newdigital, 2013.10.13 18:04

GBP/USD weekly outlook: October 14 - 18

The pound was lower against the dollar on Friday as hopes for a

breakthrough on the U.S. budget and debt ceiling deadlock in Washington

supported the greenback, while disappointing U.K. economic data weighed

on sterling.

GBP/USD

ended Friday’s session at 1.5944, 0.13% lower for the day, after

falling as low as 1.5912 on Thursday. For the week, the pair was down

0.94%.

Cable is likely to find short-term support at 1.5885 and resistance at 1.6120.

Sentiment

on the dollar was boosted as House Republicans and the Obama

administration began a second day of negotiations on a deal to reopen

the government and raise the U.S. government borrowing limit for six

weeks.

The U.S. risks running out of cash if the debt ceiling is not raised by 17 October.

Meanwhile,

concerns over economic impact of the political deadlock in Washington

fuelled expectations that the Federal Reserve will further delay plans

to start phasing out its USD85 billion a month asset purchase program.

Wednesday’s

minutes of the Fed’s September meeting said the decision not to begin

tapering stimulus was a "close call," with all but one voting member

opting to leave the program unchanged.

Data released on Friday

showed that U.S. consumer sentiment fell to the lowest level in nine

months in October, as concerns over the impact of the government

shutdown weighed.

The University of Michigan’s consumer sentiment

index declined to 75.2 from a final reading of 77.5 in September, and

below expectations for a reading of 76.0.

Sterling came under

pressure after data released on Friday showed that U.K. construction

sector output slipped 0.1% in August, a sharp slowdown after a 2.8%

increase in July.

Earlier in the week, data showed that U.K.

industrial production fell at the fastest rate in nearly a year in

August, rising doubts over the outlook for third quarter growth.

The

Office for National Statistics said U.K. industrial production fell

1.1% in August, defying expectations for a 0.4% increase, after inching

up 0.1% in July.

The ONS said manufacturing production fell by a

seasonally adjusted 1.2% in August, confounding expectations for a 0.4%

increase.

In the week ahead, investors will continued to closely

monitor political developments in Washington. Trade volumes are likely

to remain light on Monday, with U.S. markets closed for a holiday. U.K

data on employment and retail sales will be in focus as markets attempt

to gauge the strength of the economic recovery.

Ahead of the

coming week, Investing.com has compiled a list of these and other

significant events likely to affect the markets. The guide skips Friday

as there are no relevant events on this day.

Monday, October 14

Markets in the U.S. are to remain closed for the Colombus Day holiday.

Tuesday, October 15

The U.K. is to produce official data on consumer price inflation and producer price inflation.

The U.S. is to release a report on manufacturing activity in the Empire state.

Wednesday, October 16

The

U.K. is to release official data on the change in the number of people

unemployed and the unemployment rate, as well as data on average

earnings.

Thursday, October 17

The U.K. is to

produce data on retail sales, the government measure of consumer

spending, which accounts for the majority of overall economic activity.

The

U.S. is to publish the weekly government report on initial jobless

claims, as well as data on manufacturing activity from the Philly Fed.

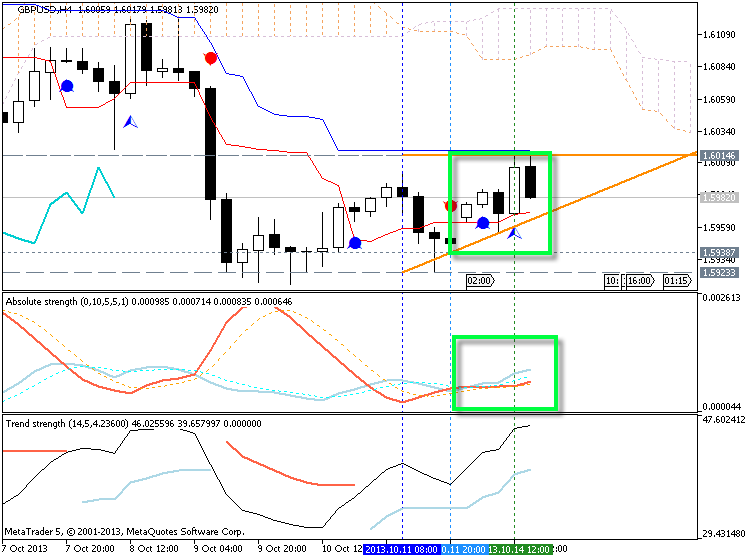

This is interesting situation on H1 timerame for now : Chinkou Span line is going along historical price and ready to cross this price anytime from above to below (image - see on the left side), price is inside Ichimoku cloud with flat.

