Greetings !

At the request of users, today I decided to publish a list of frequently asked questions from real users.

This is a small guide that will help you understand many aspects.

Q0. Do we need a VPS?

You will need a VPS to provide a reliable communication channel with your broker.

I've been using This VPS for myself for many years now.

If you are using a Demo account to test the system, then it is not critical.

Q1. How much pips is its SL, TP ?

Answer: Q1. We use a fixed SL, all transactions are always secured via SL for transaction security purposes. Also, each position has its own transaction expiration time. The deal will be closed on time, even if it is in big profit. The maximum SL is about 2,400 points. The maximum TP is about 5,000 points. Transactions are usually closed on time. During the drawdown, the system can open 1 additional order, equal to only 20% of the main transaction volume. This allows you to close even more profits, even during a drawdown, and minimize possible losses. Therefore, it is very difficult to answer this question statically, it depends on the market and its capabilities. We can get 10-15% profit for only one position when the maximum DD is less than 5% for the default settings.

I do not recommend using a risk of more than 5%

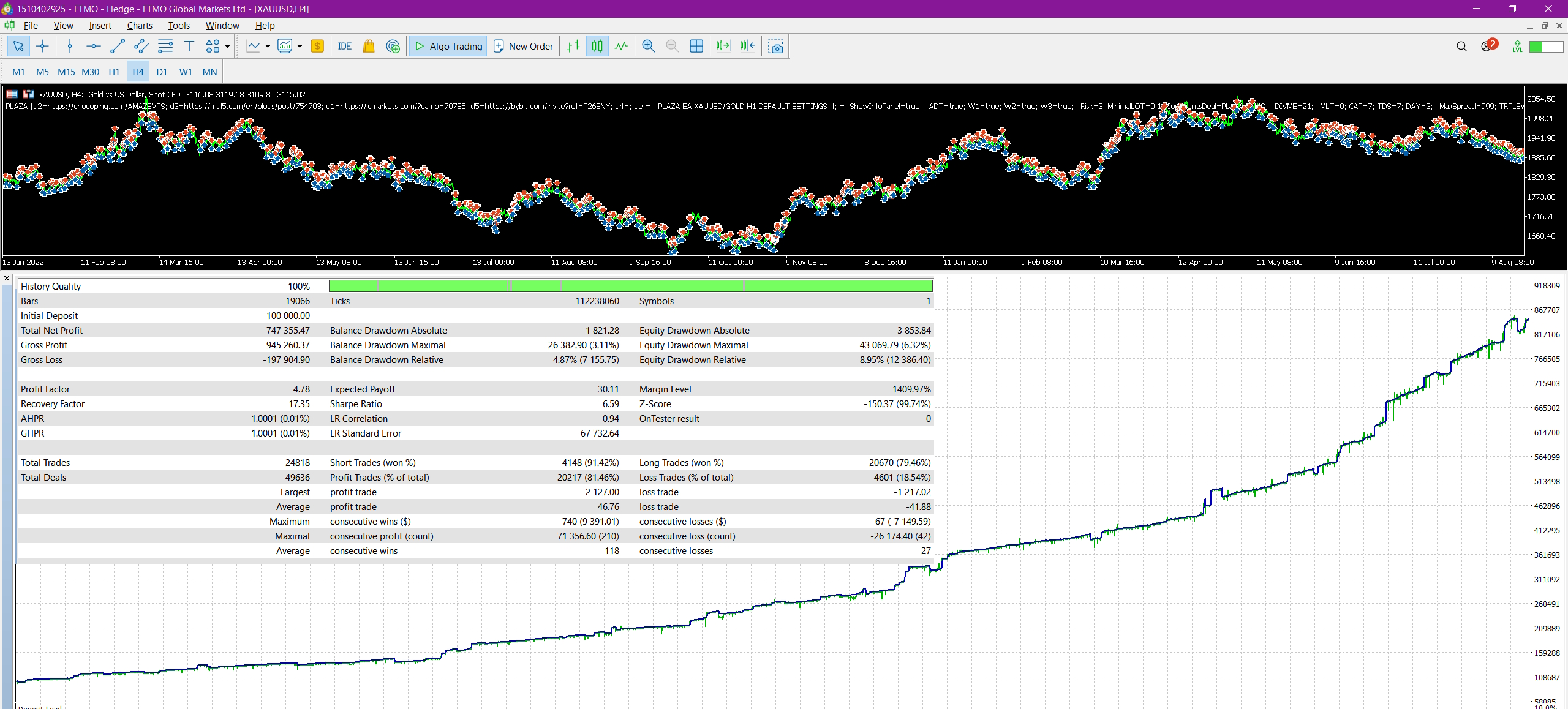

Q2. Maximum DD?

Answer: Q2. The risk parameter determines the maximum possible DD for each strategy. In total, we use three different strategies. Therefore, if desired, these strategies can be launched separately and, for example, use different risks separately, all this is regulated if desired. In the default settings, the risk is 5% for each strategy.

Q3. Can Plaza be used of other currency pairs too like EURUSD, GDPUSD, Silver(XAGUSD) etc ?

Answer: Q3. The trading system can work with other currency pairs, at the moment it only works for gold, in the near future we plan to add separate currency pairs as separate settings that we previously used in version 2.

