Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.08 07:18

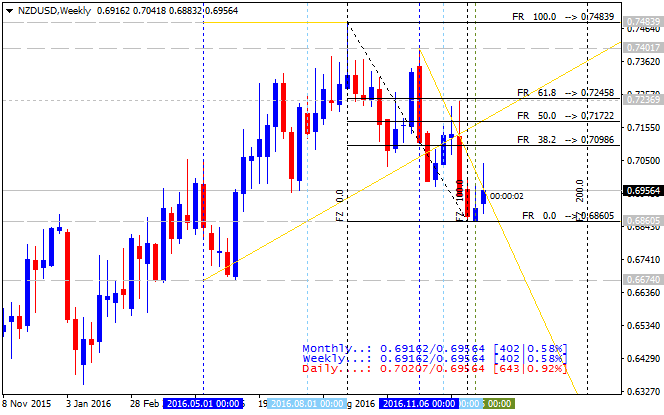

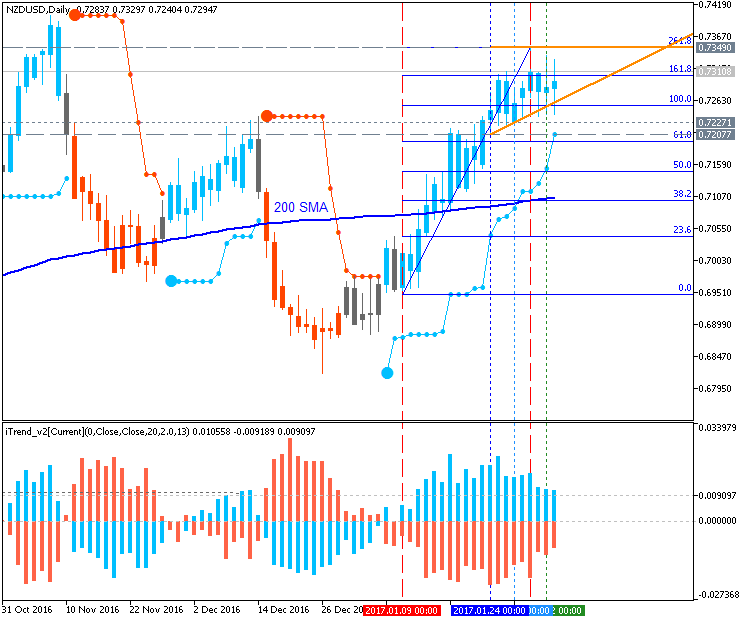

Weekly Update: NZD/USD - bearish trend to be resumed with symmetric pattern to be crossed to below (based on the article)

"NZD/USD is vulnerable to say the least. The 1985-1993 trendline was resistance in Kiwi from July to November. In fact, price action since July just completed a head and shoulders top. Throw in the fact that 2 of the last 6 weeks are of the outside bearish variety the Bird looks like it’s in for a world of hurt. Also, the entire rally from August 2015 qualifies as a re-test of the long term bear move that began with the double top confirmation in early 2015. The re-test, head and shoulders, and rally from 2015 as a wedge is so textbook it scares me."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.13 14:53

