Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.24 10:57

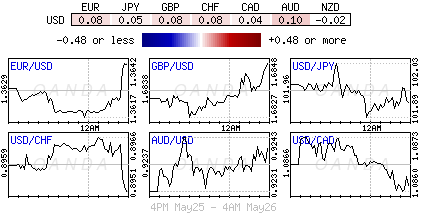

Forex Weekly Outlook May 26-30The dollar and the pound enjoyed a positive week and the euro continued to grind lower. European Parliamentary Elections, US Durable Goods Orders, Consumer Confidence, GDP figures form the US and Canada as well as US employment data are the main market movers this week.

The FOMC meeting release failed to bring surprises. The main focus was on normalizing monetary policy after the Fed finishes its asset purchase tapering. The Fed expects growth will continue to accelerate in 2014 despite the unexpected softness in the first quarter attributed to bad weather conditions. The euro was pressured lower once again, through a combination of unimpressive data and more talk from the ECB regarding an imminent rate hike. In the UK, mostly positive data kept the pound bid, and cable still has a shot on 1.70. The Aussie showed weakness despite a positive surprise from China. Where will currencies go in the last week of this turbulent month?

- European Parliamentary Elections: The European Parliament elections takes place every five years. This time 751 MEPs will be elected and the voters will have more of a say in the appointment of the next Commission president. According to recent surveys, only 37 percent of Europeans believe their voice counts in Brussels. Policymakers in Brussels are trying to democratize the election process, and for the first time, the election results will be linked to the selection of the European Commission president. The major risk is that Euro-skeptic parties from the right will gain ground, thus undermining the decision making processes in the union.

- US Durable Goods Orders: Tuesday, 12:30. Orders for long lasting U.S. manufactured goods increased more than expected in March, jumping 2.6%, higher than the 2.1% rise estimated, while Core orders edged up 2.0%, beating forecasts of a 0.6% increase. Capital spending plans increased significantly indicating a pickup in growth in the second quarter. This report correlates with other manufacturing data indicating expansion. Durable goods orders are expected to decline by 0.5%, while core orders are expected to rise 0.2% this time.

- US CB Consumer Confidence: Tuesday, 14:00. US consumer confidence came below market consensus in April reaching 82.3 from 83.9 in the previous month. Analysts expected a slightly stronger reading of 82.9. Consumers assessed current business and employment conditions less favorably than in March, however the short-term outlook remained strong. Consumer confidence is expected to rise to 83.2.

- Haruhiko Kuroda speaks: Wednesday, 0:00. BOE Governor Haruhiko Kuroda will speak in Tokyo. Kuroda stated last month that consumer inflation may exceed the central bank’s projection in the fiscal year that ended in March. BOE Governor is confident that Japan’s economy is progressing in line with the banks forecasts. Kuroda may explain the BOJ’s decision of maintaining monetary policy. Market volatility is expected.

- US GDP (second release): Thursday, 12:30. The preliminary estimate of GDP growth for the first quarter of 2014 showed a weak growth rate of 0.1% dragged down by lower demand and unusually harsh weather conditions. Nevertheless, consumer spending increased 3.0% in the first three quarters. With weather conditions back to normal, housing and corporate investment should rebound sharply. GDP growth estimate for the first quarter is expected to show a 0.6% contraction and this could weigh on the dollar.

- US Unemployment Claims: Thursday, 12:30. The number of Americans filing initial claims for unemployment benefits edged up by 28,000 last week to 329,000, but still remaining at low levels suggesting a steady pace of hiring. The four-week average declined 1,000 to 322,500 indicating an increase in job openings. The pickup in hiring may help boost economic growth for the rest of 2014. Jobless claims are expected to reach 321,000 this time.

- US Pending Home Sales: Thursday, 14:00. Contracts to buy existing U.S. homes edged up in March by 3.4% following a 0.8% contraction in the prior month. The reading was well above expectations for a 1.0% rise. This was the first good sign in nine months that the housing market is recuperating. The strong reading suggest that the housing market will continue to support growth in the US economy. Pending home sales are expected to rise further by 1.1%.

