You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EURUSD rises on the Feds give and take statement, then comes back off (based on forexlive article)

CE Inflation projections are lower to 1% -1.6% from 1.6% – 1.9% but the Core PCE they only lowered by 0.1% to 1.5%-1.8% from 1.6% -1.9%.

As Adam points out there is a lot of hedging going on.

Technically, the EURUSD has found support at the 200 hour MA on the first dip after the initial rise. That level is currently at the 1.2404 level. The 1 minute chart above shows the up and down volatility and the bounce off that level. If the market is to turn, it needs to get below this level.

On the topside the 100 hour MA at the 1.2450 area saw price action remain above that MA for a total of 12 minutes. The move back below, has shown the disappointment. We will see if Yellen can now push the pair one way or the other. .

AUD/USD dropped further to as low as 0.8106 so far and met mentioned target of 100% projection of 0.9401 to 0.8642 from 0.8910 at 0.8151. Intraday bias remains on the downside and deeper fall should be seen to 0.7945/8066 key support zone. On the upside, above 0.8235 minor resistance will turn bias neutral and bring consolidations first. But break of 0.8539 is needed to confirm near term reversal. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, recent development in AUD/USD suggests that it's building downside momentum and the fall from 1.1079 is accelerating again. Focus is now on 0.8066 key support level, 61.8% retracement of 0.6008 to 1.1079 at 0.7945. Decisive break there will carry long term bearish implication and pave the way to long term fibonacci level at 0.7182 and below. On the upside, break of 0.9504 is needed to confirm medium term reversal. Otherwise, we won't turn bullish even in case of strong rebound.

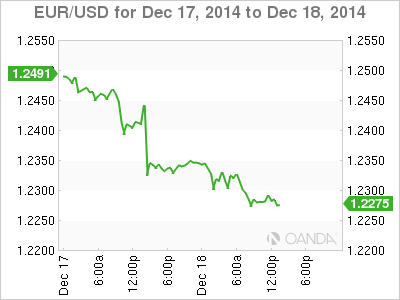

EUR/USD Technical Analysis: Prices Retreat Below 1.24 Mark (based on dailyfx article)

The Euro turned sharply lower against the US Dollar, with sellers reclaiming a foothold below the 1.24 figure. A daily close below the intersection of falling wedge top resistance-turned-support and the 38.2% Fibonacci expansion at 1.2324 exposes the 50% level at 1.2249. Alternatively, a turn above the 23.6% Fib at 1.2418 opens the door for a challenge of the December 16 high at 1.2569.

Risk/reward considerations argue against entering short with prices in close proximity to support. On the other hand, the absence of a defined bullish reversal signal suggests taking up the long side is premature. We will remain flat for now, waiting for a more actionable opportunity to present itself.

EUR/USD - Euro Sinks As Yellen Hints At Rate Hike In Mid-2015 (adapted from seekingalpha article)

EUR/USD is steady on Thursday, following the euro’s sharp losses following the Federal Reserve statement on Wednesday. In the European session, the pair is trading slightly above the 1.23 line. On the release front, German Ifo Business Climate rose to 105.5 points. Later in the day, the US will release Unemployment Claims and the Philly Fed Manufacturing Index.

The shaky euro took another tumble on Wednesday, courtesy of the Federal Reserve. Previous Fed policy statements have usually stated that the Fed would maintain low rates for a “considerable time”, but the December statement changed terminology, saying the Fed would be “patient” before raising rates. In a follow-press conference, Federal Reserve chair Janet Yellen was less ambiguous, saying that the Fed was unlikely to raise rates for the “next couple of meetings”. The markets took this to mean that a rate hike is in the works, but not before April. The news sent the euro sprawling, as the currency lost about 170 points on Wednesday.

