You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

if actual > forecast = good for currency (for CAD in our case)

[CAD - Trade Balance] = Difference in value between imported and exported goods during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers

==========

Canada posts trade deficit in April on record high imports

Canada posted an unexpected trade deficit of C$638 million ($585 million) in April from an upwardly revised C$766 million surplus in March, Statistics Canada data indicated on Wednesday.

Imports climbed 1.4 percent to a record high $43.46 billion, as volumes rose 1.9 percent and prices declined 0.4 percent. Exports decreased 1.8 percent to $42.83 billion as volumes and prices fell by 0.8 percent and 1.0 percent, respectively. Following are the seasonally adjusted figures in billions of Canadian dollars: Merchandise trade April March(rev) change pct March(prev) Balance -0.638 +0.766 n.a +0.079 Exports 42.825 43.625 -1.8 42.703 Imports 43.463 42.860 +1.4 42.623

if actual > forecast = good for currency (for CAD in our case)

[CAD - Overnight Rate] = Interest rate at which major financial institutions borrow and lend overnight funds between themselves. Short term interest rates are the paramount factor in currency valuation - traders look at most other indicators merely to predict how rates will change in the future

==========

Bank of Canada leaves key interest rate unchanged

The Bank of Canada left its benchmark interest rate unchanged at one per cent today.

An unchanged rate means governor Stephen Poloz does not believe the Canadian economy is strong enough to withstand higher interest rates, despite lingering concern about high consumer debt and rising housing prices.

Poloz is not scheduled to discuss his decision publicly on Wednesday, but the analysis accompanying his announcement notes that inflation is approaching the two per cent target rate earlier than anticipated.

The loonie was down 0.29 of a cent to 91.37 cents US as the central bank signalled it is in no rush to raise rates.

The benchmark overnight rate is used by retail banks to set rates for savers and borrowers, though the range of consumer rates may vary depending on bond yields.

The rate has been a one per cent for more than three years, dating back to September 2010, the longest stretch of level rates in Canadian history.

Poloz is dealing with a mixed bag of economic results, including exports that have not yet picked up as quickly as anticipated and an unemployment rate of 7 per cent, with evidence of many long-term unemployed.

In March, Poloz reiterated a growth rate of 2.5 per cent this year for the Canadian economy, but told a business audience that slow growth is the new norm for developed economies.

Last month it noted only 1.2 per cent GDP growth rate in the first quarter, but Poloz's note this morning attributed that to "severe weather and supply constraints."