- Canadian GDP: Friday, 12:30. The Canadian economy expanded by 0.2% in February after a 0.5% growth in January. The reading came in line with market forecast, indicating a modest recovery from the 0.4% contraction in December. However estimate for the first quarter growth stand at 1.7%-to 1.9%. February’s growth is credited to the mining and oil and gas industries. The agriculture and forestry sector contracted 1.5%. Manufacturing rose 0.6% after increasing 1.6% in January, and goods production climbed 0.5%. GDP for March is expected to reach 0.1%.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.24 17:06

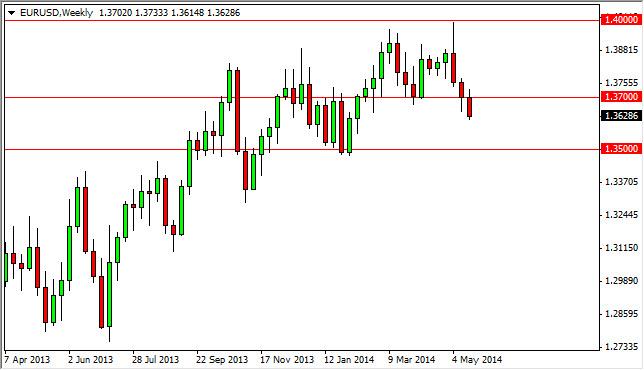

EUR/USD forecast for the week of May 26, 2014, Technical AnalysisThe EUR/USD pair initially tried to rally during the week, busting back above the 1.37 handle. However, we found enough resistance above to push the market back down and form a negative candle. It now appears that we are heading towards the 1.35 handle where we would test significant support again. That being the case, we are bullish of this market and fully anticipate supportive candles to be reason enough to start buying on short-term charts with a longer-term bias. Ultimately, if we get below the 1.35 level, things get really ugly.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.26 17:48

ECB Alert To Low Inflation Risk, Ready To Take Action, Says Draghi

European Central Bank President Mario Draghi said on Monday that the bank remains alert to the risks to a prolonged period of low inflation and expressed readiness to take action if required.

At an ECB forum in Sintra, Portugal, Draghi said a prolonged period of low inflation would call for a more expansionary stance, which would also include the asset purchase programme.

If a temporary shock turns more persistent, any monetary policy response might arrive too late, he said, suggesting more pre-emptive action from the central bank.

Markets expect expansionary actions from the ECB as hinted by Draghi at the post decision press conference in May. The central bank chief said the bank would decide on further action after seeing the June macroeconomic projections.

"What we need to be particularly watchful for at the moment is the potential for a negative spiral to take hold between between low inflation, falling inflation expectations and credit, in particular in stressed countries," he said today.

There is a risk that disinflationary expectations take hold and that may cause households and firms to defer expenditure in a classic deflationary cycle, Draghi warned.

Banks may respond to this situation with stricter credit standards and worsens debt burden. "This is fertile ground for a pernicious negative spiral, which then also affects expectations," Draghi said.

Term-funding of loans, be it on-balance sheet or off-balance sheet, it could help reduce any drag on the recovery coming from temporary credit supply constraints, the central banker added.

Further, he said, "We are not resigned to allowing inflation to remain too low for too long."

Inflation has remained below the ECB's target of 'below, but close to 2 percent' for the fifteenth consecutive month in April.

IHS Global Insight's Chief European Economist Howard Archer said the ECB seems highly likely to cut its refinancing rate from 0.25 percent to 0.15 percent or 0.10 percent and to take its deposit rate marginally into negative territory.

It is also looks probable that the ECB will take some liquidity measures in June, he added. However, Archer said he is doubtful that the bank will undertake full blown quantitative easing.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.26 17:57

Euro Steady As Anti-EU Parties Rock Elections

The euro dipped before recovering losses against the U.S. dollar on

Monday following European Union (EU) parliamentary elections that saw

several anti-EU parties make significant gains.

Despite thin trading due to a holiday in the U.S. and England, anxious

investors also trained an eye on the outcome of the Ukrainian

presidential election and a European Central Bank (ECB) hosted gathering

in Portugal over the weekend for possible impacts.

Euro equity markets managed to push higher, dismissing the strong gains

antiausterity parties made in the EU parliamentary elections. Heading

into the event risk last Friday, the market had already priced in a

strong euro-skeptic showing. This morning’s push higher is mainly the

‘relief’ effect.

