How to Get the Most Out of the Golden Nights Expert – Settings, Tips, and FAQs

EA Settings and Configuration Guide

In this section, I will provide a detailed overview of all the parameters of the EA and how to set them for optimal performance. If you are new to using the EA or want to fine-tune the settings, this guide will assist you.

The default settings are generally well-optimized, so no modifications are needed to get started. However, two alternative settings are available for those who want more detailed control, featuring automatic risk management and a recovery mode.

Shared alternative settings:

-

ATR-based Stop Loss and Take Profit with a Moving Average trend filter: This setting determines the stop loss and take profit levels based on the Average True Range (ATR) and uses a moving average filter to identify the market trend.

-

Recovery mode: This configuration also uses ATR-based stop loss and take profit levels with moving average filters, specifically optimized to potentially offset previous losses. MT4 set

EA Parameters:

- Text used as comment in trade orders: This name appears in the trade notes.

- Display info panel on chart: Enables or disables the info panels displaying account data and key settings.

- Magic Number – The unique identifier for the EA. Helps ensure the EA only manages its own trades.

- Allow only one open trade at a time: If set to false, only one trade will be allowed at a time. If set to true, new trades can be opened even if there is an existing position.

- Select SL/TP/TS calculation mode

This option allows you to calculate the stop loss, take profit, and trailing stop levels based on the ATR (Average True Range) indicator. - ATR indicator period

Sets the period used for the ATR calculation. - Timeframe used for ATR calculation

Specifies the timeframe on which the ATR is calculated. - Multiplier for SL based on ATR

The stop loss is determined by multiplying the ATR value by this factor. - Multiplier for TP/TS based on ATR

The take profit and trailing stop values are calculated by multiplying the ATR by this factor. - Stop Loss & Take Profit: Set the stop loss (SL) and take profit (TP) in pips.

- Enable trailing stop: Enables or disables the trailing stop.

- Start trailing after profit: Set the pip value at which the trailing stop will start working.

- Distance to trail stop: Set the pip distance at which the trailing stop will follow the price.Breakeven – Enables breakeven functionality.

- Enable breakeven function: Enables breakeven functionality.

- Profit to move stop to breakeven: Sets the profit level (in pips) at which the stop loss will be moved to breakeven.

- Extra profit to move stop above breakeven: Sets how many pips beyond the entry point the stop loss should be placed after breakeven is triggered.

- Enable trailing take profit: Enables dynamic trailing of the take profit.

- Start trailing TP after loss: The trailing TP activates when the distance between price and TP reaches this value.

- Distance of trailing TP from price: The take profit will trail the price by this amount of pips.

- Enable Virtual Stops: Enables virtual stop loss and take profit, meaning the SL and TP are not sent to the broker but handled internally.

- Emergency Stop Multiplier (0 = disabled) – Adds a real SL/TP beyond the virtual one, calculated as a multiplier of the original SL/TP. Set to 0 to disable.

- Add Pips to Emergency Stop (0 = disabled) – Adds a fixed number of pips to the virtual SL/TP and places a hidden real SL/TP further away as a backup. Set to 0 to disable

- Time Offset Mode

Choose whether trading times should be set manually or automatically adjusted to the last trading hour of the day based on server time.

Note: The automatic time adjustment does not work in the strategy tester, only in live or demo trading environments. - Start TimeHour & Start Time_Minute: The start time of the trade, in hours and minutes.

- Enable spread filter: Enables or disables the spread filter.

- Maximum allowed spread: The maximum allowed spread, beyond which no trades will be opened.

- Fixed lot size per trade: Set a fixed lot size (works only if the auto lot function is disabled).

- Enable auto lot calculation: Enables the auto lot function, which calculates the risk as a percentage of the equity.

- Risk % per trade (auto lot mode): Set the risk per trade as a percentage of the equity.

- Enable recovery mode after loss: Enables or disables the recovery mode.

- Lot multiplier after a losing trade: Multiplies the lot size by this value after a loss.

- Reset after this many losses: Resets the lot size after the specified number of consecutive losses.

- Reset after this many profits: Resets the lot size after the specified number of consecutive wins.

