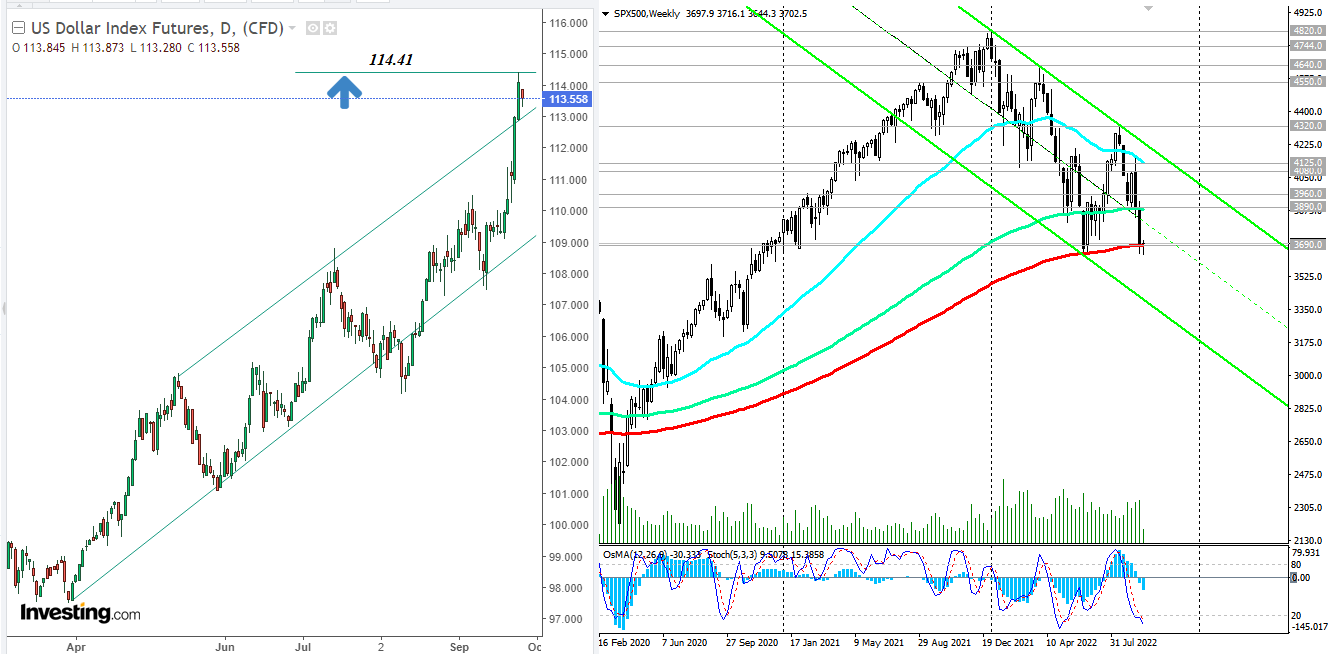

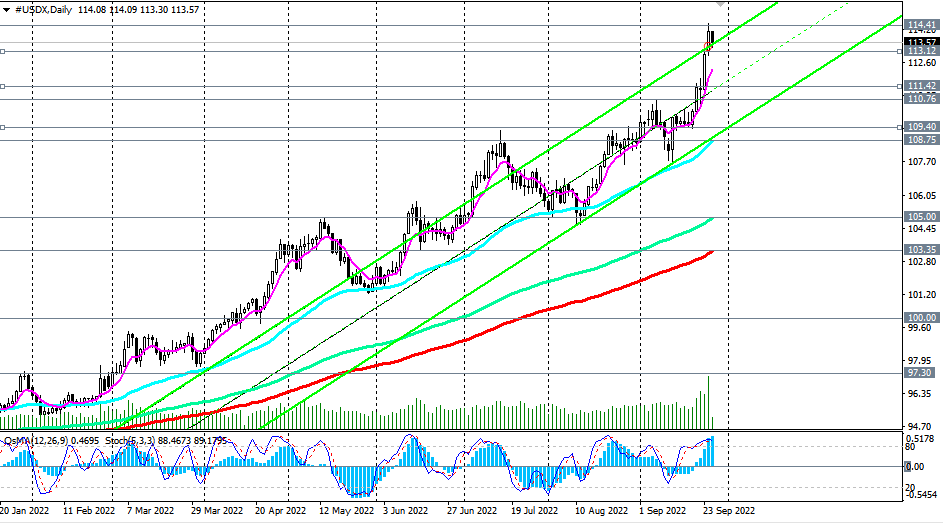

As we noted in our Fundamental Analysis today, “the dollar's uptrend continues, pushing the DXY to new highs on its way to over 20-year highs near 120.00, 121.00. Breakdown of yesterday's local maximum at 114.41 will be a confirming signal of our assumption”.

In an alternative scenario, the very first signal for short-term sales will be a breakdown of the short-term support level 113.12. The target is an important short-term support level 111.42. Its breakdown, in turn, may provoke a deeper correction to the support levels 109.40, 108.75. However, once again we note that this is an alternative and theoretically possible scenario.

Strong bullish momentum based on fundamentals prevails, favoring long positions.

At the moment, market participants have somewhat suspended their activity in the market in anticipation of speeches (at 11:30 GMT) by the heads of the Fed and the ECB.

A little later (at 12:30 GMT), the US Census Bureau's key report will be released with data on orders for durable goods and capital goods (excluding defense and aviation), implying large investments in their production (for other events this week, see The most important economic events of the week 26.09.2022 – 02.10.2022).

Support levels: 113.12, 111.42, 110.76, 109.40, 108.75, 105.00, 103.35

Resistance levels: 114.00, 114.41, 115.00

see details -> https://www.instaforex.com/ru/forex_analysis/322778/?x=PKEZZ

signals -> https://www.mql5.com/en/signals/author/edayprofit

see also “Technical analysis and trading recommendations” -> https://t.me/fxrealtrading