You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

Home Prices Rise In April But Pace Is Slowing, Says S&P/Case Shiller

Prices of single-family U.S. homes sold during the month of March rose 0.2% over February on a non-seasonally-adjusted basis, according to the latest S&P/Case Shiller report. Long-term data indicates that price gains are cooling off across the country.

“The year-over-year changes suggest that prices are rising more slowly,” said David M. Blitzer, S&P Dow Jones Indices Index Committee chairman. “Annual price increases for the two Composites have slowed in the last four months and 13 cities saw annual price changes moderate in March. The National Index also showed decelerating gains in the last quarter.”

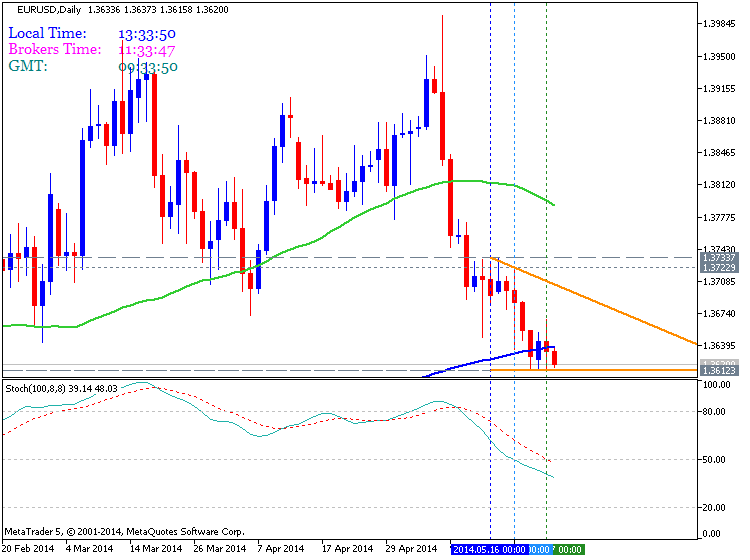

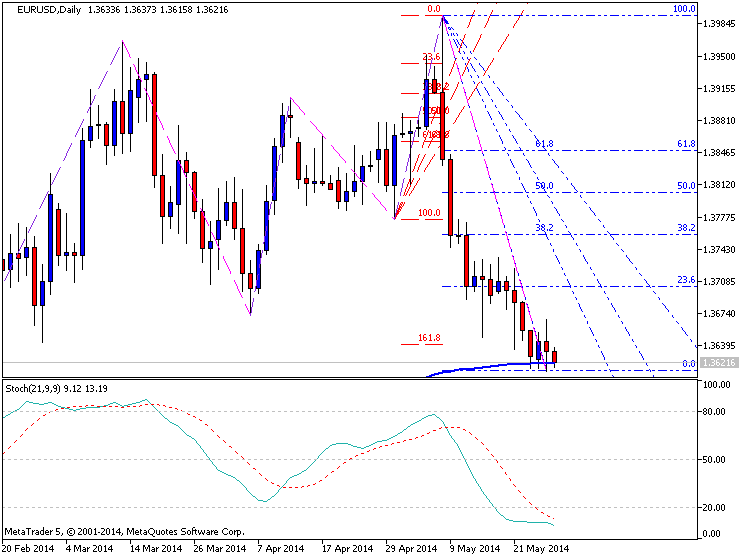

EUR/USD Technical Analysis – Selloff Expected to Resume

The Euro is aiming to move lower after taking out the bottom of a Rising Wedge chart formation carved out over the past six months. Near-term support is now at 1.3598, the 76.4% Fibonacci retracement. A break below this barrier targets the February 3 low at 1.3476. Resistance is at 1.3673, the 61.8% level, with a turn above aiming for the Wedge bottom at 1.3716.

We entered short EURUSD at 1.3654 in line with our long-term fundamental outlook. The initial target is 1.3598. A stop-loss is set to activate on a daily close above 1.3710. We will book profit on half of the trade and trail the stop to breakeven once the first objective is hit.

NZD/USD Technical Analysis – Focus Remain on 0.85 Figure

The New Zealand Dollar declined against its US counterpart as expected after prices formed a Bearish Engulfing candlestick pattern. A break below rising trend line set from late March has exposed the 0.8500-13 area, marked by the 38.2% Fibonacci retracement and the October 22 close. A further push below that aims for the 50% level at 0.8415. The trend line – now at 0.8562 – has been recast as resistance, with a turn back above that eyeing the 23.6% Fib at 0.8607.

The 0.85 figure has acted as formidable horizontal support over the past two months and we will opt to wait for that level to be broken as a signal of downside conviction before entering short. In the meantime, we remain flat.

2014-05-28 01:00 GMT (or 03:00 MQ MT5 time) | [NZD - ANZ Business Confidence]

if actual > forecast = good for currency (for NZD in our case)

NZD - ANZ Business Confidence = Level of a diffusion index based on surveyed manufacturers, builders, retailers, agricultural firms, and service providers

==========

New Zealand Business Confidence Continues To Fall In May

New Zealand business confidence eased in May although the outlook on general business prospects remained positive, results of a survey by ANZ Bank showed Wednesday.

The balance of business confidence slipped 11 points from the previous month's score to 53.5 in May. This is also 17 points below February's peak.

The slide in confidence can be attributed to higher interest rates, fall in commodity prices, high NZ dollar and leveled out house prices, the survey showed. However, though confidence in all sub-sectors eased in May, the levels of confidence remained well above average.

Activity expectations of firms regarding their own business fell to 53 points from 51 points in April, still remaining close to double the long-term average. Expected profitability fell for the third consecutive month, but at 31, the situation still augurs well for investment and employment.