- Enable trading on Monday - Friday: Enables or disables trading on specific days of the week.

- Minutes before market close on Wednesday to exit trades

Defines how many minutes before market close the trade should be exited on Wednesday. - Enable early close on Friday to reduce weekend gap risk

Enables closing trades a certain number of minutes before Friday market close to avoid potential weekend gaps. - Minutes before market close on Friday to exit trades

Specifies how many minutes before close the position should be closed on Friday.

- Enable Buy Above MA: If enabled, buy trades will only be opened when the price is above the moving average.

- Moving Average Timeframe: Select the timeframe for the moving average filter.

- Moving Average Period: Set the period used for calculating the moving average.

- Enable RSI filter: Enables the RSI-based entry filter.

- RSI timeframe: Select the timeframe for the RSI.

- RSI calculation period: Set the number of periods used in RSI calculation.

- Minimum RSI level to allow trading: Trading is allowed only if RSI is above this level.

- Maximum RSI level to allow trading: Trading is allowed only if RSI is below this level.

- Enable ATR filter: Enables filtering based on ATR (Average True Range).

- ATR timeframe: Select the timeframe for ATR calculation.

- ATR calculation period: Set the number of periods used to calculate ATR.

- Max allowed ATR value for trading: The EA will not trade if the ATR is higher than this value.

- Initial balance used to calculate drawdown

Sets the initial balance value used as a reference to calculate drawdown. - Enable daily drawdown protection

Activates a daily drawdown limit. If reached, all open trades will be closed and trading will be disabled for the rest of the day. - Max daily drawdown in percent (based on balance)

Set the daily drawdown limit in percentage. Calculated based on the current account balance. - Enable overall max drawdown protection

Enables a maximum drawdown limit based on the initial balance. -

Max total drawdown in percent (based on initial balance)

Set the maximum overall drawdown percentage. Once this limit is hit, all trading will be disabled permanently until reset manually.Note:

There are many proprietary (prop) trading firms, each with their own rules. The built-in drawdown calculations follow FTMO’s rules, as they are one of the most popular and widely used.

For example, if the initial balance is $10,000 and the max drawdown limit is set to 9%, trading will stop once the balance drops to $9,100.

Similarly, if the daily limit is set to 2%, trading will stop for the day after a $200 loss from the day’s high.