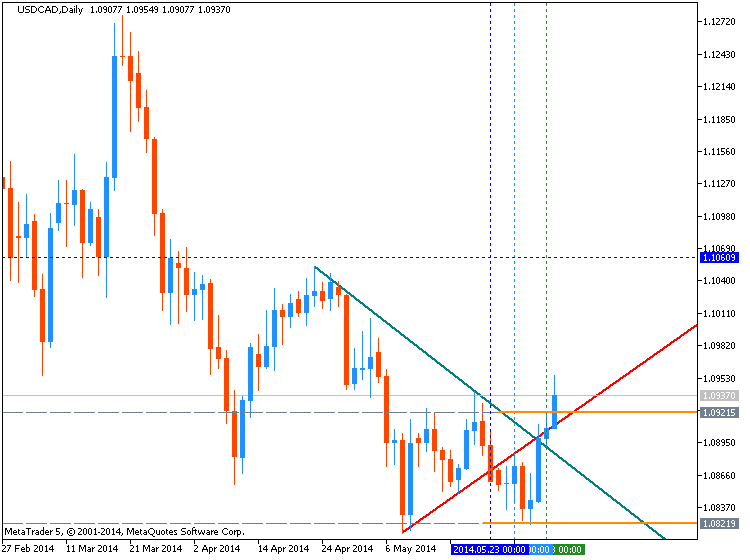

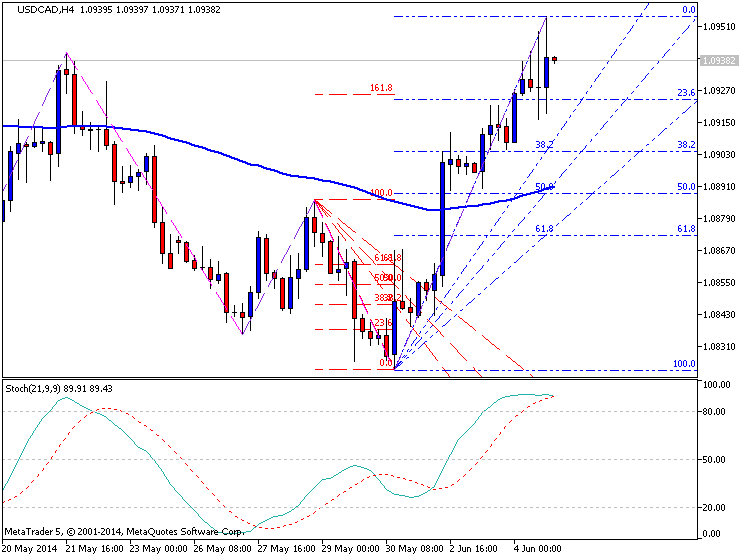

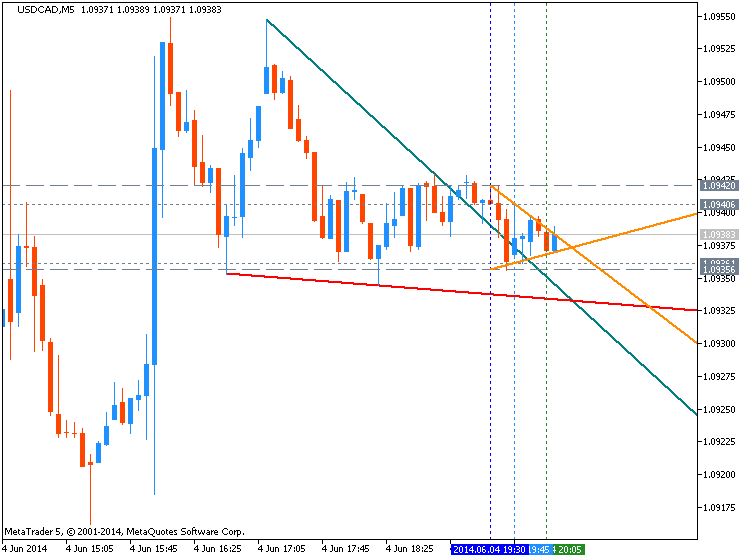

USD/CAD rises to 1-month highs, BoC holds

The U.S. dollar rose to one-month highs against its Canadian counterpart on Wednesday, after the Bank of Canada left interest rates unchanged, while downbeat Canadian trade data weighed on demand for the loonie.

USD/CAD hit 1.0951 during U.S. morning trade, the pair's highest since May 6; the pair subsequently consolidated at 1.0947, gaining 0.36%.

The pair was likely to find support at 1.0891, Tuesday's low and resistance at 1.0989, the high of May 5.

In a widely expected move, the BoC held its benchmark interest rate at 1%, saying that "the balance of risks remains within the zone for which the current stance of monetary policy is appropriate."

Earlier Wednesday, official data showed that Canada's trade balance swung into a deficit of C$0.64 billion in April, from a surplus of C$0.77 billion in March whose figure was revised up from a previously estimated surplus of C$0.08 billion.

Analysts had expected the trade surplus to narrow to C$0.10 billion in April.

In the U.S., the Institute of Supply Management said its non-manufacturing index rose to a nine-month high of 56.3 in May, from a reading of 55.2 the previous month, compared to expectations for a rise to 55.5.

The data came after payroll processing firm ADP said non-farm private employment rose by 179,000 in May, below expectations for an increase of 210,000. April's figure was revised down to a gain of 215,000 from a previously reported increase of 220,000.

A separate report showed that U.S. trade deficit widened to $47.24 billion in April, from $44.18 billion in March whose figure was revised from a previously estimated deficit of $40.40 billion. Analysts had expected the trade deficit to widen to $40.80billion in April.

The loonie was lower against the euro, with EUR/CAD adding 0.25% to 1.4902.