Thirty percent of businesses are expected to hire more staff over the year, the same score as in the previous month. Investment intentions, though remaining higher than average, fell to 23 in May from 30 in April. Export intentions dropped to 25, leveling with October 2013.

Residential construction activity is expected to rise by 63 percent and construction activity by 59 percent, with the confidence indices rising to 63.2 and 58.8, respectively, in May.

The survey showed that the composite growth indicator signals a potential 5.7 percent growth in economy.

EUR/USD remains capped by 200-day SMA

The EUR/USD made another recovery attempt at the beginning of the European session and retested daily highs, but it was once again capped by the 1.3635/40 area, leaving the euro vulnerable near 2-month lows.

The EUR/USD found resistance at a high 1.3637 and slid to fresh daily lows at 1.3624 in recent dealings. The EUR/USD however, continues to consolidate in a narrow range Wednesday, showing lack of determination to extend a move either side of the board, as investors await German unemployment figures and Eurozone confidence data.

EUR/USD vulnerable ahead of ECB decision next week

The EUR/USD remains vulnerable, having hit a 2 ½-month low of 1.3611 Tuesday. The shared currency has been under broad pressure lately after Draghi said the bank was comfortable with ease further next month. However, this has been largely priced in, leaving room for disappointment when the ECB meets next week.

EUR/USD technical levels

At time of writing, the EUR/USD is trading at 1.3630, virtually unchanged on the day, with immediate resistances seen at 1.3637 (May 28 high/200-day SMA), 1.3668 (May 27 high/10-day SMA) and 1.3687 (May 22 high) ahead of 1.3700 (psychological level).

On the other hand, supports could be found at 1.3624 (May 28 low), 1.3611 (May 27 low) and 1.3600 (psychological level).

2014-05-28 12:55 GMT (or 14:55 MQ MT5 time) | [USD - Redbook index]

if actual > forecast = good for currency (for USD in our case)

USD - Redbook index = The Johnson Redbook Index, released by Redbook Research Inc., is a sales-weighted of year-over-year same-store sales growth in a sample of large US general merchandise retailers representing about 9.000 stores. By dollar value, the index represents over 80% of the equivalent "official" retail sales series collected and published by the US Department of Commerce.

==========

USD/JPY on Dance Floor with Invest Diva

http://investdiva.com/2014/05/28/clueless-mr-japan/

The Doctor is in the house for an episode dedicated to helping listeners overcome some of their trading challenges. Dr. Woody Johnson and Merlin offer solutions to several listener problems, including: fear of trading live, how to identify trading problems, inability to take losses and much more. Are you having trading issues? Tune in and find out if their solutions help you get past those obstacles. If not, send in your issues and they will discuss them on the next show.

Deutsche Bank braced for fines in forex probes

Deutsche Bank AG is preparing for fines in connection with investigations into possible manipulation of emerging markets currency rates and is also braced for civil lawsuits, two sources familiar with the views of the bank's management said.

The bank's internal investigations have uncovered isolated irregularities in trading of the Russian rouble and the Argentine peso, one of the sources told Reuters.

The other source said Deutsche Bank had said it had found no evidence of irregularities in major currency pairs.

Deutsche Bank, Germany's largest bank and the world's second-largest foreign exchange trader, has suspended around half a dozen staff in connection with currency trading irregularities and has said it is cooperating with authorities.

"Our investigations into trading in FX markets are ongoing and, as we have previously said, as part of those investigations we are reviewing trading in emerging market currencies," the bank said in a written statement sent to Reuters.

A spokesman for German financial watchdog Bafin declined to comment.

Numerous banks have been caught up in allegations of manipulation of global forex rates.

Commerzbank, Germany's second-largest bank, said last week it had fired one trader and suspended another on suspicion they had tried to manipulate the Polish zloty's euro exchange rate.

Investigations into forex rates are running alongside scrutiny of benchmark interest rates. Eight financial firms have been fined billions of dollars for manipulating Libor and other reference rates, and the probe into the largely unregulated $5.3 trillion-a-day forex market could prove even costlier.

Bafin said last week that discoveries in the forex probe were worrying and it was "much, much bigger" than the investigation into benchmark interest rates.

Deutsche Bank has set aside around 2 billion euros ($2.7 billion) in legal provisions in anticipation of fines and settlements, though the bank has not specified which risks or potential fines have been covered with those provisions. ($1 = 0.7345 Euros)

2014-05-29 01:30 GMT (or 03:30 MQ MT5 time) | [AUD - Redbook index]

if actual > forecast = good for currency (for USD in our case)

AUD - Private Capital Expenditure = Change in the total inflation-adjusted value of new capital expenditures made by private businesses. It's a leading indicator of economic health - businesses are quickly affected by market conditions, and changes in their investment levels can be an early signal of future economic activity such as hiring, spending, and earnings

==========

Australia Capital Expenditure Dips 4.2% In Q1

Total new capital expenditure in Australia was down a seasonally adjusted 4.2 percent on quarter in the first quarter of 2014, the Australian Bureau of Statistics said on Thursday - coming in at A$37.076 billion.

That missed forecasts for a decline of 1.9 percent following the 5.2 percent drop in the fourth quarter.

On a yearly basis, total new capital expenditures were down 5.0 percent.

Capex for buildings and structures tumbled 7.4 percent on quarter and 2.5 percent on year to A$24.524 billion.

Capex for equipment, plant and machinery added 2.8 percent on quarter but dropped 9.6 percent on year to A$12.552 billion.