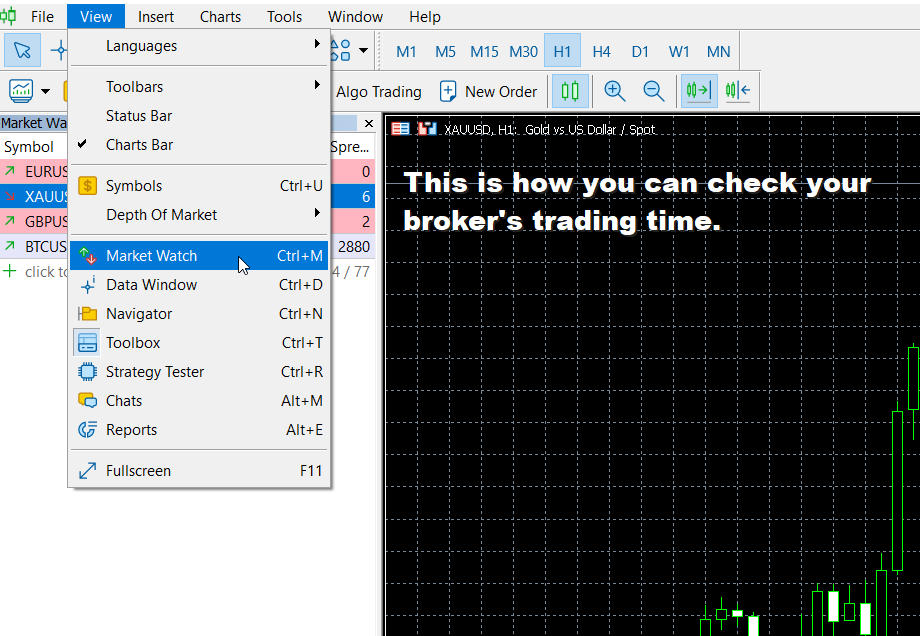

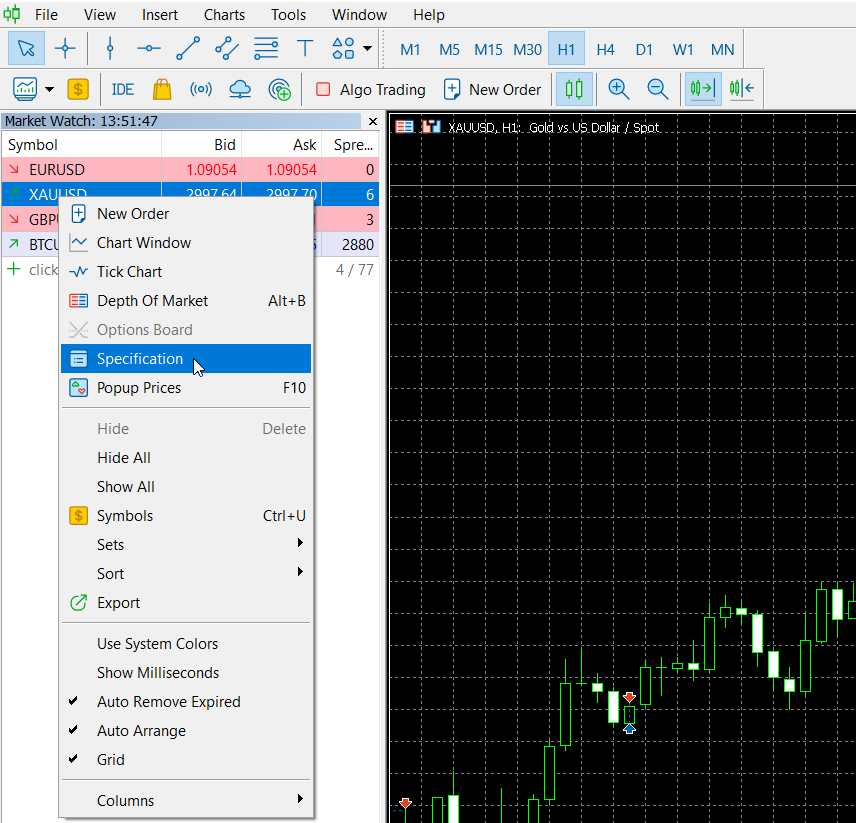

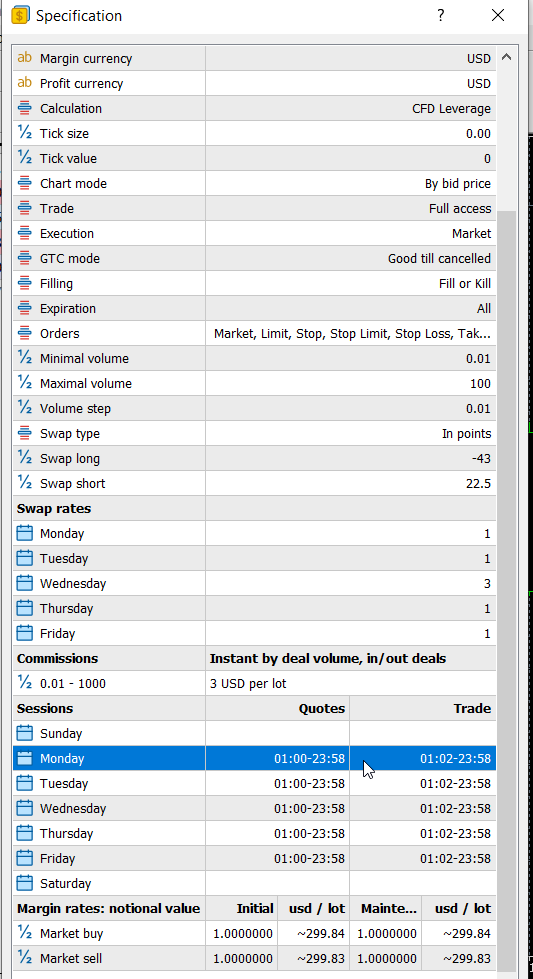

How to Check if the Broker’s Server Time Matches the Default Settings:

- Right-click on the Gold symbol in the Watchlist.

