1. What is the best time frame to daily trade the EuroDollar on the MT5? 2. German open or London open to start with EuroDollar? 3. Why is the NY session almost always more orderly for the EuroDollar?

It depends on your strategy and trading style for example: counter trend, trend following, martingale, scalping, martingale scalping, and so on.

It depends on your strategy and trading style for example: counter trend, trend following, martingale, scalping, martingale scalping, and so on.

Always and only trend following and never scalping. I don´t know martingale.

What´s the best time frame on the MT5 for daily trading the EuroDollar with a trend following trading plan when my trading day starts in Germany and ends with the NY close?

daily trading as D1?

or "daily trading" as intra-day?

It depends on your strategy selected.

Many traders are operating the broker's time (time of Metatrader) which may be different for different broker, but most brokers (the chart in Metatrader) are on GMT+0, GMT+2 or GMT+3 for example.

And the traders are using timefilter - seems - trade open starting from 6 or 8 or 9 am till 5 or 6 or 9 pm (metatrader/broker time which is the time of your chart).

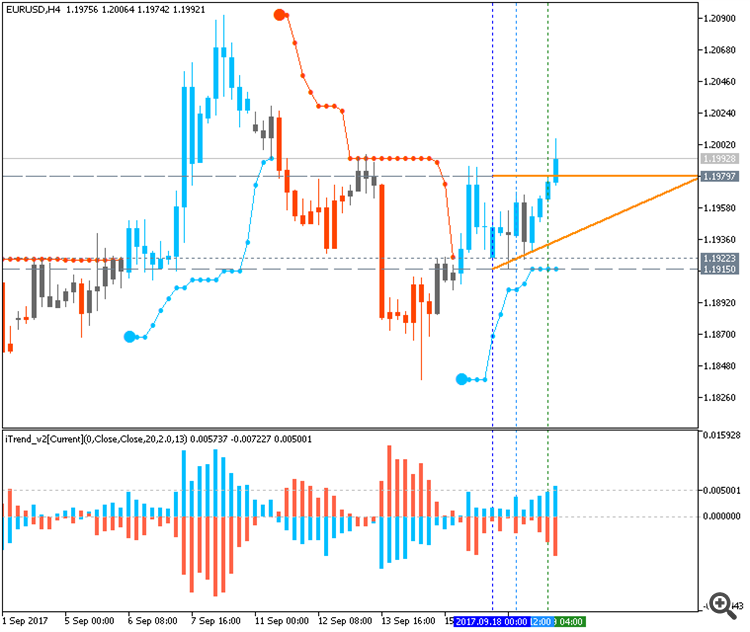

Example with trend following system (Brainwashing from here) on H4 timeframe:

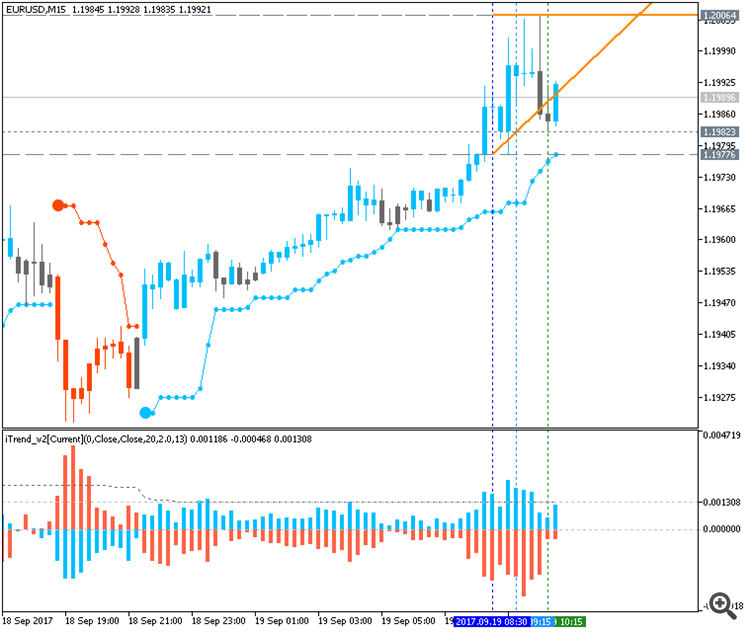

Example with same Brainwashing system on M15:

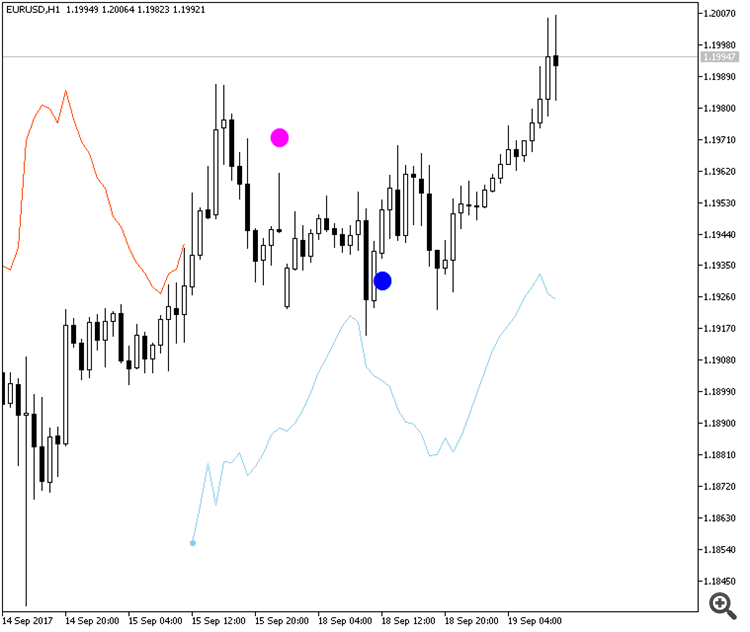

And this is AscTrend from this thread:

---------

So, as you see - it is fully dfepends on the system you are using or you are going to be used.

I mean - you should select the system first, and after that only - you will see/understand and timeframe and so on.

So, you should select the system first (we are talking about manual trading, right?), and after that only - you will know the timeframe (and time) trade.

------------

You can select the system from the following summaries:

Summaries

1. How to Start with MT5, a summary ! (incl the previous thread:How to start with MetaTrader and forex, the beginning)

2. All (not yet) about Strategy Tester, Optimization and Cloud

3. ASCTREND SYSTEM summary (incl 2 good EAs)

5. PriceChannel Parabolic system (incl 2 versions of the EA)

6. Market Condition Evaluation (2 EAs were created)

7. Ichimoku

8. Financial and trading videos - Table of Contents

9. All about Calendar tab and Macro Economic Events

10/ All about MQL5 Wizard : create robots without programming

daily trading as D1?

or "daily trading" as intra-day?

It depends on your strategy selected.

Many traders are operating the broker's time (time of Metatrader) which may be different for different broker, but most brokers (the chart in Metatrader) are on GMT+0, GMT+2 or GMT+3 for example.

And the traders are using timefilter - seems - trade open starting from 6 or 8 or 9 am till 5 or 6 or 9 pm (metatrader/broker time which is the time of your chart).

Example with trend following system (Brainwashing from here) on H4 timeframe:

Example with same Brainwashing system on M15:

With "daily trading" I mean only trading during an extended trading day (only one extended trading day) from the German open to the NY close: during a 15 hour trading day starting at 9.00 and ending at 24.00 (GMT+1) - platform time. I never leave a trade active overnight when I am not present at the screen.

I am currently trading the M2 chart as my start chart - to catch a reversal early on. I often start on the M2 chart at 9.00 and during the 15 hour extended trading day use all the charts from M2 to M30 to follow a Long UP trend ending just before 24.00 or a Long DOWN trend ending just before 24.00.

It seems to me the first trustworthy and reliable time frame to use to significantly increase the probability of sustainable continuous profitable days is the M10. The M2 to M6 charts give too many false signals during an extended 15 hour trading day. Do other traders also experience this?

So, I trade intra-day.

This is the other very simple trend following system (M15 timeframe, and you can see the time for sell and buy signals on the chart):

You state above: "M15 timeframe, and you can see the time for sell and buy signals on the chart."

Your SELL signal is a 100% false signal. You will sell at the bottom.