Antiausterity Movements Grow Across EU

In France, the National Front (+25% national vote) appeared to score a

historic victory. In Germany, Chancellor Angela Merkel’s Christian

Socialists looked to be in control, while the euro-skeptic Alternative

for Germany took +7% of the popular vote. Greece’s radical right Golden

Dawn party and the U.K.’s Independence Party also gained considerable

support. It remains unclear whether the results will have a lasting

effect on the markets beyond the beginning of this week. The

repercussions are to be felt more at domestic levels rather than at EU

or national levels. British Prime Minister David Cameron understands

clearly that the electorate in the U.K. is deeply disillusioned with the

EU, but he will not shorten the timescale for negotiating any new deal

with it. Despite the growing European antiausterity voice, it’s not

enough to impact the policy trend, as major political equilibrium

remains unchanged.

‘Chocolate King’ Wins Ukrainian Presidency

In Ukraine, candy tycoon Petro Poroshenko declared victory in the first

round of that country’s presidential election. A result not unexpected –

the pro-European businessman took more than half of the vote. The

morning’s fading geopolitical uncertainty is supporting both the Russian

stock market (Micex +1%) and the RUB (USD 34.03 and EUR 46.37)

especially after Russia gave the nod to Kiev’s new government last

Friday. With many uncertainties out of the way, the RUB is expected to

restore its correlation with emerging market currencies.

Draghi Warns of Deflation

Meanwhile, ECB President Mario Draghi delivered nothing new in his

closing remarks at the ECB’s central banker conference this morning. His

comments left the EUR little changed (€1.3840). Not surprisingly, he

sees a risk that expectations for ultralow inflations may delay consumer

and business purchases. Consider it the latest sign that euro

policymakers are prepared to take further easing measures when the ECB’s

Governing Council meets on June 5. Again, he signaled that the ECB is

weighing a “wide variety of steps from interest rate cuts to new bank

loans or broad-based asset purchases” to prevent low inflation from

undermining the region’s promising economic recovery. Euro policymakers

fear that disinflation expectations could take hold.

The real event risk for next week’s ECB meeting is in the outcome: what

if ECB policymakers choose to stand pat yet again? The central bank

cannot afford to do so at this well telegraphed meeting, otherwise the

ECB’s policy-setting team will lose what’s left of its market

credibility. The real fear is that the cuts, or whatever, do not go deep

enough. If that’s the case, the dollar’s strength that the market has

been pricing in since the last ECB meeting will be given up. In addition

to using conventional interest rate tools, options include long-term

loans to banks, and purchases of asset-backed securities.

The EUR initially lost ground early Monday on the back of strong gains

for the antiausterity parties; however, equities rallied to heights not

seen since 2008. Obviously, thin holiday conditions played a part, but

so too do limited volumes. The 18-member single currency remains

precariously perched ahead of the presumed option barriers and

psychological support at €1.3600 (€300M), 15, 20. More are seen above

€1.3650 (€350M). Stop-losses are supposedly large sub-€1.3600 and

€1.3550. On the crosses, the EUR has been underperforming and this

vulnerability could garner further support for the currency. With both

London and New York out today, the market may not have the will to

entertain much interest. Expect forex market action to pick up tomorrow.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.25 17:20