I name this setup as 'ready-to-go' :)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

read-to-go setup

This is interesting situation on H1 timerame for now : Chinkou Span line is going along historical price and ready to cross this price anytime from above to below (image - see on the left side), price is inside Ichimoku cloud with flat.

I name this setup as 'ready-to-go' :)

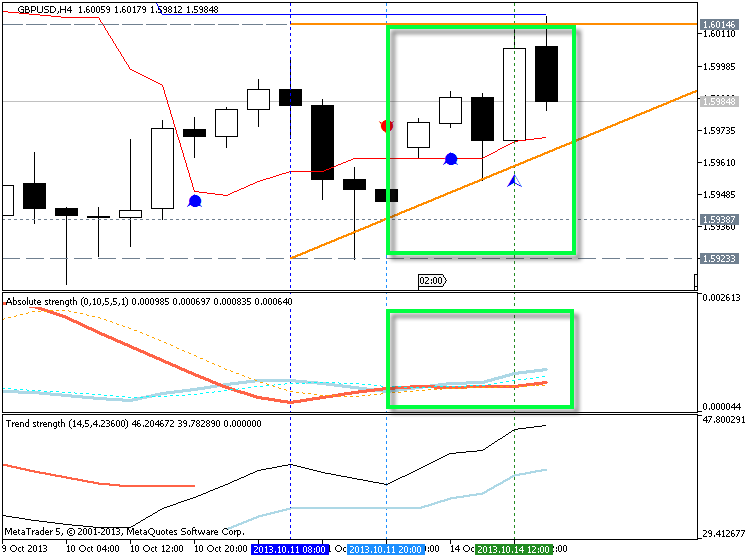

well ... it was started (see the image). But price is inside Ichimoku cloud so I do not expect big movement for downtrend for the long time sorry.

well ... it was started (see the image). But price is inside Ichimoku cloud so I do not expect big movement for downtrend for the long time sorry.

Now? It depends on the system you are trading. I opened the position (you can see it from previous post/image) :

as to me so I like to trade breakout or breakdown incl news trading.

As to GBPUSD H1 for now - the price is inside Ichimoku cloud (it means: ranging market condition) so it is risky to open trade for now.

If you want to know how to trade breakout/breakdown/news events so go to this post for example :

How to Start with Metatrader 5

newdigital, 2013.09.20 08:21

Summaries :

====

- How to Start with MT5, a summary !

- All (not yet) about Strategy Tester, Optimization and Cloud

- ASCTREND SYSTEM summary (incl 2 good EAs)

- BRAINTRADING SYSTEM HowTo

- PriceChannel Parabolic system (incl 2 versions of the EA)

- Market Condition Evaluation (2 EAs were created)

- Ichimoku

-

Financial and trading videos - Table of Contents

- All about Calendar tab and Macro Economic Events

- All about MQL5 Wizard : create robots without programming

Breakout on H1 timeframe (Chinkou Span line of Ichimoku indicator crossed historical price frok below to above) :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD H1 breakout

newdigital, 2013.10.14 19:15

GBP/USD remains higher amid U.S. budget concerns

The pound remained higher against the U.S. dollar on Monday, as growing

concerns over a potential U.S. sovereign default continued to weigh on

demand for the greenback.

GBP/USD

hit 1.5989 during U.S. morning trade, the pair's highest since October

9; the pair subsequently consolidated at 1.5968, adding 0.14%.

Cable was likely to find support at 1.5922, Friday’s low and resistance at 1.6070, the high of September 23.

Negotiations

between the White House and House Republicans broke down over the

weekend, after President Barack Obama rejected Republican proposals for a

short-term debt ceiling increase.

If a deal to raise the

government borrowing limit is not struck ahead of Thursday’s deadline,

the U.S. will face an unprecedented sovereign debt default.

