You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

VIDEO LESSON - Introduction to New Zealand Dollar

According to Wikipedia.org, New Zealand has a 2008 estimated population of around 4.2 million people, which is the first important fact for us to understand for two reasons. Firstly, as New Zealand's domestic market is so small, it must rely heavily on exports to drive economic growth, making the country especially susceptible to growth or decline in the global economy. This is particularly true when looking at the health of its main trading partners, the largest of which is Australia, followed by the United States, and Japan. Secondly, unlike other countries with a larger population, as the population of New Zealand is small, migration of people into and out of the country can have a significant effect on its economy, and therefore the currency. As Kathy Lien points out in her book Day Trading the Currency Market, strong population migration into New Zealand has contributed significantly to the performance of its economy, because as the population increases, so does domestic consumption.

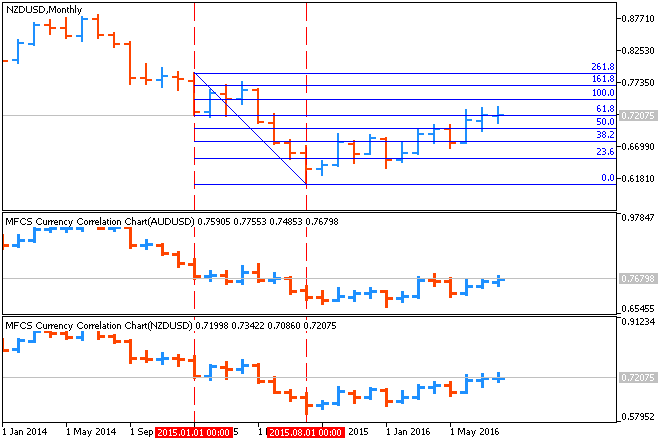

Like Canada and Australia, New Zealand is a country with vast natural resources, making the economy and therefore currency heavily reliant on exports of commodities such as Wool, food and dairy products, wood and paper products. As Australia is the country's main export market and as the Australian Dollar is also heavily influenced by commodity prices, changes in commodity prices can have a particularly potent affect on the New Zealand Dollar. Although this correlation has broken down somewhat in recent months, as you can see from this chart, the NZD/USD and AUD/USD currency pairs are highly correlated as a result of these factors:

Chart Showing NZD/USD and AUD/USD Correlations:

The last major fundamental factor that it is important to keep in mind when trading the New Zealand Dollar is, like the Australian Dollar here again, New Zealand, as of this lesson, has one of the highest interest rates in the industrialized world currently at 8.25%. This has driven the NZD/USD pair to 25 year highs recently, before selling off a bit as a result of slower growth in the New Zealand. This is important to keep in mind, as the currency has been one of the primary beneficiaries of the carry trade flows, so interest rate expectations going forward will weigh heavily on the future direction of the currency.Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.17 08:36

NZD/USD Intra-Day Fundamentals: New Zealand Jobless Rate and 41 pips price movement

2016-08-16 22:45 GMT | [NZD - Unemployment Rate]

if actual < forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Unemployment Rate] = Percentage of total work force that is unemployed and actively seeking employment during the previous quarter.

==========

From Scoop article: NZ jobless rate falls to 5.1% under new methodology

==========

NZD/USD M5: 41 pips price movement by New Zealand Jobless Rate news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.22 14:42

Technical Targets for NZD/USD by United Overseas Bank (based on the article)

H4 price is located near above 100 SMA and above 200 SMA for the bullish market condition with the ranging within the following support/resistance levels:

- 0.7323 resistance level located above 100 SMA/100 SMA in the bullish area of the chart, and

- 0.7208 support level located near 100 SMA/200 SMA ranging area.

The bearish reversal level is 0.7157 support, and if the price breaks this level to below on close H4 bar so the reversal of the intra-day price movement from the bullish to the primary bearish market condition will be started.Daily price. United Overseas Bank is expecting for NZD/USD to be continuing with 0.7170/0.7350 range:

"NZD traded quietly last Friday and at this stage, there is no reason to expect the current neutral phase to end. In other words, further range trading between 0.7170 and 0.7350 is still expected."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.24 09:37

NZD/USD Intra-Day Fundamentals: New Zealand Trade Balance and 18 pips price movement

2016-08-23 22:45 GMT | [NZD - Trade Balance]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Trade Balance] = Difference in value between imported and exported goods during the reported month.

