Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.03 17:43

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: ISM Manufacturing PMI

2017-01-03 15:00 GMT | [USD - ISM Manufacturing PMI]

- past data is 53.2

- forecast data is 53.7

- actual data is 54.7 according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - ISM Manufacturing PMI] = Level of a diffusion index based on surveyed purchasing managers in the manufacturing industry.

==========

From official report:

"The December PMI® registered 54.7 percent, an increase of 1.5 percentage points from the November reading of 53.2 percent. The New Orders Index registered 60.2 percent, an increase of 7.2 percentage points from the November reading of 53 percent. The Production Index registered 60.3 percent, 4.3 percentage points higher than the November reading of 56 percent. The Employment Index registered 53.1 percent, an increase of 0.8 percentage point from the November reading of 52.3 percent. Inventories of raw materials registered 47 percent, a decrease of 2 percentage points from the November reading of 49 percent. The Prices Index registered 65.5 percent in December, an increase of 11 percentage points from the November reading of 54.5 percent, indicating higher raw materials prices for the 10th consecutive month. The PMI®, New Orders, Production and Employment Indexes all registered new highs for the year 2016, and the forward-looking comments from the panel are largely positive."

==========

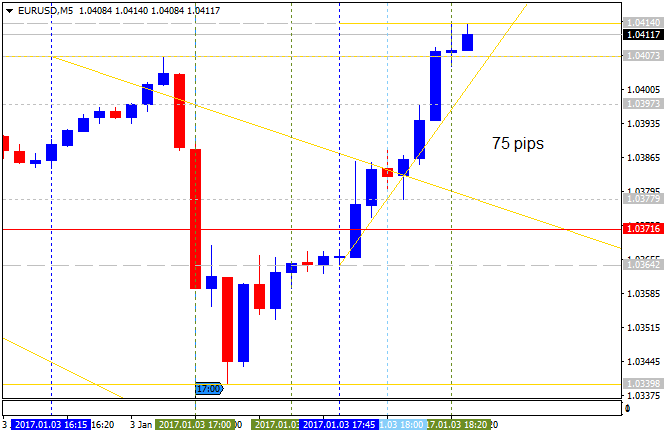

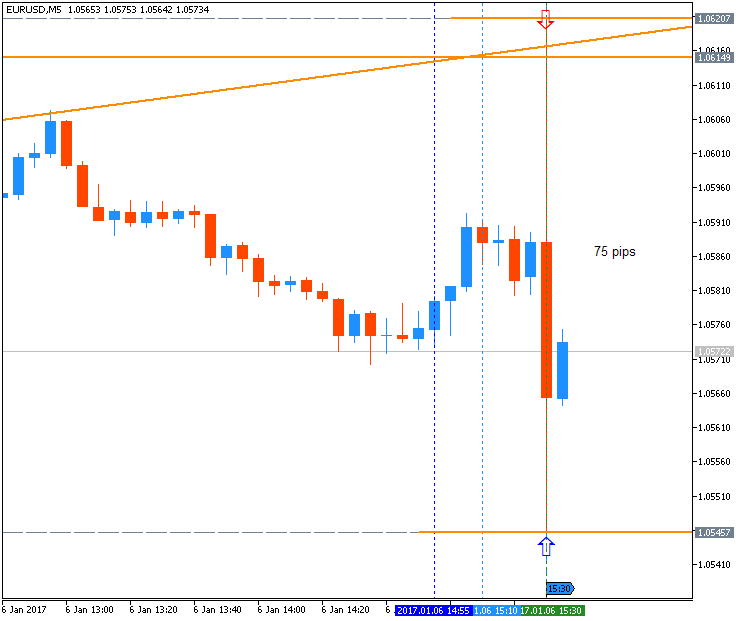

EUR/USD M5: 75 pips range price movement by ISM Manufacturing PMI news events

==========

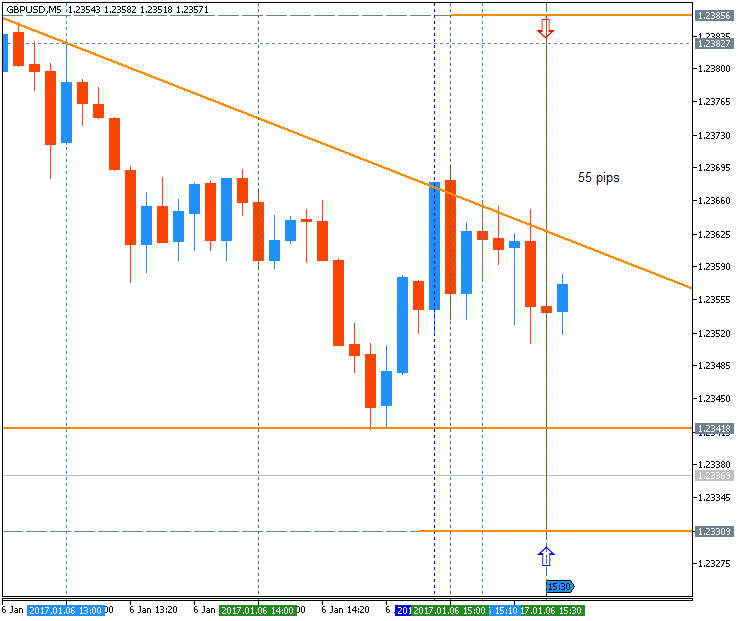

GBP/USD M5: 50 pips range price movement by ISM Manufacturing PMI news events

==========

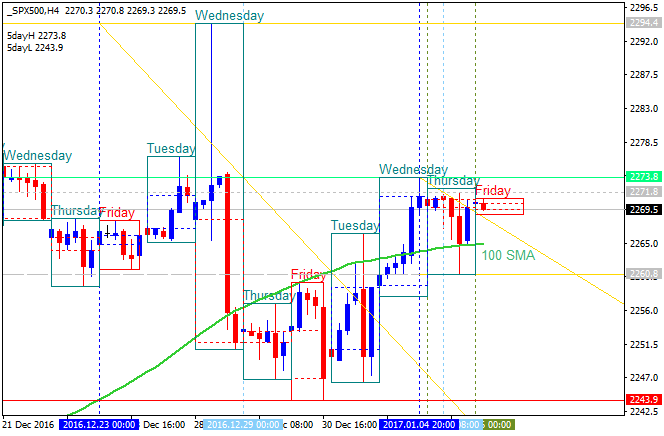

S&P 500: range pips price movement by ISM Manufacturing PMI news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.06 05:39

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: Non-Farm Employment Change

2017-01-06 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 178K

- forecast data is 175K

- actual data is n/a according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From the article: What To Expect From NFP? - Views From 10 Major Banks

BofA Merrill: "We look for a trend-like 175,000 gain in nonfarm payrolls. We expect 170,000 of this gain to come from the private sector and only 5,000 to come from the government sector. We think there is scope for the labor force participation rate to inch back up to 62.8% from 62.7%, and as a result, for the unemployment rate to move back up towards 4.8%. Smoothing through the volatility of wage growth in the past couple of months, we look for average hourly earnings to gain a trend-like 0.2% mom after a 0.1% mom contraction in November. This would push the year-over-year rate up to a healthier 2.7% from 2.5%."

