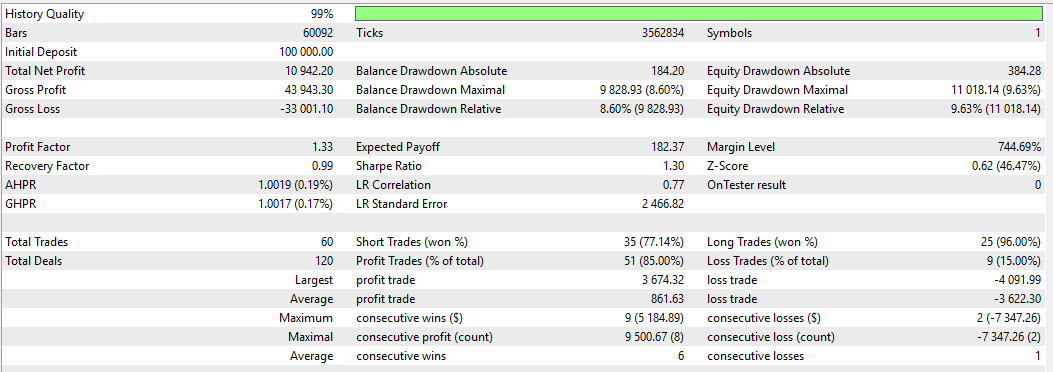

A quick and easy guide to help you set up and backtest the AOT Bot on MetaTrader 5— suitable for testing the strategy or preparing for prop firm challenges.

Step 1: Prepare Symbol Data

-

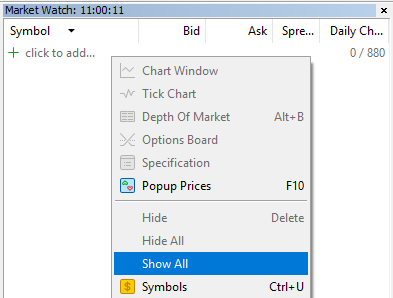

Open MT5 Market Watch.

-

Right-click anywhere in the Market Watch window and select “Show All”.

-

This will download candle data for all symbols required by the bot.

✅ Tip: Make sure all relevant symbols are visible to avoid missing data during backtesting.

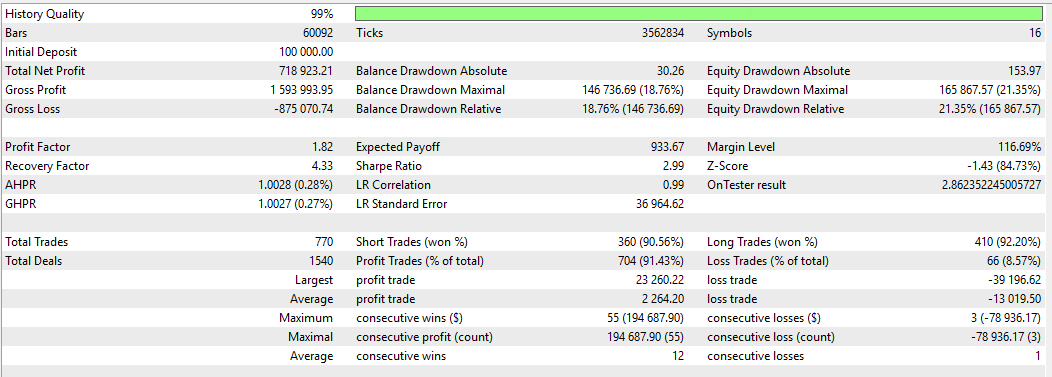

Step 2: Set Up the Strategy Tester

-

Press Ctrl+R or click the Strategy Tester icon in the MT5 toolbar.

