During yesterday's speech at a financial conference, ECB President Christine Lagarde acknowledged that the prospects for monetary policy of the European Central Bank and the Fed diverge significantly. "Our two economies are in different phases of the business cycle," Lagarde said. In her opinion, this was even before the start of Russia's special military operation in Ukraine, and "for geographical reasons, Europe is much more prone to war than the United States." She is scheduled to speak again today at 13:15 (GMT) and is likely to reiterate her key messages that risks to the European economy are skewed to the downside.

Moreover, the EU is preparing to consider the introduction of a new, fifth package of sanctions against the Russian economy. Among other things, the new measures may include the imposition of a moratorium on the import of Russian oil and gas. Although the position of European states on this matter is different, the introduction of new restrictive measures against Russia will also negatively affect the European economy, which, according to many economists, is sliding into stagflation.

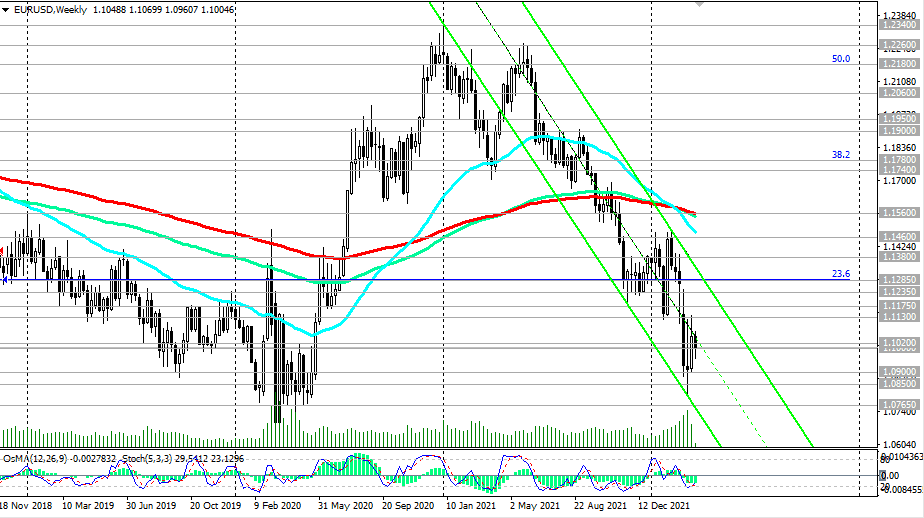

Thus, the EUR/USD pair is likely to see further decline. After the retest of the support level 1.1000 and its confirmed breakout, the targets are 1.0900, 1.0800.

More distant downside targets are located at the support levels of 1.0500, 1.0350 (2015 and 2017 lows, respectively).

In an alternative scenario, corrective growth will resume, and after the breakdown of the resistance levels of 1.1130, 1.1175 EUR/USD will head towards the key resistance level of 1.1460.

In the current situation, short positions remain preferable in our main scenario.

Support levels: 1.1000, 1.0960, 1.0900, 1.0850, 1.0765, 1.0700, 1.0500, 1.0350

Resistance levels: 1.1020, 1.1130, 1.1175, 1.1235, 1.1285, 1.1300, 1.1380, 1.1460, 1.1500, 1.1560, 1.1740, 1.1780

See also - > Trading recommendations

*) the most up-to-date "hot" analytics and trading recommendations (including entries into trades "by-the-market") - -> Telegram

**) Get no deposit StartUp bonus up to 1500.00 USD