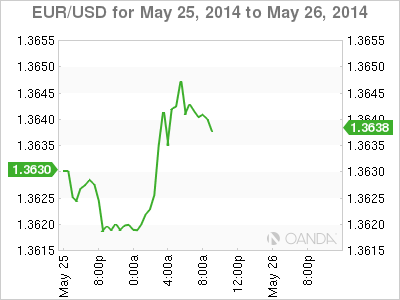

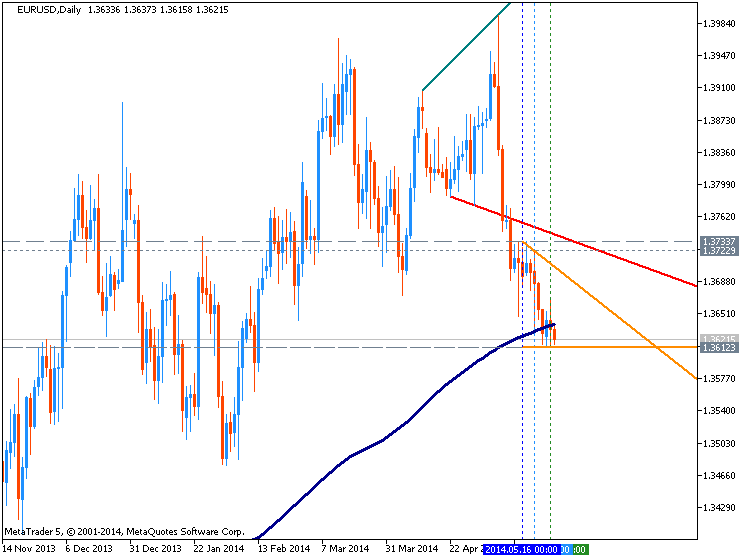

EUR/USD Fundamentals - weekly outlook: May 26 - 30The euro fell to three month lows against the broadly stronger dollar on Friday after data showing that German business sentiment deteriorated in May added to expectations for easing by the European Central Bank at its upcoming June meeting.

EUR/USD hit lows of 1.3616, the weakest since February 13 and settled at 1.3630, 0.18% lower for the day. For the week, the pair lost 0.60%.

The pair was likely to find support at 1.3560 and resistance at 1.3660.

The drop in the euro came after a report showed that the German Ifo business climate index declined to 110.4 in May; the lowest reading this year, from 111.2 in April, indicating that economic activity could slow in coming months.

The data came one day after a report showing that manufacturing activity in the euro zone expanded at the slowest rate in six months in May.

Recent comments by senior ECB officials have signaled that the bank is open to acting as soon as June to stop inflation in the currency bloc from falling too low.

On Thursday, ECB Governing Council member Jens Weidmann said the bank is prepared to take unconventional measures to counter the risks of low inflation in the euro zone.

The dollar was boosted after data on new home sales added to signs of a recovery in the housing market.

The Commerce Department reported that sales of new homes rose by a larger-than-expected 6.4% to 433,000 in April, after two months of decline. Analysts had been expecting a figure of 425,000. March's number was revised up from 384,000 to 407,000.

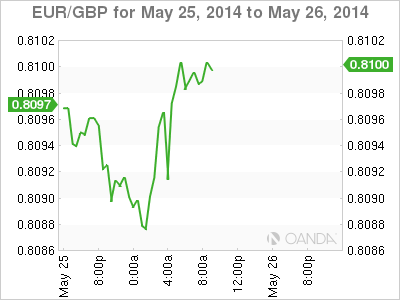

Elsewhere, the euro fell to 17 month lows against the pound, with EUR/GBP hitting 0.8082, the lowest since December 2012 before pulling back to 0.8099 at the close.

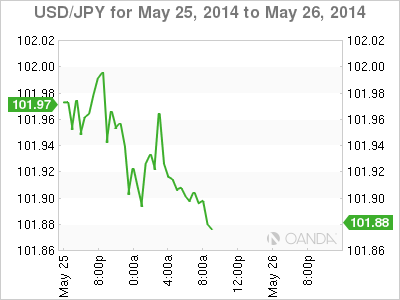

EUR/JPY ended Friday’s session at 139.02, not far from the three-and-a-half month trough of 138.13 struck on Wednesday.

In the coming week, U.S. markets are to remain closed for the Memorial Day holiday on Monday. Investors will be looking ahead to revised data on U.S. first quarter growth, while reports on U.S. consumer confidence will also be in focus.

In the euro zone, data on German consumer climate and retail sales will be closely watched.

Monday, May 26

- ECB President Mario Draghi is to speak at an event in Portugal; his comments will be closely watched.

- U.S. markets will also be closed for the Memorial Day holiday.

- ECB President Mario Draghi is to speak at an event in Portugal; his comments will be closely watched.

- The U.S. is to produce data on durable goods orders, house price inflation and consumer confidence.

- France is to release data on consumer spending, while Germany is to publish a report on unemployment change. Market research group Gfk is to publish a report on German consumer climate. The euro zone is to release data on M3 money supply and private loans.

- The U.S. is to release revised data on first quarter GDP, as well as the weekly government report on initial jobless claims and data on pending home sales.

- In the euro zone, Germany is to publish a report on retail sales, the government measure of consumer spending, which accounts for the majority of overall economic activity.

- The U.S. is to round up the week with a report on personal income and expenditure and revised data from the University of Michigan on consumer sentiment.

