newdigital, 2013.11.05 10:05

2013-11-05 07:45 GMT (or 08:45 MQ MT5 time) | [JPY - BOJ Gov Speaks]- past data is n/a

- forecast data is n/a

- actual data is n/a according to the latest press release

==========

Bank of Japan Governor Haruhiko Kuroda had a press conference about monetary policies. Mr Kuroda exercises general control over the Bank's business.

Kuroda: BoJ monetary stimulus having positive effect on economy

During a meeting with credit cooperative officials on Friday, Bank of

Japan head Haruhiko Kuroda assured that the central bank's injections of

monetary stimulus had been having favorable effects on the Japanese

economy. He projected further gradual recovery and quicker annual Core

CPI growth.

"The BOJ will continue with quantitative and

qualitative easing, aiming to achieve the price stability target of 2

percent, as long as it is necessary for maintaining this in a stable

manner," Kuroda said.

At its last meeting the BoJ decided to

keep the monetary expansion at an annual rate of JPY 60-70B, while

upgrading its view on capital expenditure.

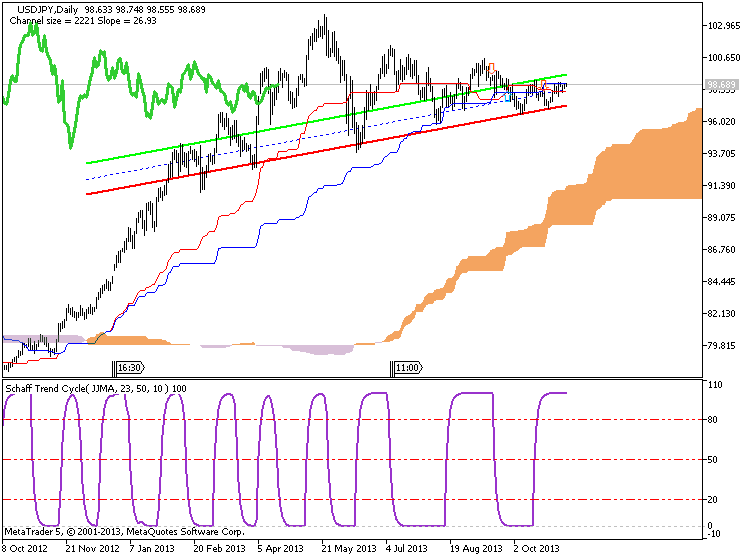

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 18 pips price movement by JPY - BOJ Gov Speaks

Updated situation for this pair for now :

D1 timeframe - price is inside Ichimoku cloud with ranging market condition

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY D1 Ranging

H4 timeframe - Chinkou Span line is going to be cross with historical price for possible correction (good to open sell trade)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY H4 - correction

newdigital, 2013.11.06 09:40

2013-11-06 03:30 GMT (or 04:30 MQ MT5 time) | [JPY - 10-y Bond Auction]- past data is 0.68|3.7

- forecast data is n/a

- actual data is 0.61|3.7 according to the latest press release

==========

'X.XX|X.X' format :

- first number is the average interest rate of the bonds sold

- second number is the bid-to-cover ratio (number of bids made per bid accepted)

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 : 27 pips price movement by JPY - 10-y Bond Auction

Trading the News: U.S. Gross Domestic Product (GDP) (based on Trading U.S. 3Q GDP- Dollar at Risk Amid Slowing Growth article)

A slowdown in the U.S. economy may trigger a new round of dollar

weakness as it raises the Fed’s scope to further delay the exit

strategy.

What’s Expected:

Time of release: 11/07/2013 13:30 GMT, 8:30 EST

Primary Pair Impact: USDJPY

Expected: 2.0%

Previous: 2.5%

Forecast: 2.0% to 2.5%

Why Is This Event Important:

Fears of a slowing recovery may encourage the Federal Open Market

Committee (FOMC) to carry its highly accommodative policy stance into

2014, and the greenback remains at risk of facing additional headwinds

over near-term as the fiscal drag continues to dampen the outlook for

growth.