- Select Specifications.

- Scroll down to the Trading Hours section.

- Check the market close time. The trading hour should be set to the last hour before the market close — for example, if the close time is 23:59, the trading hour should be 23.

- If it is 23:59, no adjustment is needed.

- If, for example, the market close time is 20:59, set the Start Time to 20:00.

An indicator is included to help you set the correct trading hours both in the Strategy Tester and for manual configuration.

BrokerTimeOffset indicator MT5

BrokerTimeOffset indicator MT4

Recommended Risk Settings:

- Conservative: 2-3% risk per trade.

- Aggressive: Max 10% risk per trade (without Recovery Mode).

Prop Firm Settings:

Since each prop firm has its own rules, make sure the EA complies with these. If many users use the same strategy, the account may be banned, so some settings need to be minimally adjusted:

- EA Name (as seen in the comments).

- Magic Number.

- Set the risk per trade between 0.5% and 3% to comply with the prop firm's daily drawdown limit.

- SL and TP slight adjustment: If you are using a trailing stop, you can adjust the TP freely as long as it is larger than the trailing stop value. You can also modify the trailing stop values by half or 1 pip.

- Trade Time adjustment (±1-2 minutes). Be cautious, as these changes can affect the results.

- Some prop firms prohibit keeping trades open over the weekend. In such cases, trading on Friday must be disabled.

Special Broker Recommendation (for brokers that raise spreads at night, e.g., XM):

If the spread increases at night, disable the trailing stop as it may negatively impact performance. Set the TP to 26 pips, which has given good results for me.

Frequently Asked Questions (FAQ)

Below you'll find a summary of the most frequently asked questions about the Golden Nights EA. This list is updated regularly.

Which time frame should I use?

The EA works identically across all timeframes. It is not time-frame dependent.

Does it work on indices or other instruments?

No. The EA is specifically optimized for gold. If you wish to try it on something else, you must backtest and optimize settings yourself, and only use it if results are promising.

Can I trade at different times or open multiple trades per day?

No. Trading at other times may reduce profitability or result in losses. The EA is designed to open only one trade per day, and only one position at a time — to maintain risk control.

Why does it only place Buy orders?

The strategy exploits typical price patterns before the gold market closes, which usually show an uptrend or consolidation. In recent years, gold has been in a strong bullish trend, supported by economic and geopolitical factors, and continues to be.

Is the swap hurting results?

Yes, it has some effect, but most trades close before the market closes.

Tips:

– Use a swap-free account

– Disable trading on Wednesdays to avoid 3x swap charges.

What about high nighttime spreads?

Some brokers increase spread at market close/open. Recommended settings:

– Trailing Stop: OFF

– TP: 26 points

This works well on brokers like XM.

Does the EA use martingale or grid?

No. Neither strategy is used.

However, there's an optional "Recovery Mode" that increases lot size after a loss. It is fully customizable and can be disabled.

Why is the risk-reward ratio low?

True, the RR is low, but this is compensated by the high win rate (~96%) according to backtests. Long-term results remain profitable.

Can I change SL/TP to improve RR?

Not recommended, as it can harm performance or even cause losses. If you insist, make sure to backtest thoroughly before going live.

Can I use this EA for prop firm challenges?

Theoretically yes, but each firm has different rules. No guarantees against bans, especially if many users employ the same EA. Always check the firm's conditions first.

Recommended Broker for Using the EA

I’d like to share my personal experience with the broker I’ve been using, which has been performing excellently with the EA. The broker offers swap-free accounts and low fees, making it a great choice for running the EA effectively.

XMGlobal for European Clients with trading leverage 1:500

That said, this EA should work well with other brokers too.

Keep in mind that low spreads, good customer support, and swap-free accounts are essential for maximizing the performance of your EA.

Before using the expert on a live account, test your settings in the strategy tester and on a demo account to understand how the system operates. This way, you can make any necessary adjustments and gain confidence in the settings.

If you have any questions or need further assistance, please don't hesitate to reach out. You can find our contact information here. We are always happy to help!

Successful trading!