There was good news out of Germany, the locomotive of the Eurozone. Ifo Business Climate, a key indicator, improved to 105.5 points, up from 104.4 a month earlier. The strong reading was very close to the forecast of 105.4 points. We’ll get a look at consumer confidence on Friday, with the release of GfK German Consumer Climate. The markets are expecting a strong reading of 8.9 points.

Meanwhile, Eurozone inflation remains at low levels, and there were no surprises as Eurozone CPI dipped to 0.3% in November, down from 0.4% a month earlier. Persistent efforts from the ECB have not improved matters, and the danger of deflation has risen with the crash in oil prices. Germany has not been immune to weak inflation, with German Final CPI coming in at a flat 0.0% in November.

AUD/USD Exhaustion Trade- Shorts at Risk Above 8064 (based on dailyfx article)

USD/CAD to Face Fresh December Highs on Dismal Canada CPI (based on dailyfx article)

Trading the News: Canada Consumer Price Index (CPI)

A slowdown in Canada’s Consumer Price Index (CPI) may spur fresh monthly highs in USD/CAD especially as the Bank of Canada (BoC) remains reluctant to further normalize monetary policy.

What’s Expected:

Why Is This Event Important:

However, another uptick in the core rate of inflation may heighten the appeal of the loonie as sticky price growth undermines the BoC’s scope to retain the current policy, and Governor Stephen Poloz may sound increasingly hawkish in 2015 as the central bank head highlights the broadening recovery in the Canadian economy.

Lower input costs paired with the slowdown in the housing market may trigger a sharp slowdown in price growth, and a dismal CPI print may heighten the bearish sentiment surrounding the Canadian dollar as it drags on interest rate expectations.

However, the pickup in economic activity along with the expansion in private sector consumption may produce a stronger-than-expected inflation report, and sticky price pressures may generate a near-term pullback in USD/CAD as it fuels bets for a BoC rate hike.

How To Trade This Event Risk

Bearish CAD Trade: Headline & Core Inflation Miss Market Forecast

- Need green, five-minute candle following a dismal CPI report to consider long USD/CAD entry

- If the market reaction favors a bearish Canadian dollar trade, establish long with two position

- Set stop at the near-by swing low/reasonable distance from cost; use at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit, set reasonable limit

Bullish CAD Trade: Canada CPI Highlights Stronger Price Pressures- Need red, five-minute candle following the release to look at a short USD/CAD trade

- Carry out the same setup as the bearish loonie trade, just in the opposite direction

Potential Price Targets For The ReleaseUSD/CAD Daily Chart

- USD/CAD may have carved a near-term top in December as the RSI quickly turns around from overbought territory.

- Interim Resistance: 1.1700 pivot to 1.1715 (100% expansion)

- Interim Support: 1.1470 (50% expansion) to 1.1480 (38.2% expansion)

Impact that the Canada CPI report has had on CAD during the last month(1 Hour post event )

(End of Day post event)

2014

Canada’s Consumer Price Index (CPI) unexpectedly jumped to an annualized rate of 2.4% in October from 2.0% the month prior, while the core rate of inflation increased 2.1% to mark the highest reading since March 2012. Even though price growth holds above the Bank of Canada’s (BoC) 2% inflation target for the seventh consecutive months, it seems the central bank remains in no rush to further normalize monetary policy amid the weakening outlook for global growth paired with the decline in energy prices. The loonie strengthened against its U.S. counterpart following the better-than-expected print, with USD/CAD dipping below the 1.1200 handle following the release. However, the market reaction was short-lived as dollar-loonie worked its way back towards 1.1250 during the North America trade, with the pair closing the day at 1.1290.

Consumer Price Index, November 2014 (official report)

The Consumer Price Index (CPI) rose 2.0% in the 12 months to November, following a 2.4% increase in October.

The slower year-over-year rise in the CPI was mainly attributable to gasoline prices, which fell 5.9% in the 12 months to November, after rising 0.6% in October.

On a monthly basis, the gasoline price index declined 7.5% in November, marking its fifth consecutive monthly decrease. In November, gasoline prices were at their lowest level since February 2011.