Also Wednesday, Markit said Germany's services purchasing managers' index fell to 56.0 in May from 56.4 in April, confounding expectations for the index to remain unchanged.

Separately, Spain's services PMI fell to 55.7 in May, from a reading of 56.5 the previous month, while Italy's services PMI rose to 51.6 last month, from 51.1 in April.

Back from a long motorcycle ride to teach in Kansas City, Brandon Wendell joins Merlin for a look at the global currency markets and listener questions! To start, Merlin looks at listener questions regarding Quicksilver and United Airlines, offering technical analysis for video viewers. Brandon takes a look at the US Dollar and its impact on the equity and commodity markets. This leads to a discussion of the Euro and its relative strength to a variety of other currencies. Finally, the duo offer suggestions on how to read volatility in the forex markets.

Apple Flirts With 52-Week High As Stock Split Looms

After software update attention shifts to iPhone 6, other new devices as Apple stock continues climb.

--------------

Apple's stock posted modest gains Wednesday morning amid a sluggish session for the broader market, continuing a recent advance that has pushed shares above $640 apiece for the first time since October 2012.

Shares climbed 0.7% to $642.28, slightly below the $644.17 52-week high from May 30 and outpacing slim gains from the major averages. The latest move higher comes on the heels of Monday’s keynote presentation from the Worldwide Developers Conference, where Chairman and CEO Tim Cook and software chief Craig Federighi unveiled the latest versions of the company’s desktop and mobile operating systems with a significant focus on personal healthcare and connectivity between apps.

Canaccord Genuity analyst Michael Walkley suggested in a note to clients that the new initiatives and Apple’s recent $3 billion purchsae of Beats “should drive increased iOS product sales and…strengthen the stickiness of the iOS ecosystem among its loyal consumers.”

Nomura’s Stuart Jeffrey wrote that the incremental changes announced Monday show a company “keeping its tinder dry” for the forthcoming release of the next-generation of iPhones and iPads, presumably in the fall. Jeffrey’s neutral take on the stock stems from his expectation that iPhone 6 anticipation may portend a strong replacement cycle but also one likely to result in challenging year-over-year comparisons in 2015.

With its latest gains Apple is up 14.4% on the year, outperforming the Nasdaq, S&P 500 and Dow Jones industrial average.At Wednesday’s prices Apple is a 10% rally away from topping its record high of $705.07 achieved in September 2012, but if the stock is going to challenge that level it will look a bit different. Apple shares are set to split 7-for-1 on Friday and begin trading on a split-adjusted basis June 9, making the equivalent of that record high $100.72 per share.

While the split means nothing from a fundamental standpoint, it may make the stock more palatable to investors who want to own a piece of the company but found its high triple-digits stock price daunting.

The split could also make Apple a candidate for inclusion in the price-weighted Dow, which has 11 triple-digit stock prices among its 30 components, led by Visa at $209.80, IBM at $184.40 and Goldman Sachs Group at $161.40.

If Dow inclusion is on Apple’s radar it may want to be careful what it wishes for. Last September the index added Goldman, Visa and Nike to replace Alcoa, Bank of America and Hewlett-Packard. Of the three new entrants, only Nike has outperformed any of the banished trio, gaining 10% to BofA’s 7.5%, while Alcoa has jumped 66% and HP 59%. Visa is up 7% since its Sept. 23 inclusion and Goldman is down almost 2%.

Since the Dow typically adds stocks that are doing well at the expense of ones with flagging stock prices, the castoffs are usually positioned to quickly move higher on any sign that things aren’t as bad as feared, a trend that has benefited HP and Alcoa. Meanwhile, the added stocks tend to scuffle following their inclusion, as Schaeffer’s investment research noted in September.

if actual > forecast = good for currency (for AUD in our case)

[AUD - Trade Balance] = Difference in value between imported and exported goods and services during the reported month. Export demand and currency demand are directly linked because foreigners must buy the domestic currency to pay for the nation's exports. Export demand also impacts production and prices at domestic manufacturers

==========

Australia Sees A$122 Million Deficit In April

Australia posted a seasonally adjusted merchandise trade deficit of A$122 million in April, the Australian Bureau of Statistics said on Thursday.

