You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

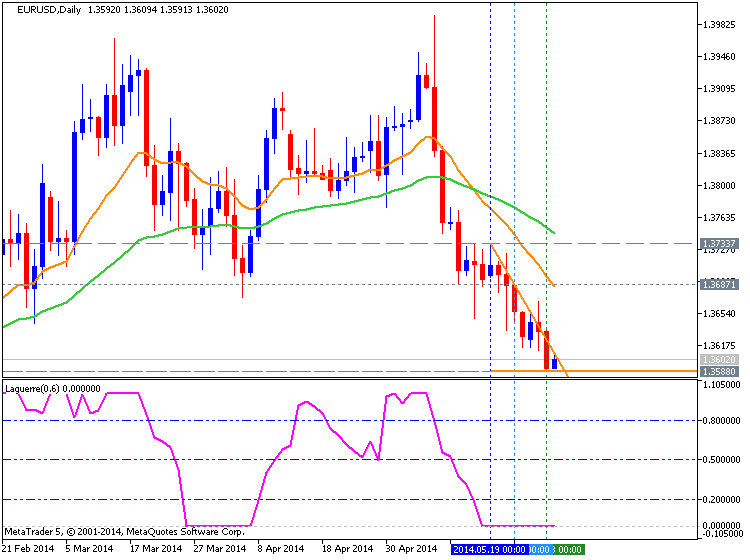

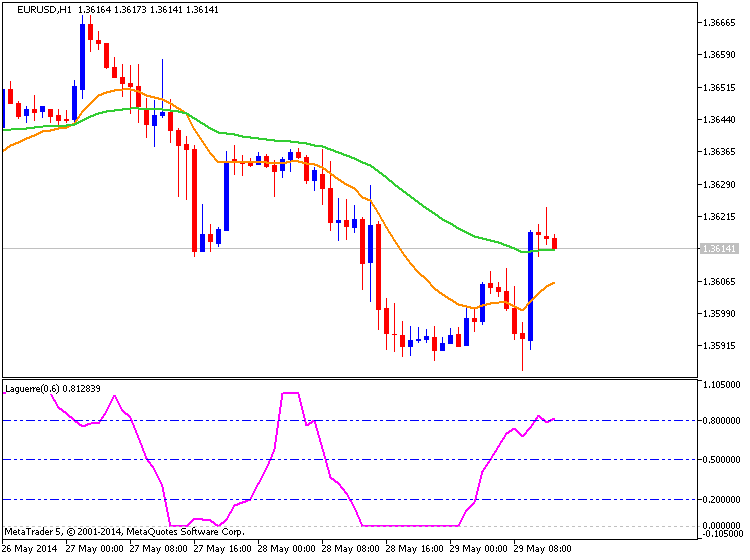

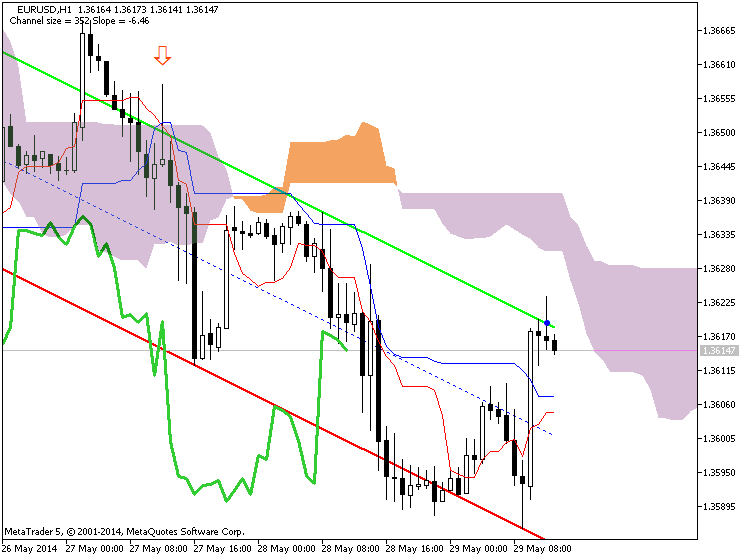

EUR/USD looks to regain 1.3600

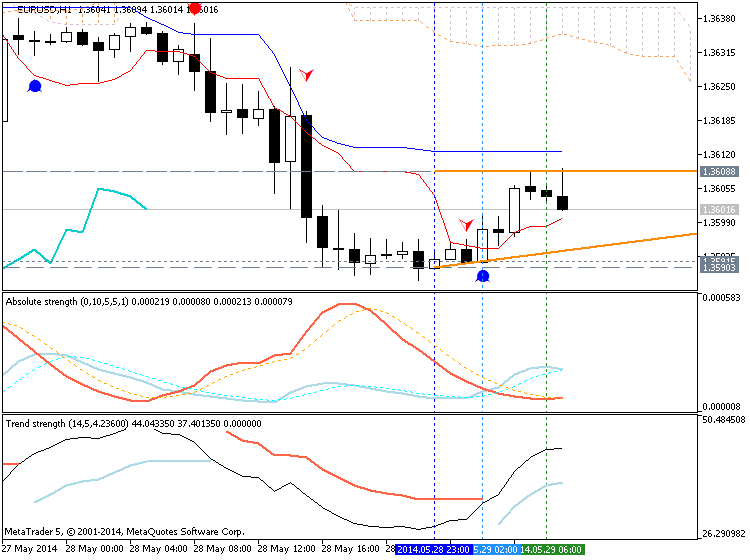

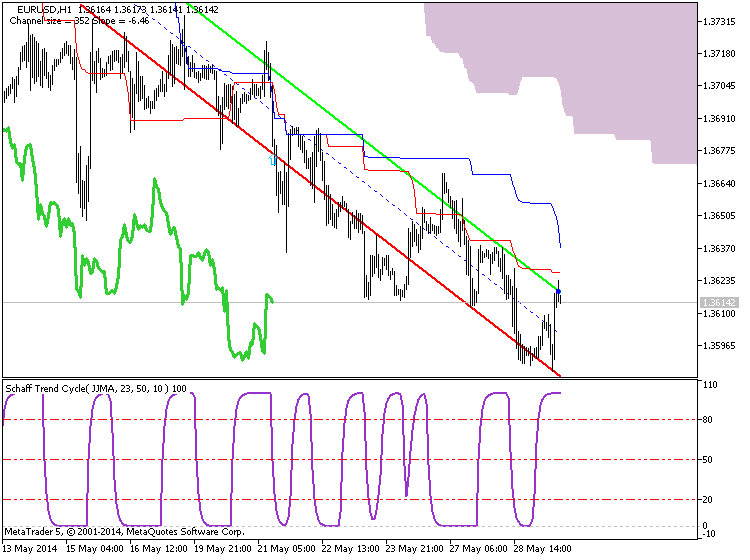

The euro is now attempting a bounce off the 1.3590 area, lifting the EUR/USD to the vicinity of 1.3600 the figure.

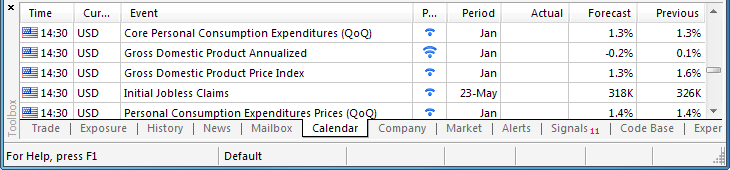

EUR/USD hinges on US docket

The absence of data releases or events in the euro area on Friday will prompt EUR traders to look for catalyst the other side of the Atlantic: Q1 GDP, Initial Claims and Pending Home Sales all due tomorrow while PCE, the Reuters/Michigan index speeches by Fed’s Lacker, Williams and Plosser due on Friday. In the view of Camilla Sutton, Chief FX Strategist at Scotiabank, “the short-term technicals are bearish… all studies are warning of potential downside risk; as spot trends lower and breaks to new multi-month lows and below the 200-day MA. For near term traders we favour short EUR positions; particularly as with the RSI at just 38 there is still plenty of downside room before the currency reaches oversold levels. Support lies at 1.3520”.

