (Price Breakout Pattern Scanner) and the EFW Channel (Red). You will need to watch out this junction very carefully in the future. The formation of bearish ABCD pattern (Harmonic Pattern Plus) is still looking good.

http://algotrading-investment.com/

https://www.mql5.com/en/users/financeengineer/seller#products