That was well shy of forecasts for a trade surplus of A$510 million following the upwardly revised surplus of A$902 million in March (originally A$731 million).

Exports dipped A$421 million or 1 percent on month to A$28.497 billion

Rural goods fell A$208 million (6 percent), while non-monetary gold lost A$131 million (11 percent), non-rural goods dropped A$96 million and net exports of goods under merchanting tumbled A$3 million (19 percent).

Services credits gained A$17 million.

Imports climbed A$604 million or 2 percent on month to A$28.619 billion.

Capital goods climbed A$399 million (8 percent) and consumption goods gained A$192 million (3 percent).

Intermediate and other merchandise goods lost A$76 million (1 percent) and non-monetary gold shed A$6 million (2 percent). Services debits gained A$96 million (2 percent).

if actual > forecast = good for currency (for CNY in our case)

[CNY - HSBC Services PMI] = Level of a diffusion index based on surveyed purchasing managers in the services industry. It's a leading indicator of economic health - businesses react quickly to market conditions, and their purchasing managers hold perhaps the most current and relevant insight into the company's view of the economy

==========

China Services PMI Slides To 50.7 In May- HSBC

Activity in China's services sectors continued to expand in May, albeit at a slower pace, the latest survey from HSBC and Markit Economics revealed on Thursday.

The services PMI saw a score of 50.7 last month, the bank said - down from 51.4 in April.

The composite PMI climbed into expansion at 50.2 in May - up from the revised 49.5 in April (originally 49.4).

A reading above 50 signals expansion in a sector, while a score below means contraction.

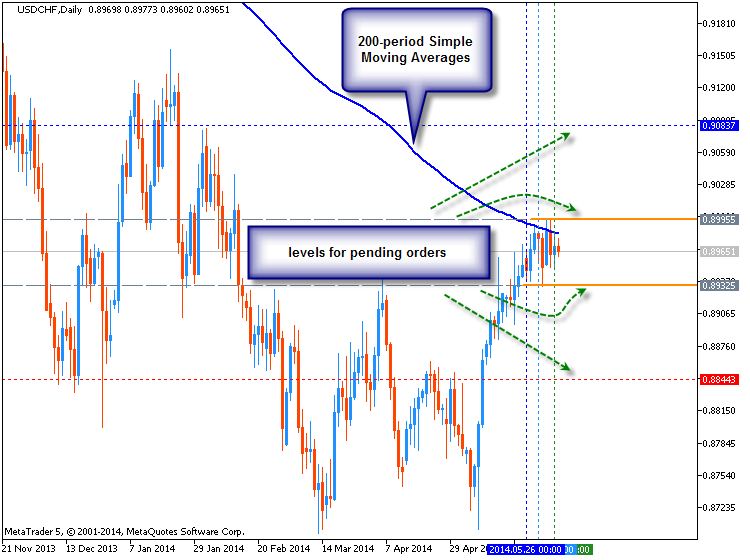

USDCHF Breakout Hindered by 200-Day Moving Average (adapted from dailyfx article)

The 200-Day Simple Moving Average

The 200-Day Simple Moving Average is one of the most popular indicators in the world. When price breaks through a 200 MA on a daily chart, it can often be seen as a topic of conversation on financial news stations, websites and newspapers.

It is primarily used to give traders and investors an overall sense of how strong or weak a currency pair is.

Typically, when a currency pair’s price falls below the 200 Day MA, it is a sign of weakness with a potential for further price decline. And when a currency pair’s price breaks above the 200 Day MA, it is a sign of strength with a potential for further price increases.

The chart above shows the recent price action surrounding the 200 Day MA. We see a large run up in price breaking through multiple resistance levels until it met this powerful MA line. We have had 6 consecutive days where price has temporarily broke through the 200 Day MA or price has come within 10 pips of the line before retreating lower. So this level is acting as strong resistance.