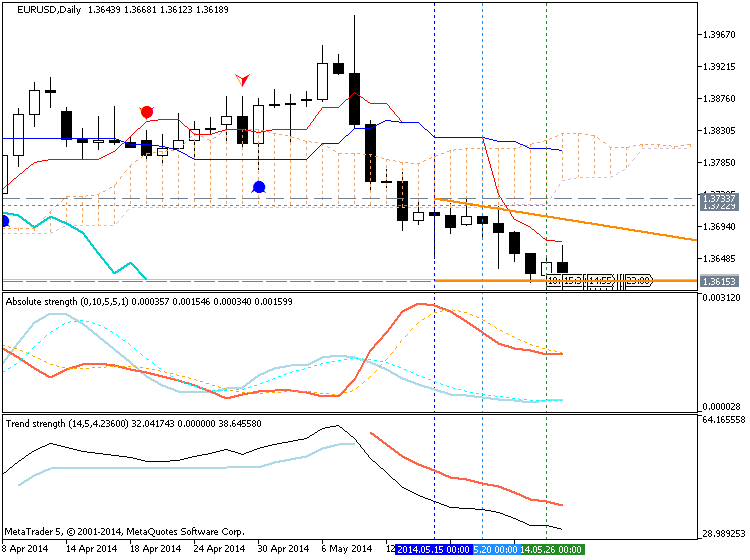

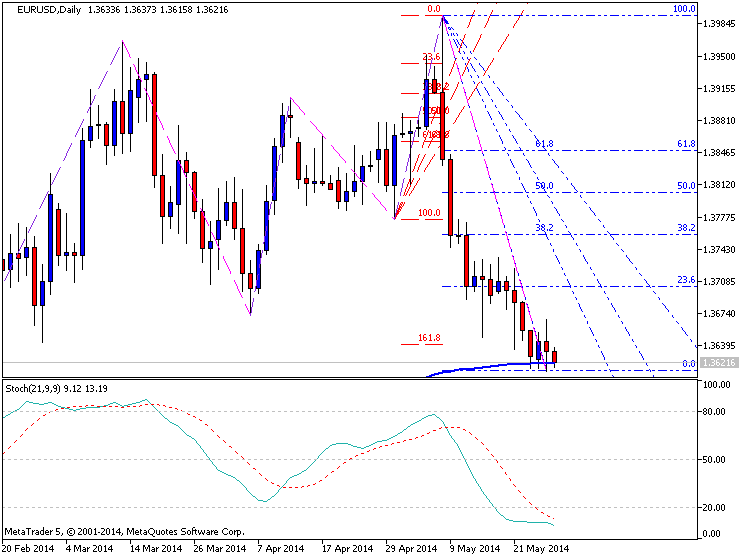

If

D1 price will break 1.3635 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

- Recommendation for short: watch D1 price for breaking 1.3635 support level on close bar for possible sell trade

- Recommendation

to go long: n/a

- Trading Summary: bearish

1.3635 support level was broken so the next nearest support level is 1.3615.

People who created sell stop pending order at 1.3635 - they are having about 20 pips in profit for equity open trades.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 06:13

EUR/USD Technical Analysis – Selloff Expected to Resume

- EUR/USD Technical Strategy: Short at 1.3654

- Support: 1.3598 (76.4% Fib exp.), 1.3476 (Feb 3 low)

- Resistance:1.3673 (61.8% Fib exp.), 1.3716 (wedge floor)

The Euro is aiming to move lower after taking out the bottom of a Rising Wedge chart formation carved out over the past six months. Near-term support is now at 1.3598, the 76.4% Fibonacci retracement. A break below this barrier targets the February 3 low at 1.3476. Resistance is at 1.3673, the 61.8% level, with a turn above aiming for the Wedge bottom at 1.3716.

We entered short EURUSD at 1.3654 in line with our long-term fundamental outlook. The initial target is 1.3598. A stop-loss is set to activate on a daily close above 1.3710. We will book profit on half of the trade and trail the stop to breakeven once the first objective is hit.

