You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.07.29 08:27

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "The Bank of England’s monetary policy committee will likely leave its benchmark interest rate unchanged at 0.25% Thursday and make no changes to either its £435 billion asset-purchase program or its £10 billion corporate-bond buying. However, the meeting could still have an impact on GBP/USD and EUR/GBP."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.03 15:23

GBP/USD Intra-Day Fundamentals: Bank of England (BoE) Interest Rate Decision and range price movement

2017-08-03 12:00 GMT | [GBP - Official Bank Rate]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Official Bank Rate] = Interest rate at which the BOE lends to financial institutions overnight.

==========

From official report :

==========

GBP/USD M5: range price movement by Bank of England (BoE) Interest Rate Decision news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.04 08:18

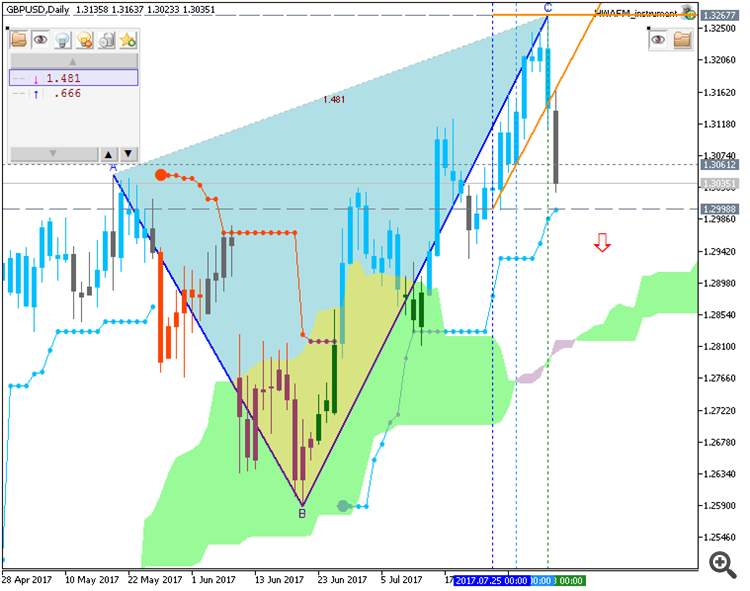

GBP/USD - daily ranging bullish; 1.3267 and 1.2817 are the keys (based on the article)

Daily price is located above Ichimoku cloud in the bullish area of the chart: the price was bounced from 1.3267 resistance level to below for the ranging to be started with 1.2817 Senkou Span line as the border between the primary bearish and the primary bullish trend on the chart.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.05 10:14

Weekly GBP/USD Outlook: 2017, August 06 - August 13 (based on the article)

GBP/USD made another move tot he upside but was forced to retreat on the BOE’s bearishness. Will it remain the loser? The upcoming week features a mix of figures from all sectors.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.10 11:17

GBP/USD Intra-Day Fundamentals: U.K. Factory production and range price movement

2017-08-10 09:30 GMT | [GBP - Manufacturing Production]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - Manufacturing Production] = Change in the total inflation-adjusted value of output produced by manufacturers.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Factory production news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.13 09:05

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "The British Pound is often seen, like the US Dollar and the Euro, as neither a safe-haven currency to be bought when investors are nervous nor a ‘risk-on’ currency to be acquired when their risk appetite increases. However, this broad generalization, like most, needs to be questioned. As for Brexit, little is happening right now as many UK politicians remain on holiday. Note, though, that Michael Saunders, one of the two hawks on the Bank of England’s monetary policy committee currently voting for a rate rise, was reported Friday as saying that the UK’s exit from the EU meant the economy would probably grow more slowly in the coming years than it would otherwise have done."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.20 10:33

Weekly Fundamental Forecast for GBP/USD (based on the article)

GBP/USD - "In the coming week, the key statistic will be the second reading of second-quarter GDP, which analysts will be watching for any deviation from the first estimates of 0.3% growth quarter/quarter and 1.7% year/year. Also on the calendar are the public finances on Monday and the Confederation of British Industry’s industrial and retail surveys on Tuesday and Thursday respectively."

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.24 12:41

GBP/USD Intra-Day Fundamentals: U.K. Gross Domestic Product and range price movement

2017-08-24 09:30 GMT | [GBP - GDP]

if actual > forecast (or previous one) = good for currency (for GBP in our case)

[GBP - GDP] = Change in the inflation-adjusted value of all goods and services produced by the economy.

==========

From official report :

==========

GBP/USD M5: range price movement by U.K. Gross Domestic Product news event

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.26 07:41

Weekly GBP/USD Outlook: 2017, August 27 - September 03 (based on the article)

GBP/USD was making attempts to recover but did not go anywhere fast and found itself grinding lower. The upcoming week feature the manufacturing PMI as well as other figures.

Forum on trading, automated trading systems and testing trading strategies

Press review

Sergey Golubev, 2017.08.29 09:29

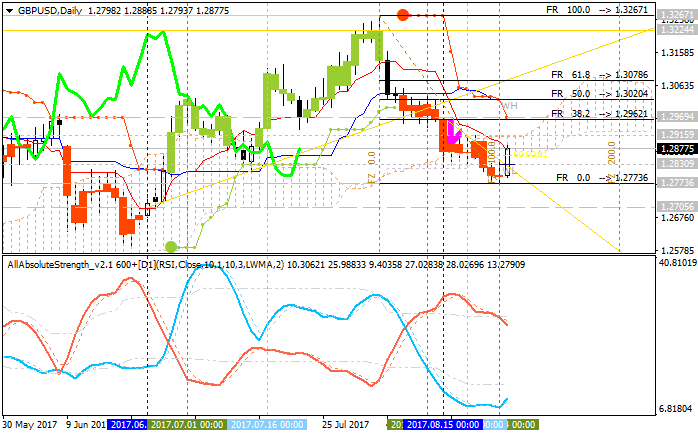

GBP/USD - ranging within/around Ichimoku cloud for the direction of the strong trend to be started (based on the article)

Daily price is ranging within and around Ichimoku cloud waiting for the direction of the strong trend to be started.

If the daily price breaks 1.2942 resistance level on close bar so the bullish reversal will be started.

If the price breaks 1.2773 support level on close D1 bar so the bearish trend will be resumed.

If not so the price will be on ranging market condition within the levels.