Reversal Flux Core

- Indicatori

- Vishnu Bajpai

- Versione: 1.50

Flux Core Reversal Indicator

Volatility-Adaptive Reversal Signals for XAUUSD (Gold) and BTCUSD (Bitcoin)

Gold (XAUUSD) and Bitcoin (BTCUSD) do not reverse because an oscillator crosses a line.

They reverse when volatility, structure, and price expansion align.

checkout my best EA for Gold (prop firm compliant, special prize for limited time - https://www.mql5.com/en/market/product/163289?

checkout my best EA for BTC (prop firm compliant), special prize for limited time - https://www.mql5.com/en/market/product/163391?

Single EA which can trade on eur,xau,btc and nasdaq- https://www.mql5.com/en/market/product/163075?

Flux Core Reversal Indicator is a volatility-driven reversal detection tool designed specifically for high-momentum instruments like Gold and Bitcoin. It uses adaptive ATR logic, dynamic thresholds, and structural pivot detection to highlight meaningful bullish and bearish reversals while filtering out random intraday noise.

What Makes Flux Core Different

Most reversal indicators repaint, lag, or over-signal during choppy markets.

Flux Core is built to do the opposite.

Instead of fixed parameters, the indicator adapts to:

-

Current market volatility

-

Price expansion relative to ATR

-

Structural pivot confirmation

This makes it especially effective on volatile assets such as XAUUSD and BTCUSD, where static indicators often fail.

Core Logic Overview

Flux Core is powered by an adaptive ZigZag-style reversal engine enhanced with ATR-based volatility thresholds.

Key components include:

-

ATR-driven reversal detection that adjusts to market conditions

-

Sensitivity presets from Very High to Very Low for different trading styles

-

Optional confirmation bars to reduce false signals

-

Dynamic reversal thresholds based on volatility and price behavior

Reversal signals are plotted only when price moves exceed a statistically meaningful threshold, not minor pullbacks.

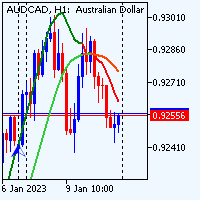

Signal Types

-

Bullish Reversal Signals appear near volatility-confirmed swing lows

-

Bearish Reversal Signals appear near volatility-confirmed swing highs

Signals are designed to highlight potential turning points, not scalp entries. They work best when combined with structure, trend bias, or execution confirmation.

Built-In Dashboard and Visual Clarity

Flux Core includes a clean on-chart dashboard that displays:

-

Current volatility (ATR)

-

Active sensitivity mode

-

Reversal threshold values

-

Trend context using multi-EMA alignment

-

Real-time bullish, bearish, or neutral bias

All visuals are minimal, non-intrusive, and optimized for clarity.

Customization and Flexibility

The indicator offers both preset and advanced customization:

-

Sensitivity presets for fast or conservative markets

-

Fully custom ATR multiplier and reversal thresholds

-

Adjustable dashboard position and text size

-

Push notifications for new reversal signals

This allows Flux Core to adapt across multiple timeframes and trading styles.

Best Use Cases

Flux Core Reversal Indicator is ideal for:

-

XAUUSD (Gold) reversal and structure traders

-

BTCUSD (Bitcoin) volatility-based traders

-

Swing traders and intraday traders seeking high-quality turning points

-

Traders who want fewer but more meaningful signals

It is not designed for high-frequency scalping or constant signal generation.

Important Notes

-

Signals are non-repainting once confirmed

-

Trade frequency depends on volatility and sensitivity settings

-

Works best in trending or expanding market conditions

-

Always confirm signals with risk management and market context

Why Use Flux Core

Flux Core is built for traders who understand that reversals are a volatility event, not a guessing game. By adapting to market conditions and filtering noise, it provides cleaner reversal signals on some of the most difficult instruments to trade consistently.

If you trade Gold or Bitcoin and want a reversal indicator that respects volatility, structure, and discipline, Flux Core is designed to give you that edge.