Rejoignez notre page de fans

PropGuard MT5 Daily Loss and Max Drawdown Dead-Line Visualizer (Dashboard and Line) - indicateur pour MetaTrader 5

- Vues:

- 2250

- Note:

- Publié:

-

Besoin d'un robot ou d'un indicateur basé sur ce code ? Commandez-le sur Freelance Aller sur Freelance

Overview

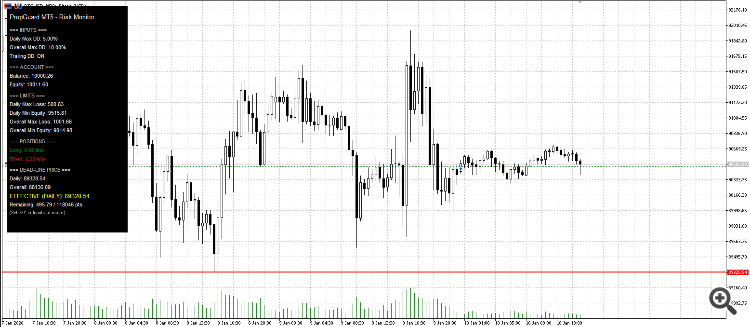

PropGuard MT5 is a chart-window indicator designed for traders who must respect strict prop-firm risk rules (Daily Loss Limit and Overall Max Drawdown). Instead of watching numbers in the terminal, PropGuard converts your risk limits into a clear, visual price level on the chart — the Dead-Line.

When price reaches the Dead-Line (based on your current exposure), your account would reach the configured drawdown boundary. This helps you make faster decisions, reduce emotional trading, and avoid rule violations.

Core Concept: The “Dead-Line”

Prop firms typically define loss limits in currency or percentage terms (daily and overall). PropGuard translates these limits into a dynamic chart level:

-

If you are net long, the Dead-Line is the price below the current market where your allowed loss is exhausted.

-

If you are net short, the Dead-Line is the price above the current market where your allowed loss is exhausted.

This line updates in real time and reflects:

-

Current equity

-

Current open positions on the chart symbol

-

The symbol’s tick value / tick size (multi-asset compatible)

What the Indicator Displays

1) Effective Dead-Line (Main Line)

PropGuard always draws the most restrictive limit as a single “effective” Dead-Line:

-

DAILY or OVERALL (whichever is closer to the current price / stricter)

2) Optional Separate Lines

If enabled, you can additionally display:

-

Daily Dead-Line

-

Overall Dead-Line

3) On-Chart Dashboard Panel

A compact panel shows:

-

Balance and Equity

-

Daily / Overall maximum allowed loss

-

Daily / Overall minimum equity levels

-

Long lots / Short lots (on this symbol)

-

Daily and Overall Dead-Line prices

-

Effective rule (DAILY / OVERALL)

-

Remaining buffer in currency and points, with optional warning highlight

Trailing Drawdown Mode (Prop-Style)

PropGuard supports both common drawdown models:

Trailing Drawdown ON

-

Daily reference: daily peak equity

-

Overall reference: overall peak equity

-

The Dead-Line can move as you reach new equity highs (risk line “trails”)

Trailing Drawdown OFF

-

Daily reference: start-of-day balance (see Notes below)

-

Overall reference: Start Capital (manual input)

-

Dead-Line is based on fixed reference values

Safety Handling (Edge Cases)

PropGuard is designed to behave safely and transparently:

-

No open positions on the symbol

→ Lines are hidden, dashboard shows “No Positions”. -

Hedged / near-zero net sensitivity (net exposure effectively neutral)

→ Lines are hidden, dashboard shows “Hedged (No dead-line)”. -

Limit already violated

→ Dashboard shows “VIOLATED!” and remaining buffer becomes negative.

Inputs (Quick Guide)

-

Daily Max DD (%) — Daily loss limit in percent

-

Overall Max DD (%) — Maximum drawdown limit in percent

-

Trailing Drawdown Mode — Peak-equity trailing ON/OFF

-

Account Start Capital — Used when trailing is OFF (overall reference)

-

Show Daily & Overall Lines Separately — Show both limits or only the effective line

-

Dashboard Corner / X Offset / Y Offset — Panel placement

-

Line Colors / Width — Visual customization

-

Warning Threshold (%) — Highlight remaining buffer when close to violation

Notes and Important Limitations (Read Before Use)

-

Symbol-specific logic: The Dead-Line is calculated from positions on the current chart symbol only.

If you trade multiple symbols, attach PropGuard to each relevant chart. -

Start-of-day balance (non-trailing mode): In version 1.00 the “start-of-day balance” is currently approximated (as noted in code comments). If you require a strict broker-day baseline derived from history, this should be implemented as an enhancement.

-

Visualization tool: PropGuard helps you visualize risk boundaries, but it does not execute trades, close positions, or enforce rules automatically.

Who This Is For

-

Prop-firm traders who need to respect daily loss and max drawdown rules

-

Traders who want a visual risk boundary instead of constantly watching equity numbers

-

Multi-asset traders (FX, indices, metals, crypto CFDs) who want a universal sensitivity approach

MT5 Telegram Trade Notifier (Bot API) — Deal Alerts

MT5 Telegram Trade Notifier (Bot API) — Deal Alerts

Utility MT5 EA that sends BUY/SELL deal notifications to Telegram via Bot API (WebRequest)

Uniformity Factor Script

Uniformity Factor Script

The script provides a quick estimation of an exponent/power factor for transformation of variable-length price increments into uniform distibution, that makes them a "random walk". The estimated value characterizes current symbol as more profitable when using in a particular trading strategy.

Viral (1M+ views) 4 Hour Range Strategy coded and tested

Viral (1M+ views) 4 Hour Range Strategy coded and tested

This EA is intended to test a popular trading strategy. My own backtest shows that this strategy does not work as it was intended

Wick Rejection Scanner Dashboard (Multi-Symbol / Multi-TF)

Wick Rejection Scanner Dashboard (Multi-Symbol / Multi-TF)

Scan multiple symbols and timeframes for wick-based rejection candles and display the latest signals in a clean on-chart dashboard with strength scoring, signal age, optional markers, and alerts.