S&P500: investors are concerned about the possibility of commencement of trade wars

More recently (at the end of last week), participants in the global financial market were concerned about the US decision to impose import duties on steel and aluminum. Today, this story was developed after it became known about the resignation of the chief economic adviser to President Donald Trump Gary Cohn, who opposed the introduction of new duties. His resignation upset the market participants, pointing out that Trump intends to pursue a tougher policy with regard to trading partners, and can unleash a large-scale trade war.

On this news, the currencies of those countries that actively trade with the US, including the Mexican peso and commodity currencies - the Canadian dollar, the Australian dollar, the New Zealand dollar - fell sharply.

Also, the main US stock indexes fell, and asylum assets rose in price because of fears about US policy. The yield on 10-year government bonds fell to 2.863% from 2.877%, while the yen rose 0.4% against the dollar during the Asian trading session.

Representatives of the world's largest economies are extremely negative about the intentions of the White House to introduce import duties.

Thus, the Minister of Economy of Germany, Brigitte Tsipris, said today that "in the event of a worsening situation, the EU is ready to respond appropriately, but our goal is to avoid a trade conflict". "Trade brings prosperity when it is based on exchange and interaction", she said. So far, the signals coming from the US are bothering me".

The EU intends to challenge the planned US introduction of import duties on steel and aluminum.

Investors are worried that the main US trading partners will retaliate and this will start the world trade war, which will negatively affect world economic growth. The EU has already announced the preparation of a package of measures worth 3.5 billion US dollars in respect of imports from the United States. In response, Trump promised to introduce a tax on cars imported from the EU.

The Reserve Bank of Australia Governor Philip Lowe said on Wednesday that it could be "very bad" for the global economy. "If the process grows, it will be very bad. If retaliatory measures are taken, the world economy will suffer a very strong blow", Philip Lowe said.

Meanwhile, the main US stock indexes are at the beginning of the European trading session in the negative territory after they collapsed at the opening of today's trading day after the resignation of Gary Cohn.

Today we expect a busy trading day.

After 13:15 to 13:30 (GMT), a block of important macro data from the US will be published, including the ADP report on employment in the private sector of the US economy (for February), foreign trade balance (January), inflation indicator of costs per unit labor force and labor productivity outside the agricultural sector for the 4th quarter, at 13:30 the Bank of Canada's interest rate decision will be published.

The growing uncertainty in trade relations between Canada and the United States will help ensure that the Bank of Canada retains the key interest rate unchanged at 1.25%.

We would like to remind you that volatility in this period will rise sharply, and this must be taken into account when making trading decisions.

*)An advanced fundamental analysis is available on the Tifia Forex Broker website at tifia.com/analytics

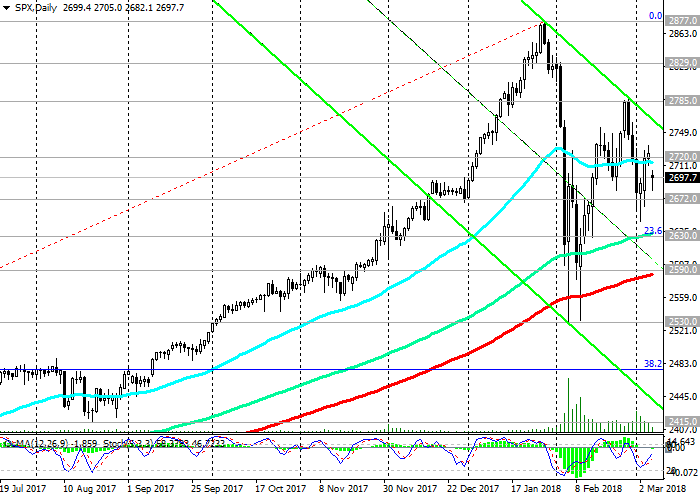

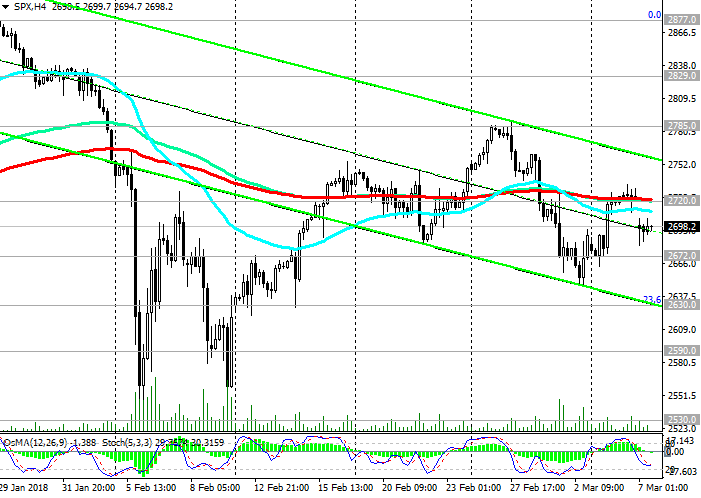

Support levels: 2672.0, 2630.0, 2590.0,

2530.0

Resistance levels: 2720.0, 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

Trading Scenarios

Sell Stop 2680.0. Stop-Loss 2735.0. Objectives 2670.0, 2630.0, 2600.0, 2590.0, 2530.0

Buy Stop 2735.0. Stop-Loss 2680.0. Objectives 2785.0, 2800.0, 2829.0, 2877.0, 2900.0

*) For up-to-date and detailed analytics and news on the forex market visit Tifia Forex Broker website tifia.com