Q4. Do we have to run its all 3 strategies on different chart at the same time or will it select itself according to market condition which you be best?

Answer: Q4. The system automatically selects the most appropriate strategy depending on the market condition, the system is launched only for XAUUSD on 1 chart with default settings. But if we want, we can run each strategy individually on three charts, it's not difficult.

Q5. Minimum Balance required?

Answer: Q5. For correct operation, $400 will be enough as the minimum balance with a leverage of 1:500 ICMarkets / ICTrading / Tikcmill / Bybit / Vantage / FPMarkets / Coinexx / FTMO / FusionMarekts

Q6 Risk to Reward ratio?

Q7. Difference between Plaza and Revera and which one is the best ?

Answer: Q7. These are completely different systems, they trade in different pairs and use different strategies to return to the market average. For me personally, the Plaza is better

Q8. As i see you launch new EAs very frequently rather then improving your previous EAs. is there any new EAs you are planning in near future?

- Thanks in advance and it would be good if you answer all questions point wise.

Q9. Approx. monthly return?

Answer: Q9 We cannot predict the future, we cannot accurately tell you the income per month or year, it will be fortune-telling on coffee grounds. Our real signals can show you approximate numbers with default settings.

Q10 The system automatically selects the most appropriate strategy...." When system automatically selects best strategy then why to add it individually of different charts ?

Answer: Q10 For example, if you want to add unique risks or your own comments to trades, divide the profit into several parts and close it over the entire market movement. This is a very flexible mechanism for each strategy, such an opportunity is simply available for those who like to study everything thoroughly.

This list will be gradually expanded ...Thx!

Today I also decided to add a description of all the parameters

- SHOW INFO - display information

- ADDITIONAL TRADES MODE - mode for adding an additional trade for 1 strategy

- STAGE 1 - activation of strategy 1

- STAGE 2 - Activation of 2 strategy

- STAGE 3 - Activation of 3 strategy

- RISK % [0=FIXED] - risk parameter, determines the maximum drawdown for one strategy (three strategies in total)

- FIXED LOT [IF RISK=0] - fixed deal size if risk = 0

- MAX DEALS DIVISION [0-DISABLE] - maximum division of positions into several parts

- MULTY RECOVERY RISK [0-DISABLE] - level of position recovery the next day

- COUNT PROFIT DIVISION [0-DISABLE] - number of profitable trades during profit fixing

- MINIMAL COUNT PARTS - the required minimum value to activate partial closing of positions

- MAX RECOVERY DAYS - number of days in recovery mode

- MAX SPREAD - maximum allowed spread

- TRIPLE SWAP FILTER - triple swap filter on Wednesday, there will be only positive swap on Wednesday

- ROLLOVER CLOSE ONLY PROFIT - The filter allows you to close all profits automatically before the rollover begins.

- ROLLOVER TIME MIN STOP ALGO - Trading session end time filter (calculated in minutes) added to avoid catching noise before the rollover starts

- RANDOM FTMO DELAY - micro shift of entry and exit points in a trade

- MAX % DD - filter of maximum drawdown by balance

- STOP FRIDAY DEALS - Friday trading filter

- [ STAGE 1 [BUY] BASED SETTINGS ] - settings for Strategy 1

- ENABLE [BUY] DEALS - activation of purchase transactions

- FIXED TAKE PROFIT - full level TP

- BUY STOPLOSS - maximum fixed SL (usually deals are closed earlier in time)

- TRAILING START - minimum required profit to activate the virtual profit tracking mode

- TRAILING STOP - distance from the current price, offset in points

- TRAILING % - percentage of current profit, offset

- MAX REC PROFIT TRACKING RANGE - profit size for deactivating virtual tracking and activating partial closing of positions

- [ С BASED SETTINGS ]

- C STAGE - activating the trading mode with currency pairs

- PATTERN MODEL - choosing a Metal or Currency pair pattern

- MODEL - the name of the currency pair model

- MAX PERIOD - the period from 1 to 50

- MIN PERIOD - the period from 1 to 50

- PERCENT - the percent from 1 to 30

- [ADDITIONAL TRADES SETTINGS]

- VOLUME % - percentage of additional transaction volume from current risk (20% by default)

- DISTANCE - distance of activation of additional order

- FIRST BE - the required profit to activate the profit tracking mode

- BE MAX MOVE - maximum distance to deactivate tracking mode

- BE MOVE DISTANCE - distance from the current price during

- BE MOVE PERCENT - % offset from dynamic profit

- ADT DEALS TP - full TP of additional deal

- ADT MAGIC - unique Magic transactions

- MAX ADT DEALS ONLINE - number of allowed additional transactions

- USE NEWS FILTER - strong news filter (pauses trading during strong news)

- NEWS SYMBOL - currency news analysis

- ST1 MAGIC - unique Magic for strategy 1

- ST2 MAGIC - unique Magic for strategy 2

- ST3 MAGIC - unique Magic for strategy 3

- CURRENCY MAGIC- unique magic number for the currency pairs trading mode

- STOP CHRISTMAS DAYS - Christmas holidays

- TYPE OF FILLING ORDER - type of filling orders, for specific brokers

- MAX FIRST LOT - maximum allowed lot size