High Low Reversal

- Indicateurs

- Satya Prakash Mishra

- Version: 1.0

- Activations: 5

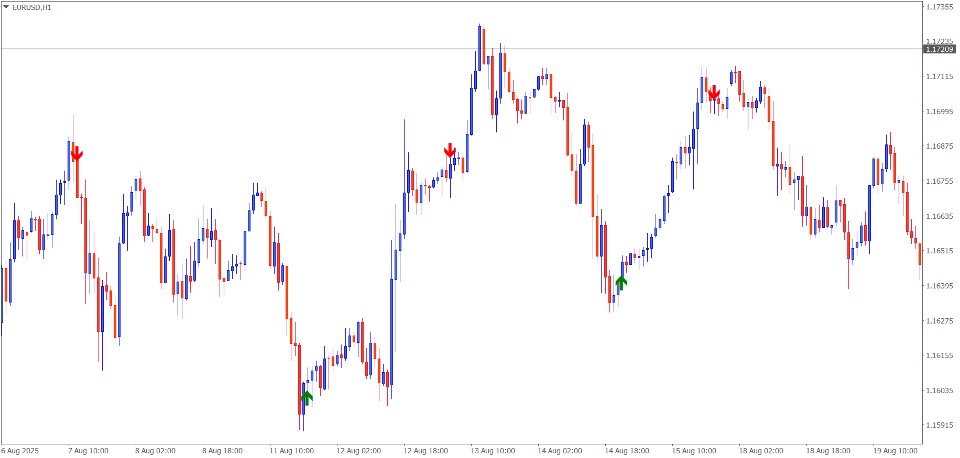

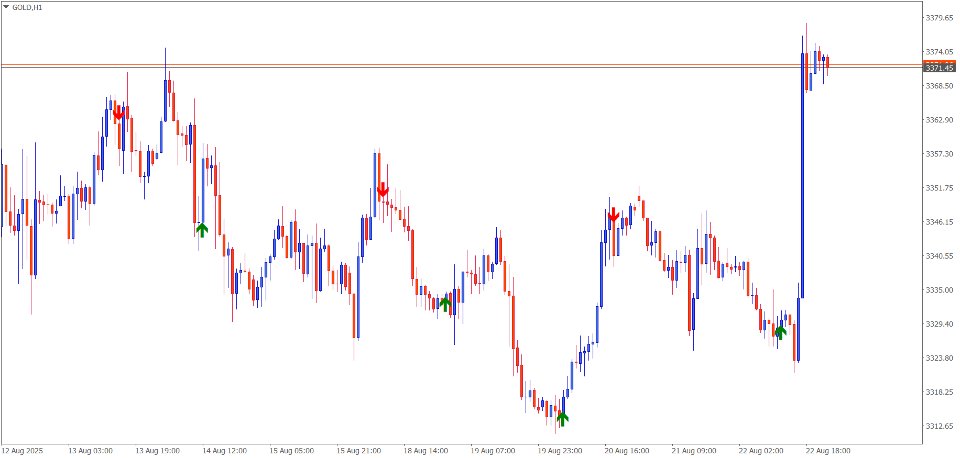

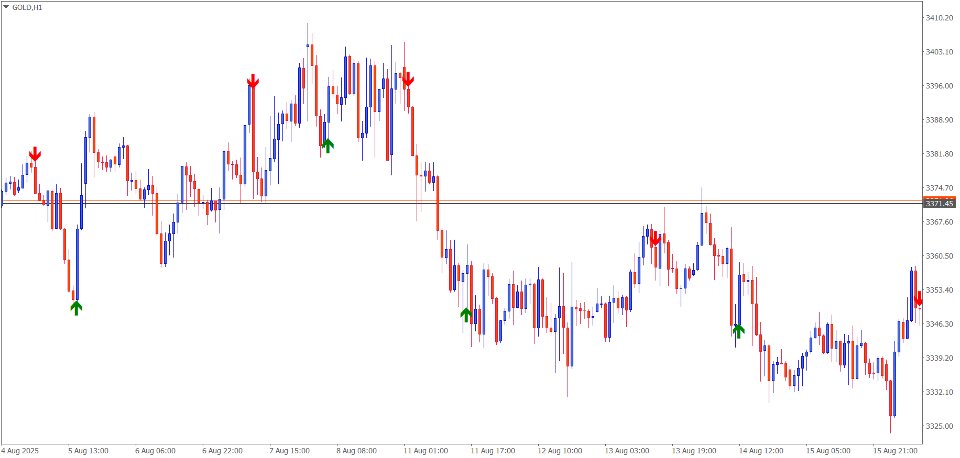

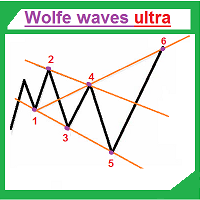

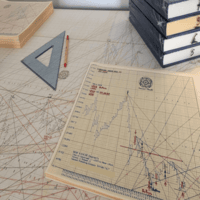

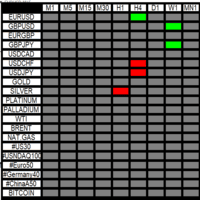

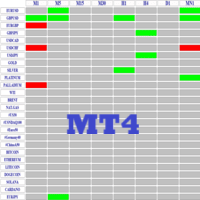

High low Reversal concept by Naveen saroha to find out new tops and new bottoms through mathematical calculations also can get with own calculation inputs available to increase or decrease swing potential,also can use auto analysis function to calculate Parameters swing heights and swing percentages. Indicator can apply all time frame and all types of market symbols.....

"""High-Low Market Signals Overview

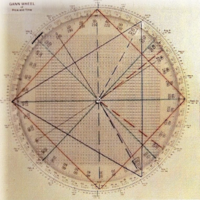

High-low market signals are technical indicators that analyze the relationship between recent highs and lows in price movements to identify potential market trends, reversals, and momentum shifts. These signals help traders understand market sentiment and make informed decisions about entry and exit points.

Types of High-Low Signals

New Highs vs New Lows Index This compares the number of stocks reaching new 52-week highs versus those hitting new 52-week lows within a specific time period. A healthy bull market typically shows more new highs than new lows, while bear markets exhibit the opposite pattern.

High-Low Index Calculation The formula is: (New Highs - New Lows) / (New Highs + New Lows) × 100 Values above +50 suggest bullish sentiment, while values below -50 indicate bearish conditions.

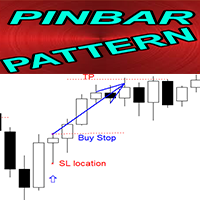

Breakout Signals When prices move above recent resistance levels (highs) or below support levels (lows), it can signal continuation of the prevailing trend or potential reversals.

Key Market Applications