If price were to remain below the MA, it could propel it lower back into the pair’s price channel. However, a breakout to the upside could add yet another reason to buy the USDCHF. Until we witness a larger price move, we are in a state of limbo.

if actual > forecast = good for currency (for EUR in our case)

[EUR - German Factory Orders] = Change in the total value of new purchase orders placed with manufacturers. It's a leading indicator of production - rising purchase orders signal that manufacturers will increase activity as they work to fill the orders

==========

German Factory Orders Recover In April

Germany factory orders recovered at a faster than expected pace in April, official figures revealed Thursday.

Factory orders increased 3.1 percent in April from March, Destatis reported. Economists were expecting a 1.4 percent rise in orders after falling 2.8 percent in March.

Foreign orders increased 5.5 percent, while domestic orders remained at the level of the previous month.

Orders from the euro area advanced 9.9 percent on the previous month. At the same time, orders from other countries were up 3.1 percent.

Trading the News: European Central Bank (ECB) Interest Rate Decision (based on dailyfx article)

Trading the News: European Central Bank (ECB) Interest Rate Decision

The EUR/USD may face a sharp selloff over the next 24-hours of trade as market participants see the European Central Bank (ECB) pushing monetary policy into uncharted territory.

What’s Expected:

Why Is This Event Important:

Beyond expectations for a rate cut & negative deposit rates, the ECB may also look to implement more non-standard measures in an effort to increase lending to small-and-medium sized enterprises (SME), but the bearish sentiment surrounding the single-currency may end up being short-lived should central bank President Mario Draghi scale back his willingness to further embark on the easing cycle.

The growing threat for deflation paired with the ongoing contraction in private sector credit may prompt the ECB to implement a range of tools to address the weakening outlook for the monetary union, and the EUR/USD may test fresh yearly lows over the near-term should central bank leave the door open for more easing.

Nevertheless, the downtick in unemployment paired with improvement in confidence may encourage the ECB to further delay its easing cycle, and a rate cut alone may present a buying opportunity for the EUR/USD as market participants have already priced-in a reduction in the benchmark interest rate.

How To Trade This Event Risk

Bearish EUR Trade: ECB Cuts Rates & Keeps Door Open for More Monetary Easing

- Need red, five-minute candle following the statement to consider a short Euro position

- If market reaction favors a short trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

Bullish EUR Trade: Governing Council Refrains from Implementing Non-Standard Measures- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bullish euro trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

May 2014 European Central Bank Interest Rate Decision

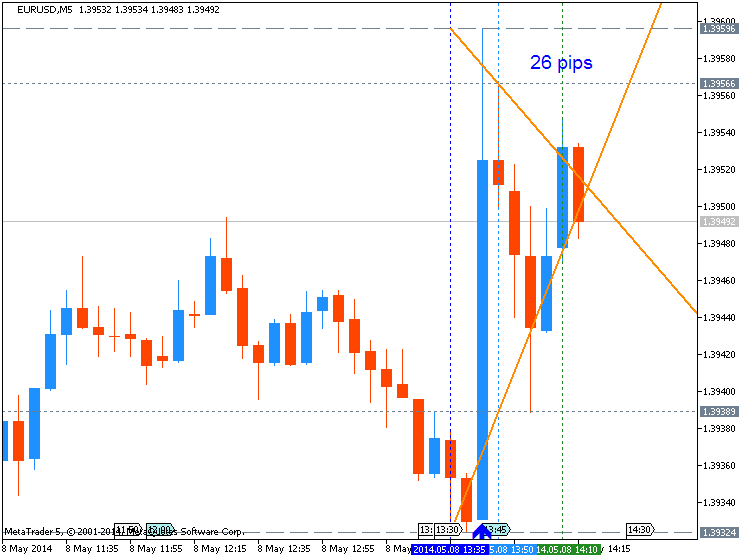

EURUSD M5 : 26 pips price movement by EUR - Interest Rate news event :

The European Central Bank kept the benchmark interest rate on hold in May as the central bank continues to see a gradual recovery in the monetary union, but it seems as though the Governing Council is showing a greater willingness to implement additional monetary support in the coming months as President Mario Draghi highlights a greater risk for deflation. Despite the initial market reaction to the ECB rate decision, speculation for more easing dragged on the EUR/USD, with the pair closing the day at 1.3838.