World

finance ministers and central bank heads in Washington for the annual

meeting of the International Monetary Fund and World Bank over the

weekend called for “urgent action” to break the deadlock, warning of the

negative impact on the global economic recovery.

Sterling was fractionally higher against the euro with EUR/GBP edging down 0.07%, to hit 0.8484.

In the euro zone, data on Monday showed that industrial production rose

1% in August, coming in above expectations for a 0.8% increase.

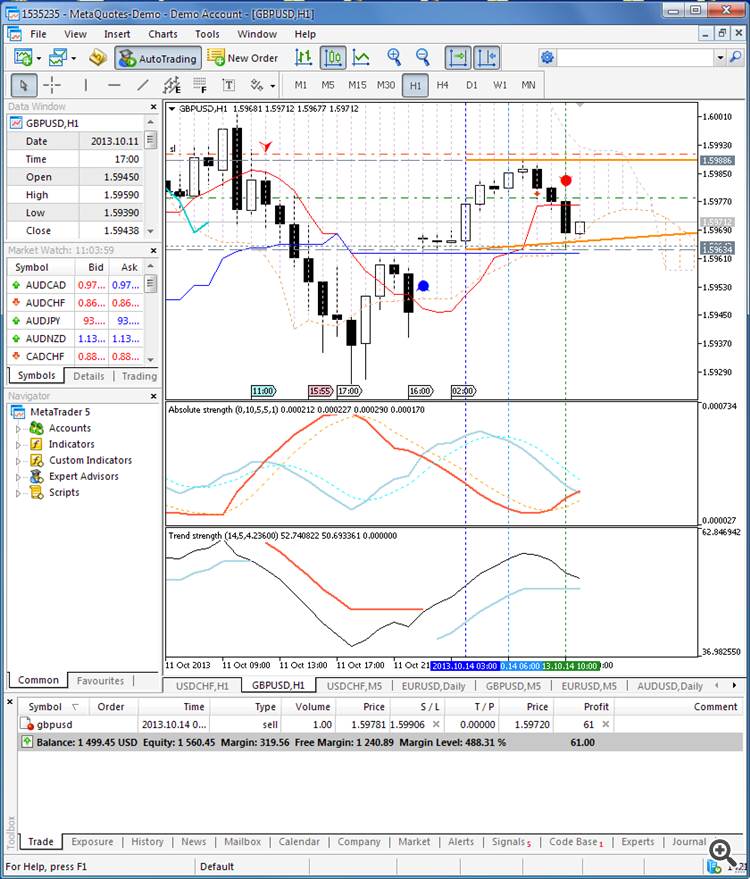

It may be breakdown to be going soon on GBPUSD h1 - look at the image :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD H1 - breakdown may be going on soon

As to H4 timeframe so it is ranging market condition -

As to D1 timeframe so it is flat for the second day :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

GBPUSD D1 - flat for the second day

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The correction is going on for the second week within bullish primary trend which was stopped by now with 1.5913 support level on D1 timeframe.

If the price will cross 1.5913 support line so the correction will be continuing for the week; and if Chinkou Span line will cross historical price from above to below - we can see the reversal on the end of the week to ranging bearish.

If the price will cross 1.6259 so we will see the primary bullish trend to be continuing with good breakout for example.

My expectation for GBPUSD D1 price is that we may see the ranging between 1.5913 and 1.6259 levels.

Recommendation for long: watch the price breaking 1.6177 resistance level for next breaking of 1.6259

Recommendation to go short: watch the price for breaking 1.5913 from above to below

Trading Summary: correction

UPCOMING EVENTS (high/medium impacted news events which may be affected on GBPUSD price movement for this coming week)

2013-10-14 01:30 GMT (or 03:30 MQ MT5 time) | [CNY - CPI]

2013-10-15 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - CPI]

2013-10-15 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - PPI Input]

2013-10-16 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Claimant Count Change]

2013-10-17 08:30 GMT (or 10:30 MQ MT5 time) | [GBP - Retail Sales]

2013-10-17 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Philadelphia Fed Manufacturing Index]

2013-10-18 02:00 GMT (or 04:00 MQ MT5 time) | [CNY - GDP]

Please note : some US high impacted news events (incl speeches) are also affected on USDJPY movement

SUMMARY : correction

TREND : ranging

Intraday Chart