Hello,

This oscillator is a great one, but I have problems with it.

The signal line's end, wich is calculated by the last candle is not shown, so it always shows red at the present time. When I reset the oscillator it shows good values for a moment with the end of the signal line, but then switches back to red, (even if it has to show green).

What should i do to eliminate this problem?

I've tried to re-debug it but it didn't help.

Greets,

InfiniteDesign

What the best values for the parameters of this indicator?

Many many thanks for this great indicator.

I found the previous version as interesting and useful as the new one, or in fact even more so..

Could you please port the old one to mq5 as well ? I'd highly appreciate if it can be done.

Cheers, and thanks in advance !!

Hello,

This oscillator is a great one, but I have problems with it.

The signal line's end, wich is calculated by the last candle is not shown, so it always shows red at the present time. When I reset the oscillator it shows good values for a moment with the end of the signal line, but then switches back to red, (even if it has to show green).

What should i do to eliminate this problem?

I've tried to re-debug it but it didn't help.

Greets,

InfiniteDesign

I tried to create a Signal from this indicator, but I was unable...

Any help?

//+------------------------------------------------------------------+ //| COG.mqh | //| Bruno Pio | //| http://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Bruno Pio" #property link "http://www.mql5.com" #property version "1.00" #include "..\ExpertSignal.mqh" // CExpertSignal is in the file ExpertSignal #property tester_indicator "CenterOfGravity.ex5" // wizard description start //+------------------------------------------------------------------+ //| Description of the class | //| Title=Signals of Center of Gravity | //| Type=SignalAdvanced | //| Name=My_COG | //| ShortName=CG | //| Class=COG | //| Page=Not needed | //| Parameter=Period_,int,10,Indicator averaging period | //| Parameter=SmoothPeriod,int,3,Signal line smoothing period | //| Parameter=MA_Method_,ENUM_MA_METHOD,MODE_EMA,Signal Method | //| Parameter=AppliedPrice,int,1,Price constant | //+------------------------------------------------------------------+ // wizard description end //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ class COG : public CExpertSignal { private: CiCustom m_COG; // The indicator as an object //--- Configurable module parameters int m_Period_; // Indicator averaging period int m_SmoothPeriod; // Signal line smoothing period ENUM_MA_METHOD m_MA_Method_; // Signal line averaging method int m_AppliedPrice; // Price constant public: COG(void); ~COG(void); //--- Checking correctness of input data bool ValidationSettings(); //--- Creating indicators and timeseries for the module of signals bool InitIndicators(CIndicators *indicators); //--- Access to indicator data double CG(const int index) const { return(m_COG.GetData(0,index)); } double Signal(const int index) const { return(m_COG.GetData(1,index)); } //--- Checking buy and sell conditions virtual int LongCondition(); virtual int ShortCondition(); //--- Methods for setting void Period_(int value) { m_Period_=value; } void SmoothPeriod(int value) { m_SmoothPeriod=value; } void MA_Method_(ENUM_MA_METHOD value) { m_MA_Method_=value; } void AppliedPrice(int value) { m_AppliedPrice=value; } protected: //--- Creating indicator bool CreateCOG(CIndicators *indicators); }; //+------------------------------------------------------------------+ //| Constructor | //+------------------------------------------------------------------+ COG::COG(void) : m_Period_(10), // Indicator averaging period m_SmoothPeriod(3), // Signal line smoothing period m_MA_Method_(MODE_EMA), // Signal line averaging method m_AppliedPrice(1) // Price constant { } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ COG::~COG() { } //+------------------------------------------------------------------+ //+------------------------------------------------------------------+ //| Checks input parameters and returns true if everything is OK | //+------------------------------------------------------------------+ bool COG:: ValidationSettings() { //--- Call the base class method if(!CExpertSignal::ValidationSettings()) return(false); //--- Check periods, number of bars for the calculation of the MA >=1 if(m_Period_<1) { PrintFormat("Incorrect value set for one of the period! Period_=%d", m_Period_); return false; } //--- Check periods, number of bars for the calculation of the MA >=1 if(m_SmoothPeriod<1) { PrintFormat("Incorrect value set for one of the period! m_SmoothPeriod=%d", m_SmoothPeriod); return false; } //--- Fast MA smoothing type must be one of the four values of the enumeration if(m_MA_Method_!=MODE_SMA && m_MA_Method_!=MODE_EMA && m_MA_Method_!=MODE_SMMA && m_MA_Method_!=MODE_LWMA) { PrintFormat("Invalid type of smoothing of the fast MA!"); return false; } //--- m_AppliedPrice must be validy if(m_AppliedPrice<1 || m_AppliedPrice>11) { PrintFormat("Invalid type of Price!"); return false; } //--- All checks are completed, everything is ok return true; } //+------------------------------------------------------------------+ //| Creates indicators | //| Input: a pointer to a collection of indicators | //| Output: true if successful, otherwise false | //+------------------------------------------------------------------+ bool COG::InitIndicators(CIndicators *indicators) { //--- Standard check of the collection of indicators for NULL if(indicators==NULL) return(false); //--- Initializing indicators and timeseries in additional filters if(!CExpertSignal::InitIndicators(indicators)) return(false); //--- Creating our indicators if(!CreateCOG(indicators)) return(false); //--- Reached this part, so the function was successful, return true return(true); } //+------------------------------------------------------------------+ //| Creates the "COG" indicator | //+------------------------------------------------------------------+ bool COG::CreateCOG(CIndicators *indicators) { //--- Checking the pointer if(indicators==NULL) return(false); //--- Adding an object to the collection if(!indicators.Add(GetPointer(m_COG))) { printf(__FUNCTION__+": Error adding an object of the COG"); return(false); } //--- Setting parameters of the COG MqlParam parameters[5]; //--- parameters[0].type=TYPE_STRING; parameters[0].string_value="CenterOfGravity.ex5"; parameters[1].type=TYPE_INT; parameters[1].integer_value=m_Period_; // Period parameters[2].type=TYPE_INT; parameters[2].integer_value=m_SmoothPeriod; // Signal line smoothing period parameters[3].type=TYPE_INT; parameters[3].integer_value=m_MA_Method_; // Signal line averaging method parameters[4].type=TYPE_INT; parameters[4].integer_value=m_AppliedPrice; // Price constant //--- Object initialization if(!m_COG.Create(m_symbol.Name(),0,IND_CUSTOM,5,parameters)) { printf(__FUNCTION__+": Error initializing the object of the COG"); return(false); } //--- Number of buffers if(!m_COG.NumBuffers(2)) return(false); //--- Reached this part, so the function was successful, return true return(true); } //+------------------------------------------------------------------+ //| Returns the strength of the buy signal | //+------------------------------------------------------------------+ int COG::LongCondition() { int signal=0; //--- For operation with ticks idx=0, for operation with formed bars idx=1 int idx=StartIndex(); //--- Values of COGs at the last formed bar double last_fast_value=CG(idx); double last_slow_value=Signal(idx); //--- Values of COGs at the last but one formed bar double prev_fast_value=CG(idx+1); double prev_slow_value=Signal(idx+1); //---If CG > Signal && CG-1 < Signal-1 if((last_fast_value>last_slow_value) && (prev_fast_value<prev_slow_value)) { signal=100; // There is a signal to buy } //--- Return the signal value return(signal); } //+------------------------------------------------------------------+ //| Returns the strength of the sell signal | //+------------------------------------------------------------------+ int COG::ShortCondition() { int signal=0; //--- For operation with ticks idx=0, for operation with formed bars idx=1 int idx=StartIndex(); //--- Values of COGs at the last formed bar double last_fast_value=CG(idx); double last_slow_value=Signal(idx); //--- Values of COGs at the last but one formed bar double prev_fast_value=CG(idx+1); double prev_slow_value=Signal(idx+1); //---If CG < Signal && CG-1 > Signal-1 if((last_fast_value<last_slow_value) && (prev_fast_value>prev_slow_value)) { signal=100; // There is a signal to sell } //--- Return the signal value return(signal); }