How To Trade This Event Risk

Trading the U.S. 3Q GDP print may not be as clear cut as some of our

other trade setups in light of the European Central Bank (ECB) Meeting

Bearish USD Trade: 3Q GDP Expands Less Than 2.0%

- Need to see red, five-minute candle following the print to consider a short dollar trade

- If market reaction favors a bearish dollar trade, sell USDJPY with two separate position

- Set stop at the near-by swing high/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Shift stop to cost on remaining position once initial target is hit, set reasonable limit

- Need green, five-minute candle to favor a long USDJPY trade

- Implement same setup as the short dollar trade, just in reverse

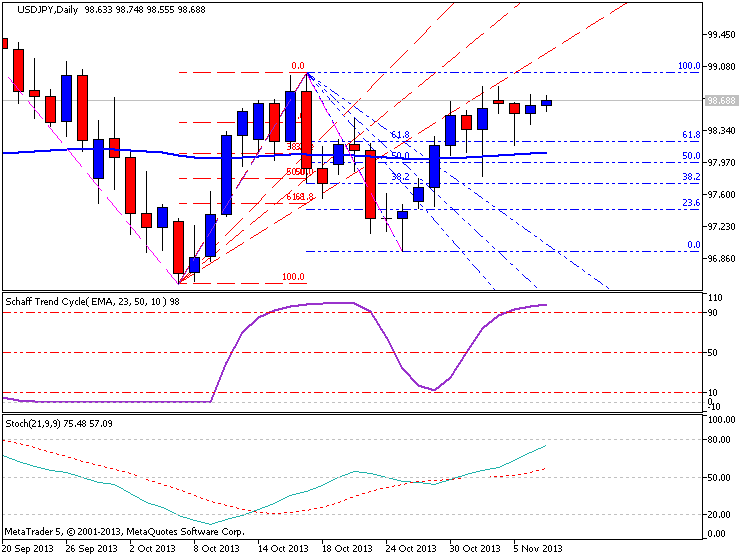

Potential Price Targets For The Release

- Still Stuck in Wedge/Triangle Formation; Continues to Approach Apex

- Relative Strength Index Retains Threatening Trendline Resistance

- Interim Resistance: 99.00 Pivot to 99.20 (23.6 expansion)

- Interim Support: 96.40 (23.6 expansion) to 96.60 (50.0 expansion)

- David Song

- www.dailyfx.com

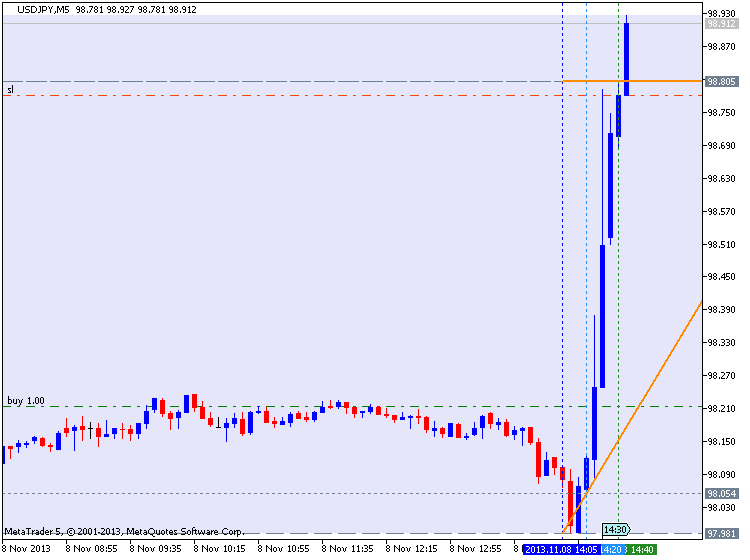

Good and profitable trade for USDJPY based on US GDP news event - right now :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

USDJPY M5 - US GDP news event

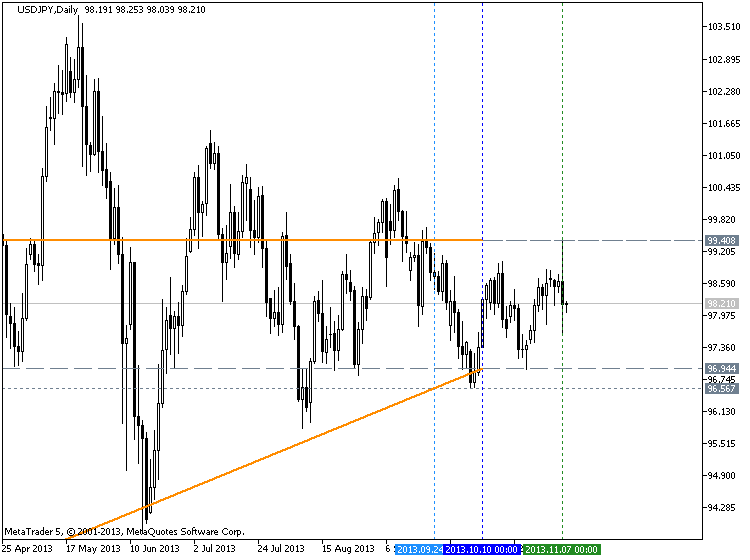

The name of this thread is Possible Breakout To Bullish? So, we got it :