Gasoline prices fell in all provinces on a year-over-year basis in November. Prince Edward Island recorded the largest decline, while British Columbia posted the smallest.

Prices increased in seven of the eight major components in the 12 months to November. Higher shelter and food costs led the rise in the CPI, while the transportation index was the only major component to decline year over year in November.

GDP data from Canada and the US, US Durable Goods Orders, New Home Sales, Unemployment claims, Haruhiko Kuroda’s speech are the major topics in Forex calendar. heck out these events on our weekly outlook.

Last week, Federal Reserve Chair Janet Yellen switched the phrase “considerable time” with the word “patience” in referral to rate hikes, at the FOMC press conference. The move was made to calm markets awaiting sharp policy shifts. Three Fed officials registered their dissent expressing discomfort with the Fed’s message. The Jobless claims came out better than expected with a drop to 289K, reaffirming US labor market’s strength. Philly Fed Manufacturing index came below expectations reaching 24.5 following the steep rise in November, still maintaining a positive score. New orders plunged from 35.7 to 15.7 and employment down from 22.4 to 7.2 points. Will the US economy continue to strengthen in 2015?

Euro Struggles Ahead of Greek Election- USD/CAD Carves Lower Highs (based on dailyfx article)

US Dollar Fundamentals (based on dailyfx article)

Fundamental Forecast for US Dollar: Bullish

The US Dollar finished at fresh multi-year highs versus the Euro and near key peaks versus other currencies, boosted by a sharp improvement in US interest rate expectations on a highly-anticipated Fed interest rate decision.

We expectsignificantly less volatility in the holiday-shortened week ahead, but traders should be wary of any surprises from revisions to the Q3 US Gross Domestic Product report, US Durable Goods Orders data, and two Home Sales releases. Although admittedly unlikely, any surprises in the third revision to Q3 GDP figures could have a marked effect on US interest rates and the Dollar itself.

The US Dollar jumped alongside short-term yields on this past week’s highly-anticipated US Federal Open Market Committee interest rate decision. Fed officials initially disappointed those who expected a more hawkish shift in policy in the first FOMC meeting since the end of Quantitative Easing in October. Yet short-term treasury yields and implied US interest rates rose sharply as Fed Chair Janet Yellen essentially said that rate hikes could come after as few as two meetings.

The US Dollar continues to track changes in the US 2-year Treasury Yield—a strong proxy for Fed interest rate expectations—with great accuracy. A sharp reversal leaves the 2-year UST yield at more than twice the low it set through October 15—the exact day of the US Dollar low as seen through the Dow Jones FXCM Dollar Index (ticker: USDOLLAR). Since that date, the Greenback has surged a remarkable 11 percent versus the interest-rate sensitive Japanese Yen, 7 percent versus the Australian Dollar, and 5 percent versus the Euro.

US Dollar traders will almost certainly track changes in yields and interest rate expectations, and a key question is whether domestic economic data can continue to impress and send rates and the USD to further peaks. Dollar momentum seems stretched, and economic data can only surpass expectations for so long. Yet the US Dollar remains in an uptrend until it isn’t, and we’ll need to see concrete signs of a turn to call for a meaningful turnaround.

Traders should otherwise keep an eye on developments in the Russian financial crisis and broader Emerging Markets. Many were surprised to see the US S&P 500 track the USD/Ruble exchange rate on a virtual tick-for-tick basis, but the truth is that further destabilization in Russia threatens contagion and carries direct implications for global financial markets.

Contagion risks sent the S&P 500 sharply lower and the flight to safety likewise pushed the US Dollar down versus the Euro and Yen as traders excited USD-long positions in a hurry. Both the Greenback and the S&P recovered sharply into the end of the trading week. Whether or not the Dollar continues higher may subsequently depend on the trajectory of the Ruble and broader financial market risk sentiment.