Trading the News: U.S. Gross Domestic Product (GDP) (based on dailyfx article)

The preliminary U.S. 1Q GDP report may spur a near-term rebound in the EUR/USD as the growth rate is expected to contract 0.5% during the first three-months of 2014.

What’s Expected:

Why Is This Event Important:

Indeed, a marked downward revision may undermine the near-term rebound in the dollar as it gives the Federal Reserve greater scope to further delay its exit strategy, and the greenback may struggle to hold its ground ahead of the next policy meeting on June 18 should the data print drag on interest rate expectations.

Subdued wage growth paired with sticky inflation raises the risk of seeing a larger-than-expected contraction in the U.S. economy, and a dismal print may spark a rebound in the EUR/USD as the dampens the prospects for a stronger recovery in 2014.

Nevertheless, the resilience in private sector consumption paired with the ongoing improvement in the labor market may generate an upbeat GDP report, and a positive development may trigger fresh monthly lows in the EUR/USD as it raises the outlook for the U.S. economy.

How To Trade This Event Risk

Bearish USD Trade: U.S. Economy Contracts 0.5% or Greater

- Need to see green, five-minute candle following the release to consider a short dollar trade

- If market reaction favors a bearish dollar trade, sell EUR/USD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: 1Q GDP Exceeds Market Forecast- Need red, five-minute candle to favor a short EUR/USD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The ReleaseEUR/USD Daily

The preliminary 4Q GDP showed a downward revision in the growth rate, with the world’s largest economy expanding an annualized 2.4% during the last three-months of 2014, while Personal Consumption increased 2.6% during the same period after climbing 2.0% in the third-quarter. Despite the weaker-than-expected GDP print, the EUR/USD failed to hold above the 1.3800 handle during the U.S. trade, with the pair ending the day at 1.3798.

Forex snapshot

Pound regains lost groundSterling has pulled back some of the losses it incurred this week as traders await the US GDP report at 1.30pm (London time).

The pound is trading at $1.6728, up 0.1% on the day after mixture of short covering and bargain hunting helped sterling. The main focus of the day is the US gross domestic product report, and the consensus is for a decline of 0.6%. This will give a good indication of what the Federal Reserve will do next.

The pound has been in a downward trend versus the US dollar this week as softer-than-expected updates from the UK dragged on the pound. Bad weather in the US was blamed for the poor growth during the first three months of the year. A strong GDP report could see the pound head lower towards the $1.66 level; to the upside we could target the 100-hour moving average of $1.6804.

Euro higher ahead of US GDPThe euro is back above the $1.36 level, up 0.18% on the day as dealers look ahead to the GDP report from the US.

As I mentioned previously, the euro has been in a downward spiral versus the US dollar for the past three weeks, as there is speculation that the European Central Bank will introduce a stimulus package to tackle deflation in the eurozone.The euro is trading at $1.3615 as traders square up their books before the US reveals its preliminary GDP report, and analysts are expecting a decline of 0.6%. If the report is worse than expected we could target $1.3660, however a strong growth report could drive the euro to $1.3550.

U.S. GDP Contracts 1.0% In First Quarter

Primarily reflecting a downward revision to private inventory investment, the Commerce Department released a report on Thursday showing that U.S. gross domestic product decreased in the first three months of 2014.

The report showed that GDP decreased by 1.0 percent in the first quarter compared to the initial estimate for a 0.1 percent uptick. Economists had been expecting the revised data to show a somewhat smaller contraction of about 0.5 percent.

Trading Options with Russ Allen

Coming off a whirlwind teaching tour, Master trader Russ Allen sits down with Merlin to talk about the new technology which allows him to teach traders online while watching each of their trading screens. This allows him to correct mistakes, and show proper trading techniques to traders who are in the comfort of their own homes, around the world. Later, Russ handles a couple listener questions about Implied volatility, and shows a couple tools to measure it. More importantly, he shares with listeners what IV means to a professional trader and why we should pay special attention to it. Merlin and Russ also discusses his upcoming Hour with the Pros, where he will be covering OCO and Bracket orders.

