Watch how to download trading robots for free

Find us on Facebook!

Join our fan page

Join our fan page

You liked the script? Try it in the MetaTrader 5 terminal

- Views:

- 3625

- Rating:

- Published:

-

Need a robot or indicator based on this code? Order it on Freelance Go to Freelance

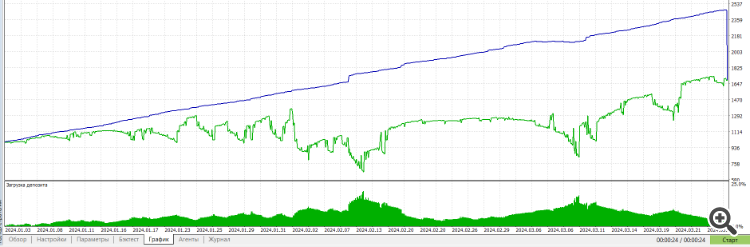

The two moving averages crossover strategy is one of the most common trading strategies in the financial market. It is based on the use of two moving averages (usually a long term and a short term) and signals an entry into a position based on their intersection.

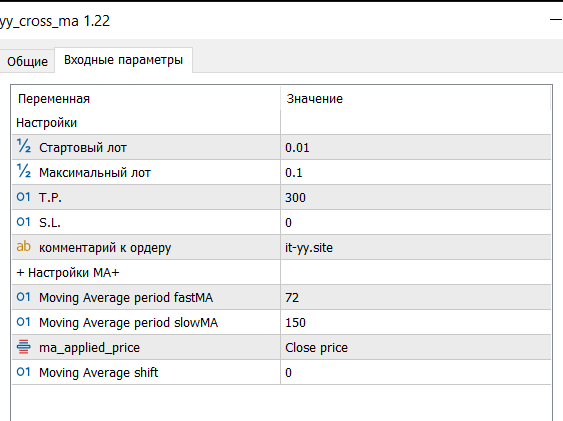

- Selection of moving average periods: The trader selects two periods for the moving averages. For example, it could be the 50-day and 200-day moving averages.

- Defining Signals: When a short-term moving average (e.g. 50-day) crosses a long-term moving average (e.g. 200-day) from bottom to top, this can be considered a buy signal (long position) as it may indicate the beginning of an uptrend. Conversely, a short-term moving average crossing a long-term moving average from bottom to top may be considered a sell signal (short position).

- Risk Management and Stop Loss Levels: A trader may also consider introducing stop loss orders to manage risk. For example, a stop loss can be set at a certain percentage of the current price to protect against large losses in the event of an unfavourable price movement.

Translated from Russian by MetaQuotes Ltd.

Original code: https://www.mql5.com/ru/code/48961

Confluence Index Stoch+RSI+MACD

Confluence Index Stoch+RSI+MACD

MULTI TF Confluence Index Stoch+RSI+MACD

Average Day Range

Average Day Range

Average Daily Range Indicator.

Simple_Session_Price_Change

Simple_Session_Price_Change

The simplest indicator showing on the current symbol the price change in % since the opening of the trading session.

Script with example functions for creating graphical objects

Script with example functions for creating graphical objects

The script provides a set of functions for creating all standard graphical objects for use in your own developments. The functions presented in the script can be used "as is" or modified to your requirements.