Trend Confirmation High-low signals help confirm whether current market trends have broad participation. Strong uptrends should show expanding new highs with minimal new lows.

Divergence Detection When market indices reach new highs but the high-low ratio doesn't confirm (fewer stocks participate), it may signal weakening momentum and potential reversal.

Market Breadth Analysis These signals measure how many securities are participating in market moves, providing insight into the strength and sustainability of trends.

Trading Strategies

Momentum Trading Traders often buy when stocks break above recent highs with strong volume, expecting continuation of upward movement.

Mean Reversion Some strategies involve selling at new highs or buying at new lows, betting on price reversions to average levels.

Risk Management High-low signals help establish stop-loss levels and position sizing based on recent volatility ranges.

Limitations and Considerations

False Signals Markets can produce false breakouts where prices briefly exceed highs or lows before reversing, leading to potential losses.

Market Context High-low signals work best when combined with other technical indicators, fundamental analysis, and consideration of overall market conditions.

Time Frame Sensitivity The effectiveness of these signals varies significantly across different time frames (intraday, weekly, monthly), requiring careful selection based on trading objectives.

Volume Confirmation High-low moves should ideally be accompanied by significant trading volume to validate the signal's reliability.

High-low market signals are valuable tools for understanding market dynamics, but they should be used as part of a comprehensive analysis framework rather than standalone decision-making criteria. Successful implementation requires practice, proper risk management, and continuous learning about market behavior patterns.""""""