- Multi Timeframe Indicators

- How to call iCustom ZigZag

- I just want to get some value from Indicator "ZigZag" by iCustom(), but always fail

If you search the Codebase you should find plenty of code examples, using ZigZag is fairly common.

Forum on trading, automated trading systems and testing trading strategies

Welcome,

- Usually people who cannot code do not receive free help on this forum, although it could happen if you are lucky. Be patient.

- If you show your attempts and describe your problem clearly, you will most probably receive an answer from the community.

- If you do not want to learn to code, that is not a problem. You can either look at the Codebase if something free already exists, or in the Market for paid products (also sometimes free).

- Finally, you also have the option to hire a programmer in the Freelance section.

Good luck.

How to use ZigZag custom indicator in an EA - the thread

How to call zigzag inidcator in ea? - thread

============

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2007.02.26 14:52

Usually zigzag is used as a filter. But zigzag is not simpe indicator. You may read it here:

Interpretation

The Zig Zag indicator is used primarily to help you

see changes by punctuating the most significant reversals.

It is very important to understand that the last "leg"

displayed in a Zig Zag chart can change based on

changes in the underlying plot (e.g., prices). This is

the only indicator in this book where a change in the

security's price can change a previous value of the indicator.

Since the Zig Zag indicator can adjust its values based on

subsequent changes in the underlying plot, it has perfect

hindsight into what prices have done. Please don't try

to create a trading system based on the

Zig Zag indicator--its hindsight is much better than

its foresight!

In addition to identifying significant prices reversals,

the Zig Zag indicator is also useful when doing Elliot Wave counts.

For additional information on the Zig Zag indicator,

refer to Filtered Waves by Arthur Merrill.

and:

Elliott Wave Theory

The Elliott Wave Theory is named after Ralph Nelson Elliott. Inspired by the Dow Theory and by observations found throughout nature, Elliott concluded that the movement of the stock market could be predicted by observing and identifying a repetitive pattern of waves. In fact, Elliott believed that all of man's activities, not just the stock market, were influenced by these identifiable series of waves. With the help of C. J. Collins, Elliott's ideas received the attention of Wall Street in a series of articles published in Financial World magazine in 1939. During the 1950s and 1960s (after Elliott's passing), his work was advanced by Hamilton Bolton. In 1960, Bolton wrote Elliott Wave Principle--A Critical Appraisal. This was the first significant work since Elliott's passing. In 1978, Robert Prechter and A. J. Frost collaborated to write the book Elliott Wave Principle.

Interpretation

The underlying forces behind the Elliott Wave Theory are of building up and tearing down. The basic concepts of the Elliott Wave Theory are listed below. Action is followed by reaction. There are five waves in the direction of the main trend followed by three corrective waves (a "5-3" move). A 5-3 move completes a cycle. This 5-3 move then becomes two subdivisions of the next higher 5-3 wave. The underlying 5-3 pattern remains constant, though the time span of each may vary. The basic pattern is made up of eight waves (five up and three down) which are labeled 1, 2, 3, 4, 5, a, b, and c on the following chart. Waves 1, 3, and 5 are called impulse waves. Waves 2 and 4 are called corrective waves. Waves a, b, and c correct the main trend made by waves 1 through 5. The main trend is established by waves 1 through 5 and can be either up or down. Waves a, b, and c always move in the opposite direction of waves 1 through 5. Elliott Wave Theory holds that each wave within a wave count contains a complete 5-3 wave count of a smaller cycle. The longest wave count is called the Grand Supercycle. Grand Supercycle waves are comprised of Supercycles, and Supercycles are comprised of Cycles. This process continues into Primary, Intermediate, Minute, Minuette, and Sub-minuette waves.

As to me so I used zigzag in more simple way in Channel trading system: when I am losing money in manual trading so I start to trade channel trading system to recover deposit size https://www.mql5.com/en/forum/173261

If you search the Codebase you should find plenty of code examples, using ZigZag is fairly common.

ok thank,

How to use ZigZag custom indicator in an EA - the thread

How to call zigzag inidcator in ea? - thread

============

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2018.04.10 16:07

- ZigZag For Long Term - expert for MetaTrader 4

- Random ZigZaG - expert for MetaTrader 4

- The adviser on the indicator ZigZag - expert for MetaTrader 4

- Fibo Retracement Trader - expert for MetaTrader 5

- DoubleZigZag - expert for MetaTrader 5

- ZigZagEvgeTrofi ver. 1 - expert for MetaTrader 5

- Last ZZ50 - expert for MetaTrader 5

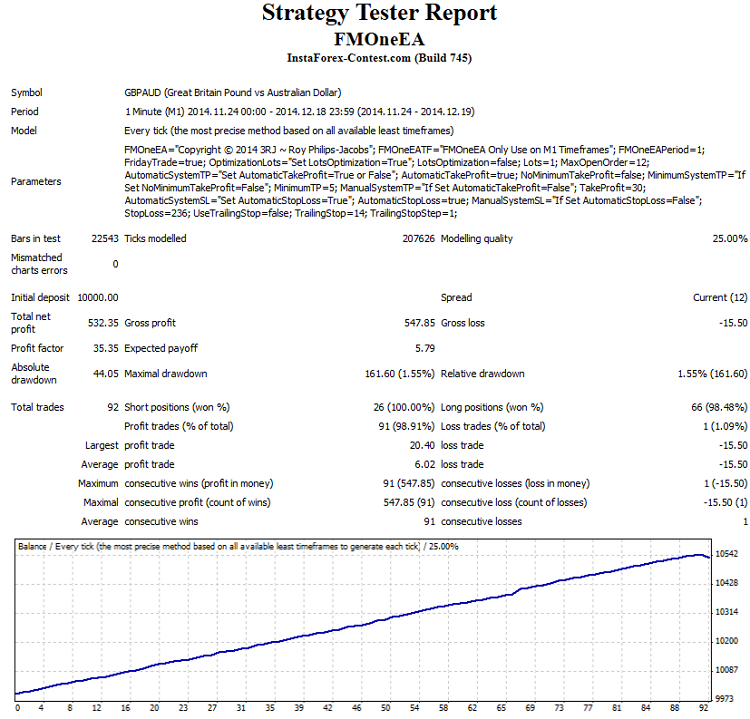

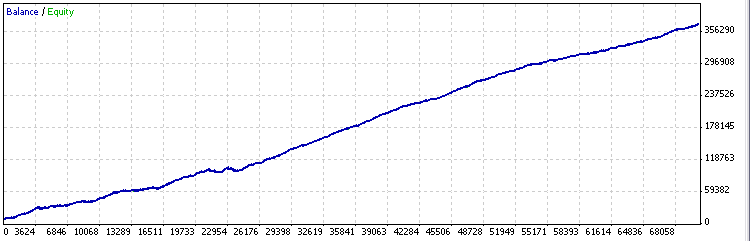

- FMOneEA - expert for MetaTrader 4

- Aver4Sto+Postzigzag(Set-up for USDJPY only) - expert for MetaTrader 4

- e_RP_250 - expert for MetaTrader 5

- On the MaZi - expert for MetaTrader 4

- FX-CHAOS_SCALP - expert for MetaTrader 4

- Fractal ZigZag Expert - expert for MetaTrader 4

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use