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

bullish breakout

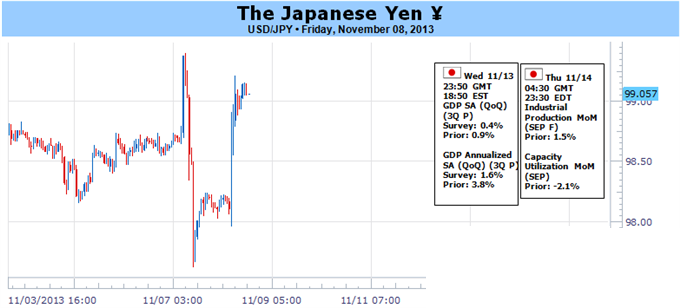

USD/JPY Technical Analysis (adapted from USD/JPY Technical Analysis – Clear Direction Still Lacking article)

- Prices continue to consolidate above trend line support set from June (97.34)

- A break downward exposes swing lows at 96.93 and 96.55

- Resistance is at 98.75 (range top); a break higher targets 99.74 (trend line)

2013-11-08 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Nonfarm Payrolls]

70 pips by equity (sl is on breakeven) for NFP trading for now :

newdigital, 2013.11.10 19:00

Based on the article : Is The USD/JPY Finally Ready to Break Higher?

Fundamental Forecast for Japanese Yen: Neutral

- US Dollar attempts break above critical resistance versus Yen only to reverse sharply lower

-

We’re watching US Treasury Yields and Japanese data to gauge whether the pair breaks higher

The Japanese Yen finished the week almost exactly where it began, but an impressive Dollar surge leaves the USDJPY exchange rate at major technical levels. Might this be the week we finally see a major break in the Yen?

The Yen has gone almost nowhere versus the US Dollar as relatively steady monetary policy expectations for both the US Federal Reserve and the Bank of Japan keeps the yield-sensitive currency similarly stable. Yet there’s little secret that Japanese Prime Minister Abe and BoJ Governor Kuroda have made it a priority to keep policy as loose as possible in a bid to fight deflation and boost economic growth.

Thus we look to upcoming GDP

figures to gauge whether the so-called policies of “Abenomics” are

taking effect and—more importantly—whether the BoJ is likely to keep

current Quantitative Easing measures unchanged through the foreseeable

future.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

The price for D1 timeframe is located inside Ichimoku cloud which is indicating ranging market condition. But Chinkou Span line (the closing price plotted 26 days behind) of Ichimoku indicator is crossing historical price from below to above on open bar with uptrend which was going on for Friday for example. The nearest resistance to be broken for possible breakout is 98.67 and next one is 98.84

Chinkou Span line is crossing historical price for possible breakout on W1 timeframe as well, and the price is located on bullish zone which is above Ichimoku cloud. The price is on flat for now with good possibility for uptrend to be continuing for this week.

UPCOMING EVENTS (high/medium impacted news events which may be affected on USDJPY price movement for this coming week)

2013-11-05 05:30 GMT (or 06:30 MQ MT5 time) | [JPY - BOJ Gov Speaks]

2013-11-05 07:45 GMT (or 08:45 MQ MT5 time) | [JPY - BOJ Gov Speaks]

2013-11-05 23:50 GMT (or 00:50 MQ MT5 time) | [JPY - Monetary Policy Meeting Minutes]

2013-11-07 05:00 GMT (or 06:00 MQ MT5 time) | [JPY - Leading Index]

2013-11-07 13:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2013-11-08 02:00 GMT (or 03:00 MQ MT5 time) | [CNY - Trade Balance]

2013-11-08 13:30 GMT (or 14:30 MQ MT5 time) | [USD - Nonfarm Payrolls]

Please note : some US high/medium impacted news events (incl speeches) are also affected on USDJPY price movement

SUMMARY : ranging

TREND : bullish

Intraday Chart