==========

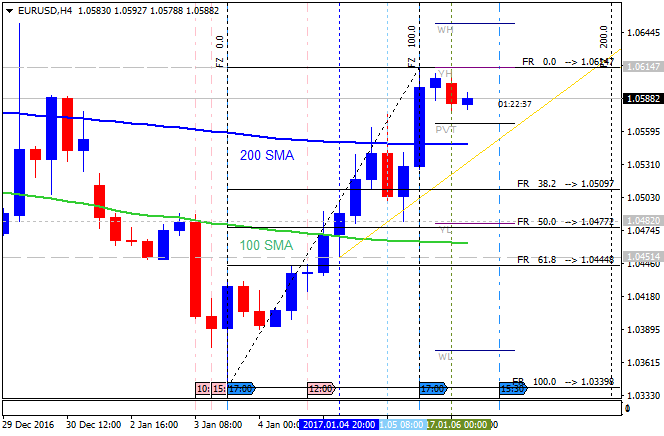

EUR/USD H4 ahead of NFP: bullish reversal with 1.0614 resistance to be broken for the bullish trend to be continuing

==========

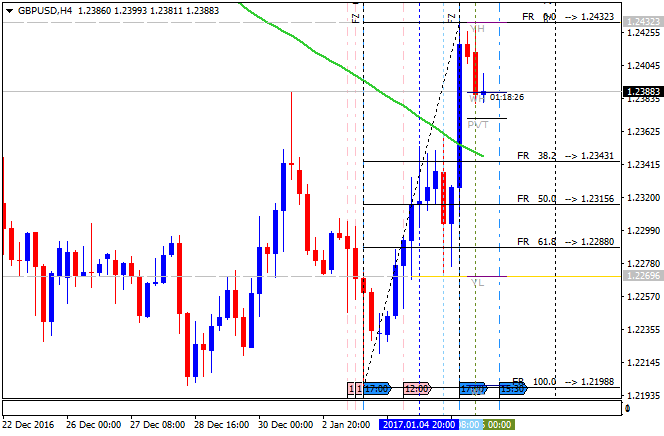

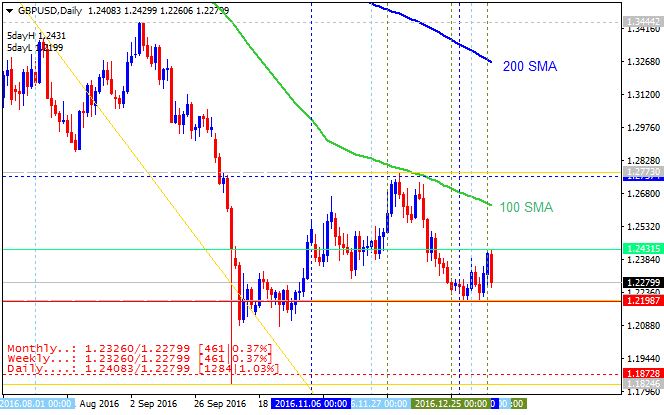

GBP/USD H4 ahead of NFP: ranging within 200/100 SMA area waiting for direction

==========

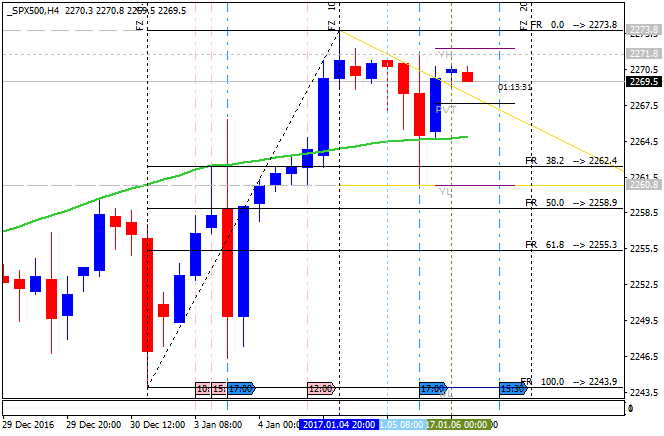

S&P 500 H4 ahead of NFP: trending above 200 SMA and near above 100 SMA for the bullish trend to be continuing or for the ranging condition to be started

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.06 14:37

Intra-Day Fundamentals - EUR/USD, GBP/USD and S&P 500: Non-Farm Employment Change

2017-01-06 13:30 GMT | [USD - Non-Farm Employment Change]

- past data is 178K

- forecast data is 175K

- actual data is 156K according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Non-Farm Employment Change] = Change in the number of employed people during the previous month, excluding the farming industry.