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 11:40

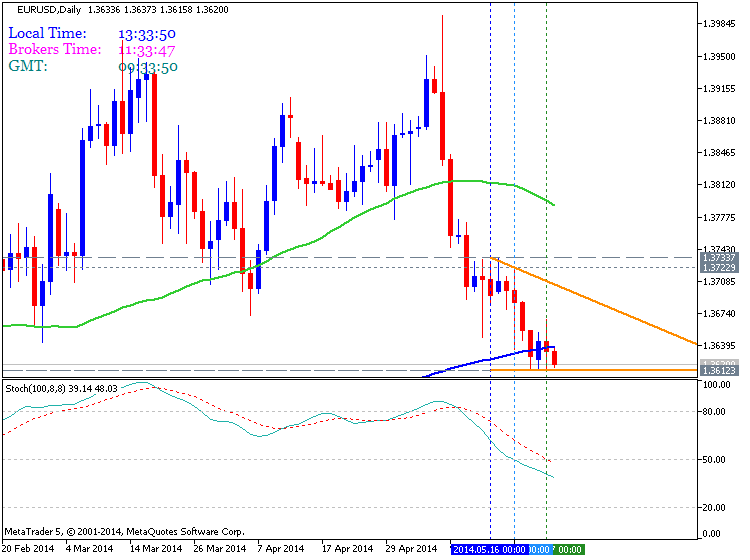

EUR/USD remains capped by 200-day SMA

The EUR/USD

made another recovery attempt at the beginning of the European session

and retested daily highs, but it was once again capped by the 1.3635/40

area, leaving the euro vulnerable near 2-month lows.

The EUR/USD

found resistance at a high 1.3637 and slid to fresh daily lows at 1.3624

in recent dealings. The EUR/USD however, continues to consolidate in a

narrow range Wednesday, showing lack of determination to extend a move

either side of the board, as investors await German unemployment figures

and Eurozone confidence data.

EUR/USD vulnerable ahead of ECB decision next week

The

EUR/USD remains vulnerable, having hit a 2 ½-month low of 1.3611

Tuesday. The shared currency has been under broad pressure lately after Draghi

said the bank was comfortable with ease further next month. However,

this has been largely priced in, leaving room for disappointment when

the ECB meets next week.

EUR/USD technical levels

At

time of writing, the EUR/USD is trading at 1.3630, virtually unchanged

on the day, with immediate resistances seen at 1.3637 (May 28

high/200-day SMA), 1.3668 (May 27 high/10-day SMA) and 1.3687 (May 22

high) ahead of 1.3700 (psychological level).

On the other hand, supports could be found at 1.3624 (May 28 low), 1.3611 (May 27 low) and 1.3600 (psychological level).

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.28 15:32

2014-05-28 12:55 GMT (or 14:55 MQ MT5 time) | [USD - Redbook index]

- past data is 1.0%

- forecast data is n/a

- actual data is 0.7% according to the latest press release

if actual > forecast = good for currency (for USD in our case)

USD - Redbook index = The Johnson Redbook Index, released by Redbook Research Inc., is a sales-weighted of year-over-year same-store sales growth in a sample of large US general merchandise retailers representing about 9.000 stores. By dollar value, the index represents over 80% of the equivalent "official" retail sales series collected and published by the US Department of Commerce.

==========

MetaTrader Trading Platform Screenshots

MetaQuotes Software Corp., MetaTrader 5, Demo

EURUSD M5 : 21 pips price movement by USD - Redbook index news event

Forum on trading, automated trading systems and testing trading strategies

newdigital, 2014.05.29 08:02

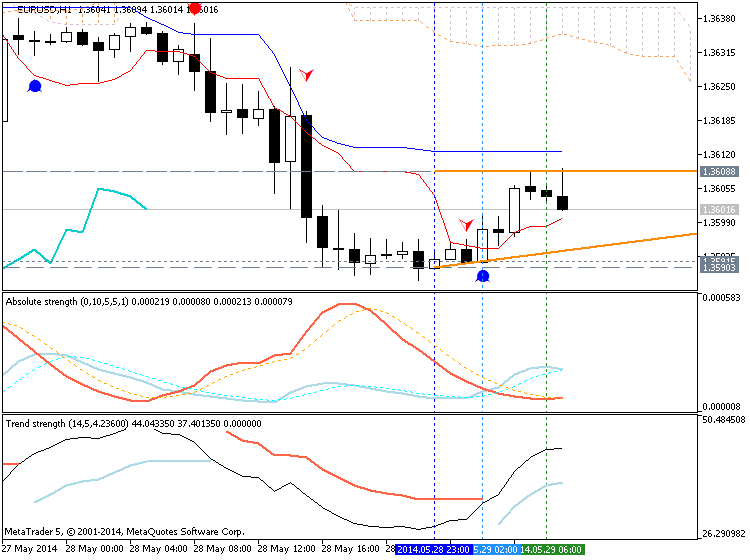

EUR/USD looks to regain 1.3600

The euro is now attempting a bounce off the 1.3590 area, lifting the EUR/USD to the vicinity of 1.3600 the figure.