Your example is a very good example why longer time frames often give very late - and thus False - signals - for intra-day trading. Those signals may be perfect signals for inter-day or inter-week trading, but such false signals are obviously inappropriate for intra-day trading. That is why I use the M2 to get in early after a trend Reversal - with my trading system.

What I am questioning here is whether the M10 may be the best time frame for intra-day trading.

Thank you for all the examples.

I trade the minute charts. Starting with the M2. Never on the M1 - I don´t scalp. I am here on this particular occasion looking for a broader view about which minute time frame could probably be the best for intra-day trading.

The M10 has just given a SELL signal for the EuroDollar - and it seems to be valid.

You state above: "M15 timeframe, and you can see the time for sell and buy signals on the chart."

Your SELL signal is a 100% false signal. You will sell at the bottom.

Your example is a very good example why longer time frames often give very late - and thus False - signals. That is why I use the M2 to get in - with my trading system.

What I am questioning here is whether the M10 may be the best time frame for intra-day trading.

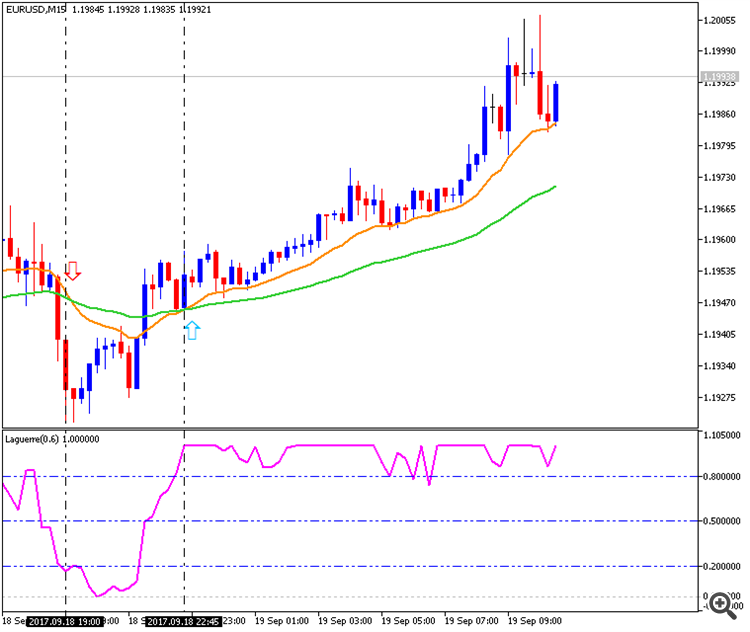

This is Laguerre scalping system (free to download from this post) so it depends on what you are trading with it:

- MA crossing confirmed with overbought-for-sell/oversold-for-buy levels of Laguerre indicator (in separate window), or

- MA crossing confirmed with breakout of Laguerre levels (overbought for buy and oversold for sell - same with RSI indicator for examle).

And false signals are the signals too so it means: any system is having false signals and true signals.

----------------

As to M10 chart so it may be the best timeframe for some system but for some other system - not.

Beause everything is started with the trading system (with indicators uploaded here as the source codes with the rules to trade).

This is Laguerre scalping system (free to download from this post) so it depends on what you are trading with it:

- MA crossing confirmed with overbought-for-sell/oversold-for-buy levels of Laguerre indicator (in separate window), or

- MA crossing confirmed with breakout of Laguerre levels (overbought for buy and oversold for sell - same with RSI indicator for examle).

And false signals are the signals too so it means: any system is having false signals and true signals.

----------------

As to M10 chart so it may be the best timeframe for some system but for some other system - not.

Beause everything is started with the trading system (with indicators uploaded here as the source codes with the rules to trade).

Thank you.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

1. What is the best time frame to daily trade the EuroDollar on the MT5? - to trade the EuroDollar from the German open to the New York close.

2. Is it worth starting to trade the EuroDollar with the German open or is the the London open always the better option trading the EuroDollar?

3. Why is the NY session almost always better to trade the EuroDollar in terms of technical analysis than the European session? EuroDollar signals seem to be much clearer during the NY session and ordered than in the London session.

What could the explanation for that be? Is it because most traders agree on the EuroDollar trend by then?