==========

From the official report:

"Total nonfarm payroll employment rose by 156,000 in December, and the unemployment rate was little changed at 4.7 percent, the U.S. Bureau of Labor Statistics reported today. Job growth occurred in health care and social assistance."

==========

EUR/USD M5: 75 pips range price movement by Non-Farm Payrolls news events

==========

GBP/USD M5: 37 pips range price movement by Non-Farm Payrolls news events

==========

S&P 500: pips range price movement by Non-Farm Payrolls news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.07 09:49

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "Next week presents a single day with a batch of data points for the British Pound, and that’s on Wednesday when we get NIESR GDP, November trade balance figures and industrial production numbers. Any evidence of additional strength may serve to only make those prior forecasts from the BoE look ‘more wrong’ while bringing additional top-side to the British Pound."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.08 07:09

Weekly Update: GBP/USD - ranging within narrow levels with 1.18 key support (based on the article)

"GBP/USD needs to take out the December high in order to suggest anything meaningful on the upside. Until then, it’s sideways at best. Don’t forget about the 96 month (8 year) cycle low count. Pay attention to the following levels; the former floor in the 1.3500-1.3700 zone and the line that extends off of the 1992 and 1998 highs (hits the 2009 low) near 1.1000."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.11 12:06

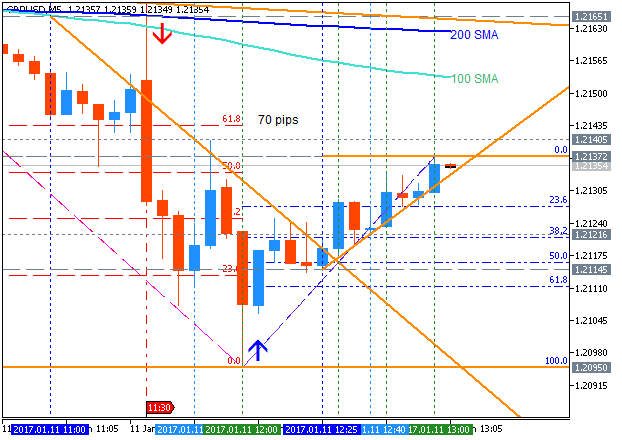

GBP/USD Intra-Day Fundamentals: U.K. Factory production and 70 pips range price movement

2017-01-11 09:30 GMT | [GBP - Manufacturing Production]

- past data is -1.0%

- forecast data is 0.6%

- actual data is 1.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

From official report:

- "In November 2016, total production was estimated to have increased by 2.1% compared with October 2016."

- "The monthly estimate of manufacturing increased by 1.3% in November 2016; the largest contribution came from pharmaceuticals, which increased by 11.4%. Pharmaceuticals can be highly erratic, with significant monthly changes, often due to the delivery of large contracts."

==========

GBP/USD M5: 70 pips range price movement by U.K. Factory production news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.13 14:53