EUR/USD hinges on US docket

The

absence of data releases or events in the euro area on Friday

will prompt EUR traders to look for catalyst the other side of the

Atlantic: Q1 GDP, Initial Claims and Pending Home Sales all due

tomorrow while PCE, the Reuters/Michigan index speeches by Fed’s Lacker,

Williams and Plosser due on Friday. In the view of Camilla Sutton,

Chief FX Strategist at Scotiabank, “the short-term technicals are

bearish… all studies are warning of potential downside risk; as spot

trends lower and breaks to new multi-month lows and below the 200-day

MA. For near term traders we favour short EUR positions; particularly as

with the RSI at just 38 there is still plenty of downside room before

the currency reaches oversold levels. Support lies at 1.3520”.

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

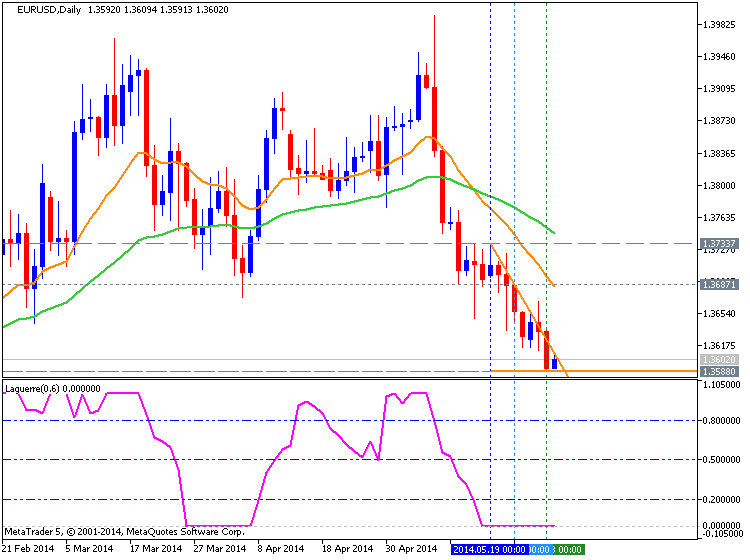

D1 price is on bearish market condition to be located below Ichimoku cloud/kumo and trying to break 1.3635 support level on close bar for the primary bearish to be continuing.

H4 price was on bearish as well with 1.3615 as the nearest support level.

W1 price is on bullish correction trying to break 1.3648 support for good breakdown together with Chinkou Span line crossing the price on close W1 bar.If D1 price will break 1.3635 support so the primary bearish will be continuing.

If not so we may see the ranging market condition within primary bearish.

UPCOMING EVENTS (high/medium impacted news events which may be affected on EURUSD price movement for this coming week)

2014-05-26 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - GfK German Consumer Climate]

2014-05-26 08:00 GMT (or 10:00 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-05-27 12:30 GMT (or 14:30 MQ MT5 time) | [USD - Durable Goods Orders]

2014-05-27 13:30 GMT (or 15:30 MQ MT5 time) | [EUR - ECB President Draghi Speech]

2014-05-27 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Consumer Confidence]

2014-05-28 07:55 GMT (or 09:55 MQ MT5 time) | [EUR - German Unemployment Change]

2014-05-28 09:00 GMT (or 11:00 MQ MT5 time) | [EUR - Consumer Confidence]

2014-05-29 12:30 GMT (or 14:30 MQ MT5 time) | [USD - GDP]

2014-05-29 14:00 GMT (or 16:00 MQ MT5 time) | [USD - Pending Home Sales]

2014-05-30 06:00 GMT (or 08:00 MQ MT5 time) | [EUR - German Retail Sales]

2014-05-30 12:30 GMT (or 14:00 MQ MT5 time) | [USD - Personal Consumption Expenditure]

2014-05-30 13:45 GMT (or 15:45 MQ MT5 time) | [USD - Chicago PMI]

2014-05-30 13:55 GMT (or 15:55 MQ MT5 time) | [USD - UoM Consumer Sentiment]

Please note : some US (and CNY) high/medium impacted news events (incl speeches) are also affected on EURUSD price movementSUMMARY : bearish

TREND : bearish

Intraday Chart