NZD/USD tumbles to 0.8450

The NZD/USD broke broke below 0.8470 and fell quickly to 0.8450 reaching the lowest price since March 12. The Kiwi is falling sharply across the board.

After bottoming the NZD/USD rebounded slightly and currently trades at 0.8468, down 0.29% for the day so far. The pair is falling for the second day in a row, accumulating a decline of a hundred pips.

NZD/USD technical outlook

The pair weakened earlier after being unable to hold above 0.8700 and accelerated to the downside after breaking short term support levels. Now headed toward the second daily close in a row below 0.8500, the outlook remains bearish.

Stocks rise as S&P 500 hits all-time highs

Stocks rose Thursday as the S&P 500 pushed further into record territory.

Investors were digesting the latest economic data that included a drop in jobless claims to near 2007 lows and a downward revision in gross domestic product that showed the economy contracted in the first quarter.The Standard & Poor's 500 index was up 0. 3%, after setting a new all-time intraday high of 1918.93. The broad-based index hit a record closing high of 1911.91 Tuesday.

The Dow Jones industrial average gained 0.3% and the Nasdaq composite index jumped 0.5%.

The yield on the 10-year Treasury was unchanged at 2.44%, remaining at their lows for the year.

While the overall stock market has moved little this year, one theme that continues to play out is the large amount of corporate deals being announced. Apple said late Wednesday it was buying Beats Headphones for $3 billion, and now there's a bidding war for Hillshire Brands.

"It's an encouraging sign because companies see the economy improving," said Joe Tanious, a global markets strategist with J.P. Morgan Asset Management. "Last thing you want to do as a large company is use your cash to buy a company when you have an uncertain outlook on the economy."

Shares of Hillshire Brands surged 17% after chicken producer Tyson Foods made a $6.8 billion offer for the deli meats and hotdog maker. The offer comes two days after Pilgrim's Pride made a $6.4 billion bid for the company.

Overseas, European markets saw lackluster trading. London's FTSE 100 index rose 0.3% to 6871.29 and Germany's DAX index was flat at 9938.90.

Asian stock markets were mixed. Japan's Nikkei 225 rose 0.1% to 14,681.72 and Hong Kong's Hang Seng index fell 0.3% to 23,010.14.

U.S. stocks edged lower for the first time in five days Wednesday, but most action was in the bond market where the yield on the 10-year Treasury note fell to its lowest in 11 months.

On Wednesday, the S&P 500 fell 2.13 points, or 0.1%, to 1,909.78. The Dow dropped 42.32 points, or 0.3%, to 16,633.18. The Nasdaq composite fell 11.99 points, or 0.3%, to 4,225.07.

2014-05-29 22:45 GMT (or 00:45 MQ MT5 time) | [NZD - Building Consents]

if actual > forecast = good for currency (for NZD in our case)

[NZD - Building Consents] = Change in the number of new building approvals issued

==========

New Zealand Building Permits Rise 1.5%

The total number of building permits issued in New Zealand was up a seasonally adjusted 1.5 percent on month in April, Statistics New Zealand said on Friday - standing at 2,082.

That beat forecasts for a decline of 3.5 percent following the 8.3 percent jump in March.

Excluding apartments, the number of permits dropped 5.2 percent to 1,650.

The unadjusted value of building work consented in April was NZ$1.140 billion. This consisted of NZ$739 million of residential work and NZ$401 million of non-residential work.

DOJ Investigating 15 Banks for Fraud

The US Department of Justice has commenced criminal and civil investigations into at least 15 banks and payment providers as a component of a broad consumer fraud probe, information disclosed on Thursday by a congregational committee showed.

