I wanted to publish a short post to remind us all to zoom out, and stop focusing on short term performance. I believe that one of the greatest advantages algorithmic traders have, over traders that place their orders manually, is that we do not have to look at charts and our P&L daily.

We all have the tendency to look at our P&L every day, some look many times every day. When we are in a position we cling to our computers and phones to look at the price action as it unfolds, we stare at our floating P&L hoping price will move in the right direction.

It is a natural reaction. Humans are wired neurologically to avoid suffering and seek pleasure. We cannot help but interfere and intervene in any way possible to achieve that goal of lowering pain and increasing pleasure. It is a survival mechanism, and we all have it.

For us traders, we naturally feel good when our P&L is in the green, on the flip side we feel down when it is in the red.

Unfortunately, for most people the painful experience related to losing is much more intense and vividly felt than the pleasurable experience of winning. There is something about the human mind that makes painful experiences, such as losing money, permeate through us intensely, yet the pleasure of making profits is often short lived and is not as tangible an experience as losing.

When we as algorithmic traders go through loosing streaks or periods of drawdown, there is a part inside all of us that whispers to us, to intervene, to take control and make the suffering stop. It is so easy to just click the exit button or open a hedged position or add additional positions in the same direction to average into a larger position, hoping the markets will change direction soon. All traders have done it. If you say you haven't, I do not believe you, no offense:) But if we give in, and start interfering, we will loose the statistical edge our system otherwise provides us with.

Personally I believe that it is the intense psychological experience that is involved with trading live funds that make most traders fail. It is very challenging for humans to stick to the rules of a system, when it looks like the system is not working, in the here and now.