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

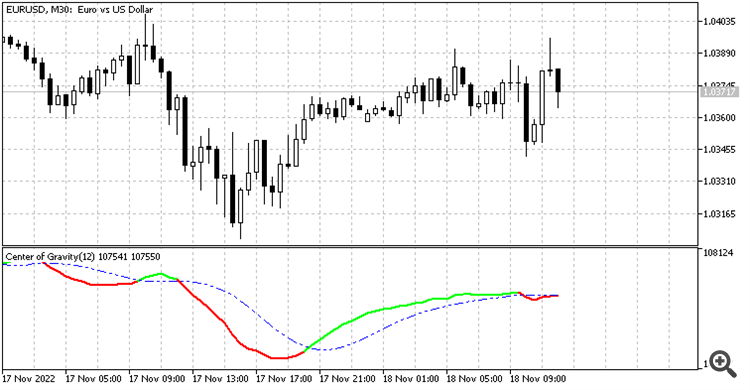

Center of Gravity J. F. Ehlers:

Center of Gravity actually has a zero lag and allows to define turning points precisely. This indicator is the result of Ehler's study of adaptive filters.

The indicator Center of Gravity allows to identify main pivot points almost without any lag.

The idea of calculating a center of gravity appeared from the investigation of lags of different filters with the finite impulse response (FIR) in accordance with the relative amplitude of filter coefficients. SMA (Simple Moving Average) is a FIR-filter, in which all coefficients have one and the same value. As a result the center of gravity of SMA is an exact center of the filter. WMA (Weighted Moving Average) is a FIR-filter, in which the last price change is weighted through the filter length, and so on.

The values of weighting are coefficients of filters. Coefficients of WMA filters can be presented as contours of a triangle. The center of gravity is on the 1/3 of the triangle base length. Thus WMA gravity center is shifted to the right with respect to the center of gravitation of SMA of the same length, which gives us a smaller lag. For all examples with FIR filters the sum of productions of coefficients and the price must be divided by the sum of coefficients for preservation of original prices.

Author: Nikolay Kositsin