-

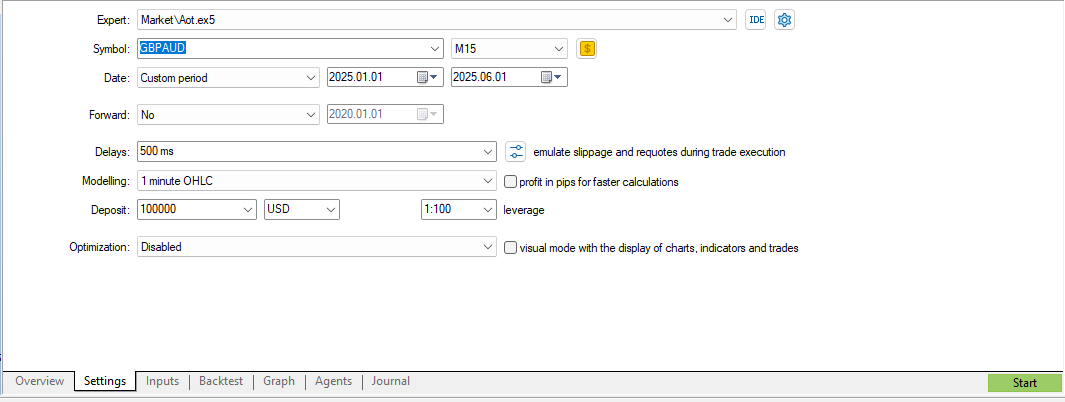

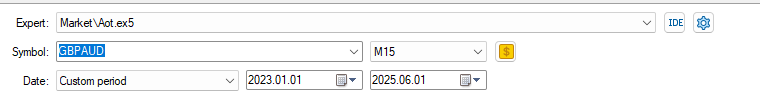

In the Strategy Tester panel, configure the following:

-

Expert: Select AOT Bot.

-

Symbol: Choose a currency pair (e.g., GBPAUD).

-

Model:

-

Use M1 OHLC for faster tests.

-

Choose Every tick based on real ticks for higher accuracy.

-

-

Date Range: Set a period of 3–4 years for more reliable results.

-

Deposit: Set your starting capital (e.g., $100,000 to simulate prop firm conditions).

Step 3: Configure Trading Parameters

The AOT Bot can operate in two modes. This step is crucial depending on your test scenario:

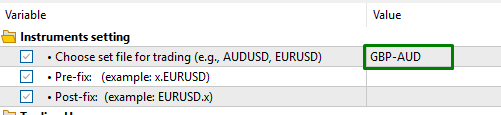

Option 1: Single Instrument Test

-

Configure the bot to match the specific symbol selected in the Strategy Tester.

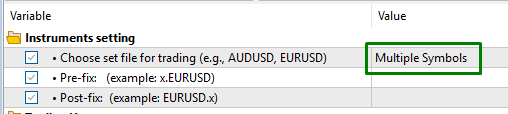

Option 2: Multiple Instrument Test

-

Enable the “Multiple Symbols” option in the bot settings to allow trades across multiple pairs.

Position Sizing Options

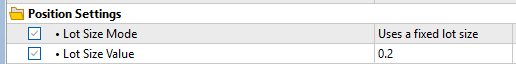

- Fixed Lot Size: Set a constant lot size per trade.

- Example: This set will make the trade open with fixed lot = 0.2 for every entry signal:

-

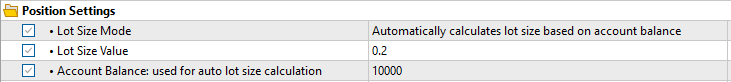

Auto Lot Size: Enable automatic lot sizing based on your account balance for dynamic risk management.

- Auto Lot Size (Dynamic Position Sizing): Enable Auto Lot Size to let the bot automatically adjust position size based on your account balance—ideal for dynamic risk management across different capital sizes.

- Lot Size to Trade = Lot Size Value × (Your Actual Capital / Standard Capital for Calculation)

-

Example:

Let’s say you set:

-

Lot Size Value = 0.2

-

Standard Capital for Calculation = $10,000

Then:

-

If your account balance is $10,000, the bot will trade 0.2 lots.

-

If your account balance is $5,000, the bot will scale down and trade 0.1 lots.

-

If your account balance is $20,000, the bot will scale up and trade 0.4 lots.

🧠 This ensures your risk per trade scales proportionally with your capital.

-

⚙️ Choose the sizing that best reflects your trading style or challenge requirements.