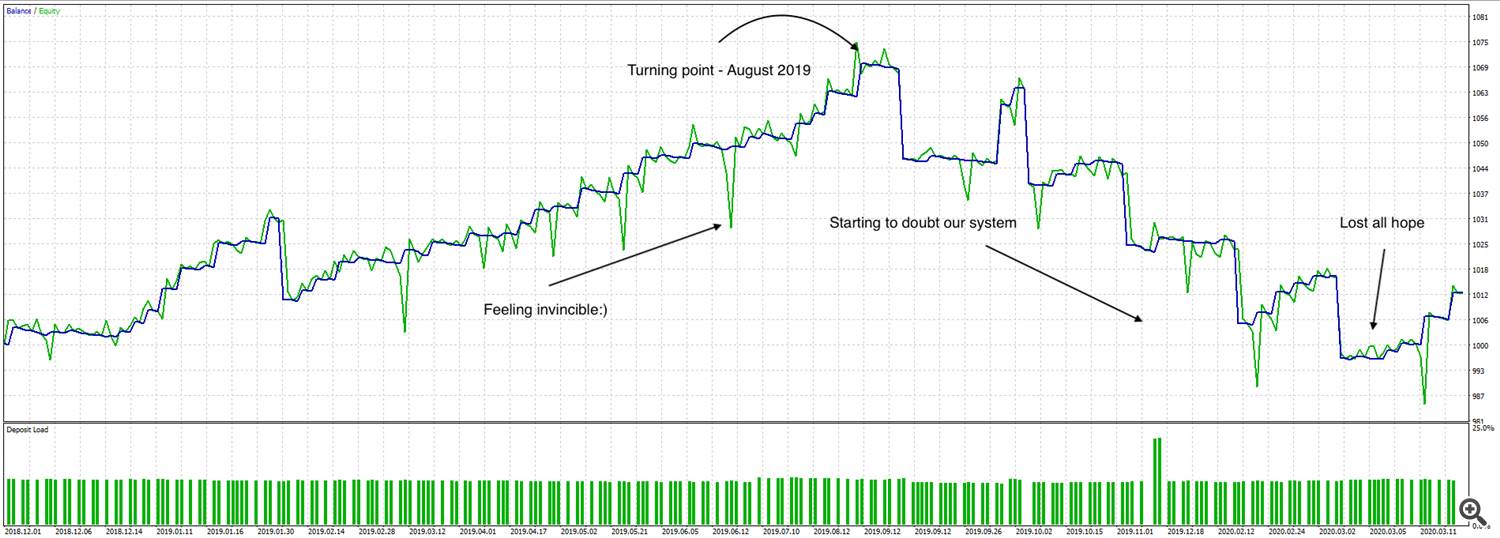

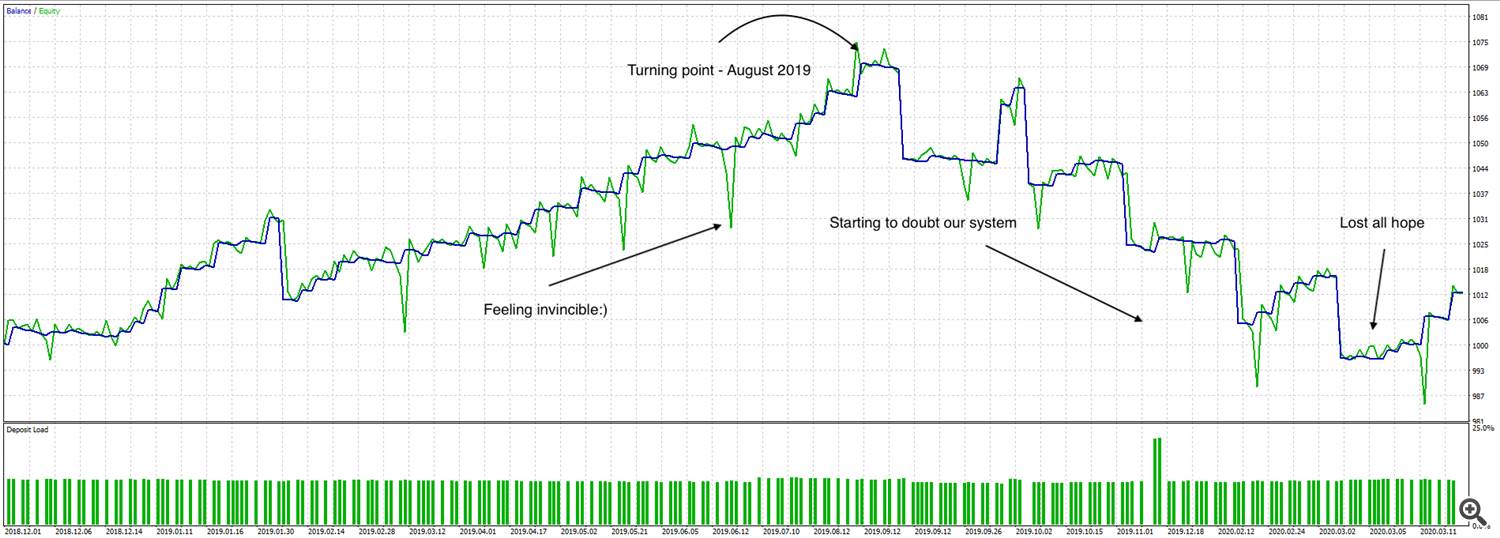

Look at the three equity graphs below. In the first image you see the equity curve of one of my expert advisors.

It shows a good period from December of 2018 until August of 2019. In those 9 months, we felt great. We started thinking of how much money we would make in the next 5 years. We were sure that all of our financial worries were over and we would spend the rest of our lives free and happy.

But then from August of 2019 something seems to have changed and we don't understand why.

By December of 2019 we start getting seriously concerned, but we somehow find the courage to keep playing the same system. We might feel a sense of greed, and we promise ourselves, once we get back to the equity high of august 2019, we will quit and be happy with the little bit of money we made during the profitable period before then.

Then comes February of 2020 and we are devastated. We have absolutely no trust in our system. We are sure it must be broken. All of our dreams seem so far away. By March of 2020, after a seven months long painful and tortuous losing streak, we decided to cut our losses and turn off the algorithm.

We blame ourselves for being foolish and naive dreamers. We feel ashamed and decide trading is not for us.

But look what would have happened if we had left the system alone to do what it is designed to do. Just after we called quits, the markets turned in the favour of our system and have pretty much been on one long winning streak ever since.

When we zoom out even more and look at the equity curve from 2010 until today, that period from December of 2018 to March of 2020 seems insignificant. We feel absolutely no pain when we look at the loosing streak we discussed above from August 2019 to March 2020. in hindsight, it is clear to us that it is just a minor pullback before reaching higher highs. But going through that period live, was immensely painful.

When we observe this equity graph from January 2010 to November 2021 we feel confident that this is a great system. That is because we look at the performance fully zoomed out. When we zoom in on a weekly or monthly basis, there are many periods where this system that performs very well over a long period has performed extremely poorly. Looking at those periods give us no emotional upset, as we know that what came later made up for that, plus more.

So why is it so difficult to keep that objectivity and rational mindset when we trade live? I do not have the answer to that. But I have learned from experience, that as long as my systems stay within my pre-defined risk tolerance, I will not interfere, and there is no need for me to look at closed and floating P&L. Every now and again I check in just to see if my Terminal is online and there are no connectivity issues between my terminal and my broker. But other than that, I let me systems do what they do, because I know that they have a statistical advantage that is gathered from a large data set.

Essentially, what we do as traders is find insufficiencies in different markets and take advantage of those by playing them over and over and over. We look for patterns or signs in the market that repeat themselves, and which have a higher probability of being followed by a certain market behaviour, rather than another. If our statistical edge is extrapolated from a large enough data set with robust testing methods that include enough out-of-sample data to avoid curve fitting and ample forward testing, there is no reason for us to be emotionally involved. We do best to simply look away, and trust our system.

I hope this short article will help you on your path of becoming a professional algorithmic trader!

If you find any value in the article, I will appreciate if you give it a like.

Stay green!