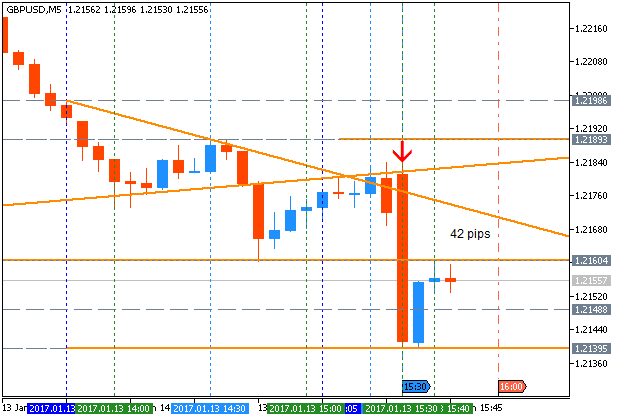

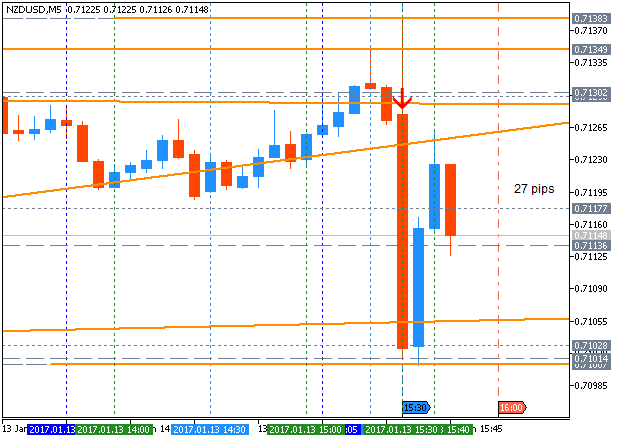

Intra-Day Fundamentals - EUR/USD, GBP/USD and NZD/USD: U.S. Producer Price Index and Advance Retail Sales

2017-01-13 13:30 GMT | [USD - PPI]

- past data is 0.4%

- forecast data is 0.1%

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

"The Producer Price Index for final demand increased 0.3 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.4 percent in November and were unchanged in October. (See table A.) On an unadjusted basis, the final demand index climbed 1.6 percent in 2016 after falling 1.1 percent in 2015."

==========

2017-01-13 13:30 GMT | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.5%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

EUR/USD M5: 54 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

==========

GBP/USD M5: 42 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

==========

NZD/USD M5: 27 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.19 14:56

Intra-Day Fundamentals - NZD/USD, USD/CNH and Dax Index: Philadelphia Fed Business Outlook Survey

2017-01-19 13:30 GMT | [USD - Philly Fed Manufacturing Index]

- past data is 21.5

- forecast data is 16.3

- actual data is 23.6 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Philly Fed Manufacturing Index] = Level of a diffusion index based on surveyed manufacturers in Philadelphia.

==========

From official report:

"The index for current manufacturing activity in the region increased from a revised reading of 19.7 in December to 23.6 this month.* Forty percent of the firms reported increases in activity this month; 17 percent reported decreases. The general activity index has remained positive for six consecutive months, and the activity index reading was the highest since November 2014 (see Chart 1). The other broad indicators suggest sustaining growth. The index for current new orders increased 11 points this month, with 41 percent of the firms reporting increases. The shipments index remained at a high reading but fell 1 point. Both the delivery times and unfilled orders indexes were positive for the third consecutive month, suggesting longer delivery times and an increase in unfilled orders."

==========

NZD/USD M5: 32 pips range price movement by Philadelphia Fed Business Outlook Survey news events

==========

Dax Index, M5: range price movement by Philadelphia Fed Business Outlook Survey news events

==========

USD/CNH M5: 116 pips range price movement by Philadelphia Fed Business Outlook Survey news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.26 08:14

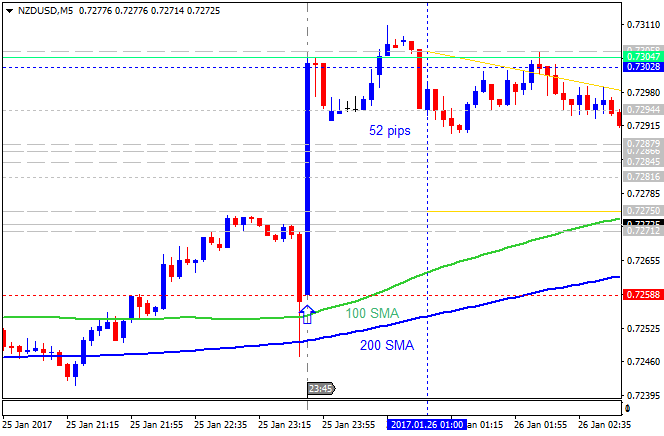

NZD/USD Intra-Day Fundamentals: NZ Consumer Price Index and 52 pips range price movement

2017-01-25 21:45 GMT | [NZD - CPI]

- past data is 0.3%

- forecast data is 0.3%

- actual data is 0.4% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The consumers price index (CPI) rose 0.4 percent (up 0.7 with seasonal adjustment).""Transport prices rose 3.7 percent, influenced by higher petrol and air transport prices."

