VIX INDEX: Understand how this can reflect in your negotiations

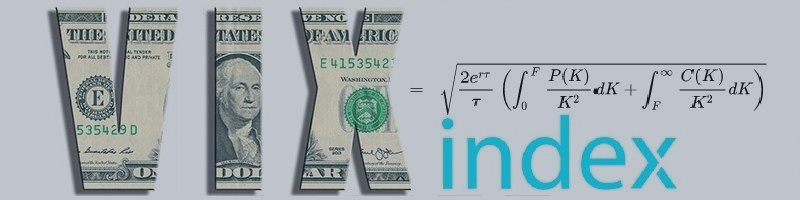

You who follow the foreign exchange market know that volatility is one of the main factors to be observed in operations. Proof of this is the visibility that the VIX index (Volatility Index), which measures the volatility of S&P 500 stock options, has gained in recent years.

What is the VIX Index?

It is a VIX index that measures the volatility of S&P 500 stock options, the main stock market index in the United States. VIX has been one of the most important indexes for measuring traders' uncertainty in risk scenarios, such as economic crisis and interest rates, among others.

Interpretation:

Although the VIX is often referred to as the "fear index", a high VIX is not necessarily a downward trend. Instead, the VIX is a measure of the volatility perceived by the market in any direction.

VIX works as a risk meter and plays an important role in crisis mapping.

VIX at a high level means that the market as a whole is highly volatile, which means that price movements can rise or fall quickly and widely. From this point, a warning signal is generated for all investors.

Utility:

The higher the VIX index, the greater the price volatility, resulting in a tense market and more indecisive and fearful traders, at which point its observation is essential considering advanced operations of some algorithms that use VIX high to reduce risk exposure , and even stop operations momentarily.

The lower the VIX index, the lower the price volatility, resulting in a market with more predictable trends, also at this point it is essential to observe it.

In my signal provider Maryland FX the VIX Index is always observed for good decision making, if you are interested in getting to know my work better click here.

I will leave a video that expands the knowledge about the VIX Index a little more