==========

==========

NZD/USD M5: 18 pips price movement by New Zealand Trade Balance news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.08.28 08:23

Fundamental Weekly Forecasts for Dollar Index, GBP/USD, USD/JPY, AUD/USD, NZD/USD, USD/CNH and GOLD (based on the article)

NZD/USD - "From a technical perspective, it’s worth keeping an eye on the 0.7350 level, which the price of NZD/USD has failed to overcome. Much focus is on the US Dollar into the Kansas City Fed’s Annual Jackson Hole Symposium. A more dovish than expected Janet Yellen, and a break above 0.7350 could signal the beginning of the next big move higher in NZD/USD. However, a breakdown below 0.7200 could show that a shift has happened in the market that would lean toward a weaker NZD and/ or strong USD that could eventually bring us below 0.7000."

Daily price is located above 100 SMA/200 SMA bullish area of the chart for 0.7219 support level to be tested to below for the secondary correction to be started. Alternative, if the price breaks ascending triangle pattern together with 0.7322 level to above with 0.7379 target to re-enter so the primary bullish trend will be resumed.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.02 14:48

Intra-Day Fundamentals - EUR/USD, USD/JPY, AUD/USD and NZD/USD: Non-Farm Payrolls

2016-09-02 12:30 GMT | [USD - Non-Farm Employment Change]

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

"Total nonfarm payroll employment increased by 151,000 in August, and the unemployment rate remained at 4.9 percent, the U.S. Bureau of Labor Statistics reported today. Employment continued to trend up in several service-providing industries."

==========

NZD/USD M5: 65 pips price movement by Non-Farm Payrolls news event

Forum on trading, automated trading systems and testing trading strategies

Market Condition Evaluation based on standard indicators in Metatrader 5

Sergey Golubev, 2016.09.05 08:47

The most interesting pair you can make money with - EUR/NZD

EUR/NZD: bearish breakdown. This pair is on bearish market condition condition for the breakdown to be started on open daily bar for now: the price is breaking 1.5218 support level to below for the breakdown to be continuing. Chinkou Span line of Ichimoku indicator is located below the price indicating the bearish trend to be continuing on good breakdown way.

The most likely scenarios for the price movement for the week:

If daily price breaks 1.5218 support level to below on close bar so the daily breakdown will be continuing with 1.5113 bearish target to re-enter, if not so the price will be on bearish ranging within the levels.

There are the following news events which will be affected on EUR/NZD price movement for the coming week:

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.14 08:11

NZD/USD Intra-Day Fundamentals: NZ Current Account and 11 pips range price movement

2016-09-13 22:45 GMT | [NZD - Current Account]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Current Account] = Difference in value between imported and exported goods, services, income flows, and unilateral transfers during the previous quarter.

==========

==========

NZD/USD M5: 11 pips range price movement by NZ Current Account news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.15 08:58

NZD/USD Intra-Day Fundamentals: New Zealand Gross Domestic Product and 30 pips price movement

2016-09-14 22:45 GMT | [NZD - GDP]

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

==========

NZD/USD M5: 30 pips price movement by New Zealand Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2016.09.21 10:05

Technical Targets for NZD/USD by United Overseas Bank (based on the article)

H4 price was bounced from 0.7284 and 200 SMA to above to the bullish area of the chart with the traded within the following support/resistance levels:

- 0.7379 resistance level located far above 100 SMA/200 SMA in the bullish area of the chart, and

- 0.7284 support level located near 200 SMA in the beginning of the bearish trend to be started.

The descending triangle pattern was formed by the price to be broken to below for the possible bearish trend.Daily price. United Overseas Bank is expecting for this pair to be on ranging market condition within 0.7240/0.7380 levels:

"The breach of 0.7340 indicates that the recent bearish phase has ended. The outlook for NZD from here is unclear and we prefer to hold a neutral view and expect this pair to trade listlessly between 0.7240 and 0.7380. Looking further ahead, the downside appears to be more vulnerable but a sustained weakness is likely only if there is a break below the very strong 0.7220/40 support zone."