Simple Ichimoku Scalping thread

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2014.03.07 09:08

Who Can Trade a Scalping Strategy? (based on dailyfx article)

- Scalpers look to trade session momentum

- Scalpers do not have to be high frequency traders

- Anyone can scalp with an appropriate trading plan

The term scalping elicits different preconceived connotations to

different traders. Despite what you may already think, scalping can be a

viable short term trading methodology for anyone. So today we will look

at what exactly is scalping, and who can be successful with a scalping

based strategy.

What is a Scalper?

So you’re interested in scalping? A Forex scalper is considered anyone

that takes one or more positions throughout a trading day. Normally

these positions are based around short term market fluctuations as price

gathers momentum during a particular trading session. Scalpers look to

enter the market, and preferably exit positions prior to the market

close.

Normally scalpers employ technical trading strategies utilizing short

term support and resistance levels for entries. While normally

fundamentals don’t factor into a scalpers trading plan, it is important

to keep an eye on the economic calendar to see when news may increase

the market’s volatility.

High Frequency Trading

There is a strong misconception that all scalpers are high frequency

traders. So how many trades a day does it take to be considered a

scalper? Even though high frequency traders ARE scalpers, in order for

you to qualify as a scalper you only need to take 1 position a day! That

is one of the benefits of scalping. You can trade as much or as little

as you like within a giving trading period.

This also falls in line with one of the benefits of the Forex market. Due to the 24Hr trading structure of Forex, you can scalp the market at your convenience. Take advantage of the quiet Asia trading session, or the volatile New York – London overlap. Trade as much or as little as you like. As a scalper the choice is ultimately yours to make!

Risks

There are always risks associated with trading. Whether you are a short

term, long term, or any kind of trader in between any time you open a

position you should work on managing your risk. This is especially true

for scalpers. If the market moves against you suddenly due to news or

another factor, you need to have a plan of action for limiting your

losses.

There are other misconceptions that scalpers are very aggressive traders

prone to large losses. One way to help combat this is to make scalping a

mechanical process. This means that all of your decisions regarding

entries, exits, trade size, leverage and other factors should be written

down and finalized before approaching the charts. Most scalpers look to

risk 1% or even less of their account balance on any one position

taken!

Who can Scalp?

So this brings us to the final question. Who can be a scalper? The answer is anyone with the dedication to develop a trading strategy and the time to implement that strategy on any given trading day.

=================

Trading examples

Metaquotes demo

- MT5 statement is here

- Updated statement is here

- More trading updates

- Updated MT5 statement

- More updates

- 811 dollars for 3 trading days and final statement for scalping

GoMarkets broker, initial deposit is 1,000

- statement (77 dollars in less than 1 hour)

Alpari UK broker initial deposit is 1,000

- statement (517 dollars for one day)

RoboForex broker initial deposit is 1,000

- first statement

- updated statement (257 dollars in 2 days)

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

hey all i have this little scalping ea but im sure there can be a better tweak done to it to make it a little safer

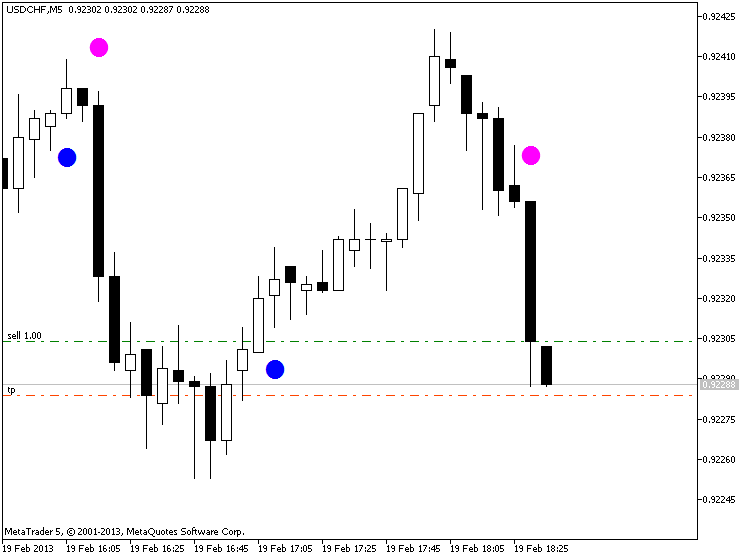

the ea is based on fractal channels

thinks that will help

1. ma filter ( option to turn off )

thinking 55 smoothed ma, trades only buy signals if above ma and visa versa

2. news filter turn off 30 min before and after news, ( option to turn off )

and any other suggestions that one might have

ill add all files so all can test and hope we can come up with something

first 3 files are what came with the ea

ill add a forex fatory news indi and a pic of what it looks like.

thanks in advance

<Removed Decompiled Code>