You are missing trading opportunities:

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

Registration

Log in

You agree to website policy and terms of use

If you do not have an account, please register

EUR/USD Retains Bullish Pattern Despite Thin Market Participation (based on dailyfx article)

AUD/USD Outlook Mired by Speculation for Reserve Bank of Australia (RBA) Rate Cut.

Monthly Forex Forecast: May 2015 (based on dailyforex article)

The USD has fallen meaningfully in value over the past 1 month and 3 month periods. This is a significant quantitative change in the market and is suggestive of continuing USD weakness over the coming month. Next, it should be noted that both the GBP and the JPY have been enjoying steady movement overall for many months, with the GBP rising and the JPY falling. Over the past 3 months, we are also seeing strong turnarounds from bearish to bullish in CAD and NZD, and in AUD to a lesser extent. This suggests that the current month will see rises in GBP, CAD, NZD and AUD, and falls in USD and JPY – in these orders of preference.

Many traders believe fundamental factors should either be ignored completely, or taken as the primary factor to consider in entering or exiting a trade. Fundamental analysis is best used as a final filter in deciding whether to take a trade that already looks good from a technical perspective.

Therefore let’s consider the aforementioned currencies from a fundamental perspective. Both the GBP and the CAD have higher base rates than the USD. Of the three currencies, the market probably sees the next rate rise as most likely to come in the GBP, closely followed by the USD. The USD is seen as having the strongest economy, but that perception is arguably under threat now. The CAD may be impacted by the price of oil with a positive correlation, and the price of oil is bouncing back and rising strongly. Overall it seems that the fundamental factors are mixed and questionable enough to probably not be a block in the direction of the trades discussed.

EUR/USD Weekly Fundamental Analysis, May 4-8, 2015 – Forecast (based on fxempire article)

The EUR/USD closed the week at 1.1199 after touching a two month high. The dollar extended its gains against the pound from Thursday’s session after weaker-than-expected manufacturing report. It has recovered most of its losses from earlier in the week.

Economic data released Thursday showed Chicago-area manufacturing activity expanding for the first time in three months, weekly jobless claims falling to their lowest level in 15 years, and a larger-than-expected increase in a closely watched measure of wage inflation. That data helped support the argument, advanced by Federal Reserve policy makers, that weak first-quarter growth was primarily due to transient factors, including bad weather and labor disputes at western seaports.

While not spectacular, Friday’s data didn’t provide a strong signal to the contrary.

Strong economic data increases the possibility that Fed policy makers will raise interest rates at their June meeting, a move that would benefit the dollar.

The euro posted its biggest monthly gain in 4 1/2 years in April as speculators pared record bearish bets. Positive economic reports suggest the European Central Bank’s asset-purchase program is working, while U.S. growth remains uneven. Markets in Europe, including Germany and France, were closed for national holidays, leading to thin trading.

The euro is still forecast to fall by year-end. The median estimate of more than 60 economists compiled by Bloomberg News sees the euro at $1.04 on Dec. 31, more than 7 percent lower than yesterday’s closing price.

“We’ve seen an improvement in European fundamentals, which has translated into support for the euro,” said Joe Manimbo, an analyst at Western Union Business Solutions, a unit of Western Union Co. in Washington. “For the most part, it’s just the euro’s ability to steal the dollar’s lost thunder on the low pulse for the U.S. economy in the first quarter.”

EUR/USD Monthly Fundamental Forecast May 2015 (based on fxempire article)

The EUR/USD had a stellar month in April closing in the 1.12 level after the ECB kicked off its stimulus program and data started printing a bit better than in previous months. Greece continued being a thorn in everyone’s side. The euro is expected to trade flat or a bit weaker in April as US data should start to print a bit stronger. In Spain and Italy, the export-led recovery has boosted industrial production and is starting to spill over into the broader economy, while deflationary tailwinds and rising consumer confidence in France have coincided with higher household spending.

Efforts by France and Italy to push through much needed structural reforms, as well as the Greek government’s decision to reshuffle its negotiating team to broker an extension to its current bailout program also bode well for stronger consumer and business confidence and longer-term growth. Headline deflationary pressures in the euro zone have also eased from -0.6% y/y in January to the most recent release of 0% in April, underpinned by rising energy and food prices. This, combined with monetary stimulus, is forecast to gradually drive the headline print up to a year-end rate of 0.6% y/y in 2015 and 1.3% in 2016. The ECB intends to fully implement its roughly €1.1 trillion QE program and has no plans to alter its policy stance unless the higher inflation trend is firmly anchored. With euro zone inflation forecast to be in line with the ECB’s target of close to, but below, 2% by 2017, we believe that QE will run its full course through September 2016.

Soft economic data for Q1, still-low inflation prints, and overall USD strength were cited by the FOMC at its March meeting as the overall rationale for delaying interest rate hikes into the later part of 2015 and moderating the extent of hikes to be delivered. An April FOMC statement that pointed to a number of economic positives but failed to mention constructive stirrings on the inflation front didn’t change our view that the FOMC is likely to engage in so-called ‘liftoff’ at its September meeting. A hawkish interim surprise would require extraordinarily strong data between now and the June or July FOMC meetings – not our base case.

Three lessons from Warren Buffett for forex traders (based on forexlive article)

Warren Buffett is the world's most famous long-term investor but forex traders can learn from him too.

