After Tuesday's meeting between US President Donald Trump and North Korean leader Kim Jong-Un, and also in anticipation of the outcome of the meetings of the central banks of the US and the Eurozone, the world stock indices retain a restrained-positive dynamic.

It is widely expected that today the Fed will raise the key interest rate by 0.25 percentage points to 1.75% -2%. The probability of such an increase is estimated by investors at 94%. This scenario is already included in the prices. Investors will be concerned with the question of how many more increases the Fed can make before the end of the year - one or two. The decision on the rates of the Fed will be published at 18:00 (GMT), and at 18:30 a press conference will begin at which the head of the Federal Reserve, Jerome Powell, will explain the decision taken by the Fed, and also express the opinion of the FRS leadership on the prospects for economic growth in the US.

Published on Tuesday, the data again pointed to the steady strengthening of inflation in the US, which should convince the Fed to further gradually increase interest rates. The consumer price index (CPI) in May grew by 2.8% compared to the same period last year. Thus, last month the annual price increase was the strongest since February 2012.

The labor market in the US remains stable, and unemployment reached 3.8% in May, the lowest level since 1969. The last time the unemployment rate was 3.8% was recorded in April 2000. The average hourly earnings in the US in May rose by 0.3% (against the forecast of + 0.2% and + 0.1% in April) and by 2.7% (in annual terms).

The US economy continues to grow more confident than others, the macroeconomic situation in the US remains favorable, indicating that it is possible to raise rates after today's meeting more than once.

Market participants will closely follow Powell's speech to catch signals about the Fed's tougher position on monetary policy. If Powell unequivocally signals about the possibility of 4 rate increases this year, then the dollar can become sharply stronger. But the stock indices can again turn to the "south".

Investors also do not forget about the risks and threats that have emerged against the backdrop of escalating trade contradictions between the US and major trade and economic partners, such as China, the EU, Canada.

Thus, the monetary policy of central banks, as well as the threat of escalation of trade wars, will be the main driver in the financial markets in the short term.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

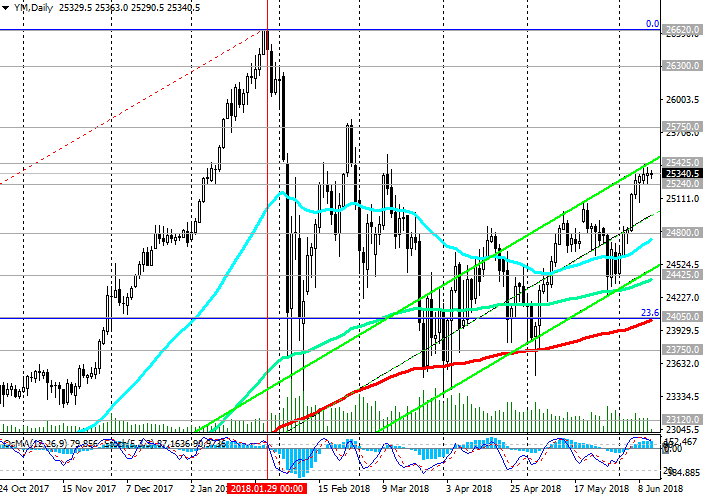

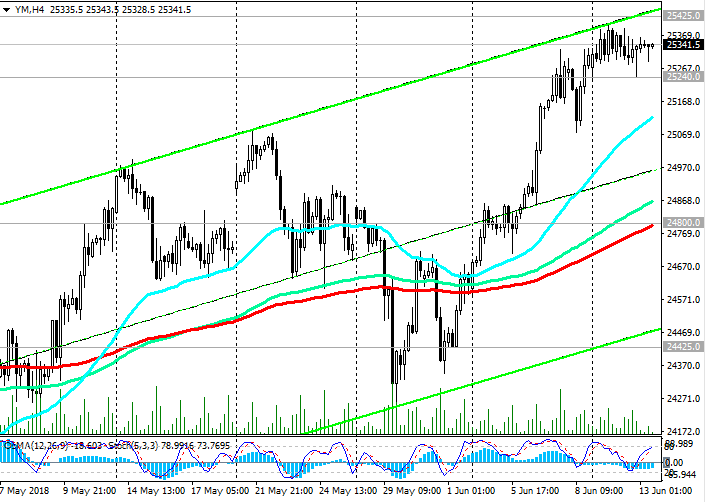

Support levels: 25240.0, 24800.0, 24425.0,

24050.0, 23750.0

Resistance levels: 25425.0, 25750.0, 26300.0, 26620.0

Trading Scenarios

Buy Stop 25430.0. Stop-Loss 25200.0. Take-Profit 25750.0, 26300.0, 26620.0

Sell Stop 25200.0. Stop-Loss 25430.0. Take-Profit 25000.0, 24800.0, 24425.0, 24050.0, 23750.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com