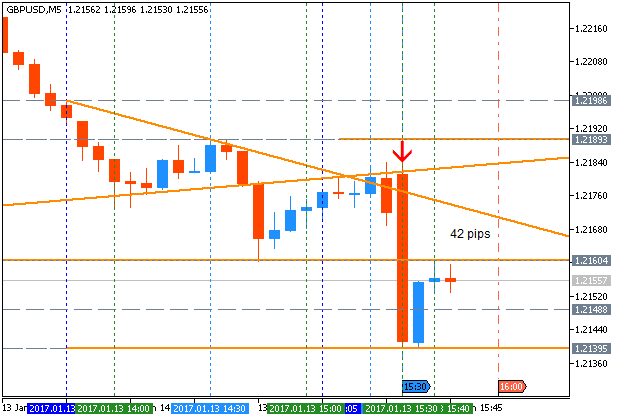

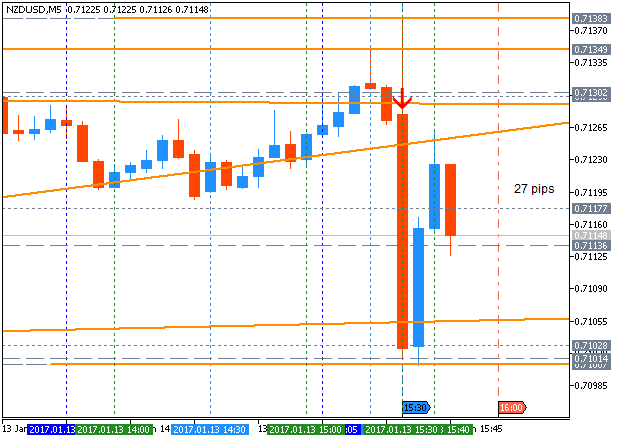

Intra-Day Fundamentals - EUR/USD, GBP/USD and NZD/USD: U.S. Producer Price Index and Advance Retail Sales

2017-01-13 13:30 GMT | [USD - PPI]

- past data is 0.4%

- forecast data is 0.1%

- actual data is 0.3% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - PPI] = Change in the price of finished goods and services sold by producers.

==========

From official report:

"The Producer Price Index for final demand increased 0.3 percent in December, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.4 percent in November and were unchanged in October. (See table A.) On an unadjusted basis, the final demand index climbed 1.6 percent in 2016 after falling 1.1 percent in 2015."

==========

2017-01-13 13:30 GMT | [USD - Retail Sales]

- past data is 0.2%

- forecast data is 0.5%

- actual data is 0.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for USD in our case)

[USD - Retail Sales] = Change in the total value of sales at the retail level.

==========

EUR/USD M5: 54 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

==========

GBP/USD M5: 42 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

==========

NZD/USD M5: 27 pips range price movement by U.S. Producer Price Index and Advance Retail Sales news events

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.15 06:33

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "On Tuesday, we’ll finally get some element of clarity on the matter from PM Theresa May when she delivers a speech designed to lay out her plans for Britain’s execution of Brexit. Just before Christmas, Theresa May told senior Members of Parliament that she would make a speech in the new year to share those plans and strategies to ‘forge a truly global Britain that embraces and trades with countries across the world.’ This is that speech; but more recent indications from PM May have appeared to indicate that a Hard Brexit may be more likely – as she’s laid out the priorities of taking control of immigration and leaving the jurisdiction of the European Court of Justice. Notice that within those priorities is not ‘access to the single market,’ and this has many concerned that the execution of Brexit may be more acrimonious than initially-feared. But the combination of these two very relevant, yet opaque drivers for the British Pound and the U.K. can present a daunting back-drop for near-term trend identification in GBP-pairs. As such, the forecast on the British Pound will be set to neutral for the week ahead until more clarity is had on Brexit and inflationary pressure within the U.K. economy."

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.17 11:36

GBP/USD Intra-Day Fundamentals: U.K. Consumer Price Index and 72 pips range price movement

2017-01-17 09:30 GMT | [GBP - CPI]

- past data is 1.2%

- forecast data is 1.4%

- actual data is 1.6% according to the latest press release

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - CPI] = Change in the price of goods and services purchased by consumers.

==========

From official report:

- "The Consumer Prices Index (CPI) rose by 1.6% in the year to December 2016, compared with a 1.2% rise in the year to November."

- "The rate in December was the highest since July 2014, when it was also 1.6%."

- "The main contributors to the increase in the rate were rises in air fares and the price of food, along with prices for motor fuels, which fell by less than they did a year ago."