In a probe dubbed “Operation Choke point”, which commenced more than a year ago, US prosecutors will be seeking to end fraud by pursuing financial institutions that utilize money for a number of suspect transactions, Reuters reported.

The Oversight Committee of the House of Representatives released on Thursday documents that showed the DOJ had on-going criminal investigations on four payment providers, one bank and a number of officials since November 2013.

A memo from the DOJ that was part of the documents disclosed showed that the department was separately looking into at least 10 lenders and payment processors as provided for under a civil fraud law.

Maame Ewusi-Mensah Frimpong of the DOJ’s civil division stated in the memo that because of the investigations, some banks had halted payment processing for firms or individuals the institutions suspected of being involved in fraudulent activities against customers.

“We believe we already have denied fraudulent merchants access to tens, if not hundreds, of millions of dollars from consumers’ bank accounts, and that amount will increase daily and indefinitely,” Frimpong stated in the DOJ memo dated November.

In January 2014, the DOJ secured a $1.2 million settlement with Four Oaks Fincorp Inc, a North-Carolina-based small lender, after the bank was accused of facilitating transactions worth $2 billion for a payment provider that had ties with allegedly fraudulent merchants, according to the Wall Street Journal. The settlement was reaffirmed by a federal judge in April.

However, House Republicans took issue with the way the DOJ probe was carried out. They accused the Justice Department of executing a shadowy attempt to take business away from companies that operated legally.

AUDUSD M5 with 45 pips in profit (by equity) for NFP :

News Trading – Good & Bad

There’s no doubt that trading around news is exciting. It’s where we see the most volatility and the largest swings in our accounts’ equity. But as any news trader can attest, this type of volatility is a double edged sword. For any profit earned off of a news release, there was the possibility of a loss of equal size had the trade gone against us.

This is why you often hear me say “It’s a coin flip” when talking about having a position when an economic news release is announced. No one knows whether released data will be positive/negative or bullish/bearish. The only thing we know about economic data is when it will be released.

USDCAD M5 : 94 pips price movement by USD - Non-Farm Payrolls news event :

Now that we know when the news events occur, how should these affect our open positions?

When to Leave Trades Open During the News

There are two primary reasons why a person should leave a trade open during a major news event.

- The trade was based on fundamentals in the first place.

- The trade is a long term trade (greater than two week hold time)

The first reason is an obvious one but is worth mentioning. If our trade is based on fundamentals, we should leave it open to face fundamental news events. After all, that should be a large portion of our trading edge when it comes to fundamental trading. In the short term, positions can face large swings, but in the long run, price should move in our favor if we are correct on our fundamental analysis.The second reason for leaving a trade open during news is if we are in a long term position; defined by a trade we plan on holding for longer than two weeks. We are looking at a longer period of time with a stop loss wide enough to endure sudden fluctuations caused by news events. It's likely the price will not move far enough to stop us out, so the trade may still play out as planned.

And even if we come across a time when a news event moves price far enough to stop out a longer term trade, we must remember that news is a coin flip. It can just as likely hit our limit as it can our stop. So in the long run, we want to keep our long term trades open during the news.

When to Close Trades During the News

But what about the trades that we should consider closing around news events? In my opinion, we should look to close out short term trades if either their stop or their limit is set within the Daily ATR (14), also known as the Average True Range. ATR tells us the average range from high price to lose price over the last 14 trading days. This gives us indication on how far we can expect the currency pair to move on a normal day.

If we are placing a trade with a stop or limit within the Daily ATR(14), we should consider closing out the trade before a High Importance news event is released. This is because price can move violently in either direction rendering your technical analysis void. It's highly likely that the news event will turn your technical trading edge into a 50/50 coin flip. It takes a perfectly formulated strategy and turns it into a roulette wheel.

Hot Off the Press

Fundamental news events can both be great for a position or absolutely horrible, so it's important to see if our strategy can sustain whatever the news brings. If our trades are long term or fundamentally driven, we should make it in the long run if we have an edge. If we are trading short term however, it might be best to run to cover and close out the trade. Why put in the time and effort just to flip a coin?