==========

NZD/USD M5: 52 pips range price movement by NZ Consumer Price Index Index news event=

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.01 07:07

NZD/USD Intra-Day Fundamentals: New Zealand Jobless Rate and 65 pips range price movement

2017-01-31 21:45 GMT | [NZD - Unemployment Rate]

- past data is 4.9%

- forecast data is 4.8%

- actual data is 5.2% according to the latest press release

if actual < forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Unemployment Rate] = Percentage of total work force that is unemployed and actively seeking employment during the previous quartey.

==========

From official report:

- Labour force participation continued to grow.

- Employment growth remained strong.

- Unemployment rate rose to 5.2 percent.

- Wage growth steady.

==========

NZD/USD M5: 65 pips range price movement by New Zealand Jobless Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.04 16:38

Weekly Fundamental Forecast for NZD/USD (based on the article)

NZD/USD - "The central bank may keep the door open to further embark on its easing-cycle as the upward pressure in the New Zealand dollar exchange rate ‘continues to generate negative inflation in the tradables sector.’ In turn, Governor Wheeler may prepare New Zealand households and businesses for another rate-cut as ‘significant surplus capacity exists across the global economy,’ and the 0.8% expansion in New Zealand Employment may do little to alter the RBNZ’s cautious outlook as wage growth remains depressed. In turn, a slew of dovish rhetoric from Governor Wheeler and Co. may spur near-term headwinds for the New Zealand dollar as the central bank appears to be in no rush to remove its accommodative policy stance."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.09 07:46

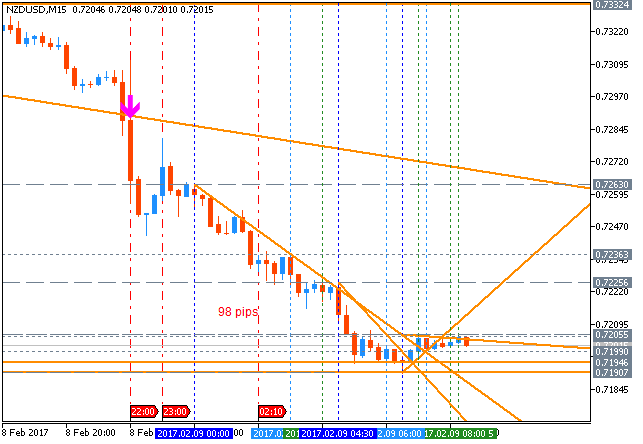

NZD/USD Intra-Day Fundamentals: RBNZ Official Cash Rate and 98 pips range price movement

2017-02-08 20:00 GMT | [NZD - Official Cash Rate]

- past data is 1.75%

- forecast data is 1.75%

- actual data is 1.75% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

NZD - Official Cash Rate] = Interest rate at which banks lend balances held at the RBNZ to other banks overnight.

==========

From official report: Official Cash Rate unchanged at 1.75 percent

- "The Reserve Bank today left the Official Cash Rate (OCR) unchanged at 1.75 percent."

- "New Zealand’s financial conditions have firmed with long-term interest rates rising and continued upward pressure on the New Zealand dollar exchange rate. The exchange rate remains higher than is sustainable for balanced growth and, together with low global inflation, continues to generate negative inflation in the tradables sector. A decline in the exchange rate is needed."