==========

GBP/USD M5: 72 pips range price movement by U.K. Consumer Price Index news event

==========

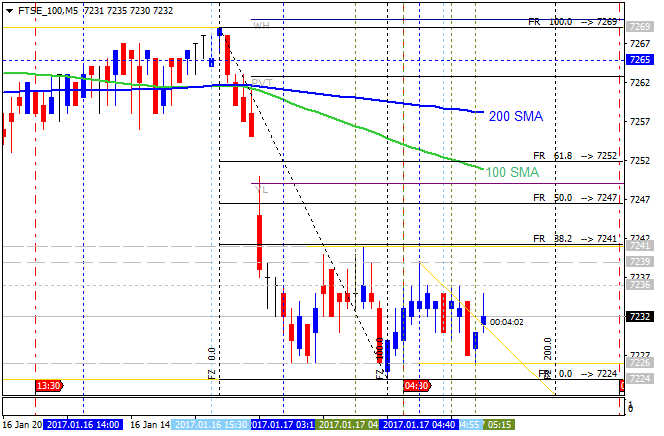

FTSE 100 Index, M5: pips range price movement by U.K. Consumer Price Index news event

Forum on trading, automated trading systems and testing trading strategies

Sergey Golubev, 2017.01.17 13:40

GBP/USD Intra-Day Fundamentals: Prime Minister May Speaks and 122 pips range price movement

2017-01-17 11:45 GMT | [GBP - Prime Minister May Speak]

- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

[GBP - Prime Minister May Speak] = The Speech about details of the United Kingdom's exit from the European Union, in London.

==========

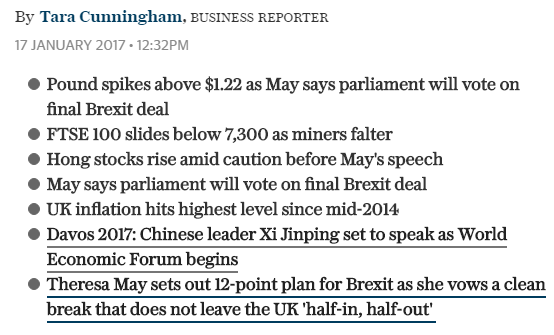

From telegraph article: Pound spikes above $1.22 and FTSE 100 falters as Theresa May promises parliament vote on Brexit

==========

GBP/USD M5: 122 pips range price movement by Prime Minister May Speech news event

==========

FTSE 100 Index, M5: pips range price movement by Prime Minister May Speech news event

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

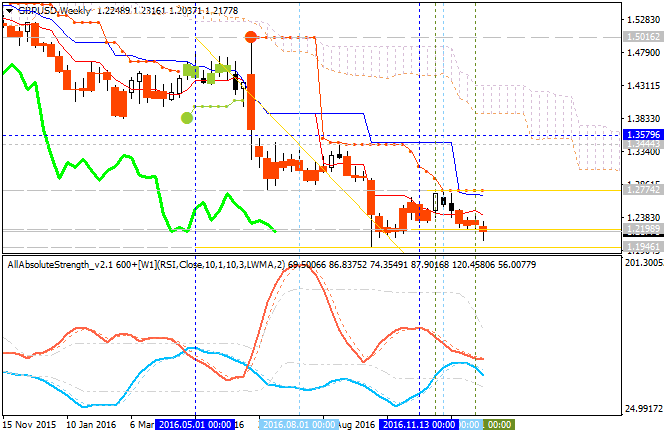

GBP/USD January-March 2017 Forecast: weekly ranging bearish; daily possible bullish reversal

W1 price is located below Ichimoku cloud in the bearish area of the chart. The price is on ranging within narrow support/resistance levels since the beginning of the November last year with the descending triangle pattern to be formed by the price for the bearish trend to be continuing. By the way, Trend Strength indicator is estimating the trend as a rally to be started, and Absolute Strength indicator is evaluating the trend as a ranging to be continuing.

If we look at the daily price so the bullish reversal level at 1.2387 is testing by the price to above for the reversal of the daily price movement from the ranging bearish to the primary bullish market condition. Thus, we may see good daily breakout soon with weekly rally with 1.2772 target for example.

Trend:

W1 - ranging bearish