Unisciti alla nostra fan page

- Visualizzazioni:

- 1813

- Valutazioni:

- Pubblicato:

-

Hai bisogno di un robot o indicatore basato su questo codice? Ordinalo su Freelance Vai a Freelance

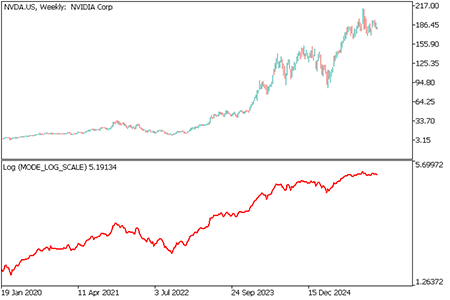

Multi-Mode Logarithmic Transform Indicator.

This indicator provides four distinct methods for analyzing price action through logarithmic transformation .

By moving away from absolute currency values to relative percentage-based values, it allows for a more accurate assessment of assets with high growth or significant volatility.

In a standard linear chart, the distance between $10 and $20 (a 100% increase) looks the same as the distance between $100 and $110 (a 10% increase).

On a Log scale, the 100% move will appear much larger than the 10% move, reflecting its true relative impact.

How to use this indicator:

Log Scale (Absolute)

Calculation uses the natural logarithm of the current closing price.

Normalizing Exponential Growth.

- Ideal for assets like Bitcoin or long-term technology stocks where price has moved from $1 to $1,000+.

- It prevents the most recent high prices from visually compressing the older history.

- Trends on a log scale represent a constant percentage growth rate rather than a constant dollar increase, making them more reliable over years of data.

Calculation running sum of all individual log returns.

Performance Tracking.

- It creates a "Growth Curve" starting from zero. Unlike absolute price, the cumulative scale

- allows you to compare the ROI of different assets (e.g., Gold vs. S&P 500) starting from the same baseline.

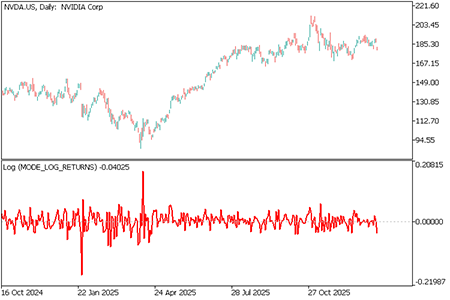

Log Returns (Difference)

The difference between the natural log of the current price and the previous price.

Momentum Measurement tool.

- Displays the "speed" of price change.

- A spike in log returns shows a sudden surge in relative momentum regardless of the absolute price level.

Log Volatility (Deviation)

The Standard Deviation of the Log Returns over a defined period of bars.

Identifying Market Regimes.

- It measures "noise" and risk in percentage terms.

- A volatility of 0.02 means the asset typically moves ~2% per bar.

- Low log volatility often precedes major breakouts, while extreme spikes in log volatility often signal market exhaustion or panic.

Larry Williams XGBoost Onnx

Larry Williams XGBoost Onnx

adoption of Larry William's method using AI Time-Series XGBoost

iCrosshair - Real-Time Candle Metrics on Hover

iCrosshair - Real-Time Candle Metrics on Hover

Hover over any candle to see what MT5 doesn't show: Range size, Body percentage, Wick ratios. Smart, fast, and customizable.

RiskSizer Panel Lite MT5 - Risk Percent Lot Calculator With One Click Buy Sell

RiskSizer Panel Lite MT5 - Risk Percent Lot Calculator With One Click Buy Sell

RiskSizer Panel Lite is a simple MT5 trading panel that calculates an estimated lot size based on your risk percent. Drag two chart lines to set SL/TP, then use one-click BUY/SELL for fast manual execution.

Trading strategy Heads or Tails

Trading strategy Heads or Tails

The classic version of the Heads or Tails trading strategy with the analysis of the signal block code.