Forex Forecast – Quant vs Chart Reading (based on dailyforex article)

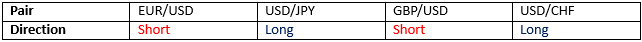

Quantitative ForecastOn this basis, the quantitative momentum forecast for the edge during the coming week is as follows:

Technical ForecastOn this basis, my technical analysis forecast for the edge during the coming week is as follows:

EUR/USD weekly outlook: May 4 - 8 (based on investing.com article)

The euro backed off two-month highs against the dollar on Friday after reports indicated that the U.S. economy may be stabilizing after a recent soft patch.

EUR/USD was down 0.22% to 1.1198 late Friday, still not far from two-month peaks of 1.1289.

The Institute for Supply Management reported that activity in the manufacturing sector was stable in April, after slowing in the five previous months.

The ISM manufacturing index came in at 51.5 in April, matching the March reading, which had been the lowest since May 2013.

Another report showed that U.S. consumer sentiment rose in April to its highest level since January.

Separately, the Commerce Department said construction spending fell 0.6% to an annual rate of $966.6 billion in March, the lowest level since September.

The reports, while mixed, fuelled optimism that the U.S. economy has turned a corner after a recent bout of weakness.

The dollar had received a boost after a report on Thursday showed that the number of Americans filing new claims for jobless benefits fell to a 15-year low of 262,000, pointing to healthy growth in the labor market.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, was last up 0.53% to 95.38 late Friday, after falling to two-month lows of 94.47 on Thursday.

Data earlier in the week showed that the U.S. economy grew just 0.2% in the three months to March, slowing from 2.2% in the final quarter of 2014. It was the slowest rate of growth in a year.

The weaker-than-expected data prompted investors to push back expectations on the timing of an initial rate hike by the Federal Reserve to later this year from midyear.

In its rate statement on Wednesday the Federal Reserve said recent indications of a slowdown in growth were probably due to “transitory factors.”

Demand for the euro continued to be underpinned after data on inflation and bank lending earlier in the week added to signs that the recovery in the region is gaining traction.

Sentiment on the single currency was also boosted by hopes that Greece is moving closer to an agreement with its international lenders on a package of economic reforms needed to unlock bailout funds.

In the week ahead, investors will be focusing on Friday’s U.S. nonfarm payrolls report, for a fresh indication on the strength of the economic recovery. Service sector reports from the euro zone will also be closely watched.

Monday, May 4

Tuesday, May 5

Wednesday, May 6

Thursday, May 7

Friday, May 8

Markets Prepare for US Employment Reports (based on primepair article)

The Labor Department’s official figures are due on Friday and forecasters are expecting to see 231k jobs added across both public and private sectors. We will see a significant readjustment in the dollar if the data falls wide of the mark on either side. Markets have already sharply lowered their expectations for growth in the US economy and consequently the expectations for future interest rate hikes.

EUR/USD Breaks From Its Triangle; Next Messy Price Action - Goldman Sachs (based on efxnews article)

EUR/USD has broken higher from its triangle as the pair has gone past 1.10-1.1050 resistance, which held the top of the March/April triangle formation, notes Goldman Sachs.

"It is now clear that the analogy of a triangle wave 4 is no longer valid. The possibility that it’s already completed 5- waves from the May high is something to seriously consider. If this is true, it should already have started a corrective process which translates to a period of messy/counter-trend price action," GS argues.

The first big signal suggestive of a turn, according to GS, was given on Tuesday’s close above the 55-dma which has held the entire downtrend since the May 8 th high.

"The final break above it should have been a big warning sign that the low may already be in place. Further confirmation was given above 1.1052-1.1099 (prior high and low from Jan. 26th/Mar. 26th)," GS adds.

Big levels to watch:

"The next big pivot is 1.1295-1.1296; this includes 23.6% retrace of the May/March decline and the 100-dma. So far it seems to be holding well, forming a tired candle on stretched momentum. Support is down at 1.1099-1.1049," GS projects.

"If this is truly a correction, there should be potential to go higher over time. The downtrend from Jul. ‘14 comes in at 1.1654.and 38.2% of the May/March decline is all the way up at 1.18," GS adds.

"Put simply, from a pure techs perspective and in Elliott wave terms, this has potential to be a very big turning point," GS concludes.

ECB's Constancio Convinced Greece Worst-case Scenario Will Be Avoided (based on rttnews article)

European Central Bank Vice President Vitor Constancio said that he was certain that Greece's exit from the euro area will be avoided.

In an interview to the Dutch daily Het Financieele Dagblad, which was published on the ECB website on Monday, Constancio said, "Like everyone else, I am concerned. But I am also absolutely convinced that the worst-case scenario will be avoided."

"At the same time, everyone acknowledges that the degree of stress and vulnerability in the euro area has totally changed. There are no signs of contagion."

Even if a Grexit materializes, the ECB is sufficiently protected from huge losses as the risk of emergency lending to Greek banks is shared with the national central bank, the Portuguese banker said.

"We jointly bear the risk on the rest of the amount. But bear in mind that collateral has been provided. We are talking about securities that are not linked to the Greek sovereign and which, on top of that, are subject to a "haircut". This should offer sufficient protection," Constancio said.