==========

NZD/USD M5: 98 pips range price movement by RBNZ Official Cash Rate news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.14 16:04

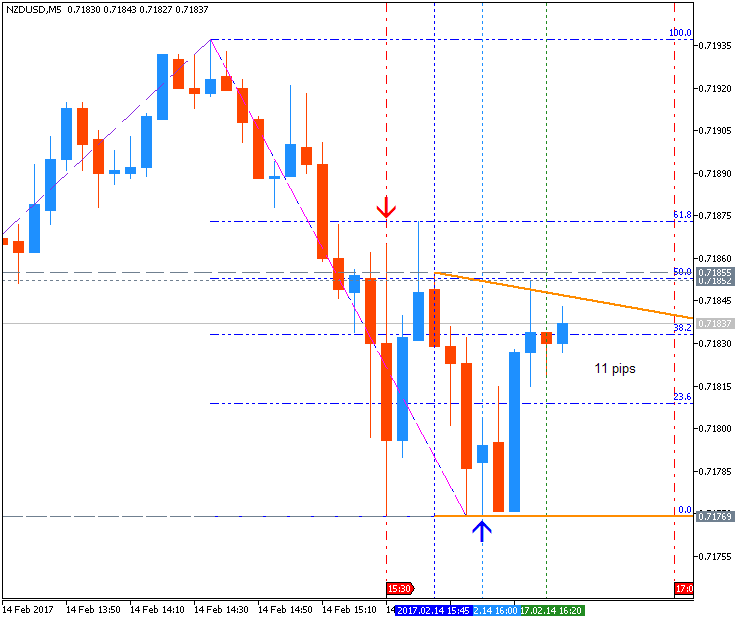

Intra-Day Fundamentals - NZD/USD: U.S. Producer Price Index

2017-02-14 13:30 GMT | [USD - PPI]

- past data is 0.3%

- forecast data is 0.3%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

- "The Producer Price Index for final demand increased 0.6 percent in January, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices rose 0.2 percent in December and 0.5 percent in November. On an unadjusted basis, the final demand index climbed 1.6 percent for the 12 months ended January 2017."

==========

NZD/USD M5: 11 pips range price movement by U.S. Producer Price Index news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.17 07:04

NZD/USD Intra-Day Fundamentals: New Zealand Retail Sales and 23 pips range price movement

2017-02-16 23:45 GMT | [NZD - Retail Sales]

- past data is 0.8%

- forecast data is 1.1%

- actual data is 0.8% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - Retail Sales] = Change in the total value of inflation-adjusted sales at the retail level.

==========

From official report:

- "The total volume of retail sales rose 0.8 percent for the December 2016 quarter. This increase follows a 0.8 percent rise in the September 2016 quarter."

- "In core retail (which excludes the two vehicle-related industries), the sales volume rose 0.6 percent in the December 2016 quarter, after a 0.2 percent rise in the September 2016 quarter."

==========

NZD/USD M5: 23 pips range price movement by New Zealand Retail Sales news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.02.20 06:29

NZD/USD Intra-Day Fundamentals: New Zealand Producer Price Index and 38 pips range price movement

2017-02-19 21:45 GMT | [NZD - PPI Input]

- past data is 1.5%

- forecast data is 0.9%

- actual data is 1.0% according to the latest press release

if actual > forecast (or previous one) = good for currency (for NZD in our case)

[NZD - PPI Input] = Change in the price of goods and raw materials purchased by manufacturers.

==========

From official report:

- "The output producers price index (PPI) rose 1.5 percent."

- "The input PPI rose 1.0 percent."

==========

NZD/USD M5: 38 pips range price movement by New Zealand Producer Price Index news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

NZD/USD January-March 2017 Forecast: ranging along 'reversal' Senkou Span line

W1 price is located near and above Ichimoku cloud and Senkou Span line which is the virtual border between the primary bearish and the primary bullish trend on the chart. The price broke symmetric triangle pattern to below to be located within the following support/resistance levels:

- 0.7484 resistance level far above ichimoku cloud in the bullish trend to be resumed, and

- 0.6820 support level located inside Ichimoku cloud in the beginning of the bearish reversal to be started.

Chinkou Span line is located below the price indicating the ranging condition, Trend Strength indicator is estimating the future possible bearish reversal, and Absolute Strength indicator is evaluating the trend as a secondary ranging.Trend:

W1 - ranging